The Story of Robo-Advisor in China

Written by Ria & Qing on 2019-04-11

Imitation is not easy. Where are the robo-advisors who aim to be the Chinese Betterment?

In the previous article, we talked about how the early robo-advisors Betterment and Wealthfront emerged in the aftermath of 2008 financial crisis and how robo-advisors are creating a new trend in the investment field.

The bright future prospect of robo-advisory has attracted a large number of domestic entrepreneurs in China and some even aim to become the next Chinese "Betterment".

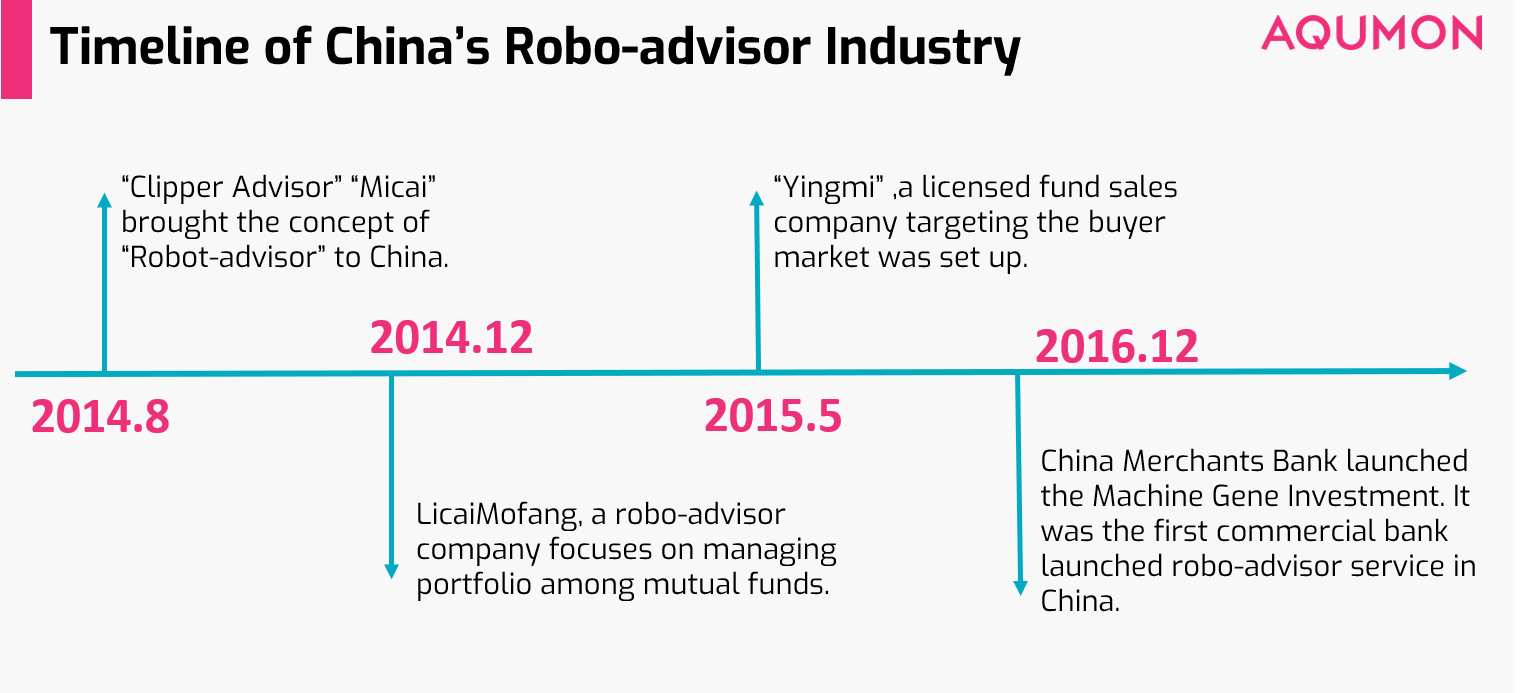

Since the launch of the first Chinese robo-advisor platform“Shèngsuàn zàiwò” (勝算在握)“ in 2014, China’s robo-advisory industry is gradually booming.

In particular, “Clipper Advisor”and“Micai App” have gained some popularity. Early Chinese robo-advisor start-ups are deeply influenced by their successful US peers, and they imitated their styles and business models to serve the Chinese market.

Given the significant differences between the Chinese and the US investment environments, the imitations do not recreate much success in China. This article is going to analyse why Chinese robo-advisors that imitate their US peers are struggling.

Even though the initial Chinese robo-advisors did not achieve much success, “Clipper Advisor” at least brought the concept of robo-advisory into the Chinese market and many start-ups rushed to imitate its business model. During this period, the number of independent robo-advisors is rising rapidly while large traditional financial institutions and asset-managers are also actively looking for opportunities in this area.

Do Chinese users buy the concept of robo-advisory?

“Slow business progress, unstable growth, only part of the financing capital goes into R&D and the technology supporting the robo-advisory is not advanced at all– this is like a Ponzi Scheme.”

——Clipper Advisor

A lot of companies rushed to the rising trend, but it did not take long until they found out that it is difficult to gain retail investors’ trust.

Traditional financial institutions have a large client base and Internet giants have advantages over the web – under this environment, independent robo-advisors are naturally disadvantaged in this competition.

A trend is like the weather, it comes and goes. When the robo-advisory trend fades out, bringing in clients and profits is increasingly difficult.

The robo-advisory features in Clipper Advisor”and“Micai App”are now marginalized, the robo-advisors are either stuck or undergoing a transformation.

China vs. U.S.– their differences in financial markets

The main reasons for the differences in the development of robo-advisors between China and the United States are as follow:

◇ Their wealth-management industries are different

Prior to the emergence of robo-advisors, the American wealth management industry was already very mature with many wealth managers. Robo-advisors are just providing Americans an alternative to the traditional human advisors. On the other hand, robo-advisors are not replacing human advisors since human advisors are not readily available yet. Robo-advisors allow China to skip the human advisor stage and it becomes a tool that Chinese financial institutions use to attract clients.

In other words, the Chinese wealth management skips a main transition stage in its evolution. Therefore, the Chinese client base for robo-advisors is a totally different story compared to the US.

◇ Their types of investors are different

The US financial market is relatively efficient with a rich variety of asset classes and the retail investors are also very mature; in contrast, the Chinese capital market is still largely underdeveloped.

In general, the American investors have a better understanding of investment and the market is largely dominated by institutional investors. In terms of investing style, many US investors are long-term passive investors and they rely heavily on portfolio diversification.

In the Chinese capital market, over half of the investors are retail investors and their knowledge related to investment is generally weaker. Many focus on short-term speculation and are not familiar with the important concepts of risk management and diversification. This is one of the reasons why Robo-advisors in China find it difficult to acquire retail clients. The targeted client groups are not clear and thus it is difficult to replicate the US robo-advisors’ model.

◇ The main sources of return from robo-advisors are different

American robo-advisors pay attention to the US tax system. For example, it will consider tax avoidance while reallocating assets and what tax-free assets incur less cost. Therefore, American robo-advisors are focusing on tax and beta returns.

In China, retail investors do not have to worry about capital gain tax and hence the demand for tax optimisation is not as important. Retail investors are overwhelmingly speculative and trade frequently. Robo-advisors with passive indexing strategy could not satisfy Chinese investors’ requirement at all.

Take a typical Chinese robo-advisor “licaimofang” 理財魔方 as an example, it is more active in its asset allocation to suit the Chinese ‘needs. There are both active and passive strategies in their fund products. On average, they suggest 6-8 reallocations annually with each reallocation making up 20-30% of the overall position. In contrast, the US robo-advisors reallocate assets twice on average per year. Therefore, we could see licaimofang’s attempts to yield a better return for Chinese investors using a more active mechanism.

◇ Their investor targets are different

There are more than 2,000 ETFs (Exchange traded funds) could be used by American robo-advisors while there are only 180 ETFs in China now. Therefore, the liquidity and risk diversification abilities of Chinese ETS are significantly lower than US ETFs. Therefore, many Chinese robo-advisors use mutual funds instead.

However, it should be noted that ETFs and mutual funds are rather different. ETFs are better at tracking index and its trading and performances are easier to be predicted; mutual funds are more complicated to trade and are largely influenced by the fund managers’ subjective discretion.

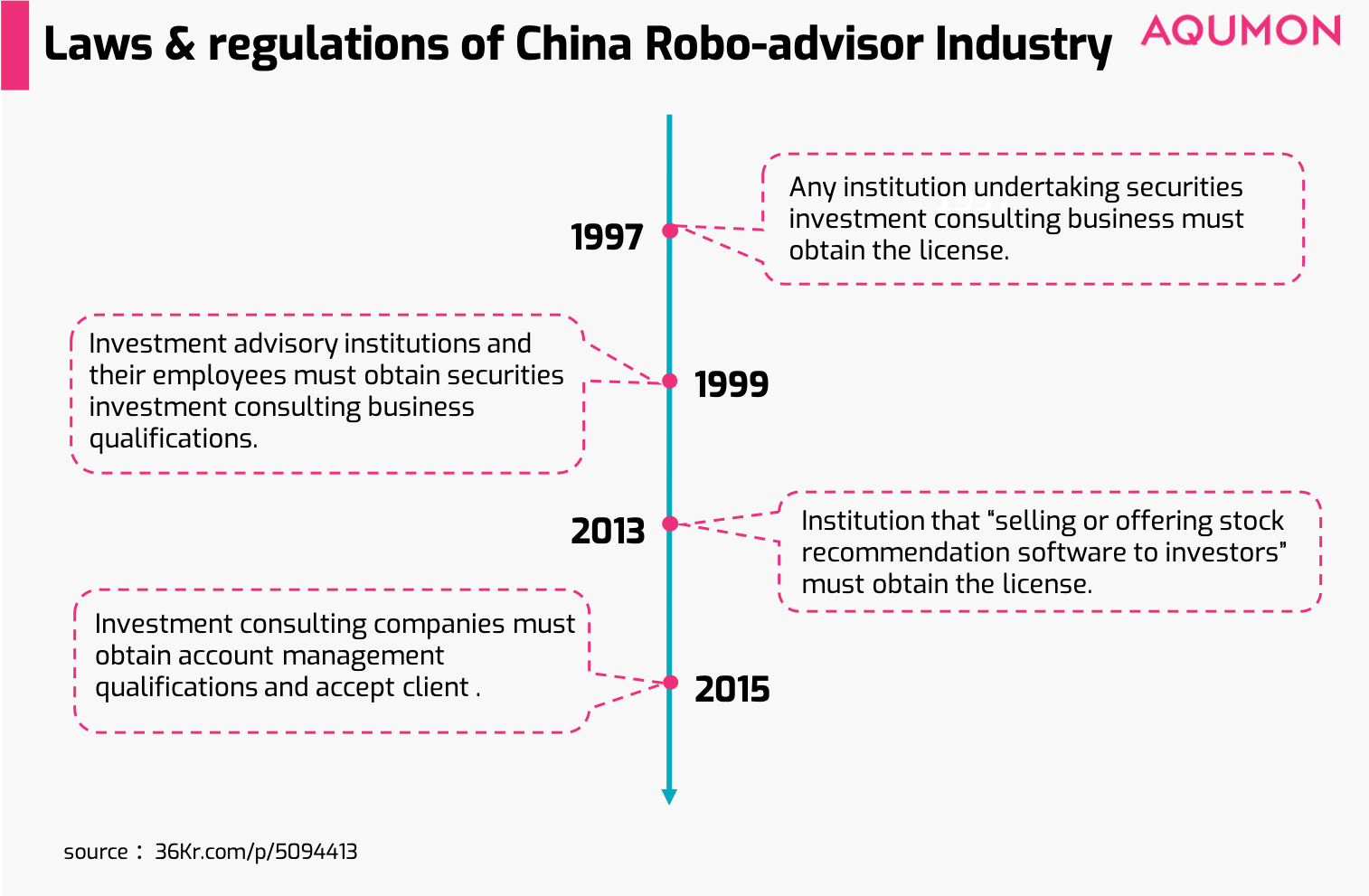

◇ Their regulations are different

The US capital market is heavily regulated, and robo-advisors are required to register as a registered investment advisor (RIA) and they are bound by the legal terms of the RIA and the U.S. Securities and Exchange Commission.

The Chinese regulator policy towards robo-advisors is still uncertain. If there is a shift in the regulatory environment, it could cause significant distortions in the robo-advisory industry. Therefore, this is also one reason why robo-advisor platforms are finding it difficult to acquire retail investors.

For example, in July 2016, the China Securities Regulatory Commission said that Chinese investors investing outside China via internet or mobile platforms are not protected by laws. This made several robo-advisors to issue an emergence notice stating their clients ‘capital is safely guarded.

Conclusion

At the moment, Chinese robo-advisors are facing a few major barriers:

1. The potential change in government policy

2. The difference in investment style (the Chinese market needs more active management and follow-up services)

3. The differences in understanding of robo-advisors

This teaches us an important lesson: successful investment must go beyond human nature, but you need to deal with human clients at the end of the day. If robo-advisors want to survive in the Chinese ecosystem, it needs to focus on the clients’ demand and the characteristics of the market. In addition, robo-advisors should be patient as it takes time for the Chinese market to understand to understand their value propositions and their investment results.

The ideology and mechanism of robo-advisors is beneficial to the market and the development of the financial industry. However, when compared with the enormous success of Yu’e Bao, robo-advisor is rather like a flop in China. Is there any potential for robo-advisors in China?

When Wealthfront was initially launched, it was mainly serving the high-income IT professionals in the Silicon Valley. In today’s China, high-quality, highly-customized and intelligent consumer businesses are continuously growing. This implies that the potential market is not actually that difficult to be spotted.

Learning from eBay, Taobao relies on the strategy of free shop opening and works directly with the end clients, it is now China’s biggest e-commerce giant. (note: eBay charges online shops for opening and their related functions). Learning from Twitter, Weibo relies on internet celebrities and viral marketing with the addition of images and videos sharing function, it is now an extremely popular social platform in China (note: Twitter is a platform mainly with word tweets)

So how should the Chinese robo-advisory industry develop? We will talk about it next time.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.