Should I Stay or Sell? Investing in Times of Market Volatility

Written by AQUMON Team on 2021-11-25

Global equity markets have been on the rise since the third quarter, with US stocks hitting another "all-time high". The latest Bank of America monthly fund manager survey (November 2021) shows that worries about world economic developments have now receded, with 51% of fund managers surveyed expecting inflation to slow down and becoming even more bullish on US equities. When the highs come and go, the sayings of "market is going down" and "market bubbles" can make investors want to sell and take profits.

If you are already an AQUMON investor, your main concerns might be "Should I continue to invest more” and "Do I need to change my investment strategy?". We will share with you some common misconceptions and facts about investment, building investment strategies for you by data in a scientific way.

Should I Sell to Take Profit or Keep on Holding? 3 common misconceptions and facts

Concern 1: Are new market highs and big drops rare?

Fact 1: Over the past 10 years, the US stock market has averaged about 34 "all-time highs" per year*. (based on the S&P 500)

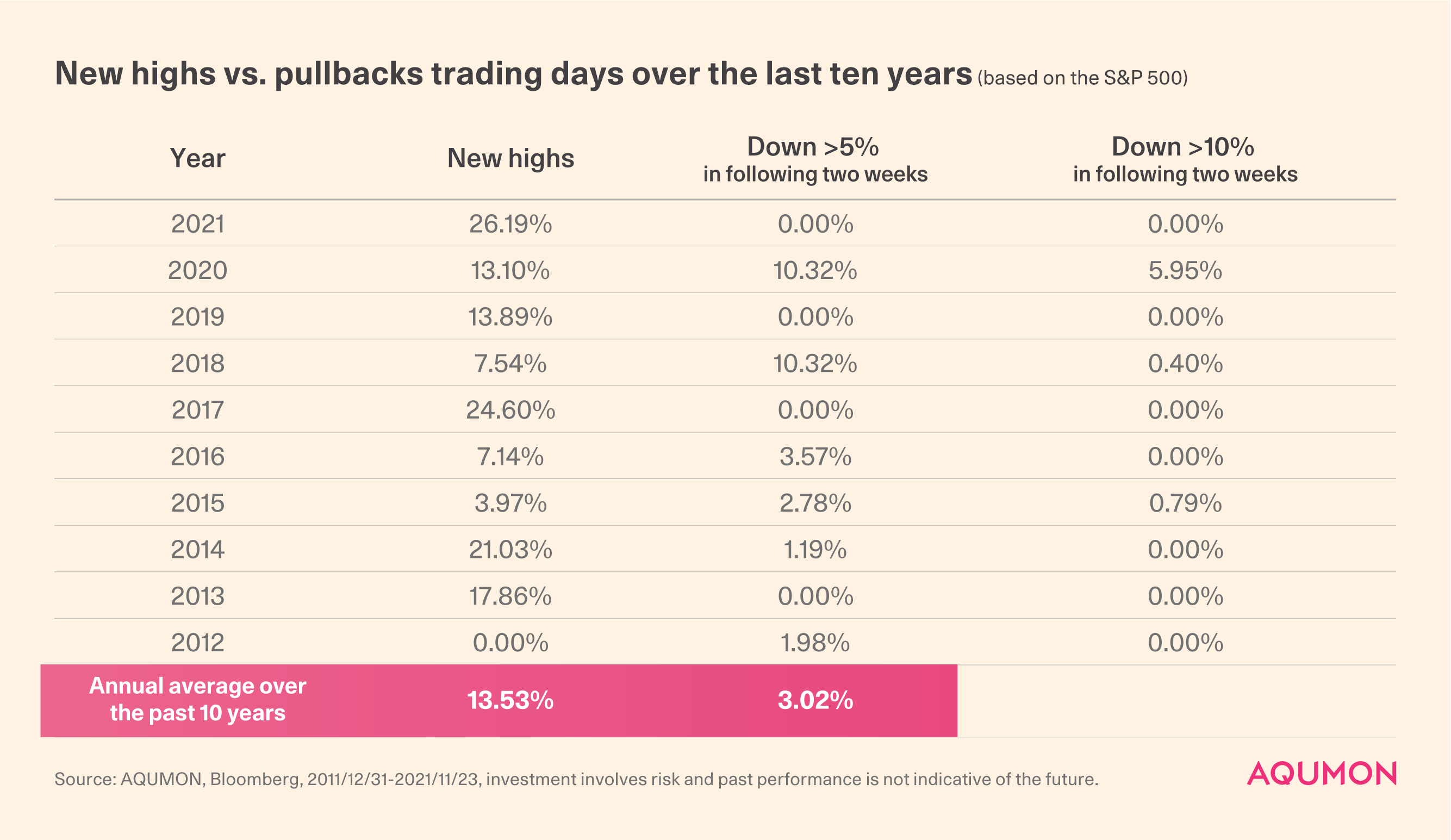

Actually, in the context of a long-term economic upturn, the stock market will reach new highs. Based on US stock market data over the last ten years (S&P 500), there have been an average of about 34 "all-time highs" per year, accounting for 13.53% of the annual trading days.

Also, in the past stock market environment, "crises" were also never rare when the market was falling. If you look at the number of days in which US stocks have fallen by more than 5% in the following two weeks, the average is 3.02% per year. In particular, market volatility has increased in recent years, with 10% of trading days in 2020 and 10% of trading days in 2018 would lead to a more than 10% fall in the following two weeks.

New market highs and drops are not that thrilling, but investors need to be aware of whether their investment options are risk-controlled in a volatile market environment, and if they are sufficiently diversified.

Concern 2: Will I lose a lot of money in a market fall?

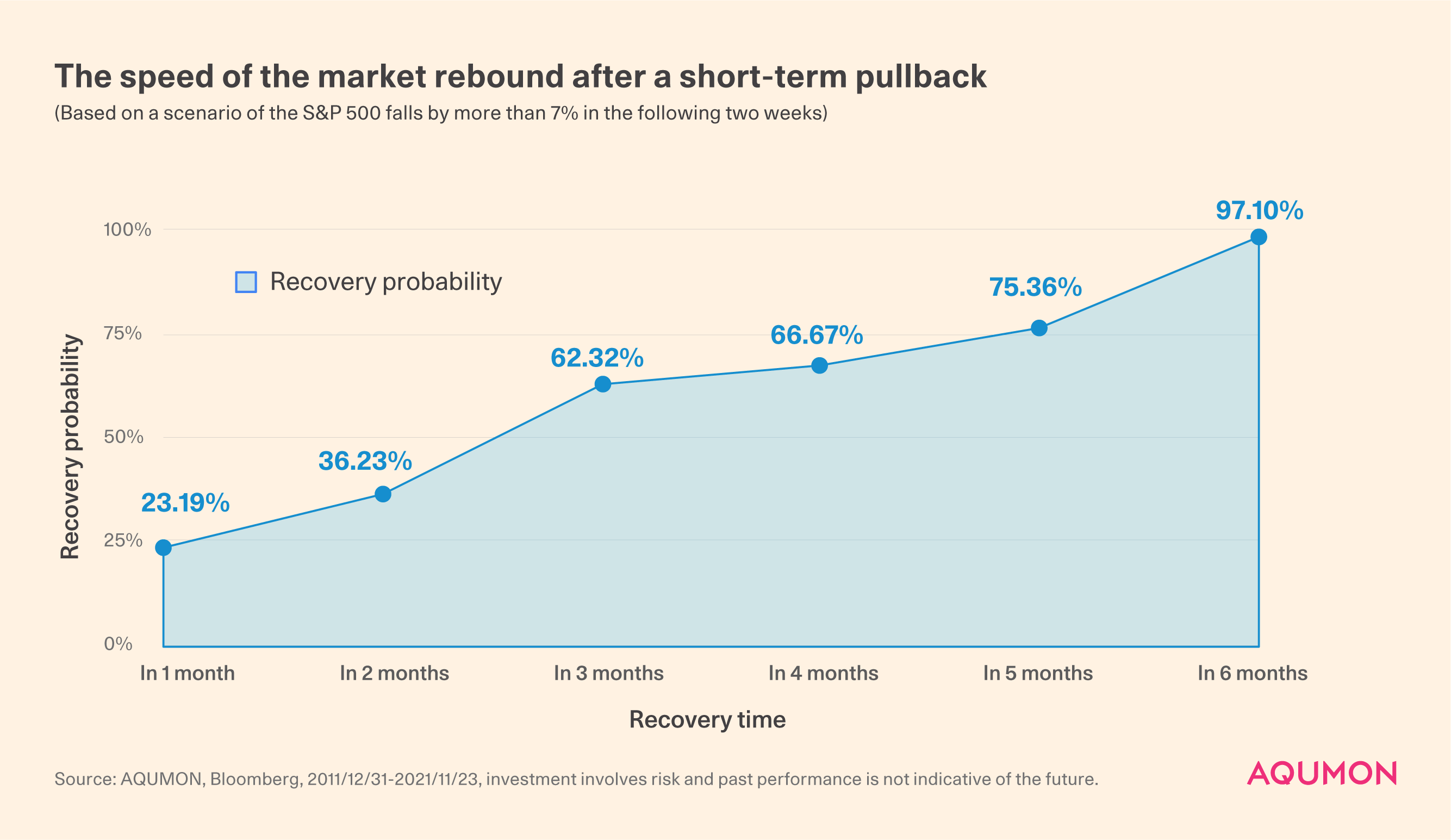

Fact 2: After a market pullback has occurred (down >7% in the next two weeks), there is a 62% chance of a recovery within the next three months.

From the end of 2008 to 22 November 2021, if the market were to fall by more than 7% in the following two weeks, the average recovery period between the fall and the rebound would be 60.84 trading days.

Based on the average recovery period, the probability of a recovery to the original market level within three months is 62.32%.

Concern 3: Long-term holding is not as rewarding as frequent trading?

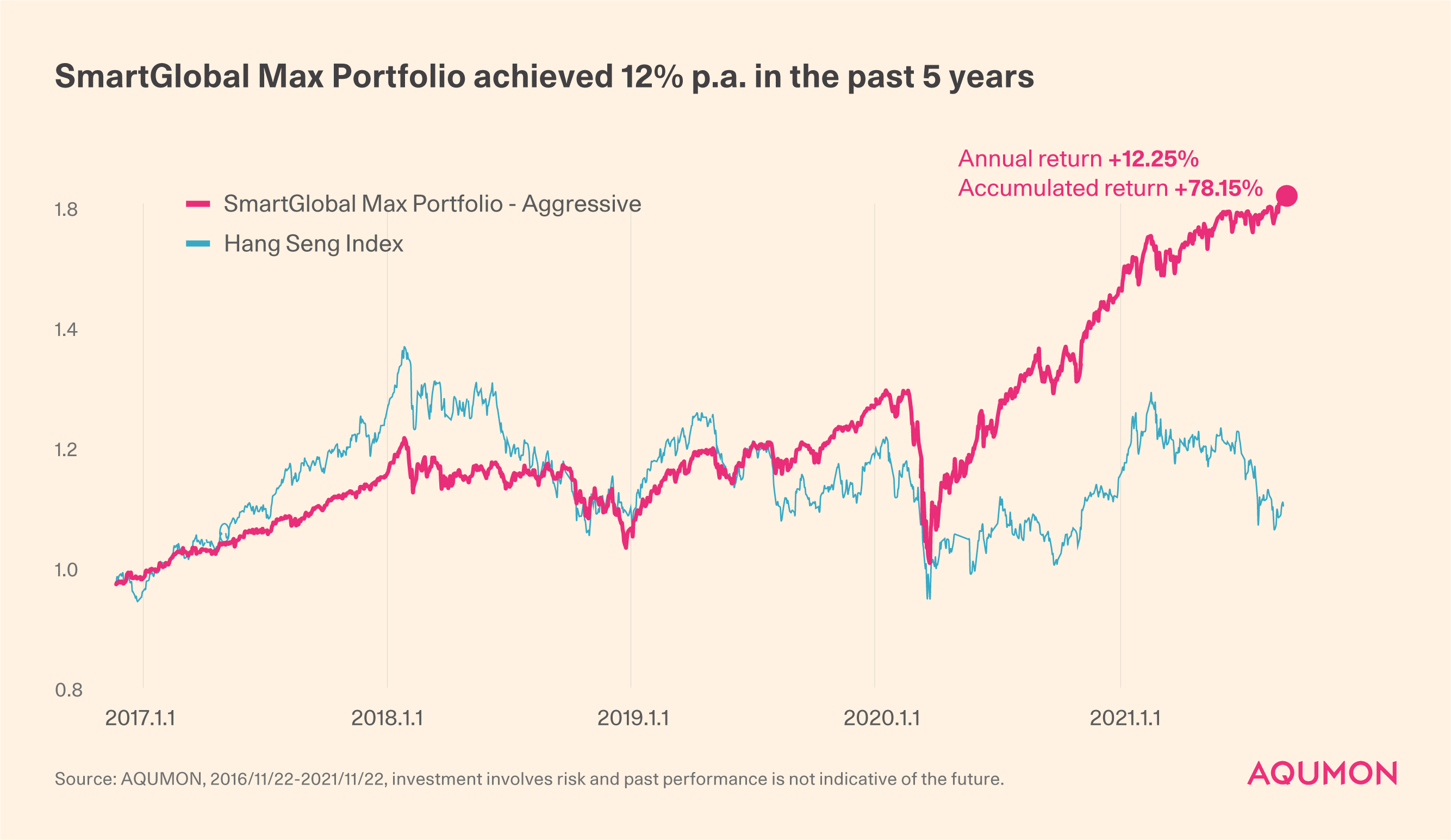

Fact 3: Your investment strategy determines the correct investment method. If you have been holding the AQUMON Flagship Portfolio since 5 years ago, you can also earn over 12% annualised returns by following the auto-rebalancing (Based on the performance of the AQUMON SmartGlobal Max US ETF Portfolio).

Which is more profitable, "Long-term holding" or "frequently trading"? There is no single standard answer to this question. But Charles Ellis, Director of Pioneer Funds, has shared his view that market movements can often be too sudden for investors to react.

In fact, many investors sold at a bad time in the market and missed out on a big rebound.

Holding long-term investing doesn’t mean that you buy and hold an investment for forever, but rather that you maintain a perpetual investment mindset.

If investors see a downturn as an investment opportunity and raise their positions at the lows, panic is no longer a negative factor in their portfolio, but a golden opportunity to perhaps buy into the dip.

In the example above, if an investor is smart enough to take advantage of a short-term 7% drop in the market (more than 7% drop in two weeks), the average annualised return over the next 3 months could be 115.34%*.

*Calculated from 2008/12/31 to 2021/11/23, if buy at the low of a 7% decline in the S&P 500 over the next two weeks, the three-month average annualised return is 115%.

AQUMON uses technology to help clients grow their wealth over the long term by selecting the best companies to invest in utilising scientific investment strategies. With this in mind, the SmartGlobal Portfolio Series was launched. Based on a globally diversified, long-term investment strategy, the AQUMON portfolios have served over 20,000 clients well.

If you have been holding the flagship portfolio since five years ago, you can earn over 12% annualised returns by following AQUMON's intelligent investment strategies with automatically rebalancing.

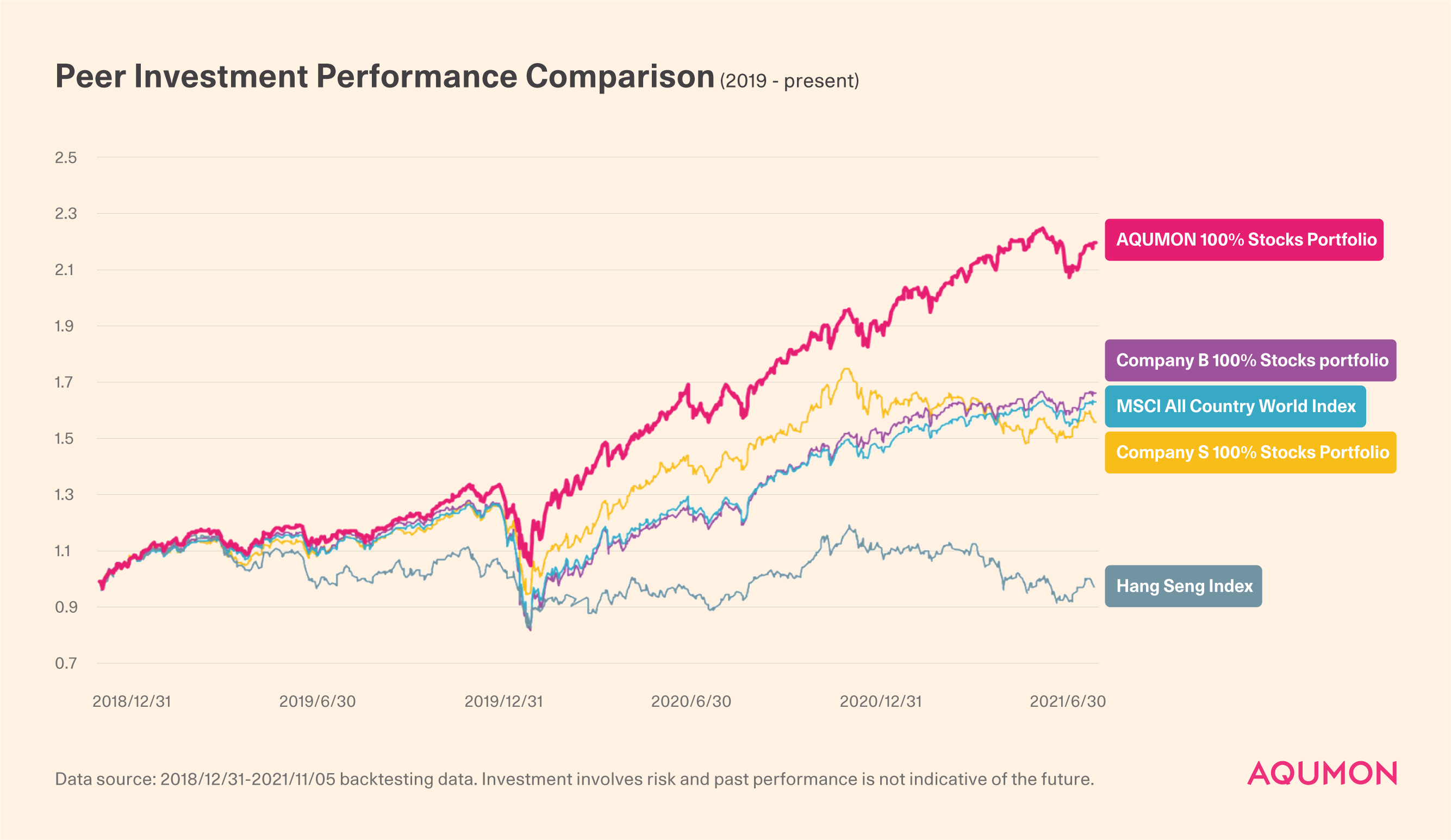

Based on the performance data of the entire smart investment industry, it has outperformed its benchmark and peer group competitors in the last three years.

3 Essential Questions for Investment Review

In a low interest rate environment, investing is a must for everyone.

The market is not the only determinant, and AQUMON's flagship portfolio believes in long-term investing, creating scientific investment solutions for each individual.

Investing is not a one-off service, it requires constant review and reassessment. Ask yourself these 3 questions in each review.

1. Have my investment objectives changed?

2. Is my current investment portfolio in the right proportion? Am I comfortable with the current investment risk?

3. if I have made a buy/sell decision, what is my plan after this action?

Reviewing your investments is also an important section.

After the review, if you wish to sell and take the profit, this does not mean the end of your investment journey, but rather to consider the point at which the next investment opportunity arises; if you wish to achieve a stop loss, then you should rethink your previous investment strategy.

AQUMON's flagship portfolios are also reviewed and upgraded based on quarterly market data and algorithmic models in order to achieve the best investment experience for our clients!

AQUMON advocates a scientific approach to wealth growth from a long-term, diversified and stable perspective, rather than using core funds from long-term investments for short-term speculation. We hope you find this helpful!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.