2024 Q1 Market Insights and Portfolio Review

Written by AQUMON Team on 2024-05-02

2024 Q1 Global Financial Markets Key Highlights

The first quarter of 2024 witnessed significant developments in global financial markets. Here are the key highlights:

The bull kept running in the US stock market in early 2024. Even the threat of interest rates staying higher for longer didn’t trip up its solid performance. Stocks staged impressive returns in the first quarter, gaining over 10%, despite diminished expectations for Federal Reserve rate cuts in 2024. Gains were led by technology stocks, especially the companies seen as most likely to benefit from the artificial intelligence boom. Value stocks also joined in the rally. Meanwhile, the bond market’s performance was dented by the prospect of the Fed putting off rate cuts until the middle of the year.

In the first quarter of 2024, China's GDP reached RMB 29.63 trillion, indicating a 5.3 percent year-on-year increase and a 1.6 percent quarter-on-quarter increase when adjusted for constant prices. This growth surpassed forecasts and can be attributed to strong output and activity in crucial manufacturing and service sectors. As a result, China is on track to meet its annual economic growth targets. Notably, various sectors of the economy, such as foreign trade and the value-added output of foreign and private companies, continued to recover during the January to March period after experiencing a prolonged period of low growth.

The Hong Kong stock market experienced fluctuations, with the Hang Seng Index (HSI) declining by 3%. The market showed signs of recovery in March, with increased trading activity and the release of annual performance reports by important companies. The raw materials sector performed well, while the healthcare and real estate sectors had weaker performance.

How Did AQUMON's Portfolios Perform?

Benefitting from the favorable state of the US stock market, our portfolio, A Better World, has successfully capitalized on the market's gains. In the first quarter of 2024, while the S&P 500 index recorded a growth of 10.16%, our portfolio outperformed with a 10.73% increase, surpassing the market by 0.57%.

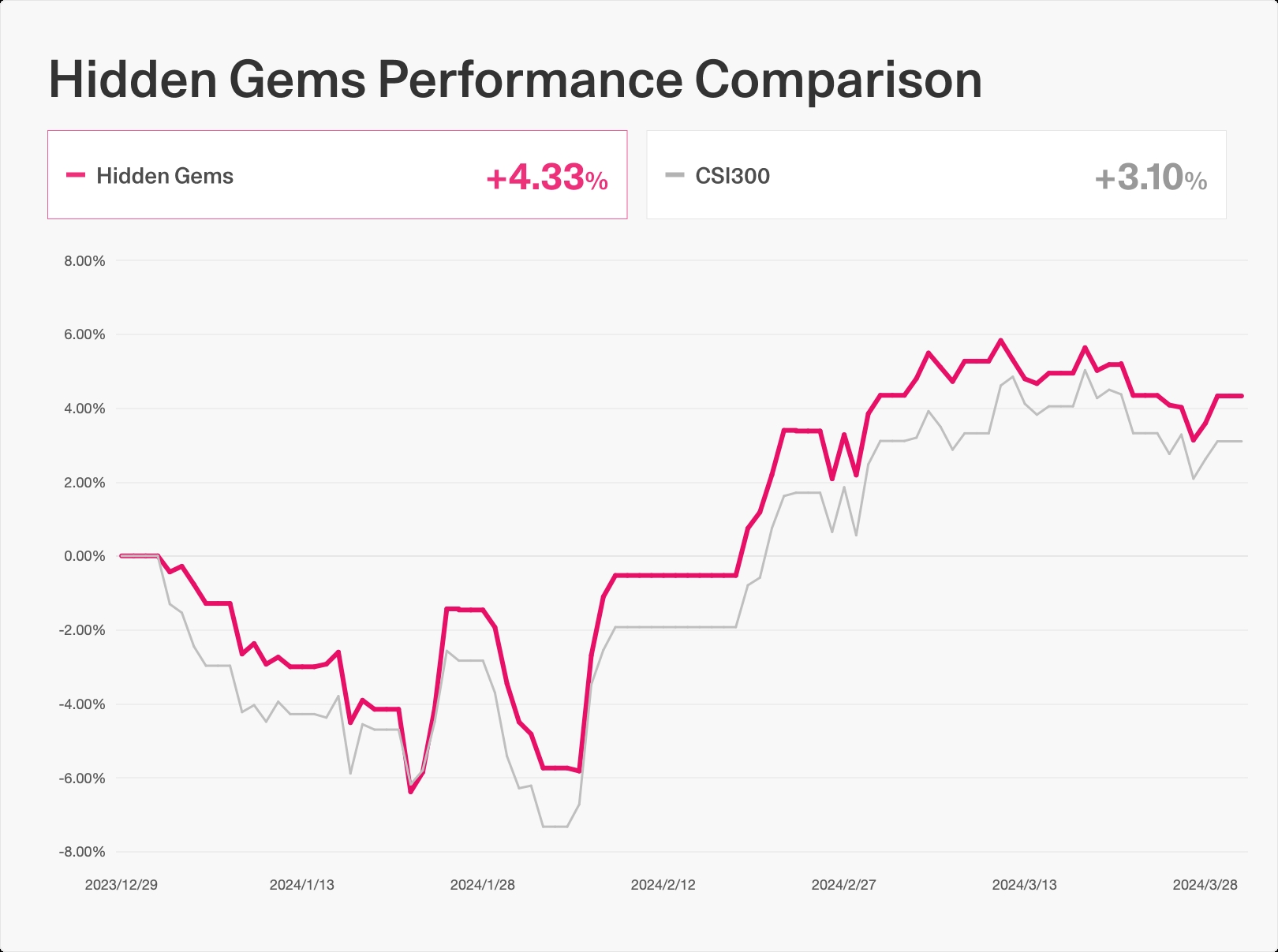

Similarly, in the China market, our Hidden Gems portfolio outperformed the CSI 300 index. In the first quarter of 2024, while the CSI 300 index grew by 3.10%, our portfolio achieved a remarkable 4.33% increase, surpassing the market by 1.23%.

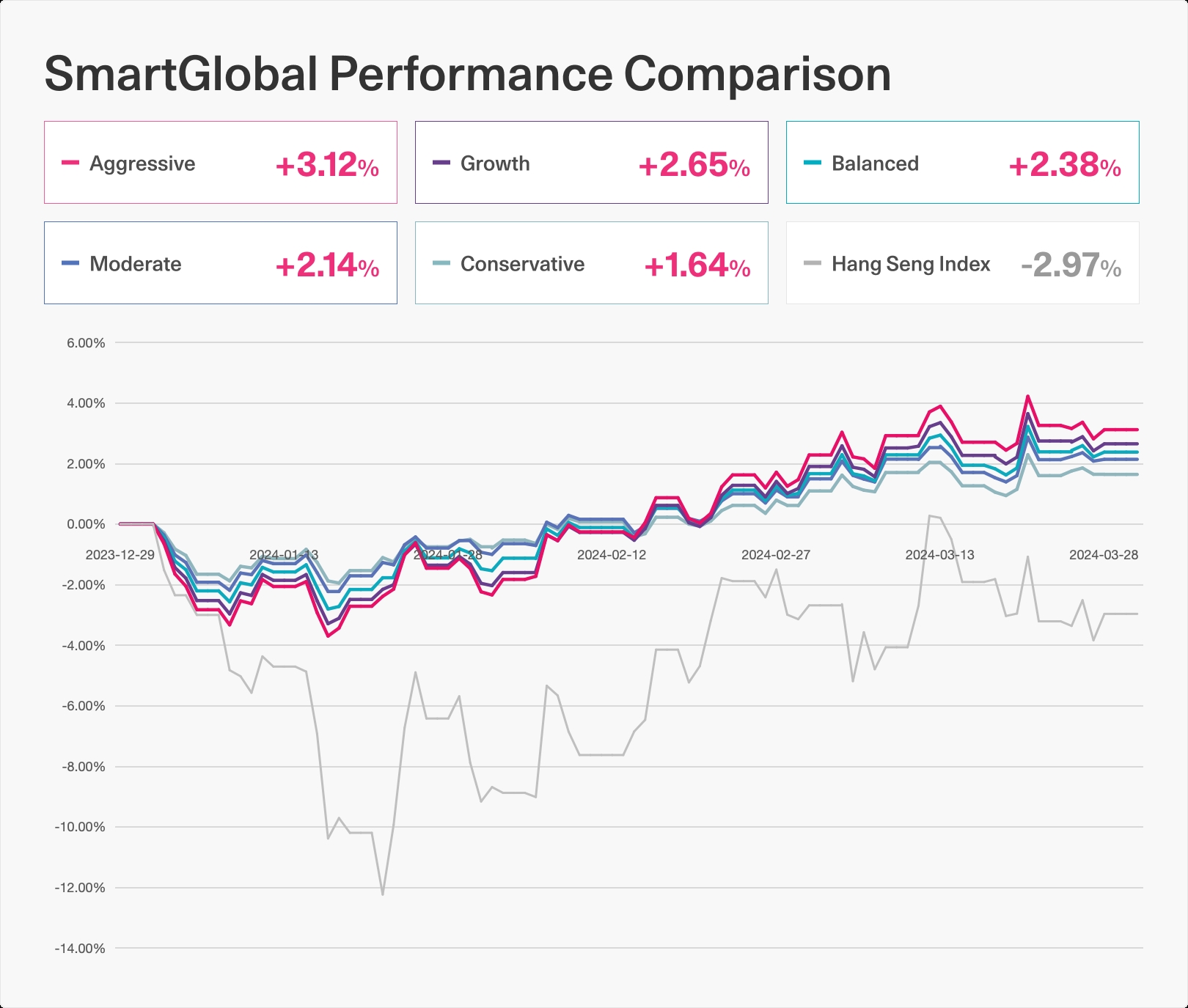

Despite the challenging conditions in the Hong Kong stock market, our flagship portfolio, SmartGlobal, has consistently delivered outstanding gains. In the first quarter of 2024, while the Hang Seng Index experienced a decline of -2.97%, our portfolios, regardless of the chosen risk levels, consistently outperformed the market by generating positive gains.

Q2 Market Outlook

In a surprising turn of events, the economy not only managed to avoid a recession in Q1 but also exhibited stronger performance than initially expected. However, concerns regarding inflation have persisted. Looking ahead to the second quarter, there is a more optimistic outlook as the Federal Reserve prepares for imminent rate cuts. Market participants are now more realistic about the timing and pace of these cuts.

The projected timeline for Fed rate cuts has been postponed until at least June. Initially, investors had accounted for the possibility of five rate cuts in 2024, but current expectations indicate that only three cuts, at most, are now anticipated.

China has established a target of approximately 5% economic growth for this year. However, there is limited information available regarding the specific measures to address the real estate crisis and stimulate consumption, leading to criticism. Nevertheless, an increasing number of investors believe that China's stimulus measures are starting to have a positive impact on actual economic performance. In Q2, there is a possibility for the Hang Seng Index (HSI) to test the 18,000 level due to anticipated further improvements in China's economic data and growing expectations of US interest rate cuts.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximize their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.