GameStop Mania and the New Breed of Retail Investor

Written by Ken on 2021-01-29

Although it was a quiet week for economic figures, added talks of monetary stimulus drove markets higher, with the US’ S&P 500 index +1.94% last week and +2.27% year to date. US technology led the way, which also resulted in the Nasdaq +4.19%. European markets were flat with the Euro Stoxx 50 index +0.08% while locally, the Hang Seng index rebounded strongly +3.06% on the back of a strong rally in Hong Kong technology stocks.

AQUMON’s diversified US ETF portfolios were +0.02% (defensive) to +1.61% (aggressive) last week and +0.07% (defensive) to +3.64% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio, with more regional exposure to Hong Kong/China, was +0.00% (defensive) to +6.87% (aggressive) year to date. Main portfolio drivers last week were Hong Kong tech stocks (+11.49%), Chinese small cap stocks (+8.09%) and US tech stocks (+4.12%). Gold also saw an uplift of +1.67%.

AQUMON’s newly launched SmartStock thematic stock portfolios also performed well. Last week, the best performer was the China Tech Stars premium portfolio +13.73%, while the worst performer was the Profit Makers standard portfolio at +0.35%. After offering our exchange traded funds (ETF) portfolios for 2+ years, we have seen great interest by investors in these newly launched stock portfolios.

This week, our investors’ wondered how they should read into the recent investor frenzy building up in January, which then shifted quickly to one singular topic: GameStop. We’ll explain what happened, how investors should read into this, and provide insights into the rise of retail investors and the subsequent market momentum.

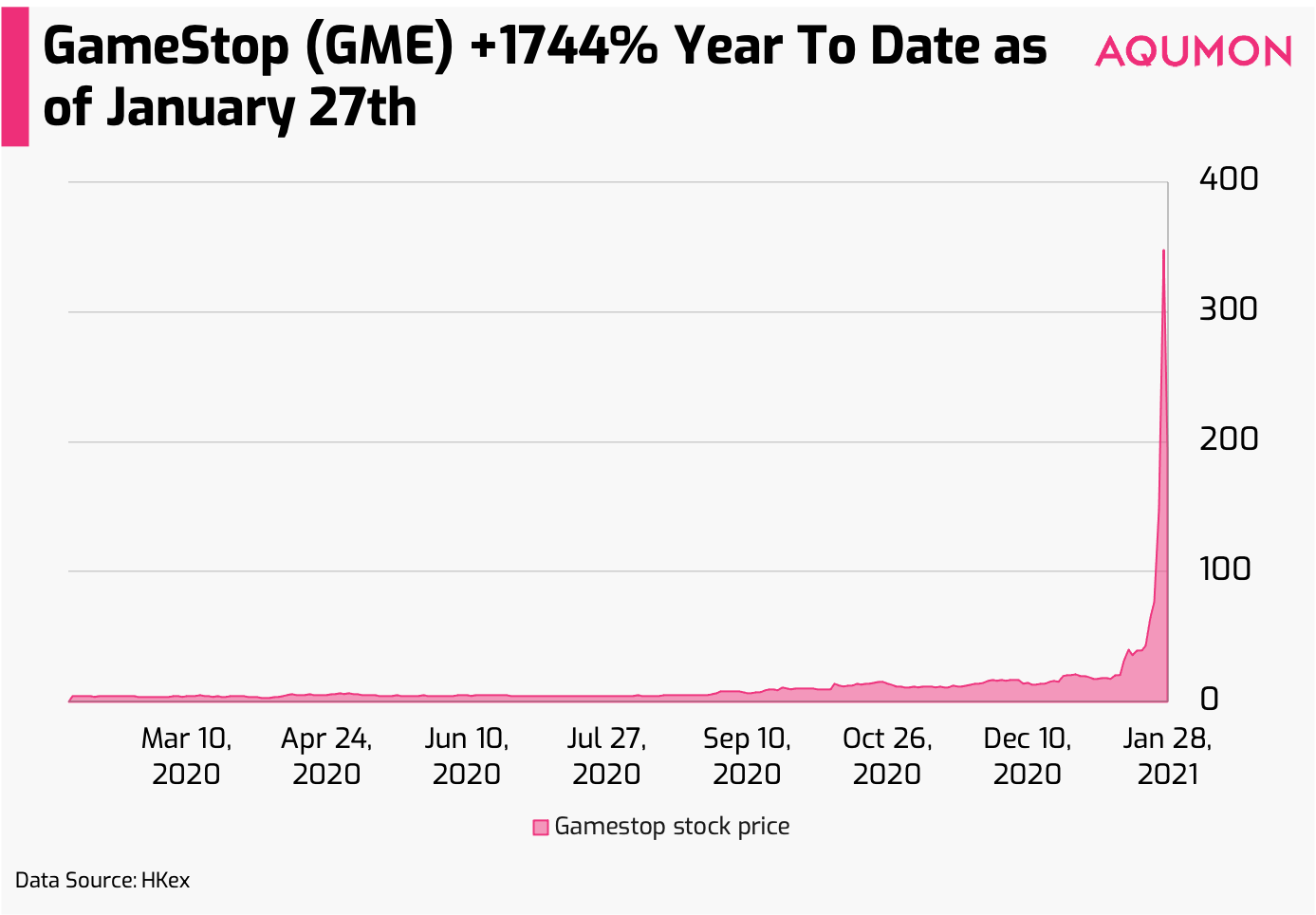

How GameStop’s (GME) stock price surged +1744.53% in January

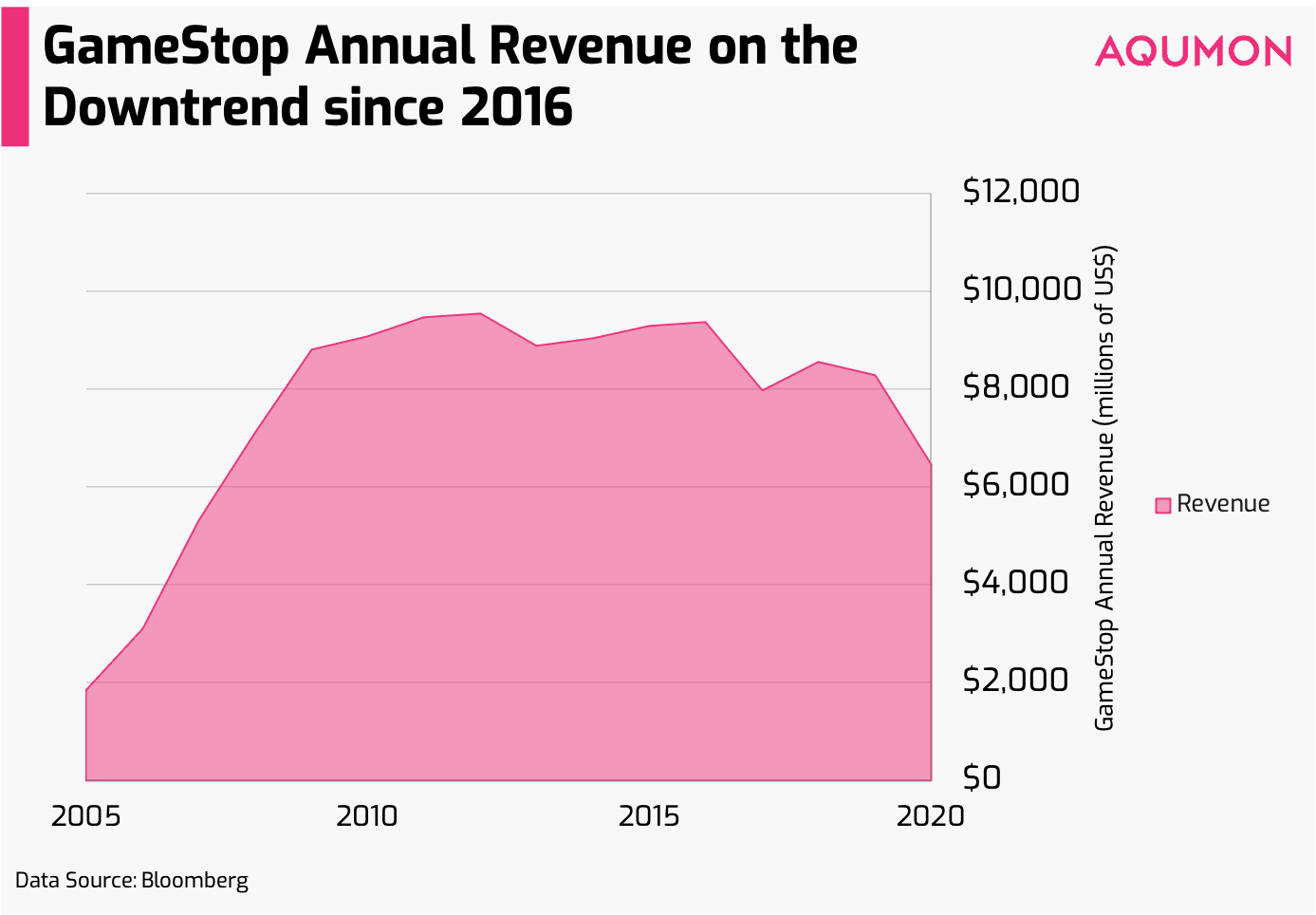

To understand why retail investors first saw fundamental value in GameStop, let's first understand GameStop’s background: the Texas-headquartered company was founded in 1984 as a brick and mortar software retailer, but transitioned into a video game retailer in the early 2000s with tremendous success. At the height of its success in 2012, it had up to 6,700 physical stores across the United States, Canada, Australia, New Zealand and Europe; and generated US$9.6 billion (~HK$74.0 billion) in revenue per year. But by 2020, its revenue had shrunk significantly to US$6.5 billion (~HK$50.1 billion):

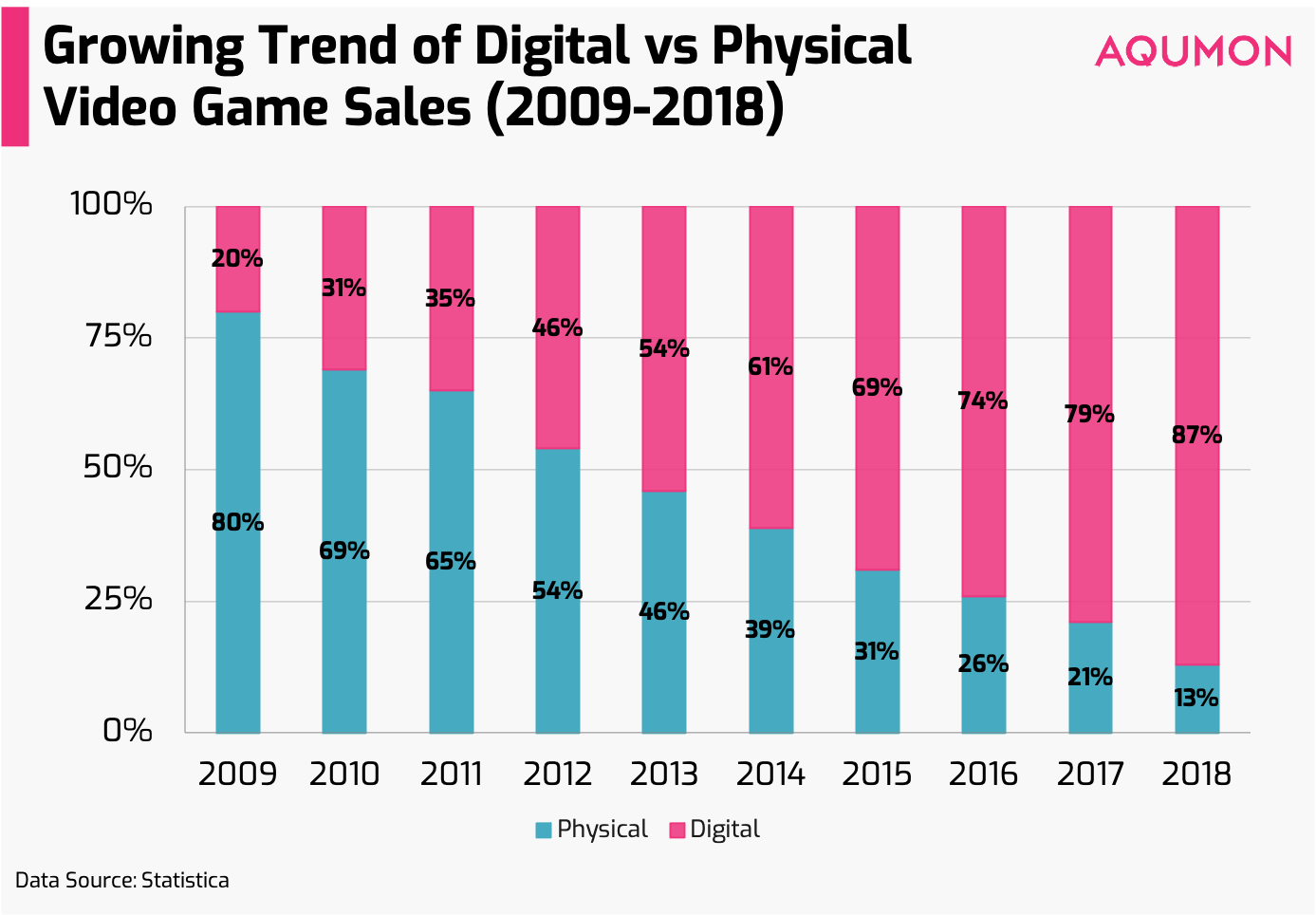

This was due to both the immediate impact of COVID-19 which resulted in nationwide store closures, as well as the longer-term trend of consumers purchasing video games digitally and directly through gaming consoles/PCs instead of at physical retail outlets.

Furthermore, the more lucrative revenue-generating downloadable content (DLC), such as in-game purchases and currency, dominated 73.9% of the world consumer video game market share. This has contributed to physical retailers, like GameStop, becoming increasingly obsolete.

If you can still remember the now-bankrupt US video-rental retailer Blockbuster, GameStop would seem to be walking in a similar direction.

So last year, why did retail investors argue that GameStop was actually ‘undervalued’? There are two main reasons:

1) Online distribution model and cost-cutting was working

Even though GameStop was badly affected by COVID-19, its extension into e-commerce sales resulted in a year on year (YoY) increase in online sales of 257% as of October 2020. Aggressive cost-cutting by new management, which resulted in over 783 store closures over the past 2 years, allowed GameStop to suffer a relatively marginal US$19 million (~HK$147.3 million) loss in Q3 2020, which is -77.1% and -96.1% down from the losses suffered in Q3 2019 and 2018 respectively. So there are some positives.

2) Video game consumption was up significantly during COVID-19

Video game sales were +63% (YoY) in 2020 and 55% of Americans reportedly played video games during the earlier phase of the lockdown. Some investors argued that video game retailers like GameStop stood to benefit from this trend as well as from the recent releases of both PlayStation 5 and Microsoft’s next-gen console.

This even caught the eye of Ryan Cohen, the billionaire founder of pet company Chewy, who bought a big position (~10%) into GameStop’s shares in August 2020 and had plans to modernize GameStop by making it a digital-first orientated company. This set the backdrop of bullish support by investors.

On the flip side, some bottom-up analysts and many hedge funds managers (like Citron and Melvin Capital) weren’t convinced by Cohen’s vision and were openly betting against GameStop’s shares (short selling). In typical short selling, you would:

1) Borrow the stock on margin from one buyer then

2) Sell it to another buyer at the current price with the intention that you can buy it back at a cheaper level as the price drops going forward and

3) Return the stock to the buyer who lent the stock to you

Here’s where the interesting thing happened. Retail investors, widely reported to originate from message board Reddit’s WallStreetBets’ (WSB) trading community (now closing in on 6 million members), found that they could profit by ‘short squeezing’ the hedge fund managers. In a typical short squeeze, as a shorted stock rises in price, the people shorting it would need to go out and buy shares to ‘make whole’ the earlier stocks they borrowed. In certain cases if there is not much supply for the stock, this may drive up the stock price. This is the case for GameStop.

Let’s give a proper example. Assume you are a short seller who thinks GameStop stock will drop from US$20. What do you do?

1) You borrow 1,000 shares at US$20 on margin from buyer so it would cost you US$20,000.

2) The stock surprises you by actually rising in price to US$40 and the buyer you borrowed from wants to close their earlier trade with you.

3) Now you need to immediately go out and buy 1,000 shares at US$40 thereby suffering a US$20,000 loss. Ouch.

What is unique about the GameStop situation was:

1) Investors banded together and invested in options rather than in the stock directly

Instead of investing in the stock itself, droves of investors systematically coordinated to invest in short-dated and deep out-of-the-money (OTM) call options. A call option gives the investor the right, but not the obligation to purchase a stock at a certain price. Out-of-the-money (OTM) call options are where the strike price of the option is above the stock price and are typically the cheapest. These are purchased when an investor is bullish on a certain stock. The further away (deeper) the strike price is above the actual stock price the cheaper the option is. This means, although typically risky for investors, retail investors were able to amplify their impact (5, 10, 100 or more times) versus just buying the stock outright.

This is unique because never in the history of financial markets has access to options trading, (traditionally risky investment products), been so easy via smartphones and online based investment platforms for retail investors. Furthermore, it is extremely rare to see this kind of systematic mobilization by such a large group of retail investors.

For the banks and institutional brokers that sell these options, they alongside certain hedge funds are essentially shorting the underlying stock. So the more call options are sold, the more of GameStop’s stock these short sellers need to buy to offset their position. When you have millions of investors buying these call options at the same time (it was reported that a record 32 million call options were sold this past Monday), the squeeze becomes like a ‘strangle’ to those shorting the stock.

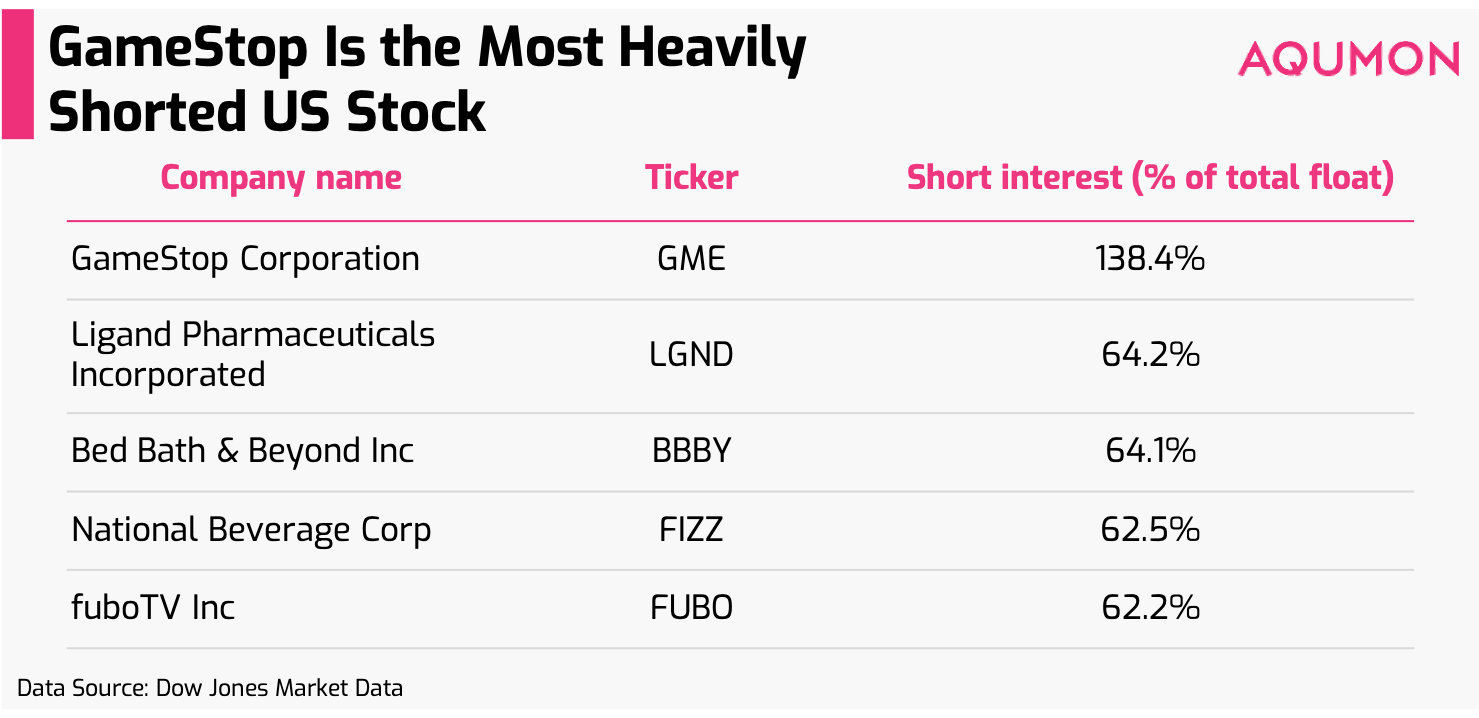

2) GameStop is the most heavily shorted stock

It is worth mentioning that GameStop is the most heavily shorted stock in the US, making it an ideal candidate to apply a short squeeze to because its highly implied volatility makes it harder for short sellers to cover their positions:

Further amplifying this squeeze into a ‘death grip’ for short-sellers is the fact that GameStop is a low float stock (~47 million shares), meaning that outstanding shares of the stock are limited. The number of floating shares is typically calculated by taking closely-held shares and restricted stock and deducting that from a company’s total outstanding shares. This reasoning makes it even harder for short-sellers to buy shares and also why it turns the ‘strangle’ into more of a ‘death grip’.

3) Beyond just generating profits, there is an element of mission-based motivation

What makes this GameStop phenomenon even more unique is that if you closely read the rhetoric by the participating retail investors, there is constant mention of “sticking it to hedge fund managers”, “making history” or “holding the line” (encouraging others not to sell and keep the short squeeze going). It is hard to gauge how many participants actually believe this or are only saying this for their personal monetary gains, but this is likely the first time in the history of the financial markets that we have seen this scale of coordinated execution by retail investors.

The bottom line is: Although this is going to end in tears for some individuals, sophisticated and professional investors need to set aside their ego and acknowledge that even though executed by retail investors, this event has turned out to be a brilliantly executed investment strategy. The retail investors behind this deserve credit and praise for beating the sophisticated investors at their own game.

So the big question I imagine you are asking is, should I jump in now?

The short answer from our end is that you can jump in at any point (since it is your right). At this point however, it is likely that your risk outweighs your return, so we don’t recommend this. Why?

1) You’re already late

This is likely the sad reality. Essentially, this current GameStop short squeeze has now become a game of ‘Hot Potato’, meaning that whoever is long this stock and sells last would be hurt the worst. The investors that got in early already made a killing. If you are buying call options now and the short squeeze loses steam, the value of your options will decay to zero. Considering fundamentals, most bottom-up research based analysts see GameStop’s stock priced at ~US$11.93 despite now trading at US$193.6. In short, buying the stock outright is very risky since there is little to no fundamental upside at this current price level.

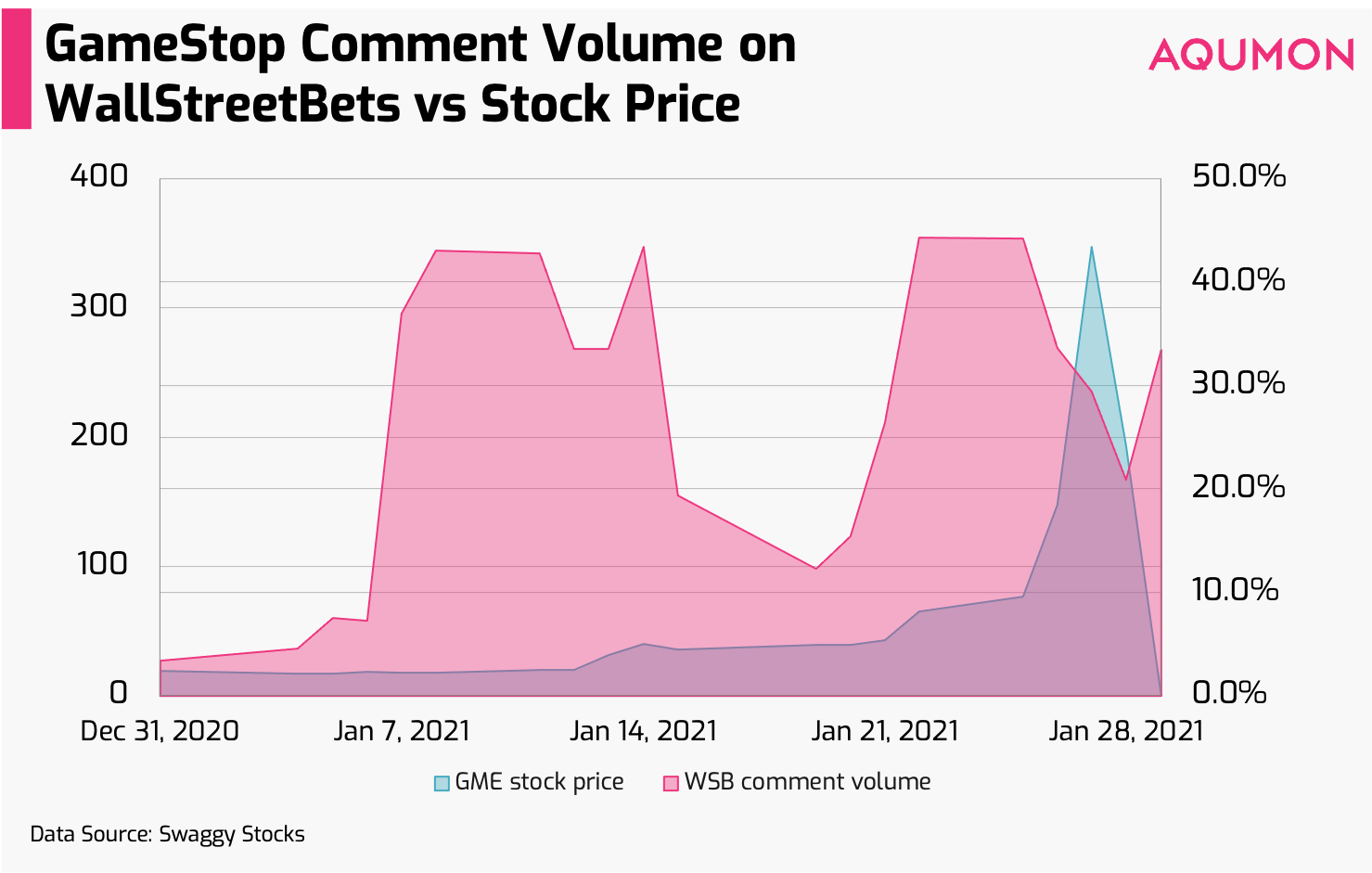

Plus, if you truly believe that communities like WallStreetBets are driving the stock price, you can see that the sentiment and volume of commentary on GameStop has already fallen relative to before:

2) Brokers and investment platforms are already limiting buys

A major reason why the stock was down -44.11% last night (alongside other heavily shorted stocks like AMC Entertainment Holdings, Blackberry Limited etc) was because Interactive Brokers, trading app Robinhood and other investment players have already started to limited buys on these stocks (in some cases only allowing sells). Does this indicate that the short squeeze is over? Based on the stock’s after-hour price action (+66% on early Friday morning Hong Kong time), this is likely a “no”. However, this action by brokers will also put pressure on retail investors who do not have “diamond hands” (when an investor is extremely willing to hold onto a trade for a long time) to increase selling.

So what will happen next? In our view, the US’ stock exchange regulator Securities and Exchange Commission (SEC) will likely step in and investigate if there has been some form of market manipulation. Based on past events, this hypothesis will be hard to prove and would be less relevant to most investors.

Looking forward, what risks are on the horizon for investors who want to partake in such short squeezes?

1) Institutional investors fighting back

Even though hedge funds like Citron and Melvin Capital are licking their wounds after this recent beating, retail investors need to realize that financial institutions and hedge funds can also band together and return the painful favor. Although retail investors are strong in numbers, hedge funds and institutional investors have strength in scale. Looking forward, jumping on the short squeeze bandwagon will be riskier for the everyday investor. The recent purchase limits by brokers and investment platforms may be the start of a coordinated response by financial institutions to this short-squeeze.

2) In the future, access to options trading may be restricted

Although we always support making investing more accessible, one area that the SEC may delve into is investor suitability for certain investment tools. For example, would risky trading tools like options be suitable for the everyday investor? If so, how much of them should they have access to? This will be a point of debate, since large scale adoption of options trading increases volatility and risk for investors, financial institutions and financial markets alike. We would not be surprised if risky investment vehicles, like options, face additional restrictions. This would make it harder for retail investors to apply similar short squeezes in the future.

3) Market risk elevated

We have witnessed multiple, well-known professional investors pointing out that the recent investor frenzy and euphoria is akin to the calm before the storm of the dot-com bust in 2002 or the Global Financial Crisis in 2008. We think they are both right and wrong. Investors in this current volatile environment need to put more priority on managing their investment risk. This is something we’ve been communicating to our investors heading into 2021. What we believe is investment accessibility has been fundamentally changed with the rise of mobile and online based investment platforms. Never in the history of financial markets has accessing the market been this easy, resulting in significant changes in our personal relationship with investing. Although markets are cyclical (we’ve been through multiple highs and lows ourselves) this new breed of investor behavior makes these comments seem like comparing apples to oranges. Both are fruits, but not quite the same.

As someone with 16+ years of investment experience, calling this “speculative” or “reckless” trading or describing this behavior as “not-real investing” misses the bigger point. Yes, there is speculative and reckless behavior by certain investors (particularly those jumping in later), but this week, some retail investors clearly and systematically outsmarted their institutional counterparts. They deserve credit where credit is due: David beat (at least temporarily) Goliath.

For AQUMON’s investors and readers, it is your right to engage in such investment activity, but we strongly recommend that our clients rationally weigh their investment risk alongside their expected return. Although this story isn’t finished, GameStop will likely turn into a business case study for years to come; ‘history’ was made this week.

As we mentioned to our clients on multiple occasions, 2021 will be a year of heightened volatility despite possible upsides in the financial markets. Managing your investment risk via diversification, holding a little more cash (for protection), and placing part of your investment allocation into bonds is our preferred strategy. Increased volatility will also result in buying opportunities, so the excess cash serves dual purposes.

For those that don’t know what to do, systematic and professional investing can be simplified and your risk properly managed easily on AQUMON’s robo advisory mobile-app. If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.