Pepsi China: The Rebellion of Joint Ventures

Written by Henry & Ria on 2019-06-20

Entering China: the most promising soft drinks market

Chinese soft drinks market began with the reform and open-up policies. Chinese brands such as Tianfu Cola, Jianlibao etc. and foreign drinks brands like Pepsi and Coke competes in this young market.

The research institutes predicted that the volume of Chinese soft drinks would keep doubling within 3 years and so on, while the soft drinks market in the US only expands with 4.2% annual rate.

Moreover, Chinese low cost and cheaper labor forces amplified this effects to a further extend. Pepsi would seize this fantastic market without a single doubt at that time.

In order to develop and educate the Chinese market quickly and smoothly, Pepsi chose different Chinese partners to cooperate with. They agreed to set up a joint venture to build up a bottling plant. And up until the late 1990s, there were 14 bottling plants for Pepsi and its partners.

And we can divide these 14 plants into 2 types:

- The control rights belonged to Pepsi: 10 of the 14 plants (Beijing, Changchun, Fuzhou, Chongqing Pepsi etc.)

- The control rights belonged to the Chinese partners: 4 of the 14 plants (Shanghai, Nanjing, Wuhan, Sichuan Pepsi etc.)

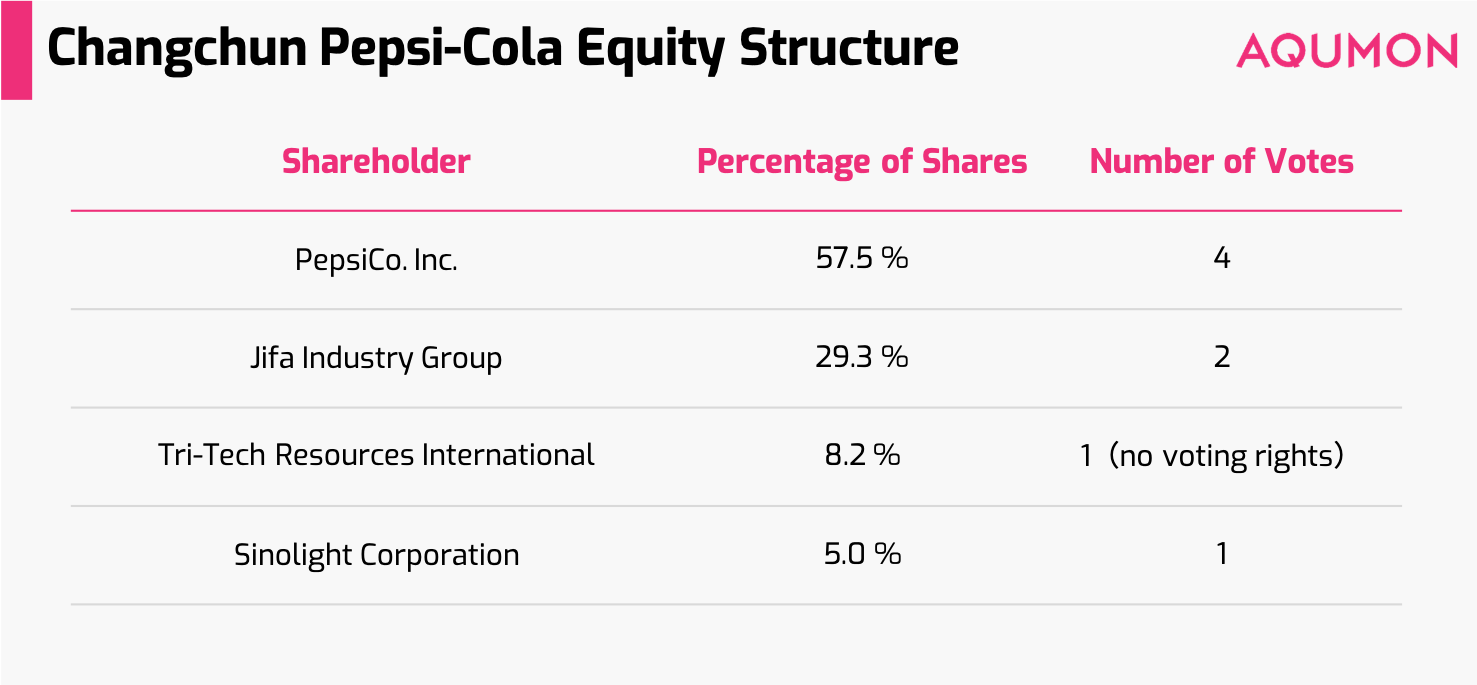

Take Changchun Pepsi as an example, its equity structure is shown in the following chart:

This division also was a hint foreshadowing later developments in the story.

4 Dukes disobeyed Pepsi China

Pepsi China had two main profit streams profit streams under this organized structure:

1. The sales of Cola Concentrate towards those bottling plants.

2. The dividend from each bottling plant’s sales revenue

One core of cola’s production is the cola concentrate syrup. And as a close person disclosed, the cost of the concentrate syrup only takes about 10% of the prices, and which was also the main source of Pepsi China’s profit.

In this structure, Pepsi controlled the production material, and its partner controlled the marketing, pricing, and distribution networks.

With lots of partners having different backgrounds and cultures, the discussion or say internal friction between Pepsi and its partners wasted a lot of time and money.

“For a Long time, your company regarded yourself as ‘redeemer’.And you get used to teaching others out of your line. When you treating conflicts between bottling plants, you want to be referees and players at the same time, which insulted the basic rule of fairness.”

——From Sichuan Pepsi to Pepsi China

1) Weak Right of Speech

Those 4 relatively independent bottling plants we mentioned above took the major part of Pepsi China’s revenue and profit by taking up 46% and 70% respectively out of the whole China market.

Unless Pepsi had the super courage, it cannot punish these 4 plants hardly.

However, Pepsi once tried to force Sichuan Pepsi (Chinese partner dominated) to lower its prices in order to grab the market share, even with no profit left.

But the Sichuan Pepsi’s Chinese partner didn’t think so, if it cannot make money from selling cola, the Chinese shareholders would have no any return, while Pepsi China still can generate revenue through the cola concentrate syrup.

2) Unfair Distribution Plan

There are 30 provinces in China, while only 14 bottling plants. Those 16 provinces without plants were free competitive “White Areas”.

After been refused when attempting buyout those 4 dukes, Pepsi China set up the “Cooperation Committee”, trying to control the distribution channels of those 4 dukes.

Pepsi tried to allocate those “White Areas” to the 10 its own bottling plants.

For example, at that time, the committee regulated that the distribution of rich eastern Sichuan Province should be owned by Chongqing Pepsi (Pepsi China dominated), while the eastern poor areas’ distribution channel is allocated to Chengdu Pepsi (Chinese Company dominated).

The 4 dukes cannot bear those unfair operations from Pepsi China anymore in the end. They reported the committee as illegal to the Chinese government, then the government found the committee didn’t got registered and the committee was forced to close in the end.

The conflicts between dukes and Pepsi China became even more and more fierce.

Serious Descent Problems

A joint venture is a business entity created by two or more parties, generally characterized by shared ownership, shared returns and risks, and shared governance. And at the primary stage of china’s reform and open-up, the Chinese government encouraged the foreign companies go into the mainland China.

Most of them need to find Chinese partners to set up joint ventures.

At that time, Chinese companies’ technology and management were not advanced and scientific as the western companies, while western companies were keen on the huge potential of Chinese market. China and foreign companies can build up joint ventures to get what they want.

However, in many Chinese-foreign joint venture cases, we found there are lots of divergences lying on the fields of management idea, development planning, and profits distribution, which may even cause an intense conflict between them.

How to end this conflict

There was no winner for the internal conflict between Pepsi China and the 4 dukes. And the later story of Pepsi China can be concluded as below:

- Pepsi China and Sichuan Pepsi had huge conflict regarding the “cooperation committee”. Pepsi China stopped the supplying of cola concentrate syrup to the Sichuan Pepsi.

- Pepsi China bought the shares of the 4 bottling plant dukes, but the loss of those bottling plants were larger and larger. In the end of year 2010, the overall loss reached 176 million USD.

- In 2011, Pepsi China sold all of its bottling plants to Kangshifu in a bundle, which means Pepsi gave up its 30 years’ bottling layout.

You may wonder what Pepsi’s old competitor Coca Cola’s story. Compared to Pepsi, Coke has the experience of China’s market even before the establishment of P.R. China. Since 1948, Coke was always waiting for the chance that it could re-enter the Chinese market.

And after the announcement of reform and open-up, Coke’s early strategies can be concluded as followed:

- Strong partnerships:

At the beginning, Coca chose powerful partners with plenty government resources, and its bottling partners were Swire Group and Kerry Group from Hong Kong, which were quite familiar with how to operate in mainland China.

- Asset-light Style:

Different from Pepsi’s 2 sources of revenue streams, Coca established its style at the very beginning - only control the cola concentrate syrup and marketing. Cola gave out all the intermediate proceeds to the 3 big partners. Owned 43 plants with its logos, but a asset-light company.

When cooperated with China Food Company to build the 1st bottling plant, Coca promised that it will provide all the machines for free, it partner only need to purchase the syrup from it every year. This favorable condition would not be rejected, particularly towards careful and poor China’s companies at that time.

While Pepsi need to negotiate with every location, one agreement for one province. Moreover, the Pepsi’s partners had management and ability backgrounds, which raised the operation cost and instability for Pepsi China to a huge extend.

What We Learned

From recent years, foreign giants gradually fell behind in Mainland China: Amazon quit the Chinese market, Oracle cut down lots of its employees, and Lotte supermarkets quit as well.

Want to survive the China market, two difficulties may not be avoided: how to find sustainable ways regarding local companies and consumption. From Pepsi China’s case, we may learn some valuable points:

1. Wide View in order to sustainable development

Compared to Pepsi’s hesitation on whether asset-light or asset-heavy style strategies, Coca Cola entrenched its asset-light style at the very beginning.

Compared to Pepsi’s costly cooperation with partners with different backgrounds, Coca Cola chose the strong partners with similar horizons.

Having the same interest, Coca’s partner and Coca would cooperate more smoothly.

2. Stable and Scientific Management Cut the Costs

The final profit comes from the difference between revenue and cost. Different from Pepsi’s unsystematic management, even the conflicts, Coke has a stable relationship with its 3 partners all the time.

The integrated management framework avoids the probable conflicts, reducing the management costs.

Similar to investing, high rate of return doesn’t mean the final earnings of investors. We also need to consider all kinds of costs, then we know the true value of an investment.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.