2023 Q1 Market Insights and Porfolio Performance Recap

Written by AQUMON on 2023-04-14

Shift Your Deposits This Spring - 2023 Q1 Insights and Portfolio Performance Updates

The global capital market has experienced quite some ups and downs during the first quarter. With a rising interest rate environment together with dragging political tension, investors have been seeking safe haven in order to preserve capital. But at the same time, worries of possible recession, high interest rates, alongside turmoil in the banking sector have brought alert to the policy makers on monetary stance. Asian stocks are expected to continue rising throughout the year, supported by the region's favorable growth prospects and the expanding economic rebound in China. European equities logged gains despite the banking crisis. Government bond yields continued to rise, recovering from their worst returns in history last year. Commodities moved lower in the last quarter while gold prices surged as a result of investors pursuing the ultimate safe haven asset.

Meanwhile, powerful and intriguing innovations like ChatGPT have created new investable concepts. So how is AQUMON coping with these?

2023 Q1 Global Financial Markets Key Highlights

-

California regulators shut down Silicon Valley Bank (SVB) and placed it in receivership under the Federal Deposit Insurance Corporation (FDIC) after the bank's collapse marked the second-largest commercial bank failure in the United States. The bank sold its securities at a $2 billion loss, pulling the trigger for a panic among the venture capital firms. Companies urgently withdrew their money from the bank, causing the bank’s stock price to plummet by more than 60%. Customers of New York-based Signature Bank, which had a balance sheet similar to that of SVB, withdrew more than $10 billion in deposits early-mid March. State regulators took over Signature Bank with the intention of protecting its depositors and easing the fears of a widespread failure in the U.S. financial system.

-

There have been repercussions observed in the global financial landscape as well. Credit Suisse, the second-largest bank in Switzerland, collapsed in March 2023 and was bought by rival UBS for 3 billion CHF (about $3.3 billion USD). Credit Suisse faced numerous high-profile scandals in recent years. Recently, Credit Suisse disclosed that they had identified material weaknesses in their financial reporting controls, and their largest shareholder ruled out further investments in the firm. Credit Suisse and UBS entered into a merger agreement on March 19, with UBS being the surviving entity, after the Swiss Federal Department of Finance, Swiss National Bank and FINMA asked both companies to conclude the transaction to restore necessary confidence in the stability of the Swiss economy and banking system.

-

The Federal Reserve raised interest rates for the ninth time on March 22, hiking rates by 0.25% and bringing the federal funds rate range to 4.75% - 5%. The increase pushes the rate to the highest it's been since May 2006. With inflation finally showing signs of cooling, the Fed is raising rates less aggressively. In the latest dot plot, the majority of Fed officials indicated a target Fed funds rate between 4% to 4.75% would be appropriate for 2023. By 2024, they see rates going down to a range between 3% to 4%.

-

On March 30, Alibaba Group (9988.HK) said it will look to monetise non-core assets and consider giving up control of some businesses. The Chinese tech conglomerate reinvents itself after a regulatory crackdown that wiped 70% off its shares. The restructuring will result in a holding company structure with six business units, each with their own boards and CEOs. The group's Hong Kong-listed shares opened 2.7% higher after the conference call and followed a 12% jump from the previous day. The change could better protect Alibaba shareholders from regulatory pressures, as penalties levied on one division in theory would not affect the operations of another.

-

ChatGPT, the popular artificial intelligence chatbot, has reached 1 million users in just 5 days of its launch and 100 million users just two months. It's developer Open AI was valued at $29 billion dollars. ChatGPT Plus recently launched at a pilot subscription price of $20. Once monetized, ChatGPT is predicted to earn a revenue of $200 million by end of 2023 and $1 billion dollars by the end of 2024. The trend of artificial intelligence chatbot leads to the NASDAQ 100 Technology Sector Index rising 23.95% in 2023 Q1.

How Did AQUMON's Portfolios Perform?

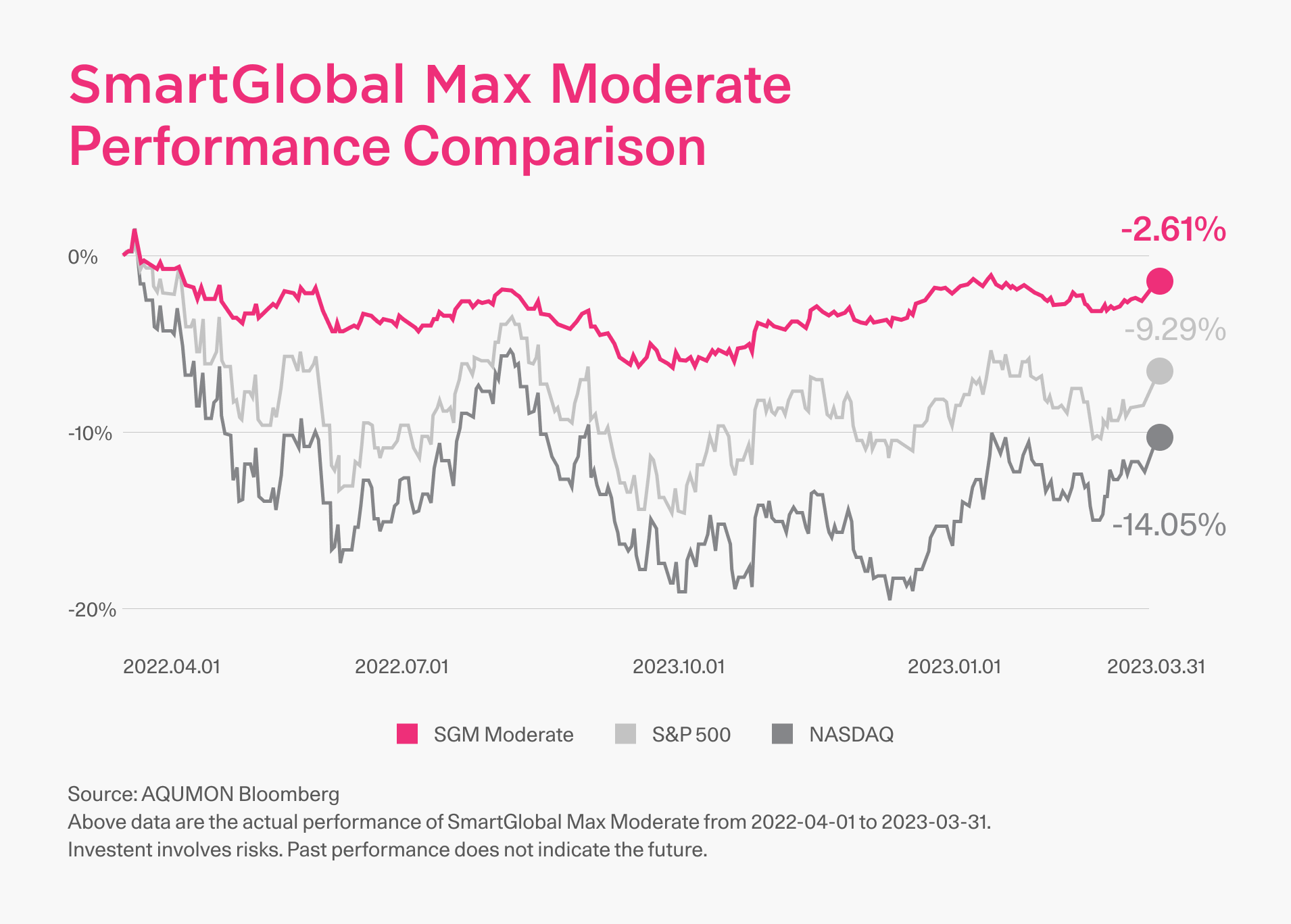

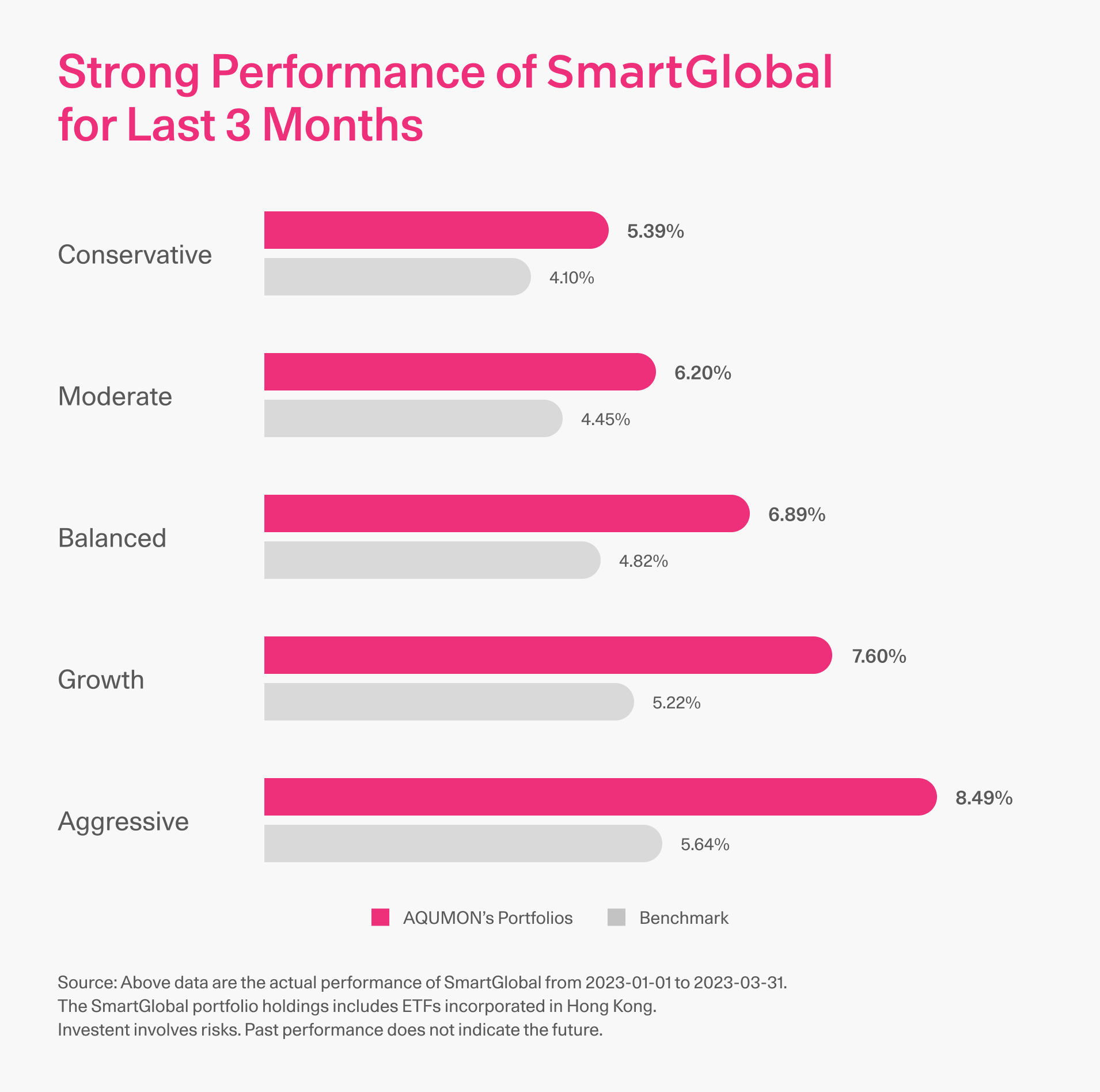

Adhering to scientific allocation, AQUMON's global asset allocation starts from big data and algorithms, and still brings stable performance to our customers. It continues to play a strong role in risk control and diversification of investment, helping our clients reduce risks and achieve reassuring investment. All portfolios outperformed their benchmarks by a wide margin. Let's take a look at the performance of the AQUMON portfolio this quarter:

Will It Be Better in 2023 Q2?

-

A recession in developed markets is now likely as a result of extensive monetary tightening to tame high inflation rates.

-

The banking sector is showing cracks, leading to banking collapses and further upheaval is expected in the coming weeks, but this is not an indicator of systemic risk within the banking system.

-

Thanks to unseasonably warm weather and a diversification of gas supplies away from Russia, Europe appears to have avoided an energy-driven recession this winter. However, the region will continue to confront a structural energy challenge in the medium term due to still-high prices.

-

Although the stock market overview is uncertain due to a series of tightening monetary policies issued by the Fed, equities are still an important part of a balanced portfolio. A near-term focus is on quality stocks as they have historically outperformed the market and bonds in the one to three years.

-

The outlook for Asia is more positive, with China’s reopening providing a key role in the country’s strong rebound, leading to opportunities for investors. The sustainability of China's reopening rebound, the knock-on effects on Asia, and sectoral beneficiaries will set the stage for the region's economies and markets in the coming months.

How Should Investors Adjust Their Asset Allocation?

Given that uncertainty will continue in the second quarter of 2023, investors should keep their defensive positioning by focusing on stable return vehicles. The best way to weather turbulence is through diversification.

-

Drive up diversification on different aspects of the portfolio in the asset class, geographic location & sector.

-

Remain relatively conservative while finding ways to enhance a portfolio's Sharpe ratio*.

-

Place more weighting on Chinese or Chinese-linked assets, which will benefit from low valuations, a recovering economy, and supportive fiscal and monetary policy, while other major global economies continue fiscal and monetary policy tightening.

*One of the widely used methods for calculating risk-adjusted returns. The higher the ratio, the greater the investment return relative to the amount of risk taken, and thus, the better the investment.

Hyper-Personalised Investment Solutions-AQUMON Bespoke

A multi-asset portfolio with global exposure carrying a dynamic allocation pertaining to underlying economic growth could potentially offset current market turmoil if a systematic approach is there to afford the right asset mix plus proper ongoing refinements. Schedule a free consultation with us to learn more about AQUMON's investment products and market-adapting solutions.

You may also contact us via 2155 2816, WhatsApp, or email bespoke@aqumon.com

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximize their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient.

Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.