H.K. Stocks 2021: The 2 Best Ways to Find Top Performing Stocks

Written by AQUMON Team on 2021-06-16

Closing half of 2021, the Hang Seng Index has hovered around the 28,000 price range since reaching a yearly high in February. As the controversies surrounding anti-monopoly and stamp duties passed, many investors have begun to look for suitable stocks in the Hong Kong market. Wondering what is suitable for you? Today we will introduce to you a smart and stable investing strategy - investing into Market Leader stocks.

What is a Market Leading Stock?

A market leader is a company where its market share is the largest in a certain industry and its dominance can affect or change the direction of an entire industry. For example when you think about mobile payments in China, Tencent and Alibaba (who own WeChat Pay and Alipay respectively) come to mind. Typically the market leader may have been someone who was first to introduce a product/service and enjoys the largest share in sales (and potentially profit) within its industry.

"AQUMON is a leading digital wealth management platform in Asia. We use big data and algorithms to recommend investment portfolios based on the risk-tolerance level of each investor. This article introduces financial knowledge in a neutral manner. "

Why Should You Invest in Market Leader Stocks? There are 2 Key Reasons as to Why:

The reason why many investors prefer investing in market leader stocks is that they are more stable and less volatile than stocks with smaller market values.

Why is this true? Let’s take a look at the characteristics of a “Market Leader Stock”:

1. Large scale and consistent business profitability

The top companies generally have competitive advantages in terms of business or technical know-how. Also, their comparatively larger scale is typically associated with greater industry competitiveness. As these companies are also relatively mature in the business cycle, they inherently enjoy a consistent advantage over raw materials purchases, production costs, business operations and price negotiation.

Furthermore, these market leaders are especially well-known among the general public which is shown by a higher level of trust in their brand. Hence, the development of the business is more secure.

This also has a positive impact during periods of market downturns.

During the COVID-19 pandemic many companies struggled to stay afloat but in comparison market leading companies typically are very resilient and some even grew in size (shown by an increase in its “market capitalization”). That is why we often hear “the big (companies) keep getting bigger”, so it pays to invest into market leaders.

2. Benefit from “following the herd” by following market leaders

You’ve probably heard many people suggest that smart investors don’t “follow the herd”. This is we can’t agree more, but...when the herd follows you, there are benefits that come from this. How so?

Market leaders are normally companies with large market values within their industry, therefore any change in their stocks will tremendously affect the whole industry.

So when certain market industries get “hot” many investors will “jump on the bandwagon” as a result. It’s no surprise when this happens the most recognizable names in that industry, the market leaders, will get a nice boost in price as a result and reward investors with higher returns.

So here’s another piece of advice - If you feel positive about the future prospects of a certain industry, you should directly invest in top stocks of that industry.

How to Find out Quality Top Stocks? 2 Tactics:

1. Assess a company’s scale by its market value

To be acknowledged as an industry leading company, it has to be large enough to be stably profitable and influential in the market.

A simple way to tell a company’s scale is by its market value. This refers to the total value of the company in the stock market. It can be calculated by multiplying the company’s current market price and its number of outstanding shares.

Obviously, there can be more than one leader in an industry. If you are looking favourably on the recent development of a certain sector, you should keep an eye on 3 to 5 companies with large market values in that industry. One can tell a lot about the industry developments by observing the trend of their top players’ stock prices.

However, be careful with your risk concentration.

If we arrange all Hong Kong stocks merely by market values, we can see the problem of over-concentration.

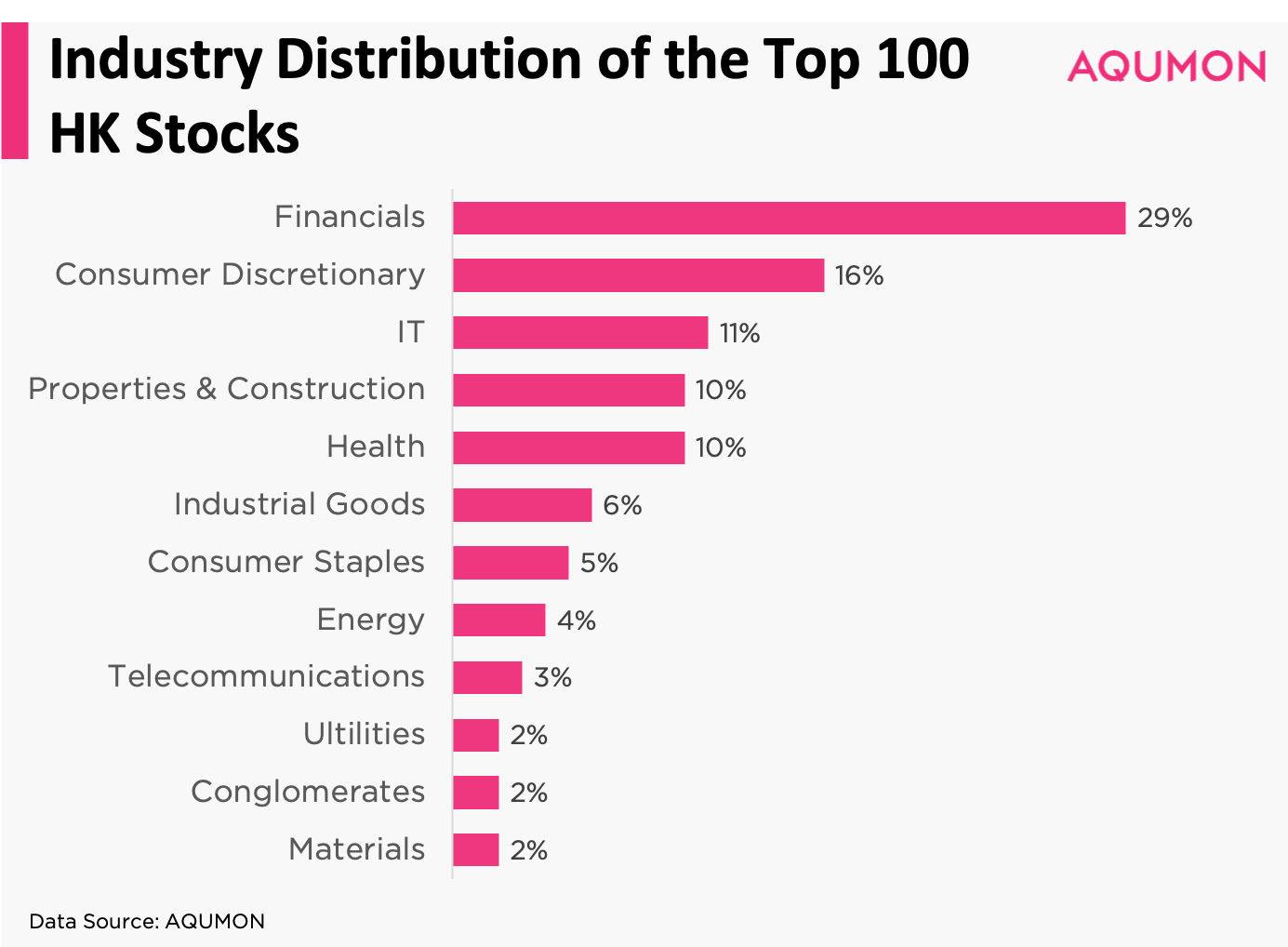

Top 10 Hong Kong stocks mainly lie in the Tech and Finance sectors. Among the top 100 stocks, the top 3 are from the Finance sector, the Consumer Discretionary and the Tech Sector respectively, and in total they take up 56% of the large market-value stocks.

The above data shows that when investors focus solely on particular industries, the risks are concentrated and market volatility will adversely affect your entire investment portfolio. So we suggest investors to diversify their investments into different industries, in order to gain profitable opportunities in various sectors, spread the risk and build wealth more stably.

AQUMON H.K. Market Leaders Portfolio comprises up to 30 quality H.K. Industries Picks in 10+ industries. The diversification strategy has significantly improved risk management and profitability.

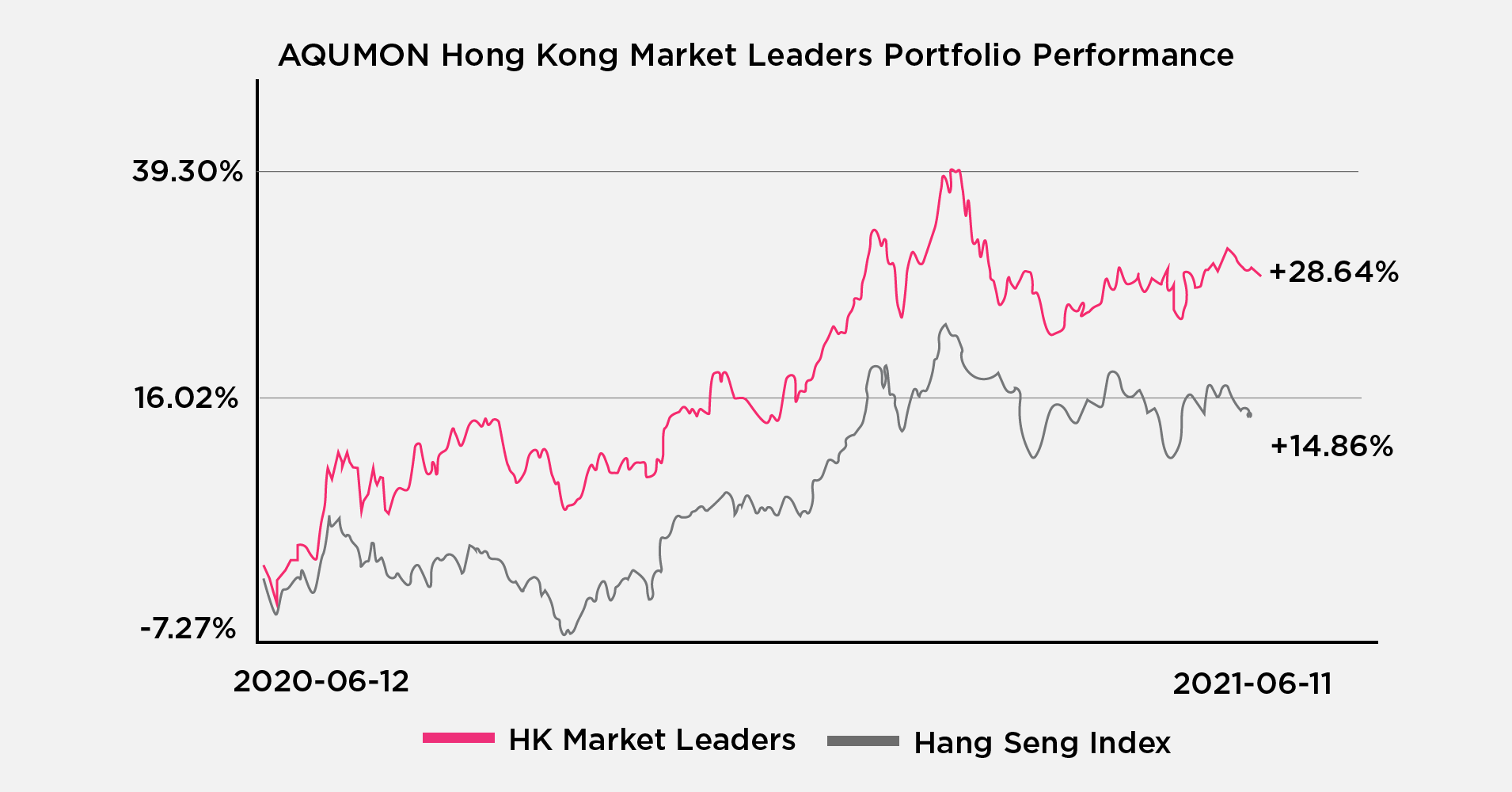

In recent years, we have been comparing investing directly in stocks with large market capitalization in the Hang Seng Index (HSI) versus investing using AQUMON’s algorithms. The result is that the H.K. Market Leaders Smartstock Portfolio outperformed the HSI by up to 15% on returns.

*This is the 1-year backtested performance. Investment involves risks. Past performance does not indicate the future returns.

2. Find The Top Stocks According To Profitability

Apart from the economies of scale, the profitability prospects of industry leading stocks are generally better than their smaller competitors. The better the business profitability, the more stable the growth prospects. This relationship ultimately contributes to the long term growth of a company’s stock price.

By ranking the most profitable US tech stocks in 2021, we showcase the reasons and methods behind assessing a company’s profitability.

Extended reading: Ranking the Most Profitable US Tech Stocks in 2021

The business operations tend to be more stable for large-scale companies. Investors can directly obtain the profitability indices from companies’ financial reports to compare which is better. Apart from the Return on Assets (ROA) index as introduced before, here we can also use another index to evaluate the profitability of the company - Return on Equity (ROE).

ROE represents the ability of a company to utilise equity (Income/Shareholders’ Equity) to earn profits. The higher the ratio, the higher the ability to generate profit per investors’ dollar.

In the previous blog, we introduced the concept of ROA (Income/Total Assets). RoA shows a company’s efficiency in using its assets to generate earnings, which is a strong indicator of a company's profitability. ROE, on the other hand, shows how efficient a company is at using its shareholders’ equity to generate earnings, also known as how effectively they use investor money.

The below list comprises stocks ranking no.1 in ROE in each industry. (New stocks which are listed in less than a year are not included in this ranking. Income and stock price data are as of June 11, 2021).

However, be mindful that some corporations might have higher liabilities, making the ratio of shareholders’ equity lower. This can lead to an abnormally high ROE as well. Therefore, a combination of ROA, liability, gross profit and other indicators can help assess holistically the performance of a company.

Undoubtedly, there are still many undiscussed factors when assessing industry leading stocks and a lot more analysis can be done if you want to deep-dive into the topic. However, if you are short on time and want some scientifically suggested stocks - AQUMON’s new H.K. Market Leaders SmartStock Portfolio is the way to go. The investment strategy uses big data and algorithms to help customers dynamically select high quality thematic stock portfolios by analyzing market capitalization, profitability, potentials for growth and other big data tools to select quality companies.

Gain access to high quality stock portfolios comprising up to 30 quality stocks with just HK$10,000! Click here to learn more about the different SmartStock portfolios offered by AQUMON. In case of any inquiry, don’t hesitate to reach out. We are here to help you in your investment journey!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.