What Can Be Wrongly Predicted about 2019's Markets

Written by Shawn on 2019-02-19

In 2018, the Chinese economy suffered a dramatic drop, no matter in which market segments. There are various factors aggravating the real economy: the uncertainty of trade war, the long economic transition period, inadequate economic reform and slowly adjustments of macro policies etc. Downward pressure on Chinese economy will definitely increase in 2019.

About the trend of global economic environment of 2019, many experts and institutions have issued their forecasts.

After last year’s shock, it becomes more difficult for everyone to forecast the global market trend.

Now let’s see what can be most probably go wrong when predicting global economy of 2019.

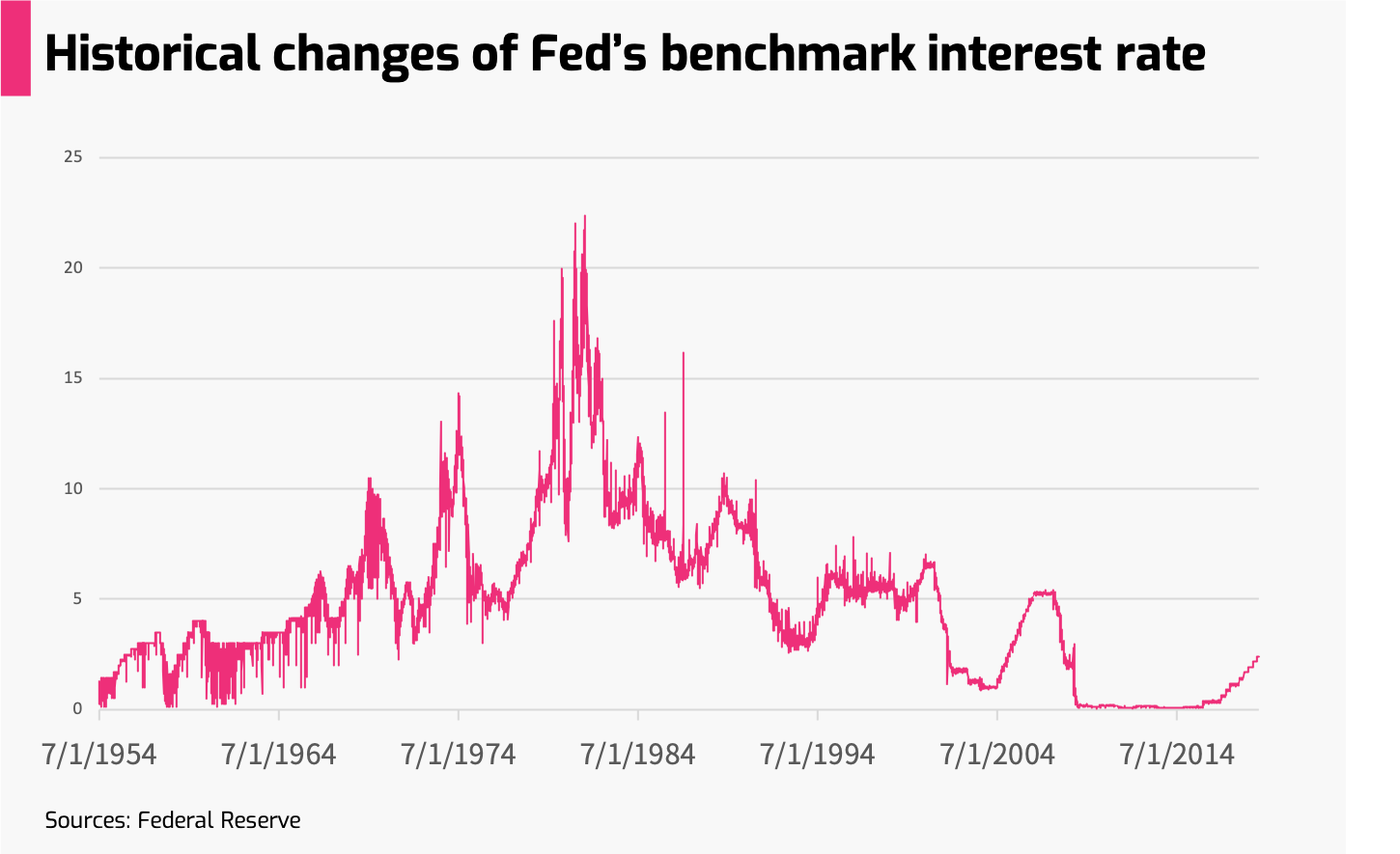

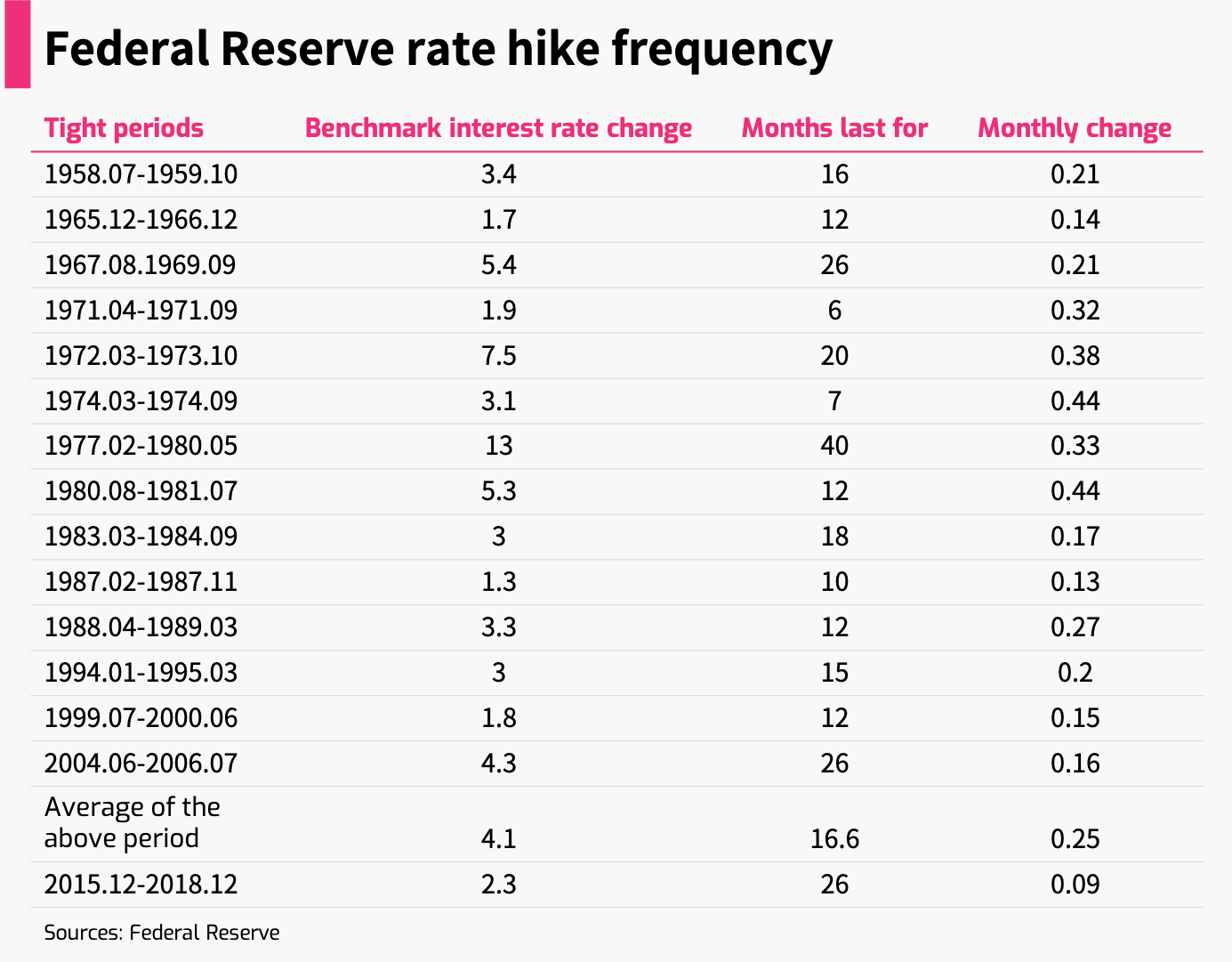

The Fed’s Interest Rate Hike

Since the beginning of 2019, The Fed holds a more cautious attitude towards raising interest rates. The main reason for this attitude is the dramatic changes in the macroeconomic environment.

Although US domestic inflation has reached the target of 2%, if the inflation level still keeps, the Fed is expected to continue the current slow rate hike.

What market worries is that the Fed will wrongly predict the trend of core inflation or temporary increase in wages and will raise the federal benchmark interest rate to more than 3% in 2019. This will greatly increase the likelihood of a US economic recession in 2020 and will also have an adverse impact on emerging market countries.

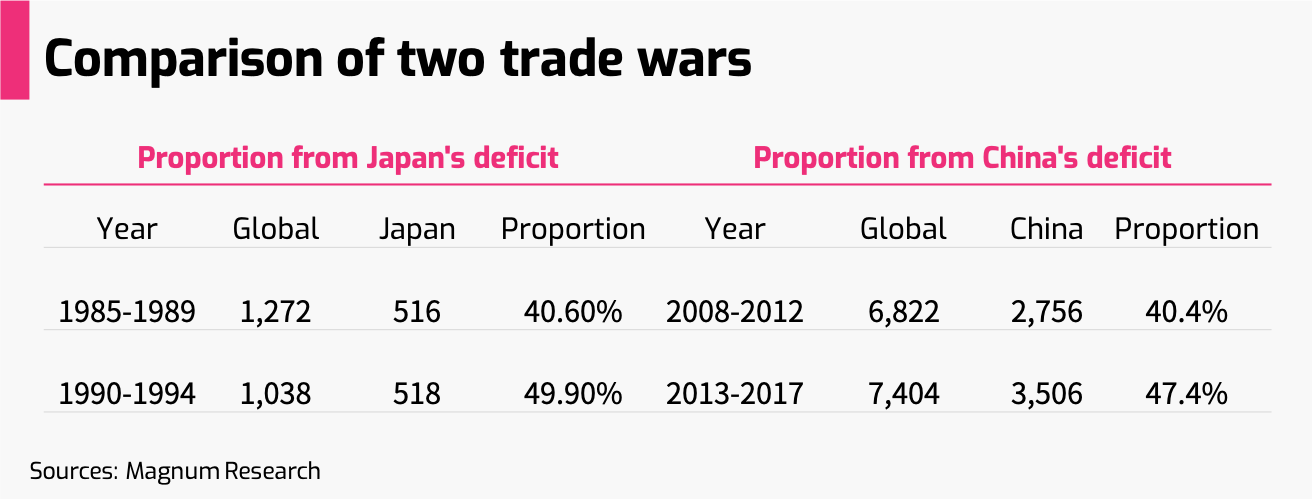

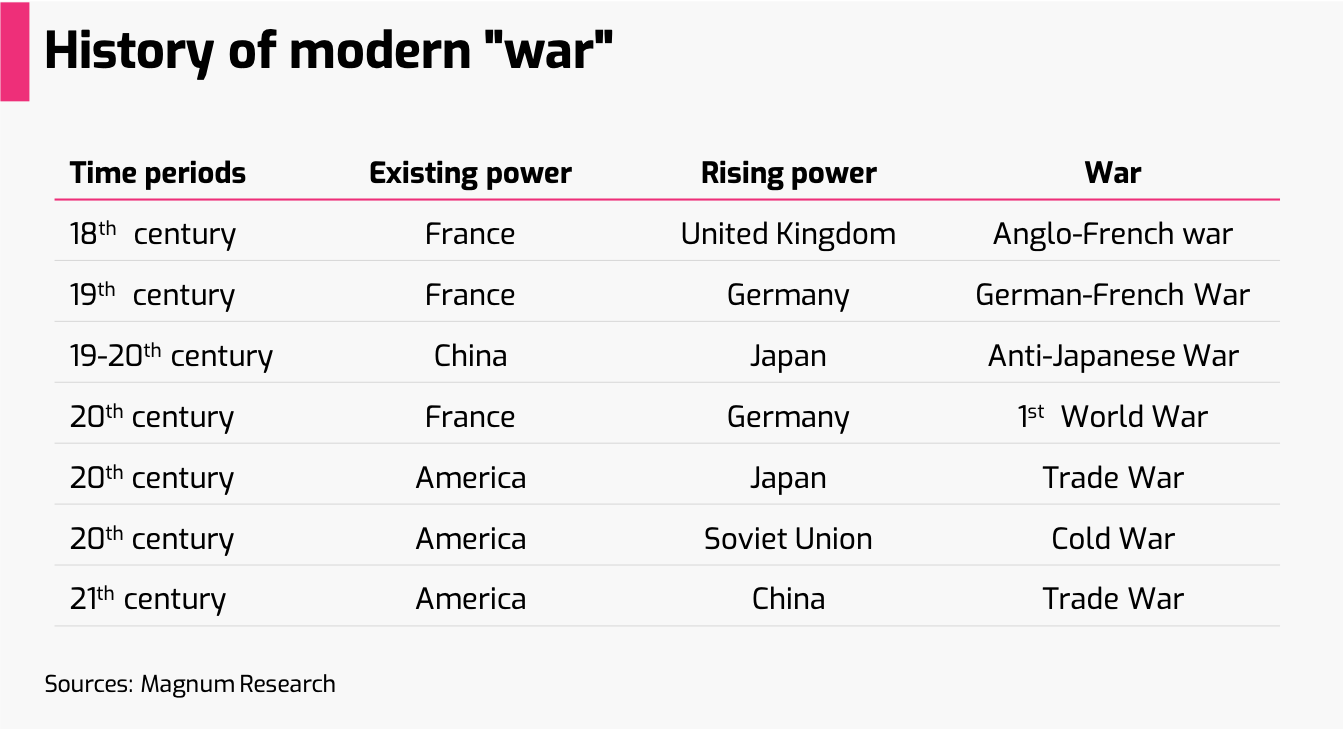

Trade War

Trade war has become an important uncertainty in current global economy.

According to the IMF's estimates, if the situation goes tough, the trade war may reduce the global economic growth rate by 0.8% in the next two years.

Looking back on the trade war between Japan and the United States decades ago. At that time, the trade deficit between them accounted for 50% of the total deficit of the United States, which is even more alarming than the current China-US deficit.

The trade war has escalated from trade issues to a comprehensive confrontation between China and the United States. If the negotiations can resolve the dispute, how much concession will China make? This is also one of the biggest uncertainties in 2019.

Development of Chinese Economy

China’s economic growth fell to 6.6% last year, which was the lowest in 28 years. Many economic experts believe that Chinese economy will continue to decline this year.

We believe that domestic tightening policies such as de-leverage in 2018 are indeed the main cause of the slowdown in economic growth. However, after the dollar interest rate hikes, emerging markets often face great risks.

In 2019, GDP growth will slow down, but consumption growth will remain relatively stable, and the trend of consumption upgrading will also continue.

Conclusions

Difficulties always accompany with opportunities. Be cautious, be calm, and you can be the one that grasp the market.

Reference

Vanguard economic and market outlook for 2019: Down but not out

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.