Grow Money Outside of Your Savings Account II

Written by Marcus on 2019-02-26

Today, with more people realizing the importance of investment, short-term investment products begin to catch public attention.

Investors favor short-term investment product, not only because it can be withdrawn at any time, but also because of its low risks.

But now comes the problems:

● What are the most common short-term investment products?

● Are they really safe with low risks?

● What new kinds of short-term investment options are there in foreign countries?

● How to select and make short-term investments?

If you also have puzzles with these questions, this article will give you a thorough answer.

Short-term Investment in China

For Hong Kong residents, the low interest rate and high entry threshold cannot satisfy people’s needs for a considerable return from their savings accounts. The interest rate of Hong Kong dollar savings deposits is only 0.125%, which means that 10,000 hkd savings deposits can only get an annual return of 12.5 hkd.

For mainland residents, although the bank interest rate will be slightly higher than that of Hong Kong, before 2013, most people will put their current assets into banks, and will not make short-term investments. However, the rise of online financial platform has arisen people’s interests towards short-term investments.

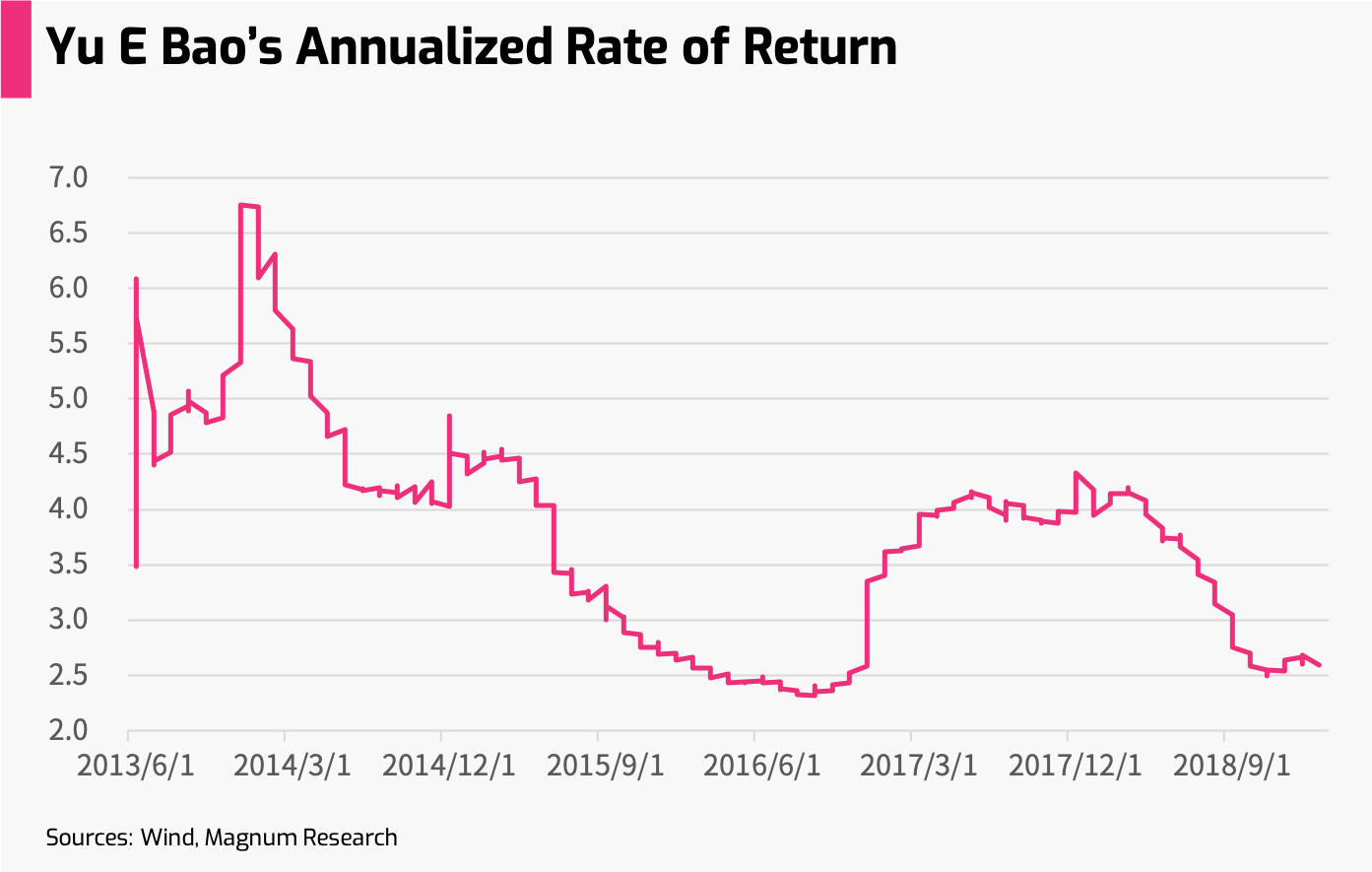

Yu E Bao, one of most famous short-term investments products in China, was launched on May 29th, 2013. It attracted investors with a 1 yuan entry threshold and it can be withdrawn at anytime. After years of steady operation, Yu E Bao’s users have exceeded 470 million people, becoming the first choice for mainland users to make short-term investments.

Let’s take a look at Tianhong Fund in Yu E Bao , it has almost maintained a long-term yield of more than 2.5% since launched, and nearly half of its 7-year annualized yield has exceeded 4%. Although its current 7-day annualized income has dropped to 2.5%, it is still quite attractive to individual investors compared to the annual interest rate of 2.25% for domestic banks.

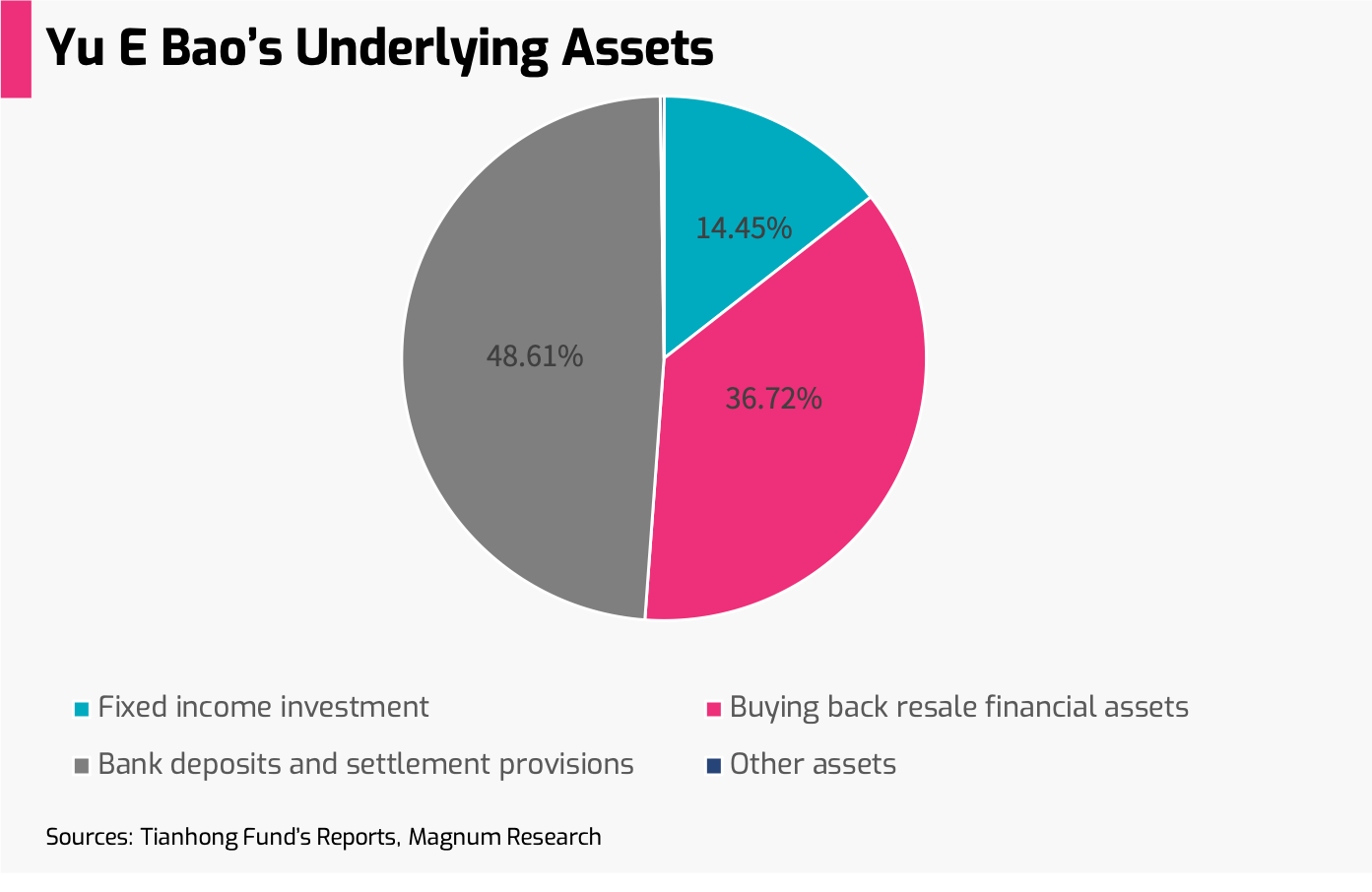

So how to achieve high liquidity and ideal profitability at the same time? We can first see the composition of the underlying assets of Tianhong Fund.

Yu E Bao is actually a money market fund, half of the assets are invested in bank deposits, and the remaining are in high-liquidity financial assets and fixed-income products. The average remaining period of the portfolio is 57 days, and with a relatively good liquidity.

Why Money Market Funds Are Relatively Safe?

Steady profit growth is one of the most attractive points for investors. Because money market funds are specifically invested in risk-free instruments with high safety level and stable income, to achieve higher profit than bank deposit while being very safe.

Now you might have doubts that why do money market funds always generate positive returns, but you will suffer losses when investing in bonds.

The reason lies in the pricing method of funds. The bond is based on market value pricing, and the fluctuation of bond price will directly reflect the net value. However, the money market fund adopts the amortized cost method, that is, for the assets held to the end of the period, the proceeds are distributed to each day.

For example, if a fund buys a bond with 100 yuan and is paid 10 yuan after 100 days, then the 10 yuan will be allocated to each day. Although in actual cases, in order to avoid hidden risks, the fund's net asset value will be determined through shadow pricing. In general, the money market fund will generate a steady income every day unless there is a default or a large amount of bonds sold.

The Development of Foreign Short-term Investment

In US, short-term investments are also popular with some new forms.

Goldman Sachs launched Marcus, an online lending platform that also provides online savings services.

After opening an account, investors can invest with only one US dollar with an annualized rate of return 2.25% and zero transaction fee, compared with 0.04-0.09% return generated by general retail banks. Few days before, Apple and Goldman Sachs just announced the issuance of a joint credit card, which is based on Goldman's online lending platform Marcus.

Betterment, a well-known robo-advisory firm in US, also invited the American drama Billions character, Maggie Siff, to advertise and then launch its own short-term investment product- Smart Saver.

The product will first analyze the short-term investment funds that are suitable for investors, then invest 80% of the funds in short-term US government bonds, and 20% in less volatile corporate bonds. The estimated annualized rate of return is 2.23%.

Is Short-term Investment Really Suitable For You?

Several common mistakes when people are investing:

- Pay too much attention to return and less in short-term investment: making it impossible to use high-liquidity assets when needing funds.

- Excessive risk aversion, allocate too much in short-term investment: sacrificing a more objective return to achieve excessive liquidity

- Clear about your financial plans, but with no good short-term investment tools to choose from (for example, for most Hong Kong residents).

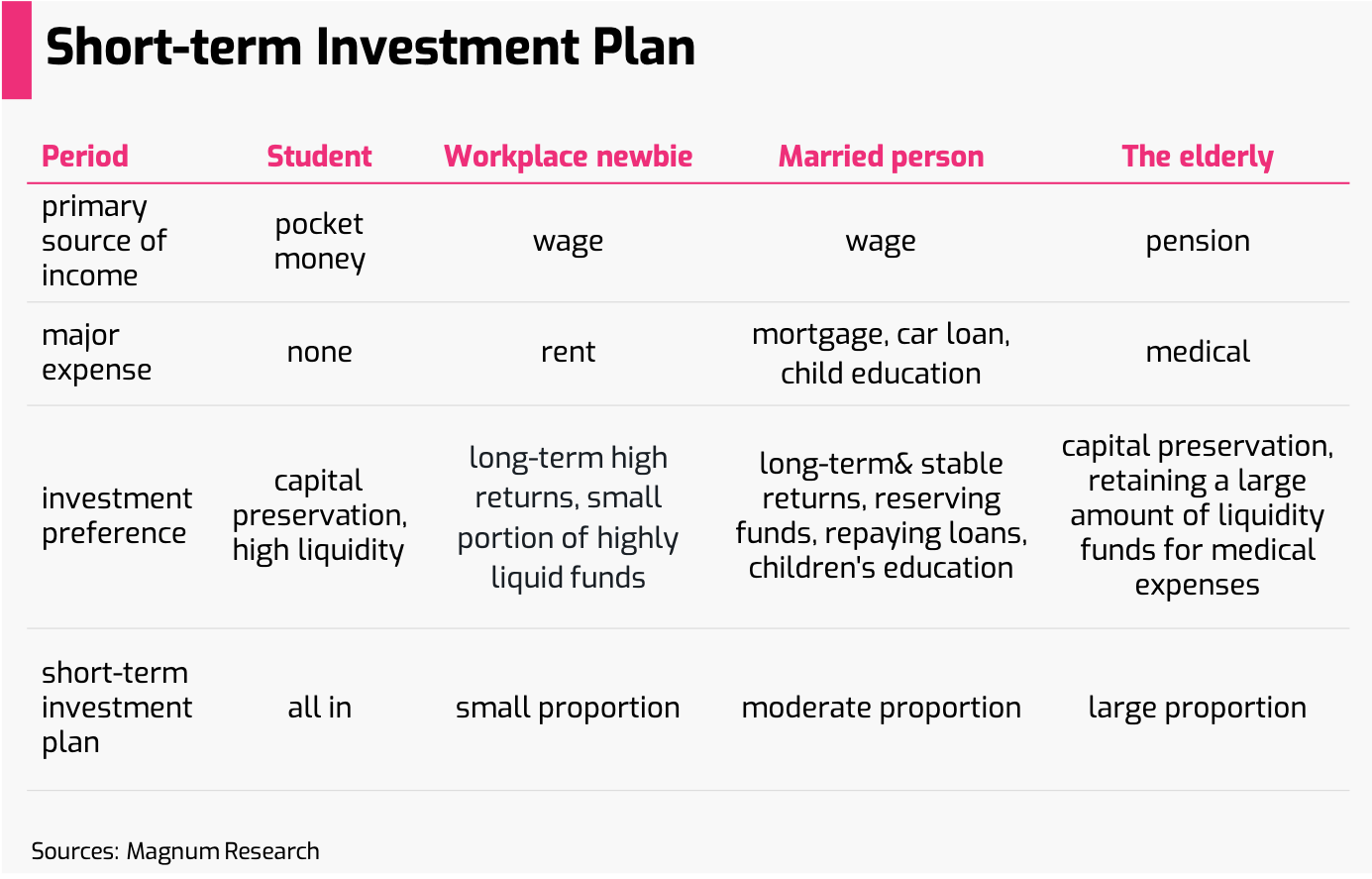

Setting up your own financial plans and reserving a reasonable amount of funds for short-term investment is the first step. Below we list the four stages for short-term investments for the different kinds of people in different periods.

Based on different personal financial plans, it is vital to reserve sufficient liquidity to meet certain urgent needs, and to invest the remaining funds into higher-yield assets.

In this article, we mainly introduced the concept of short-term investment, revealing the money market funds and some suggestions for investors to make short-term investment.

In the next section, we will continue to introduce other short-term investment products to help investors develop their most suitable short-term investment plans.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.