AQUMON 2019 Annual Investment Return Report

Written by AQUMON Team on 2020-01-12

2019 has just passed by, labelled with dramatic and unpredictable global economic and market performance. With the upcoming US Presidential Election and the increasing geopolitical tensions between Iran and the US, 2020 is meant to be filled with uncertainty, although the overall global economic condition is good before the completion of the US Presidential Election. To survive and thrive in 2020, investors need to be well-prepared for the potential downside risk even when the conditions are still good. AQUMON’s robo-advisory portfolios act as the Noah’s Ark in this perspective.

In this article, we will navigate you through the performance of AQUMON’s robo-advisory portfolios in 2019 and offer you our insights of how AQUMON’s robo-advisory portfolios can survive in the market of 2020.

What’s the performance of AQUMON’s portfolios?

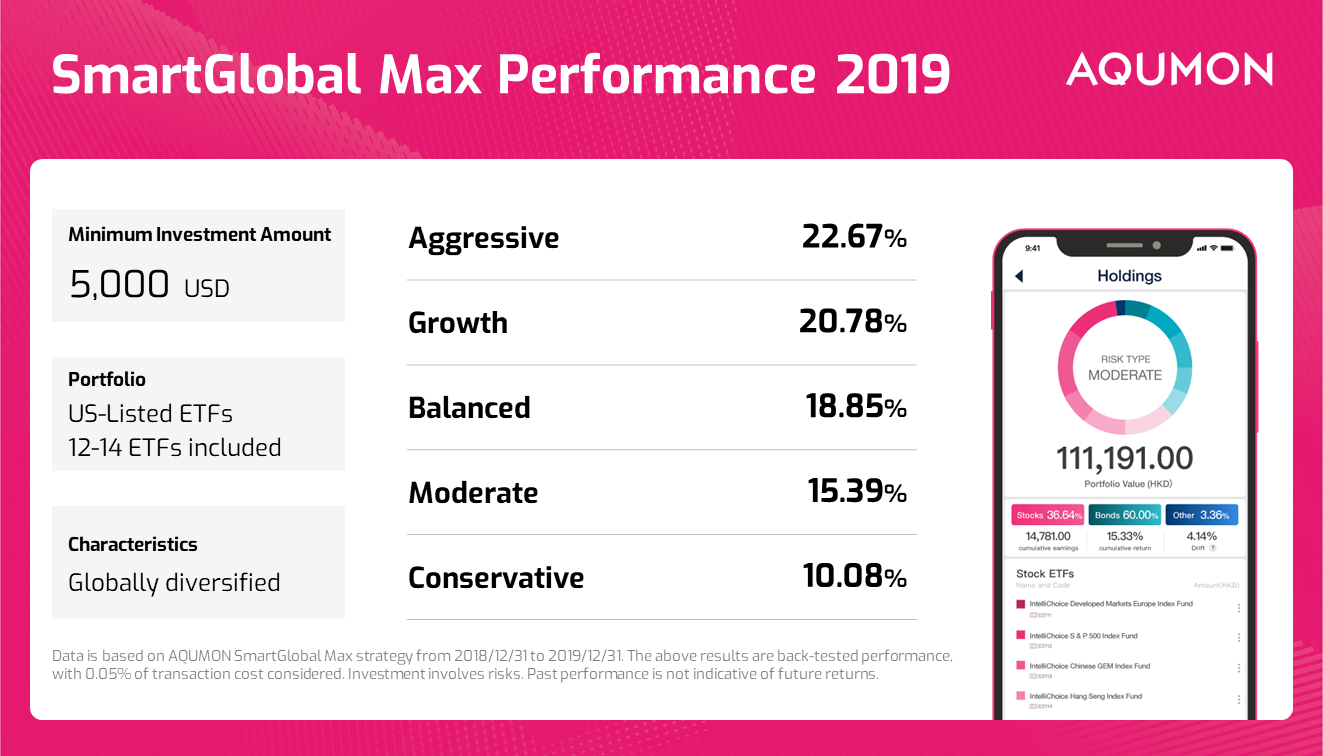

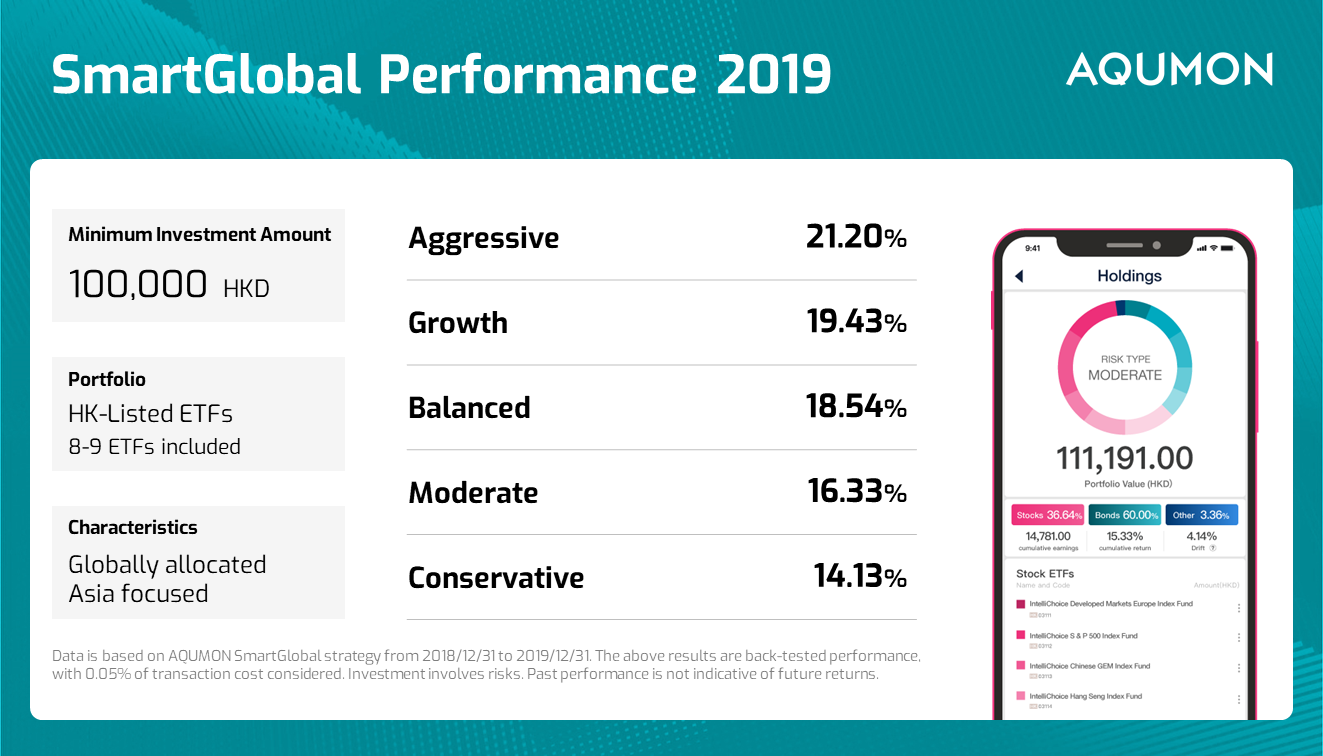

In 2019, AQUMON’s two flagship products, SmartGlobal® and SmartGlobal Max® have reached their historical high level and accomplished fruitful returns.

The five SmartGlobal® risky-asset portfolios had an annual return from 14.13% to 21.20% and a Sharpe Ratio from 2.24 to 2.69. The five SmartGlobal Max® risky-asset portfolios achieved an annual return from 10.08% to 22.67% and a Sharpe Ratio from 2.36 to 3.61. Comparably, Hang Seng Index earned only 9.07% and Sharpe Ratio of 0.59 in the corresponding period.

In the October 2019, we launched the defensive portfolios that purely invest in fixed income ETFs for both SmartGlobal® and SmartGlobal Max®. The performance is stable and remarkable, with an annual return of 3.26% and 3.90% respectively, which also outperformed the S&P Hong Kong Government Bond Index and the S&P U.S. Treasury Bill 0-3 Month Index.

There are several reasons for the remarkable performance.

On the strategy level, AQUMON’s SmartGlobal® and SmartGlobal Max® portfolios are global asset allocation strategies, which not only enjoy the economic growth and market performance of different regions but also lower the overall risk via diversification. In 2019, due to political reasons, the Hong Kong market performed poorly. However, the rest of the world, especially the US market and the A-share market, experienced a volatile but profitable return.

Via global asset allocation, SmartGlobal® and SmartGlobal Max® portfolios earn the profits from the US market and the A-share market and restrict the fluctuation from these markets. Therefore, SmartGlobal® and SmartGlobal Max® portfolios performed far better than the Hang Seng Index.

On the market level, the global markets overall experienced a volatile but fruitful year in 2019. In the first quarter of 2019, major markets recovered from the massive decline that occurred at the end of 2018, leading to a quarterly return of over 15% for S&P 500 Index and CSI 300 Index. Although the increasing tensions between China and the US in trade lead to the cooling down for major global markets, the global trend of rate cuts, especially the three consecutive cuts by the Fed starting from July, further pushed up both the risky assets and the fixed income assets to a record-high price level. Finally, at the end of 2019, the relax of the Sino-US trade conflict and the final agreement on the "Phase One" trade deal add to the optimistic mood to the market.

What will the economy and the market be like in 2020?

The global economy will still be warm but not hot in 2020. For the US, the 2017 tax breaks that companies enjoyed will have worn off by the end of 2020 but still offer momentum to the economy during the year. The Sino-US trade war may be or at least will seem to be on the road to a resolution before the result of the completion of the US Presidential Election because President Trump needs a relatively stable economic condition to compete with other candidates. The Federal Reserve may not have further rate cuts in 2020 because the economic indicators depict a healthy and strong economy; however, it is also unlikely to have a rate hike because of the pressure from White House.

On the other hand, the global economy will start to rise a little bit. Although China’s growth is admittedly slowing, China’s economy is getting more and more stable, and a 6% economic growth is still not bad. On the other side of the world, Prime Minister Johnson now has his parliamentary majority and will be able to drag Great Britain’s way to growth as it Brexits away. However, Germany may still struggle in its slowdown and the pressure from the whole EU.

Due to the economic conditions and the political needs both from CCP and President Trump, the A-share market and the US market will still thrive before the completion of the US Presidential Election, although the geopolitical tensions may introduce more volatility to the markets. The EU markets may still be plain due to the slowdown of the whole EU economy and a low enough interest rate that can be hardly further cut. The Hong Kong market may provide some amazes to the investors if the political issues are cooling down. However, there might be uncertainty for the markets if President Trump loses the Election. Also, the trade tensions may rise again after President Trump win the Election. Hence, the market in the last quarter of 2020 might be dramatic and stormy.

Why AQUMON in 2020?

Based on the economic and market prospects, AQUMON is still the best suitable wealth management tool for Hong Kong individual investors. The global asset allocation strategies still provide the investors with a channel to enjoy the profits from the US market, the A-share market and the UK market and restrict the regional or sectoral risks via diversification.

More importantly, the coming versions of AQUMON will provide the Hong Kong individual investors with better investment experience. In January 2020, AQUMON has launched its basic version for SmartGlobal® and SmartGlobal Max® portfolios and lower the minimum investment amount for SmartGlobal® portfolios to HK$50,000 and the minimum investment amount for SmartGlobal Max ® portfolios to US$1,000. This lower in minimum investment amount makes it possible for the low-income classes and youngsters to access AQUMON’s technology-empowered investment tools.

Before the end of the second quarter of 2020, AQUMON is planning to launch several new strategies on the platform and allows investors to hold more than one portfolio in the account. Also, AQUMON will allow investors to buy foreign currencies directly on the platform in the updated version, which will massively reduce the complexity and time for the clients to invest in AQUMON’s portfolios.

We believe that AQUMON is still the best suitable wealth management tool for Hong Kong individual investors in 2020.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.