3 Lessons We Learned from the 'Bond King' Bill Gross

Written by Marcus & Ria on 2019-04-11

Bill Gross, who turned 75 this year, announced his retirement back in February. Nicknamed the 'bond king', Gross co-founded Pacific Investment Management Co (PIMCO) the largest global fixed income investment company, and ran their US$270 billion Total Return Fund before joining Janus Capital Group (now Janus Henderson) in September 2014 during the winter of his career.

As his nickname would attest to, he was a superstar of the investment world. During the final 4 plus years at Janus many investors would point out the brightness of Bill's star dimmed as he rode off into the sunset of his career due to his returns consistently falling short of his competitors.

What happened? As an investor, what can you learn from the bond king's recent downfall?

From Vegas to Wall Street beginnings

After an automobile accident in 1966, Gross passed the time in the hospital by devouring Massachusetts Institute of Technology (MIT) mathematician Ed Thorp’s book “Beat The Dealer” and honing his card counting skills. Afterwards he headed to Las Vegas and the story goes that he turned US$200 into US$10,000 in short 4 months playing blackjack for up to 16 hours daily. Even though his efforts ultimately equated to making approximately US$5/hour, Gross saw many similarities between blackjack and investing since it required “mathematical skill, an obsessive quality, and a belief you can beat the system”.

Thorp’s subsequent book “Beat The Market” reinforced Gross’ beliefs and he later based his MBA thesis on it which helped him secure his first job at Pacific Mutual Life. In 1971 he launched PIMCO and based parts of his investment and risk management framework around what he learned counting cards under the bright lights of Las Vegas.

The legend of Bond Guru

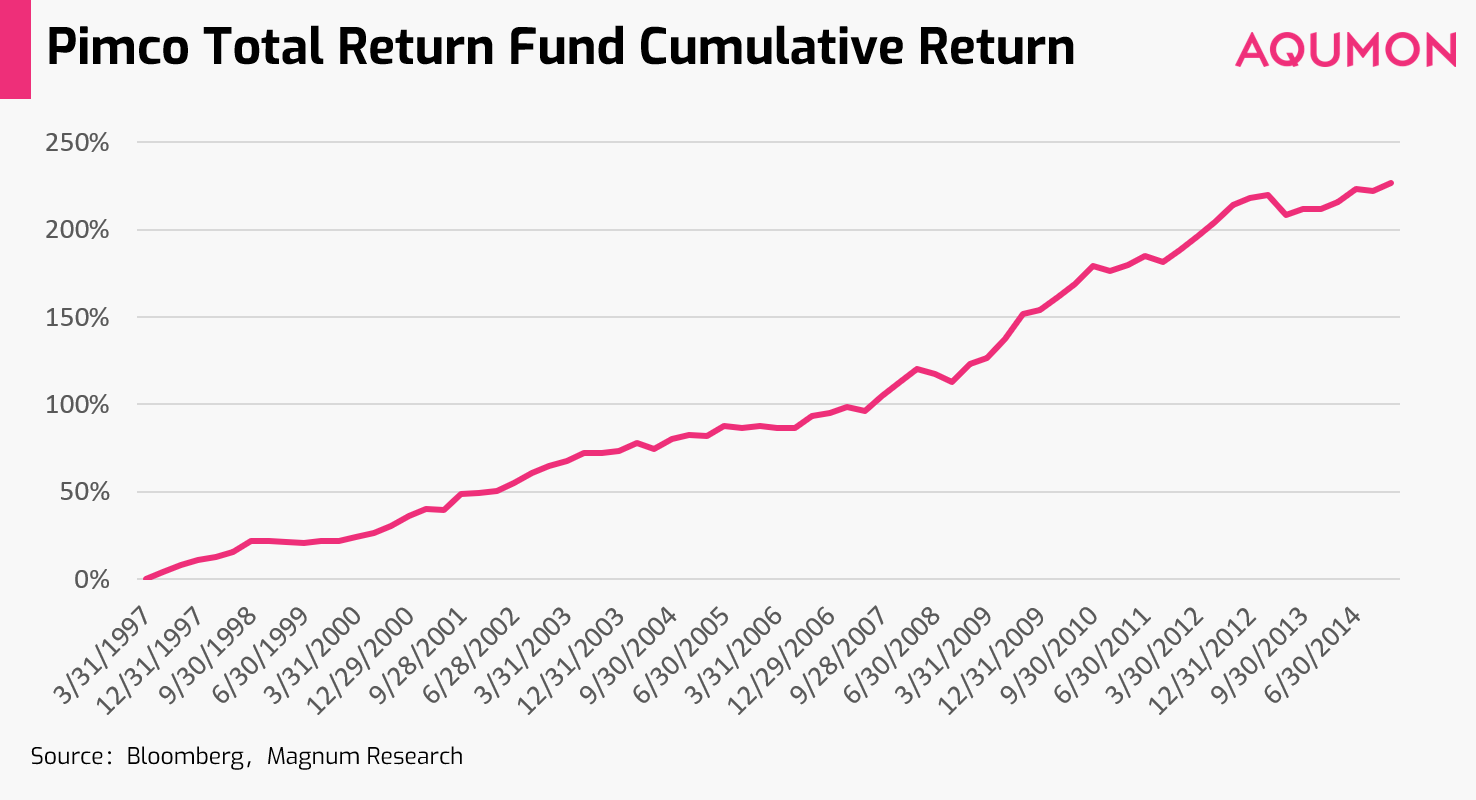

Gross co-founded the PIMCO Total Return Fund in 1987. In 2013, its assets grew to a peak of nearly $300 billion. The cumulative annualized return reached 7.8%, which made it the world's largest mutual fund and one of the most lucrative bond funds.

Timing probably helped Gross to some extent. Ever since the Total Return Fund launched in 1987, the yield on the 10-year US Treasury bond fell progressively from 8.61% to 2.52% and bond prices soared as a result. This made Gross into a billionaire. Even if he did ride on the coat-tails of the golden era for bond investing, Gross did what so many other bond managers couldn’t do. He never stopped winning and created one of the longest winning streaks in fund manager history by outperforming its benchmark by 1.14% per year from 1987 to 2014.

Will we see such an amazing run again in our lifetime? Gross doesn’t think so and was quoted as saying “a repeat performance is not only unlikely, it is impossible unless...you’ve got the gumption to blast off for Mars. Planet Earth does not offer such opportunities.”.

Erratic behavior and emotions became a challenge

Even after such an illustrious career at PIMCO in 2014 Gross was abruptly ousted from the firm he called home for 40 years. He credits his fiery exit to his undiagnosed Asperger’s syndrome which made him a “singular, dominating, angry, quiet, introverted person” who would cause increased friction at PIMCO with his difficult and odd behavior. When he tried to compromise and begged for a reduced role so he could stay at PIMCO, the firm said “no” and he decided to join Janus Henderson run by his former PIMCO colleague Dick Weil to try to regain his former glory.

Janus’s share prices surged up 40% upon news that Gross was joining but early signs of problems with Gross’ behavior was already showing. Instead of moving to Janus’ main US offices based in Denver he instead decided to open a small office physically right next to PIMCO’s office in Newport Beach. Insiders say as his obsessiveness to beat his former colleagues at PIMCO grew, so did his appetite to take on more and more risk.

Probably the right bet but the wrong time

Looking back at Gross’ performance at Janus, his returns on his Janus Henderson Global Unconstrained Bond Fund was on average 0.3% per year which lagged behind 90% of its peers according to Lipper. Redemptions hit the fund hard as the fund's assets shrunk from a peak of US$2.2 billion to just US$950 million.

So what was the reason for its underperformance?

Some pointed out that Gross’ strength at PIMCO was 1) having an extremely strong team of portfolio managers around him and 2) his ability to consistently pick the best trades/ideas that were presented to him by his team. Devoid of that strong nucleus at Janus and coupled with trying to generate returns in a bond market with low volatility Gross ultimately struggled.

Furthermore, desperate to prove that he hadn’t lost his magic, Gross later admitted he probably took excessive risk with the new fund. He was quoted as saying “I wanted to prove that I could still do it, and do it quickly.”. Two big bets he made that did not pan out: 1) that the US/German government bond yields would narrow and 2) that bonds where now in a bear market proved to be major performance drags to his new fund.

Had these trades worked out...we would be singing a completely different tune on Gross’ legacy.

So what can investors take away from Gross' recent downfall?

1) Manage your risk carefully by not overbetting in each singular investment

Bill Gross credits Massachusetts Institute of Technology (MIT) mathematician Ed Thorp with being one of his earlier mentors using blackjack betting to teach him about investing and risk management. One of the key concepts that Thorp talks about is the idea of’ ‘gambler’s ruin’ by not overbetting more than 2% of capital in each single bet to stay solvent at the blackjack table. This was an idea that a young Bill Gross took to heart and at PIMCO he kept his single credit exposure to under 2% with additional internal risk controls built in. This kept his individual losses manageable from a downside risk respective.

Unfortunately at Janus given his unconstrained investment approach, he made big bets on individual investments. This further amplified his losses when he made bad calls against the US/German government bond yields and that interest rates would rise.

2) Avoid the market noise and emotions by anchoring your investment approach with a longer term ‘secular’ view

One of Bill Gross’ strengths at PIMCO was their ability to accurately analyze the secular (3-5 year) investment outlook and couple this with their shorter term cyclical view on the market. This secular approach improved his ability to consistently add value over the long term because this reduced the market noise and made him better at following market trends. Furthermore according to Gross this will force investors to think longer term and reduces the negative impact of emotions such as fear and greed. So having this longer term ‘north star’ will help investors reduce doing the wrong thing during irrational periods in the market.

3) Unless you have a higher risk tolerance, look into investing into index funds or ETFs

The total return strategy that Gross was famous for at PIMCO attempts to outperform the broad bond market by taking modestly more risk (generally buying lower-quality bonds) than those reflected in broad-market bond indexes while targeting a similar average maturity. From Gross’ June 1987 to September 2014 tenor at PIMCO he consistently outperformed broad bond markets by over 1% annually which is unheard of for a bond manager. As the master of the total return bond game, why did Gross switch into an unconstrained style investing at Janus which is a strategy that relied heavily on big bets?

Because Gross understood nowadays there are more and more index/exchange traded bond funds that can offer similar performance to his total return approach particularly given their lower cost. In order to consistently beat the passive approach as an active bond manager he needed to bet at the right time and bet big. As Gross suggested to future bond kings in his retirement press release…”take more risk not less”.

If you can’t stomach this increased risk from certain active managers, taking a passive investment approach of investing into index funds or ETFs is something you should look into.

To get the full AQUMON experience, download our app here:

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.