Has the Worst Been Past?

Written by Victor & Jiaqi on 2019-02-12

Has the worst been past?

2018 was one of the worst years for HK/China equity investors. 2019 was also not off to a great start. In particular, the HSI Index dropped to the lowest point in 2 months around the 25,000 level on January 3rd, 2019. Since then, however, Hong Kong market rallied along with the US and China market, briefly touching the level of 28,000. Up until February 4th, 2019, the last trading day of the Year of the Dog, HSI Index has gained around 11% from the trough on January 3rd, and only 72 stocks out of the 493 stocks in the Hang Seng Composite Index (HSCI Index) had negative YTD return (as of Feb 4th, 2019).

Now as we are entering the Year of the Pig, the million-dollar question is: will this upward trend sustain or it was just a dead-cat bounce in a bear market?

What kind of stocks outperform?

To answer this question, we first need to find out what kind of stocks are leading the market rebound in January. Using our in-house multi-factor model, we found out that stocks with high growth rate, high volatility and high turnover rate outperform the market in January.

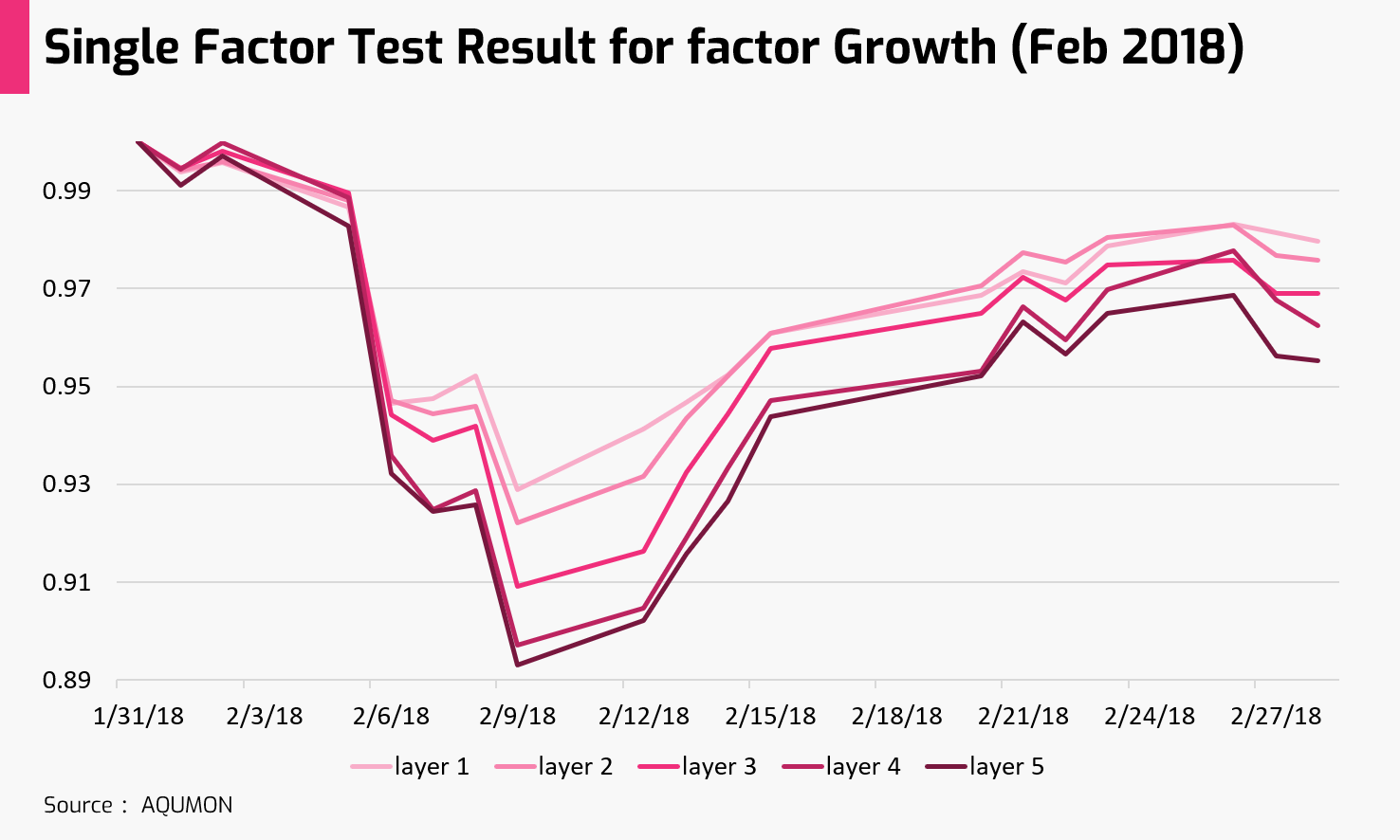

Take growth factor as an example, we separate all the stocks listed in HK into 5 layers, based on the value of growth factor. Stocks in layer 5 have growth factor in the top 20 percentile and those in layer 1 have growth factor in the bottom 20 percentile. The stocks in each of the 5 portfolios are equal-weighted. As shown in the graph, the performance of stock portfolio in layer 5 is the highest, followed by layer 4, layer 3, layer 2, and layer 1. This shows that growth is a very robust factor in January, and is positively correlated with the performance, i.e. stocks with higher growth perform better than those with lower growth.

We did the same for volatility factor and turnover rate factor and yield the same result: stocks with higher volatility, and higher turnover rate perform better. For example, Wuxi Biologics (2269 HK), China Education Group (839 HK), and Kingsoft (3888 HK) are among those stocks with high YTD performance ranking (more than 25% return), and their growth, volatility and turnover factor are all in layer 5.

This market style was in stark contrast with December 2018 where growth and turnover rate factor are negatively correlated with performance, i.e., stocks with high growth and high turnover rate underperformed and the investors flee to defensive sectors such as utilities and telecom. Thus, a style rotation favoring growth stocks in HK market happened in January, indicating that investors turned into a risk-on mode and the overall sentiment is upbeat. We believe that the following drivers lead to the factor style rotation in HK market.

Why do these stocks outperform?

On the US side:

1. Earning result were overall optimistic in the bank sector where Bank of America, Goldman Sachs and Citigroup all released better-than-expected profit. Tech giants such as Facebook smashed analyst estimate in its key holiday-quarter report, and Apple topped Wall Street analysts estimates with holiday quarter data that “could’ve been worse”.

2. The Fed holds a more dovish stance as it is no longer in any rush to raise US interests rates this year among concerns on global economy slowdown.

On China’s Side:

1. Chinese authority’s stance on deleveraging and dealing with”zombie” companies softened as the macro data releases (including GDP, consumer spending, manufacturing) showed that the economy continued to slow down. In fact, last year in October, the Politburo put more emphasis on stabilizing growth, and deleveraging as well as “property price curbs” were left off the agenda.

2. PBOC has changed its direction of monetary policy by cutting reserve ratio requirements, deploying its targeted medium-term lending facility for the first time, and creating a new instrument, the “central bank bills swap”. The swap has been perceived by many as China’s version of QE because it encourages financial institutions to buy more perpetual bonds issued by commercial banks so that these banks are able to extend more credit to the private companies.

Moreover, before the Chinese New Year, market expected that Trump-Xi talk will begin soon and nothing significantly negative came out from both US and China’s side regarding the trade issues.

To sum up, better-than-expected company fundamentals, expectations on better liquidity from more dovish monetary policies, and easing geopolitical concerns buoyed up investor’s sentiment. This risk-on mode drives the valuation of the entire market higher, but especially benefits growth stocks with high volatility and high turnover rate, those that suffered the most during the meltdown in the second half of 2018.

Will the market sustain its rising trend?

Now let’s answer the million-dollar question posted above: will this upward trend sustain or it was just a dead-cat bounce in a bear market? We are also interested to know which factor might outperform going forward. While we can’t predict the future, all the drivers mentioned above are somewhat priced in by the market. Thus, we can make educated guesses on how some crucial events may unfold going forward, and in turn shed more light on the possible scenarios of the short-term market trends.

First, let’s look at the company earnings.

While China and Hong Kong’s earnings seasons haven’t officially started yet, many China A share companies have released earning predictions of 2018. As of January 31st, 2019, out of 2995 Listcos that reported earning predictions, just less than half of them reported earning alerts. Also, more than 400 companies are projected to make a loss. In the Hong Kong market, only 84 Listcos have released earning predictions as of Feb 4th. Yet, 66 out of them have reported earning alerts, including China Life (net profit down 50-70% YoY). Since most of the large cap and mid cap Listcos out of the HSCI Index primarily operate in mainland China or has businesses closely connected to the mainland, we can project with high confidence that the overall earning predictions would not be too positive going forward.

Later in February, earnings season will officially kickstart and continue through early April, during which companies will release their financial reports and forward guidance on key financial data. Thus, it is entirely possible that uncertainties on companies’ financials grow in February and market sell-off and turn defensive before the official data release.

Secondly, let’s look at geopolitical risks.

The most relevant geopolitical risk to the Hong Kong/China market is the China-US trade spat. Shortly after the Chinese New Year, President Trump called off the meeting with President Xi in late February. A Trump-Xi deal before March 1st tariff hike deadline suddenly seems off the table. Also, the two sides haven’t figured out how to resolve the Meng Wanzhou’s case yet. As much as both sides want to avoid a conflict that could escalate into a full-blown trade and tech war, and as much as Trump seems to believe that lifting his tariffs on Chinese imports is crucial for his re-election, the US administration still has the incentive to prolong the negotiation process as a leverage against China for better terms on trade and technology. This week on Friday, Treasury Secretary Steven T. Mnuchin and U.S. Trade Representative Robert Lighthizer will lead high-level trade talks with Chinese officials in Beijing. Mnuchin is more dovish on issues related to China while Lighthizer is famous for his tougher stance, so the direction of the talk is unclear.

Different Western media have cited sources with divergent views on the prospect of this talk, but many emphasize that “lots of work need to be done”, or “sizeable distance between the two countries”. Wall Street Journal even reported that “neither side has put anything in writing yet”. It’s possible that progresses are made in the next meeting. However, caution is still the key and the market sentiment right now seems a little bit too optimistic to price in another shock on this issue.

Finally, January 2019 looks somewhat like January 2018.

In January 2018, the market rallied, most of the stocks rose, stocks with high growth, high volatility and high turnover rate outperformed, and investors sentiment got very optimistic as well as complacent. Then in February 2018, market dropped 7%, most of the stocks declined, and investor sentiment turned pessimistic. The market style also changed as stocks with low growth and high quality (high ROE, high ROA) outperformed. As shown in the charts below, the quality factor is very robust and positively correlated with return, and growth factor is also robust and negatively correlated with return.

Could this happen in 2019? Well back in early 2018 the macroeconomic condition was good and company fundamentals were very solid. The main reason behind the market meltdown was the investors’ expectation of much faster rate hikes by the Fed. Now the logics were very different, and so it’s hard to predict if history repeats itself. However, we do want to point out that investors’ sentiment right now were overly optimistic and risks are mounting, just like last year in January.

If one of the risk elements materializes, it’s entirely possible that market style changes and stocks with high growth factor value lead the market decline while stocks with high quality factor value outperform.

Therefore, from a fundamental, geopolitical, and historical perspective, we want to highlight the increasing risk of a near-term correction following January’s rally in HK stock market. Meanwhile, a bunch of other concerns remain up in the air regarding the U.S. shutdown and slowing global growth. Investors may turn into a risk-off mode, pour into low-volatility, defensive stocks and shun away from the sexy, growth stocks.

As AQUMON, we are not in the position to time the market style rotation, and it’s also possible that the style rotation does not happen in the near future. However, we will closely monitor the market to capture any signal of possible changes in market style going forward, and if the market does change, we will react promptly by switching to the robust factors with the help of our machine learning algorithms.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.