Selecting ETF: A Cost Perspective (Part I)

Written by Walter & Yufei on 2019-03-12

Suppose you want to invest in S&P 500, you will be faced with a myriad of ETF choices, including eight that are domiciled in Hong Kong, Ireland, Luxembourg, and the United States. So how should you decide which one to invest in?

As it turns out, understanding taxation is critical to helping investors make such decisions.

Understand Taxation:

ETF is an increasingly popular investment instrument due to its cost effectiveness, liquidity, diversification and international market access. With global investment footprints come convoluted tax implications. As we’ve discussed in our previous article written in traditional Chinese("默默影響投資收益的隱性成本——預扣稅" ), in addition to the highly investor level taxation, ETF investments are generally subject to two additional layers of taxation that can very substantially impact the size of take-home returns: portfolio level taxation and fund level taxation.

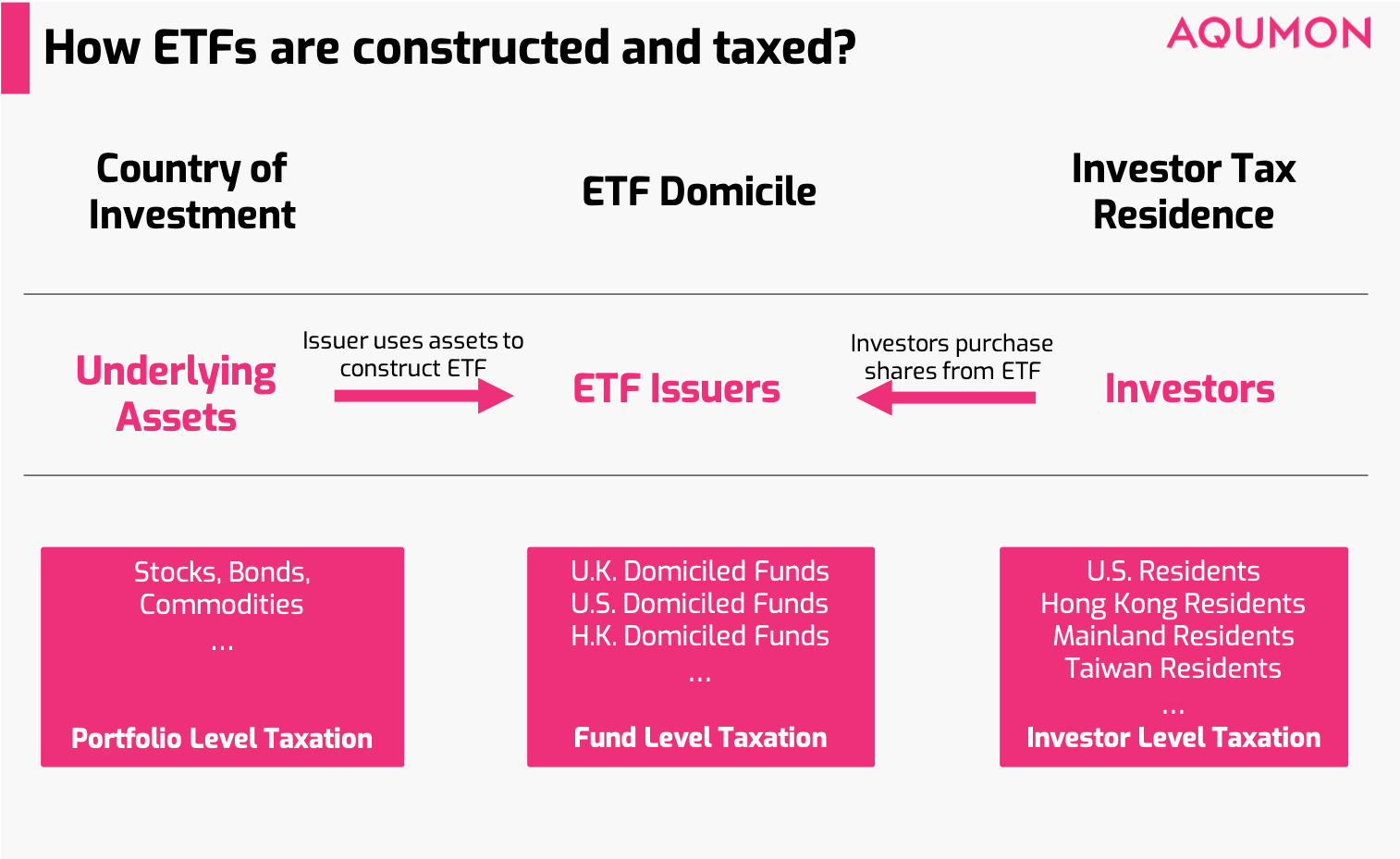

*Chart 1

To understand the three levels of taxation better, we believe that it’d be useful to take a step back and see how an ETF is constructed. When issuing an ETF, there are two things for issuers to first evaluate: ETF underlying asset and ETF domicile. Number one is what underlying assets is the fund going to track? ETF underlying assets can be many different things, but predominantly encompass equity and fixed income securities. When it comes to taxation, not only does asset class matter, the jurisdiction in which assets are located matters even more (we refer to as “country of investment” in this article), because countries will tax on incomes generated from securities in their jurisdiction. This is much like countries will tax foreign employees.

The second important decision is about the domicile of the fund. This concerns us because the domicile of the ETF determines how it will be taxed by the country of investment and how withholding tax is going to affect investors. It’s crucial to note that domicile and country of investment can be two relatively detached concepts; an Ireland domiciled ETF can have exclusively U.S. assets as underlyings while a U.S. domiciled ETF can have Irish assets.

As can be seen from Chart 1, in light of the fact that the flow of assets involves three critical components, underlying asset, ETF Issuer and investor, the aforementioned taxation also occurs at the following three stages:

- Portfolio Level Taxation: When an ETF selects and purchases underlying assets from the country of investment, it will be taxed by the jurisdiction in which the underlying asset is located: a Hong Kong domiciled ETF will be taxed by U.S. authorities if its underlying assets contain U.S. securities. An ETF with a wide geographic focus may consequently be taxed by more than one jurisdictions, at the Portfolio Level.

- Fund Level Taxation: After the ETF is constructed, the issuers must withhold tax on behalf of the authorities of its domicile. There may be double tax treaties that alleviate or even eliminate withholding tax, such as the ongoing one between Ireland and Hong Kong. Unfortunately, there is no such tax treaty between Hong Kong and U.S., so typically Hong Kong investors of U.S. ETFs would be forced to forfeit around 30% of their dividend and interests income, because the fund issuers are required to withhold tax on behalf of the IRS.

- Investor Level Taxation: Finally, when investors realize gain from their investment, they may need to report capital appreciation or dividend incomes via their personal tax reportings. This process is highly idiosyncratic and we need to consider many factors such as size of investment portfolio, income level, tax residence and many more. For the purpose of this article, we will not go into details here.

Now that we understand how ETFs are taxed, how can we use such knowledge to improve our ETF portfolio from a taxation perspective?

How can retail investors optimize ETF investment?

The objectives of investors are simple: to maximize after-tax return. To do so, we need to optimize the tax treatment for our ETF portfolios. This, nonetheless, can be a highly intricate matter, largely because of Total Costs of Ownership (TCO), which considers such factors as liquidity costs, transaction fee, management fees and most importantly, tax implications.

Tax treatment varies, depending on the tax residence of investors and tax agreements between ETF domiciles and the jurisdiction in which the underlying assets are located (country of investment). On the portfolio level taxation front, choosing the right domicile is critical. If an issuer were to issue a fund that tracks U.S. assets, a German Domiciled ETF will be taxed at 30% at the portfolio level, while an Ireland Domiciled ETF with the same underlying will be taxed 15% for equity dividends and 0% for bond interests payments. A 15% to 30% difference can be considerable, especially for high-yield fixed income ETFs. For fund level taxation, there will be large taxation discrepancies for investors who possess different tax residencies, due to tax treaties. For instance, a Hong Kong investor will be taxed at 0% for Ireland domiciled Bloomberg Barclays US Agg Total Return Value Unhedged ETF (USAG), whereas for Mainland China investors who invest in the same fund, the number would typically be 10%.

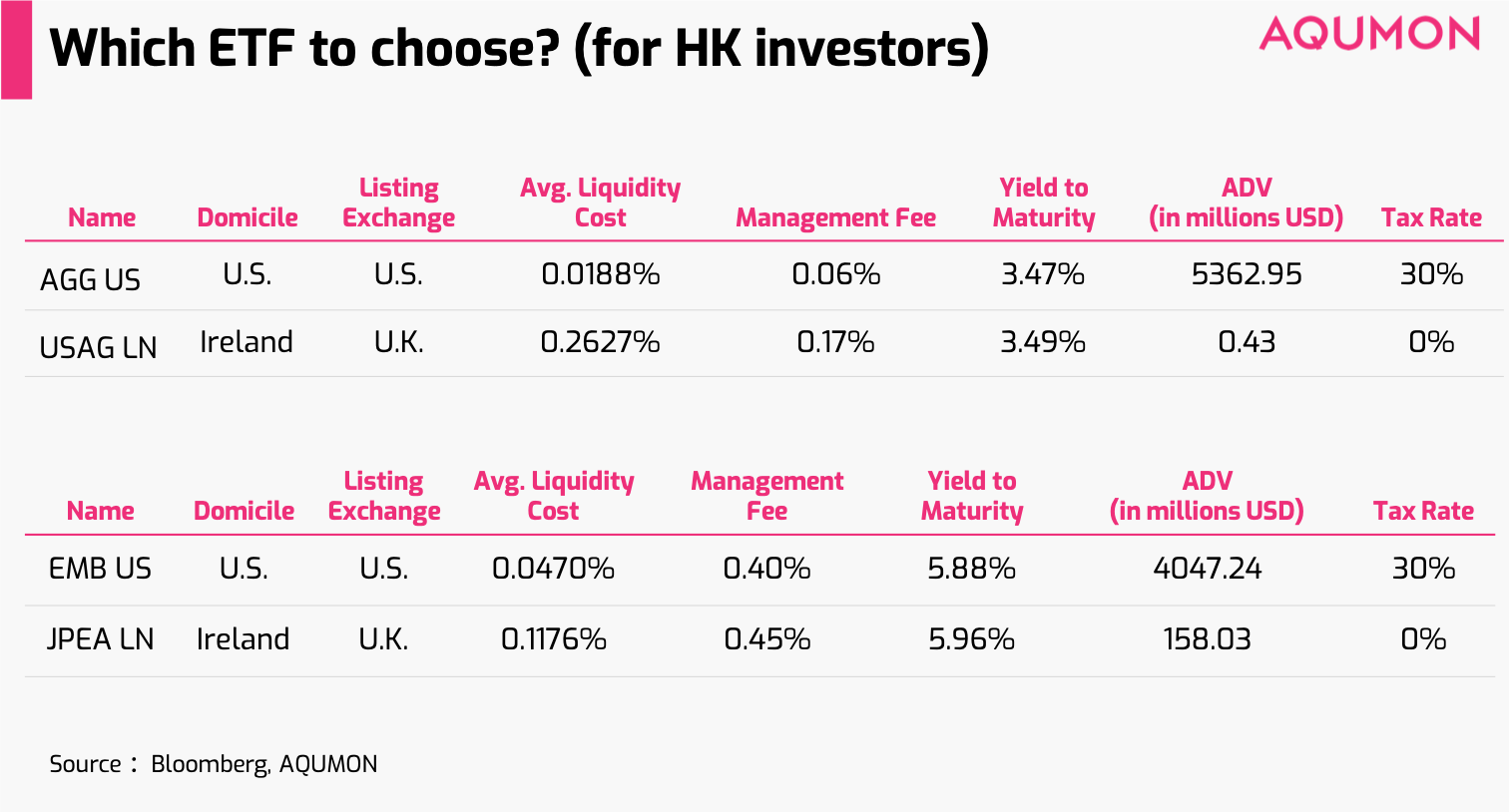

*Chart 2

Even after analyzing tax treatment, we have to consider TCO. The United States have the most developed ETF market in the world; as a result, US-listed ETFs will have better liquidity as well as lower management cost, while in some cases they will incur higher taxation costs, especially in comparison with Ireland domiciled counterparts. Take the example is Chart 2, a US-listed AGG has a management cost of 6 basis points while its Ireland domiciled counterpart USAG incurs 17 basis points. Even more substantial is the difference in liquidity cost, as measured by average bid-ask spread: AGG costs around 2 bps while USAG costs more than 26 bps. Although the tax boon can appear to be enticing, after taking into consideration liquidity costs and management costs differences, it may not be worthwhile to switch from AGG to USAG.

In a different case, a comparison analysis between J.P. Morgan Emerging Markets Bond Index Global Core Index (EMB US) and J.P. Morgan Emerging Markets Bond Index Global Core Index (JPEA LN) shows that it makes much more sense to use Ireland domiciled JPEA, despite the fact that the latter has a slightly higher management fee (45 vs 40 bps) and liquidity costs ( 11 vs 4.7 bps). Specifically for this scenario, the tax benefit is large enough to outweigh the losses due to liquidity and management costs; therefore it is advisable that a Hong Kong investor should choose JPEA over EMB, from a Total Cost of Ownership perspective.

Making investment decisions is very hard, because we are always bombarded by a wide range of products of varying quality. In this article, we have shown a small aspect of the complexity in investment decision making, and in the next, we will further illustrate with more examples.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.