What's Next for Virtual Banking in Hong Kong?

Written by Kelvin on 2019-06-03

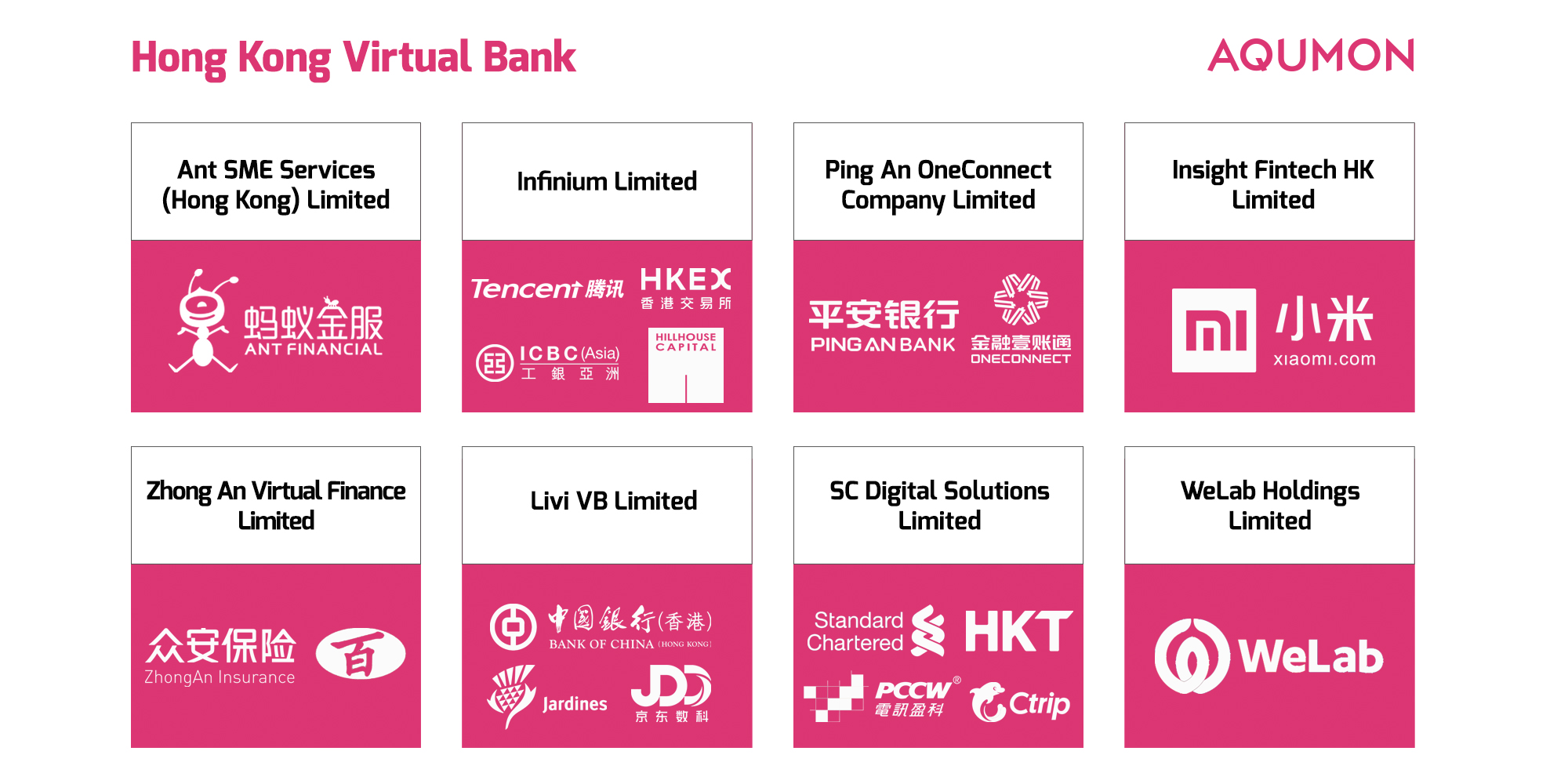

The issuance of eight virtual banking licenses by HKMA in early 2019 has a far-reaching impact. At the initial development stage, each bank is in full swing on the line of deposit and loan business.

But where is the industry’s next open front battlefield? Kelvin Lei, co-founder and CEO of AQUMON, shared his thoughts and views.

As of May 2019, there were 160 licensed banks in Hong Kong. As a global financial center, the joke about "more banks than grocery stores" in the city is indeed worthy of its fame. The timing, sources of talents, and the financial regulatory system make Hong Kong the suitable soil of Fintech firms.

The issuance of eight virtual licenses at one time also reflects the regulatory determination to reform and reshape the industry.

Key Features of Virtual Banks

1. Automatic and Efficient

Virtual banks utilize online account opening, online access to checking account and smooth interface design.

The end of 2019 was a critical point of time for eight licensed virtual banks in Hong Kong. The timing to establish the account opening platform, the loan approval procedure, the money transfer and the core business automation line was tight.

Some virtual banks worked with technology outsourcing companies to develop and design core automation programs.

2. Structural Innovation

Virtual banks differ from traditional financial institutions in the absence of brick and mortar subsidiary branches and counter services.

You won’t see a virtual bank on the street, and there is no need to hire manual tellers. In fact, this is the main reason why the automated system significantly reduces the cost of manpower.

3. Data Driven

The use of automation procedure has improved the capacity to process large volume of data, as well as the ability to train and use data.

Virtual banks could assess the financial situation of clients more accurately, and efficiently valuate anti-money laundering practices, risk control and other key due diligence process.

Even for the traditional deposit and loan remittance business, data analysis presents different user portraits, allows the bank to better understand user needs, which in return expand the business scope for virtual banks.

4. Advantages and Challenges of Virtual Banks

Advantages:

◇ No baggage of traditional financial institutions in the past

The brand-new platforms do not carry the burdensome structure of traditional financial institutions.

New lines of business have launched quickly and expand the market share before taking a bite like a shark.

◇ The price advantage for basic business lines.

Automation in the deposit business reduced labor costs, which brings virtual banks a small price advantage to accumulate customer base.

Challenges:

◇ Trust Issues.

The licensed eight banks do not necessarily form a competitive market. Compared with traditional banks, their means to acquire new customers has always been a challenge.

Virtual banks with traditional bank holdings might secure the first group of customers. But for tech startup companies with the virtual banking license, the access to clients might not work as easy as it seems.

Most importantly, the challenge comes not only from the counterattack of traditional banks, but also from the shackle of traditional ideas: banks need to have buildings, branches and clerks in uniforms.

Key to Stand Out and Thrive

At the current stage, virtual banks face important trends with the development of the industry, where two characteristics do matter:

1. Price war for basic business lines (deposit and loan remittance, etc.)

2. User experience (UI, UX design, etc.)

But what else can be done after the business has survived the first stage?

Digitalized Wealth Management

As the name implies, digital wealth management starts with two sets of data:

The financial market data, which provides investment advice to clients and carries out asset allocation schemes, which used to belong to the private banking and wealth management business.

The customer big data, which expands the scope of wealth management business.

Wealth management services are not based on selling individual products, but on the S&P four-quadrant solutions of investment, financial management, insurance, fixed income, or even a comprehensive framework that consists of securities financing and other products.

Of course, the platform requires dynamic wealth planning through automation systems, scientific algorithms and data drivers.

A success digital wealth management platform leads to low-cost, transparent, disciplined long-term investments, keeping customers extremely sticky to the platform.

The Significance of Virtual Bank Development

For virtual banks, digital wealth management is an important element that contribute to the change in revenue structure.

After the 2008 financial crisis, Morgan Stanley purchased the Wealth Management joint venture, which now accounts for 40% of its total revenue. Its successful transformation also reflects that wealth management will be a competitive market among financial institutions in the future.

The digital wealth management platform is designed to manage assets scientifically and rationally, rather than driving users into unreasonable trading activities.

Instead of charging transaction fees for each trade, the platform charges standard management fee, which creates a win-win situation for the long-term development of the bank and maximizes customer value.

Most traditional banks do not have the digital and automated system, or have been waiting for the research and development process for a long time.

Thus, for virtual banks, it is possible to win the first battle in the wealth management business.

On the other hand, the first few virtual banks that adopt digital wealth management will have a first-mover advantage and track record. Through development and tests, the platform often provides more diverse products, which attract retail and institutional clients.

For Institutions: How to Develop the Digital Wealth Management Business

There are two options for financial institutions: self-built R&D team or outsourcing.

For those that hope to launch an online business and seize the timing advantages of customers, outsourcing the technical content is indeed worth considering.

Just as Boeing and Airbus, neither of the two aerospace companies produce self-made engines, which are outsourced to the most prestigious civil airliner manufacturers in the world: General Electric, Hewlett-Packard and Rolls-Royce Trent.

But whether to choose a proprietary engine or to use an outsourced engine, the fault tolerance rate in the financial industry is extremely low, and thus we need to focus on the following points when considering building up the development of the digital platform:

1. Core R&D Capacity

◇ Sensitivity. The core algorithm and IT development require rapid and robust support for the front-end business.

◇ Scientific. Once the engine is on the line, its fault tolerance is extremely low, and the need for reliability requires the manual intervention and unscientific approach to support the trading position for millions of customers.

◇ Continuity. Banks constantly face market demands and changes, including the development of products, strategies and new regulatory rules. The algorithm will continue to improve and upgrade, and the engine must keep up with the forefront of digital wealth management business in order to provide new solutions.

Since its inception, AQUMON has continued to polish our database structure, customize algorithms and expand the API capacity. For both the cloud and resident solution, AQUMON will always meet the rigorous demands of our clients.

2. Regulatory Insights

In the wealth management industry, regulatory compliance is always the priority.

When seeking for outsourcing, institutions must choose among HKSFC licensed suppliers that comply with the regulation requirements. The supplier also needs to be able to adapt the services to regulatory changes in the future.

3. Execution and Actual Performance

The track record from actual performance is a key condition to provide institutional services. It is generally believed that a performance record for more than three years is ideal to provide robo-advisory services in the market.

Unlike the instantaneous and readily verifiable nature of deposit and loan remittance business, the automation of wealth management and investment is highly complex.

In order to support the system during global financial market fluctuations, it is essential to retain an accountable track record from actual performances.

Additionally, banks require strict, confidential, highly capable and expansionary IT docking systems, which continue to challenge the technology capacity.

To support the system and secure customer funds, the automation carrier must have smooth operation.

Diligent and efficient, AQUMON has successfully provided powerful and efficient wealth management platforms for our clients.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.