How to Face A Major Market Downturn?

Written by AQUMON Team on 2020-03-09

Financial markets don’t always go up - The Coronavirus outbreak sent markets plunging. Though the effect on the markets isn’t as catastrophic as the 2008 Global Financial Crisis, panic has nevertheless ensued.

Every major market downturn is a rampant psychological struggle for novice investors. For veterans, however, it presents an opportunity to review their own portfolio holdings.

We’ll walk you through the major traps and pitfalls investors fall into during major market downturns. But first, let’s look at the recent market trends.

What is a Bear Market?

A bear market generally refers to a long-term downward trend in the market. With a decline of more than 20% and lasting more than 2 months, we can call it a bear market period. Take the plunge in 2018, although it looks very scary, at that time, the US large-cap stocks (S&P 500 index) fell by 19.8%, but the duration was short. We can think of this as just a market correction.

In 2019, the US stock market rose too much, and the US CRSP US Total Market Index rose 29.8% in 2019. So, we still must observe the question of "whether it has entered a bear market period".

But investors are worried.

3 Common Myths of Trading during Market Downturns

In the end, people are worried whether the market crash is coming. We have summarized three major investment misunderstandings during the market downturn to help you survive this period.

Myth #1:The idea of a market crash or buying the dip, hence trading frequently.

Reality #1: For most people, the more frequent transactions, the lower the returns, and the larger the volatility in earnings.

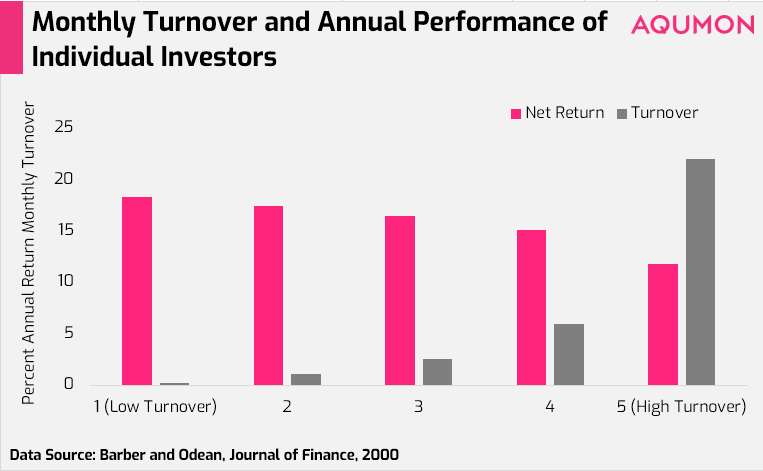

A study of US stockholders showed that the more frequently investors trade, the lower their returns. For individual investors, frequent transactions mean higher transaction costs, and they often misjudge the market due to insufficient investment knowledge.

Perhaps, will people with investment experience also have this problem?

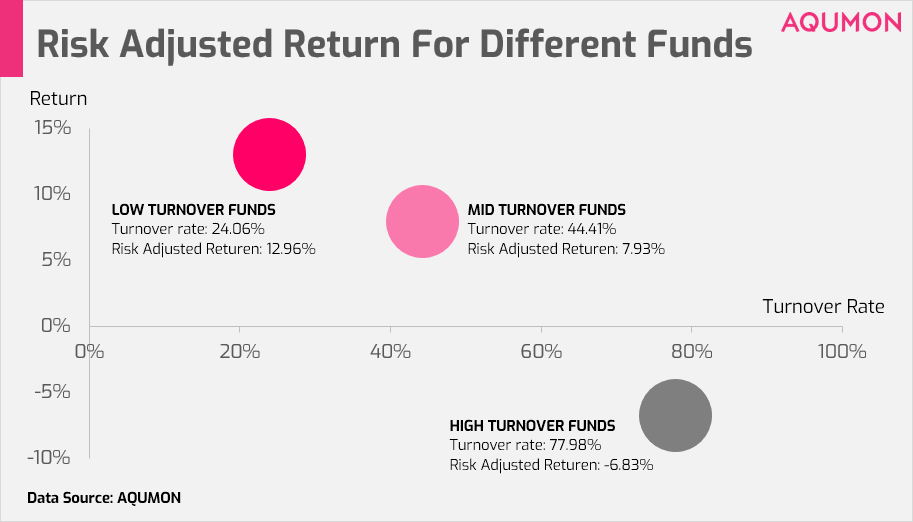

Let's look at the performance of the bear market in 2000, the dotcom bubble. We observed that from 2000 to 2002, the returns of the three types of funds (ie low, medium, and high turnover rate funds) also showed significantly different returns after 36 months.

△Turnover Rate refers to the ratio between the cumulative trading volume and the tradable volume of the frequency of a certain securities resale transaction per unit time. The selected data sources are CRSP Mutual Funds, Thomson Reuters Mutual Fund Hoidings (s12), and other active funds from 1999 to 2017. Because the position adjustment of passive funds is based on the index they track, it is not completely controlled by the fund manager, and it is not comparable with active funds, so it is eliminated. The low, medium, and high turnover rate type funds are sorted according to the turnover rate during the 2000-2002 bear market and form three types of equal-equity investment portfolios. The rate of return is the cumulative rate of return from 2000 to 2002, and the rate of return adjusted for market risk during the same period.

The above figure shows that the risk-adjusted returns of low-turnover funds (that is, the returns after excluding market factors) are significantly better than those of high-turnover funds.

During the financial crisis of 2008, all assets experienced indiscriminate shocks, and we can observe similar phenomena, but not as obvious as in 2000. At the same time, we can find that the risk-adjusted return volatility of funds with high turnover rates is significantly higher than that of funds with low turnover rates.

During a bear market, frequent trading or position adjustment does not mean higher returns.

Choosing an investment style robust passive fund and holding it for a long period of time is more likely to get better stable returns.

Myth #2: The idea that lost capital cannot be regained and abruptly cutting losses

Reality #2: Investors often miss the period of subsequent long-term rebound gains.

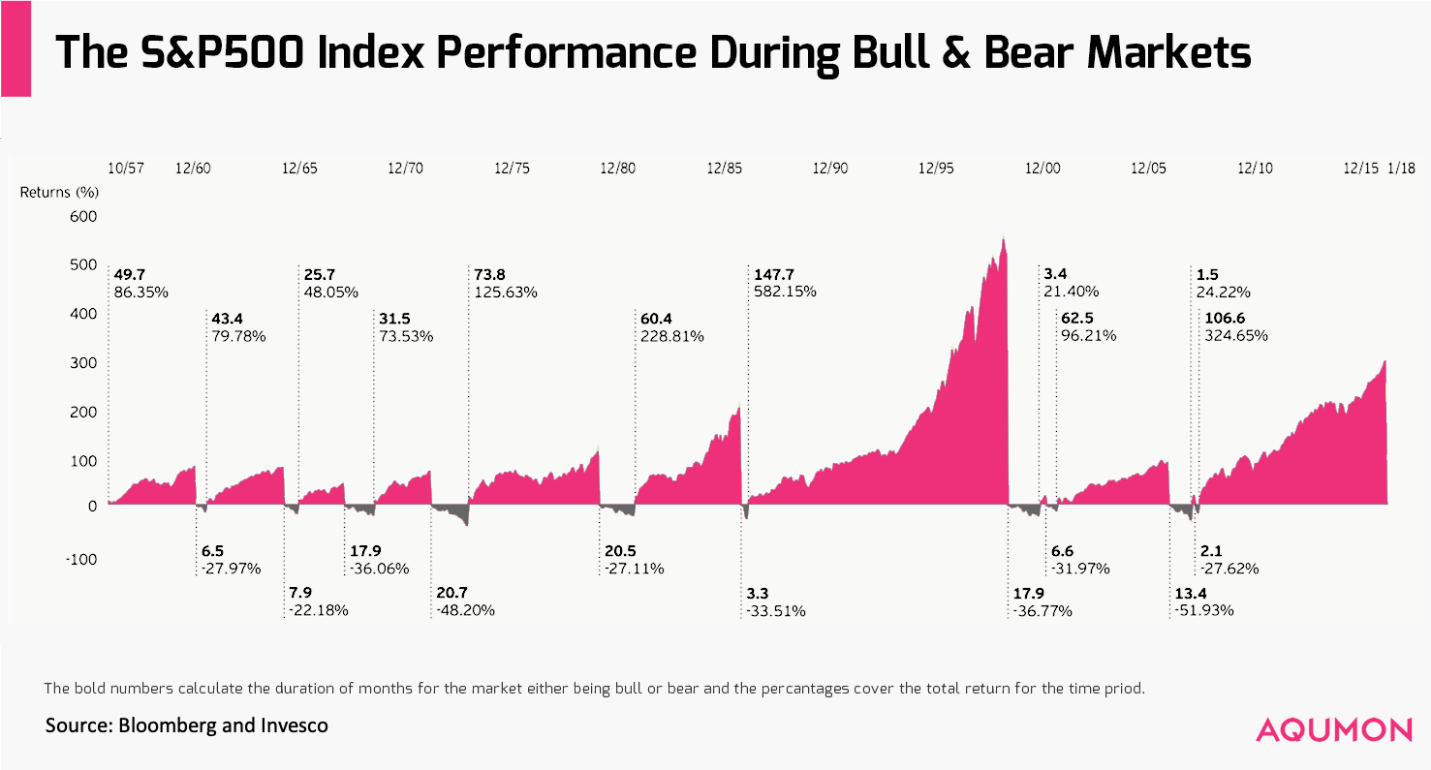

According to the trend of the S&P 500 over the years, short-term market declines often follow a longer-term market rise.

As seen from the above figure, during the period 1956-2017, the US stock market experienced a total of 11 bull markets and 11 bear markets. The average duration of each bear market is 12.2 months, with an average decline of 33.34%; and the average duration of a bull market is 54.8 months, with an average increase of 151.51%.

If we relax the conditions and consider a market correction period in which the decline is more than 7%, the results are very similar.

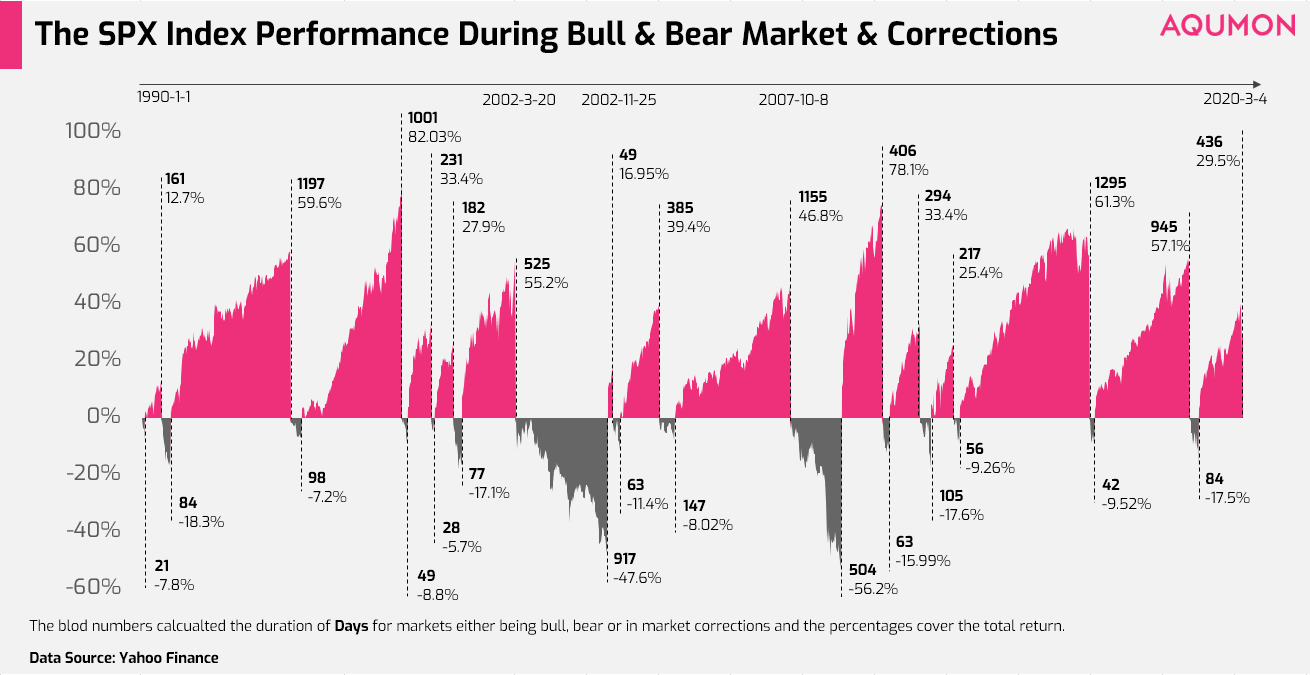

In the period from 1990 to 2020, we experienced two major market declines (bear markets) and two market corrections. The average decline was 17.2%, and in the 19 months immediately following the decline, the market rebounded strongly, with an average increase of more than 40%.

Some methods, while simple, are more effective.

In the face of market decline, do not blindly sell all your stop losses. Long-term stable investments are often best to get better returns. Although the "Buy and hold" method faces the risk of falling, it will not miss the strong market rebound in the later period.

Myth #3: Concentrating on investing in a certain type of assets because “I am unfamiliar with so-and-so area”.

Reality #3: When concentrating investments into a single type of asset, the setback is large, and the recovery time is slow

During a crisis, the degree of decline and recovery of a diversified portfolio is significantly better than that of a single market portfolio.

Let's look at a scenario like this: if you were very unlucky and started investing on January 2, 2008, the highest point in the market where the financial crisis is about to begin.

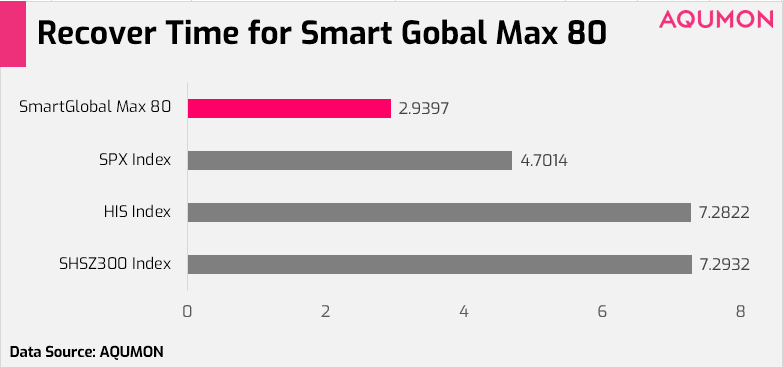

The S & P 500 would then return to its previous high in 4.7 years. It takes 7.3 years for the CSI 300 and 7.28 years for the HSI. But if you look at the aggressive portfolio of AQUMON SmartGlobal Max (80% invested in equity assets), it only takes 2.94 years to return to the previous high point, which is 1.6 times the speed of the S & P 500 index.

From the degree of decline, we can also see that the largest decline in the aggressive portfolio is 86.77% of the S & P 500 index.

This is the power of diversification.

Conclusion

Each investor will have different answers as to how to invest in the market downturn. I hope this article will reduce your mistakes.

If you still feel a little confused, it's as simple as this:

1. According to your investment purpose, do you have enough cash to survive the crisis?

2. During the bear market period, you can choose the investment method with lower turnover rate.

If you invest in funds, choose funds that have a solid investment style and a lower turnover rate. If you own a custom-made portfolio, you can choose a more passive investment method, such as AQUMON's SmartGlobal series.

3. A diversified portfolio can help you recover quickly and rise faster after falling.

Hope this helps!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.