Petty Cash Relates to Investment Choices

Written by Ria & Flo Li on 2019-09-19

Imagine that you can save a sum of egg money every month, how would you store it?

A. Hiding in a place at home

B. Divided into several parts and hidden in different places

From these two different approaches, it is not difficult to conclude that this scenario setting embodies two opposite strategies:

1) All hidden in the same place – concentration,

2) Separately hidden in different places – diversification.

Now let's change the background of this question:

If you want to invest your own income, would you choose to invest in a single asset (a stock, bond, fund, etc.) or will you invest in different asset separately?

In the context investment, will you make the same choice?

There is a very important theory in investment: "Do not put eggs in the same basket." However, the opposite voice is equally strong. Fortune magazine once wrote: "Diversification gains huge wealth, this is one of the lies."

The significance of diversification is to reduce risks while maintaining stable returns. But in fact, the so-called “diversified strategy” used by most people is too simple, which is not the optimal allocation in the true sense, and may even run counter to the expected effect.

The essential reason why many people finally choose to concentrate is because that they have not found the correct way of diversification. Not only have they spent more energy and higher management costs, but they have not achieved the desired results.

When it comes to diversification, the most common one used by many people is the "1/n strategy." This means that the funds are evenly distributed to the filtered investment.

However, in 2001, the famous behavioral economist Richard Thaler discovered that the “1/n” strategy of many investors is only to satisfy the separation effect in the mind by means of the average distribution, which is only a simple diversification with poor ability of avoiding risks.

For an analogy, it's like you put half of your egg money in the left sock while the other half in the right sock, it seems to be diversified into two places, but the storage effect in these two places is highly similar and does not reach the ideal risk dispersion effect.

Depending on the degree of diversification, we can divide the investment plan into three types: simple diversification, sophisticated diversification and global asset allocation.

Simple diversification

refers to the way, by which investors simply hold an index asset to reduce the idiosyncratic risks. (We choose S&P 500 Index, FT 100 Index, CSI 300 Index, Bloomberg Barclays Global-Aggregate Total Return Index (“LEGATRUU Index” for convenience) and Dollar Index as the testing strategies.)

Sophisticated diversification

another style for the sophisticated investors, often quantitative investors. Sophisticated diversification investors investigate broad characteristics of the assets and construct strategies that cover a large number of securities and utilize statistical or computer science technologies to generate profits. An example of sophisticated diversification is smart beta strategies. (we choose MSCI US Prime Market Value Index, Russell 1000 Growth Index, MSCI USA Minimum Volatility Index, HFRI Macro: Systematic Diversified Index, and HFRI FOF: Diversified Index in our analysis.)

Global asset allocation

an extreme of sophisticated diversification. By diversifying portfolios across all asset classes and geographical regions, global asset allocation reduces portfolio volatility and maximum drawdown but enjoys the dividends from the economic growth of developed markets and major emerging markets. (we use the five AQUMON SmartGlobal Max portfolios of different risk profiles as testing strategies.)

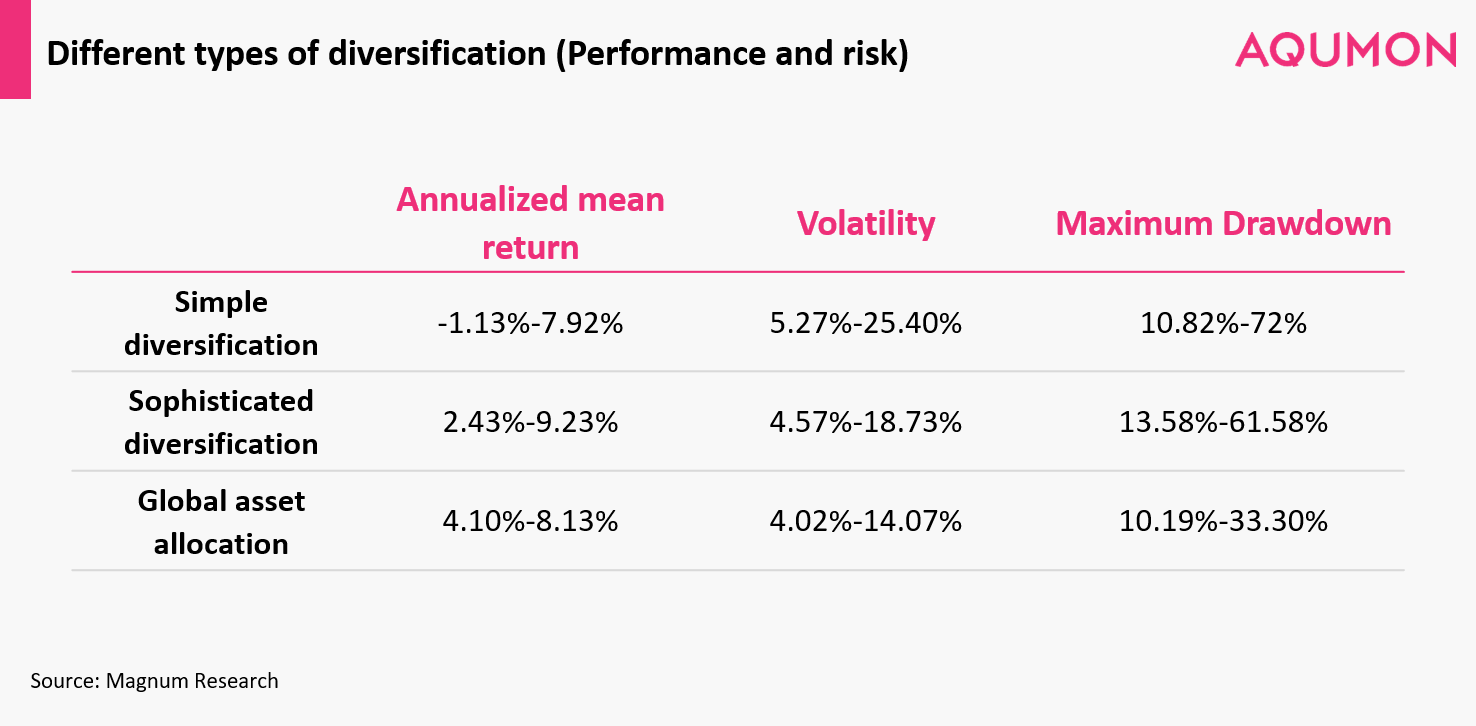

We compare data from different forms of diversified investment in terms of market performance and risk:

It is not difficult to see that simple diversification adopted by most investors who lack systematic knowledge has great volatility and maximum drawdown. These two indicators fully demonstrate that this method can hardly reduce risk and increase revenue as we expected.

Sophisticated diversification and global asset allocation have relatively better risk-return balances. But when we further compare their responses to risk, sophisticated diversification shows greater sensitivity to market risks. Therefore, its attractiveness to investors, especially low-cost investors with short-term liquidity demands, will be somewhat reduced.

These different diversified strategies can be applied to different population due to the difficulty of implementation:

- Simple diversification:The implement costs are low, and long-term average return can be high. However, the volatility and downside risk are very high for this investment approach. It is therefore only applicable for long-horizon investors (at least 5 years) without short-term liquidity demands.

- Sophisticated diversification:The after-fee performance is good, but the maximum drawdown is still very high due to its high sensitivity to market risks, leading to a less attraction to middle-horizon investors.

- Global asset allocation:The after-fee risk-return balance is the best among all investment approaches, and it presents an outstanding “defensive” feature for almost all investment horizons. Also, the initial investment for this style is acceptable for most lower-middle class and wealthier people. Therefore, for most lower-middle class, middle class, upper class people, investing via global asset allocation is a good choice.

As global asset allocation has better post-investment performance than sophisticated diversification, it will be a good way of wealth management for more than 70% of people in Hong Kong because of its good risk-return balance, high average return and excellent risk resistance.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.