Robinhood, To Invest or Not To Invest?

Written by AQUMON Team on 2021-07-30

Hottest Investment News of the Week: Controversial U.S. brokerage firm Robinhood (HOOD.US) went public on NASDAQ last night on July 29th, grossing over US$ 29 billion* in market cap! While young people have praised the app for empowering common retail investors, American billionaire Warren Buffet says it has turned the stock market into a casino.

In just four short years, Robinhood has become the most popular trading platform for young American investors; "0 commission", "free stock" and "fractional stock" are some keywords most commonly associated with the brand. Robinhood’s meteoric rise has piqued the interest of the investment market as well.

Before we jump into our analysis of Robinhood’s first day price drop of -8.37% let’s give everyone a little background on the firm and its unconventional path to its stock listing (called an initial public offering aka IPO).

Founded in 2013, Robinhood is a California-based online brokerage and fintech company. It offers equity, cryptocurrency, options trading as well as cash management services.

During the month of August 2021, AQUMON is running a limited time giveaway offer with a 1,000 person quota! Read until the end to learn how to participate!

HOOD IPO: 4 Key Takeaways

1. U.S. market’s sixth-largest IPO of 2021

In this IPO, stock volume exceeded 40 million. As of the first day of public listing (July 30th), the market cap of Robinhood has exceeded US$29 billion with a stock price of US$35.15. Robinhood’s IPO is the sixth-biggest to happen on U.S. exchanges in 2021.

2. Unconventional Revenue Model

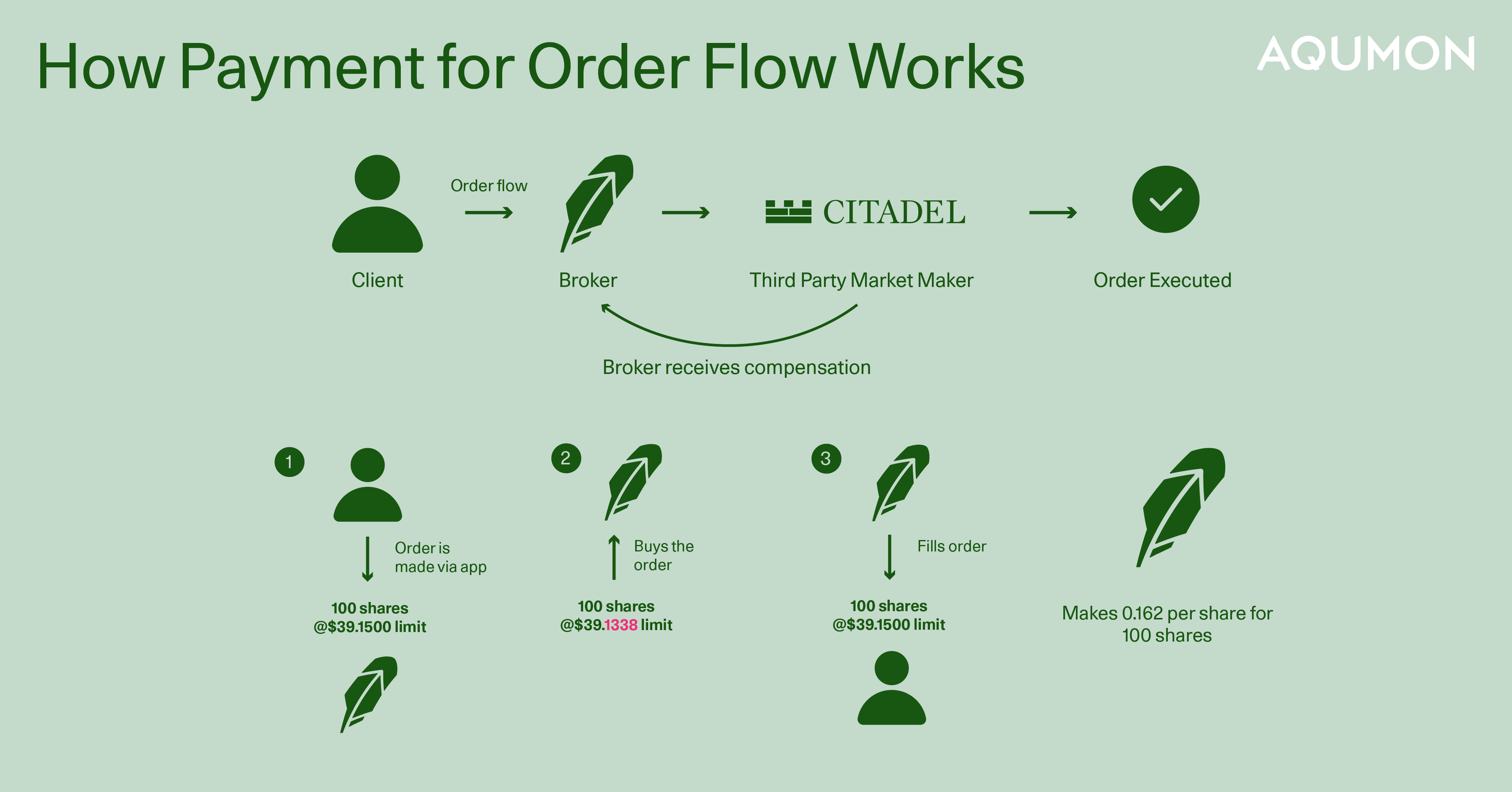

Unlike traditional brokerages that earn most of their revenue from transaction fees, Robinhood’s main revenue source is the Payment for Order Flow (PFOF) system. It is important to note that PFOF revenue does not come from retail customers, but is instead paid by third parties market makers as a “fee” for bringing in orders to them.

For example, if a Robinhood user places an order for 100 shares of Tesla, Robinhood sends the order to a market maker (such as Citadel Securities). If the order is fulfilled through Citadel, Robinhood will receive compensation. If the order is not fulfilled by Citadel, the order will be sent off to a public exchange for execution.

A market maker (MM) is a firm or individual who actively quotes two-sided markets in a security, providing bids and offers (known as asks) along with the market size of each.

In Q1 of FY 2021, nearly 81% of Robinhood’s revenue came from PFOF; 12% of revenues came from interest, while the remaining 8% came from other sources such as subscriptions for Robinhood’s premium Gold membership.

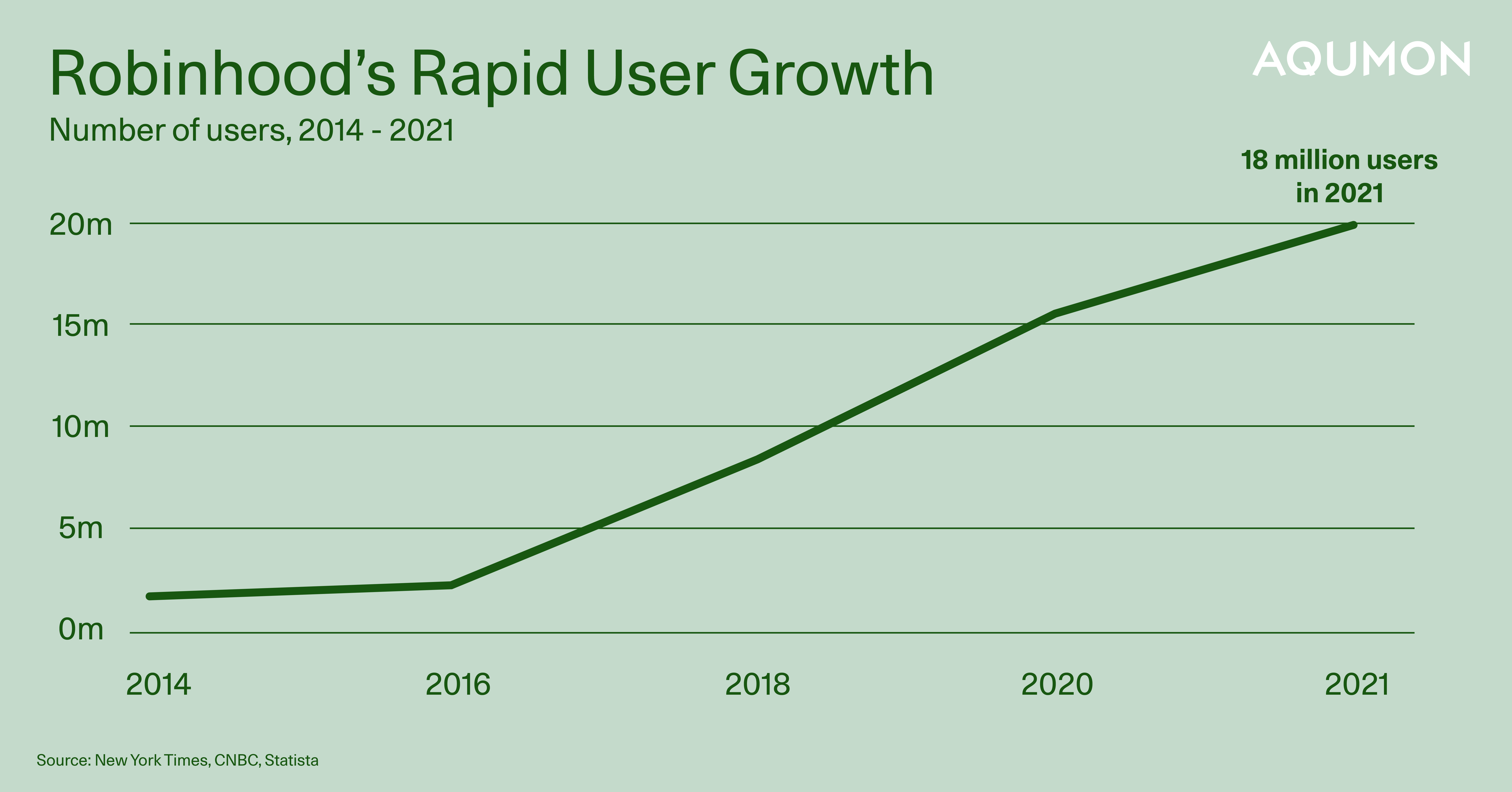

3. Chosen Trading App for Gen-Z and Millennial Investors

Self isolation during the COVID-19 pandemic led to a boom for online trading platforms. According to Sensor Tower, Robinhood saw a spike in downloads in the first half of 2020, catapulting it to be the fourth most downloaded finance app. Notably, Robinhood added 6 million new users to its platform in just the first two months of 2021. Robinhood currently boasts over 22.5 million* funded accounts.

*Data source: CNBC

Zero trading commissions, user-friendly UX design, and clever gamification strategies are Robinhood’s key attraction points to young and beginner investors. In fact, Robinhood users check the Robinhood app two to four times more frequently than users of other online brokerages!

4. Unique IPO strategy: 35% of shares reserved for Robinhood users

Typically, the majority of shares offered during an IPO are prioritised for institutional or high net worth investors. Retail investors, on the other hand, have to wait until the company is traded on an exchange to buy these stocks and thus will miss out on the first wave of stock price increases.

The Robinhood IPO reserved up to 35% of shares to its retail users (about 18.3 million shares). This means retail investors will hold a much higher proportion of IPO shares than for other IPOs.

So why did Robinhood’s stock drop on its first day of trading?

Negative market sentiment aside there were 2 main reasons why Robinhood’s stock traded lower on its first day:

1) Large allocation (35%) of the IPO to retail investors

This is not unexpected given institutional or cornerstone type investors in a traditional IPO are subject to a 6-month lockup period. This means during this period they are not allowed to sell the stock and thereby providing the stock price with more stability.

In the case of Robinhood, their stock was subject to more price volatility risk because they allocated 35%, or roughly US$700 million in stock for retail investors which have more of a tendency to sell than institutional investors.

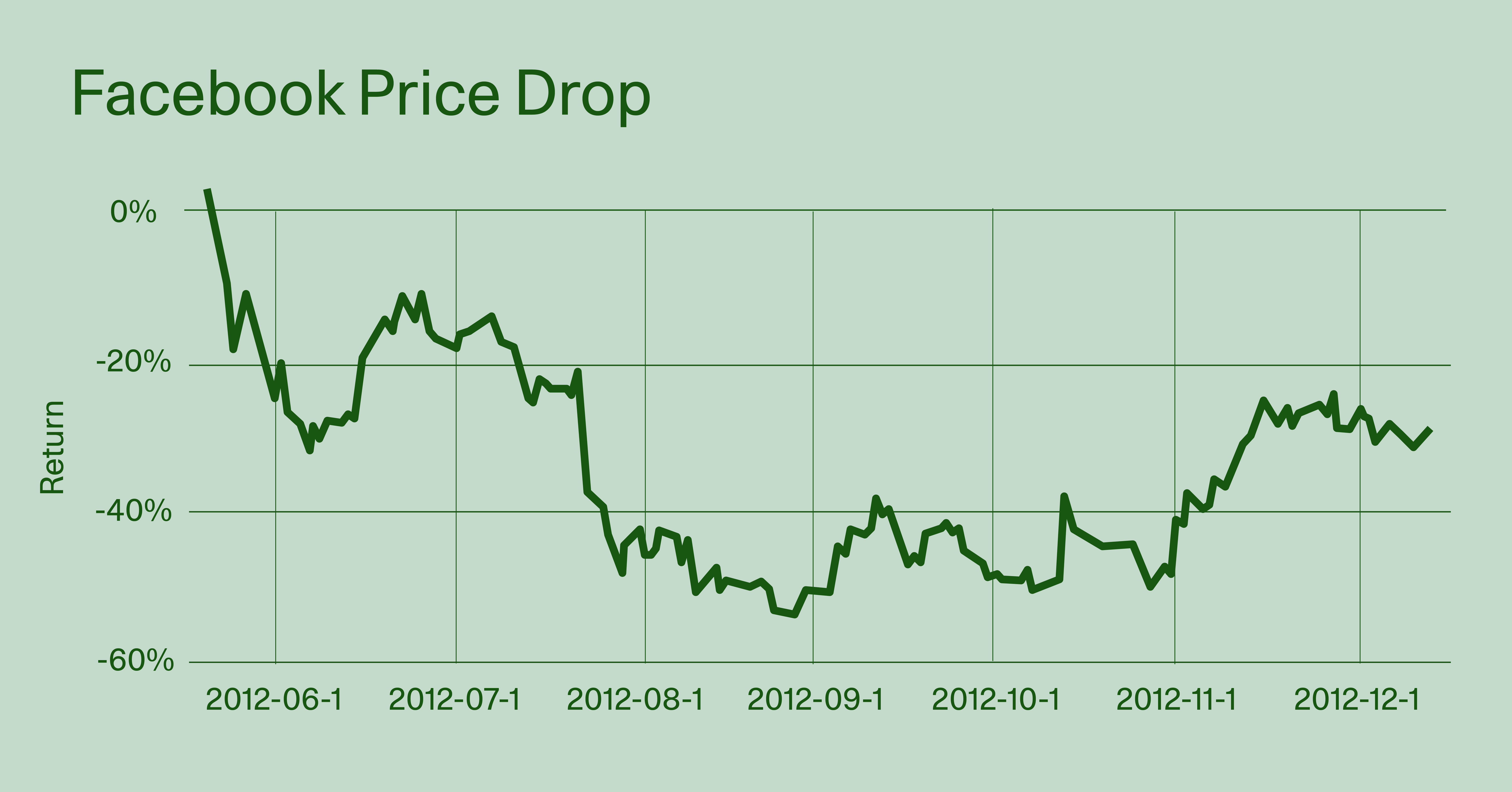

For those that remember Facebook’s IPO on May 18, 2012 the stock traded flat on the first day of its IPO largely due to the fact that 25% of its shares valued at approximately US$4 billion was reserved for retail investors. On it’s 2nd day of trading it was down -10.99%.

2) Employees could be net sellers of the stock during the IPO

Another little known fact was that Robinhood also took an unconventional approach by allowing their employees to sell up to 15% of their shares immediately during the IPO. For the majority of traditional IPOs, employees are also subject to a 6-month lockup period as well.

Looking at Robinhood’s prospectus, Co-founders Vladimir Tenev and Baiju Bhatt along with Chief Financial Officer Jason Warnick sold 1.25 million shares and 125,000 shares each netting the Co-founders US$47.5 million each and US$4.75 million for their CFO.

If this is any indication it is highly likely there was actually more selling happening on the first day than buying.

So what does this drop mean for the outlook for Robinhood?

Likely very little. If Facebook was any indication, the stock price fell over 53.62% 3 months after its IPO but the subsequent 9 years is now up 837.27% (as of July 29th 2021):

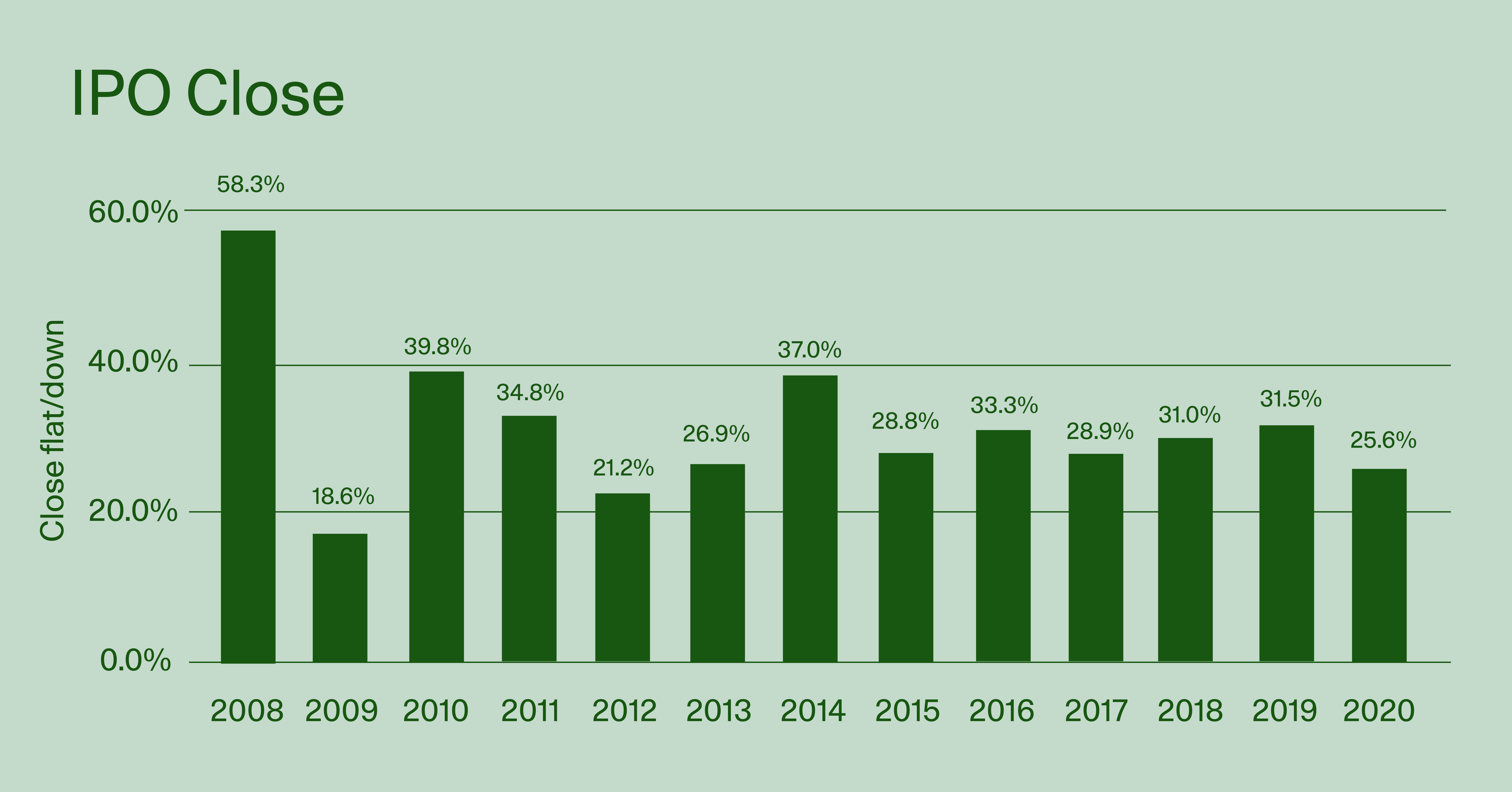

According to University of Florida Finance professor Jason Ritter (nicknamed “Mr. IPO”) the average the “IPO pop” (the jump on the first day) from 1980 to 2020 was 18.4% but investors also need to be aware that close to 30% of all IPOs close flat or down on the first day:

So trading down on the first day one’s IPO is not that uncommon. So for investors who believe in Robinhood’s upside, we remind investors to not put too much weight behind this bump in the road yesterday during Robinhood’s IPO.

AQUMON’s August Offer: Free Robinhood Shares!

From August 2nd to 20th, AQUMON will be giving out free Robinhood shares along with other popular stocks upon successful account registration! Click HERE to learn more about our stock giveaway event.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.