Is It the Market Bottom Yet?

Written by Ken on 2020-03-16

It’s been a rough week for global financial markets with pretty much nowhere to hide for investors. Even traditionally safe assets like gold or higher grade bonds sold off along with stocks.

European stock markets like the Euro Stoxx 50 Index were hit the hardest -20.00% due to the coronavirus situation. U.S.’ S&P 500 Index, Hong Kong’s Hang Seng Index and China’s CSI300 Index fared better -8.79%, -8.08% and -5.83% respectively. If not for Friday’s late bounce, U.S. stock markets would have finished the week down over 15%. Beyond short term treasuries which held up well the general bond market sold off 3-10% and gold finished -8.60%.

AQUMON’s diversified ETF portfolios were affected due to this selloff across all asset classes. Our diversified ETF portfolios are -1.39% (defensive) to -9.52% (aggressive) this past week and -0.15% (defensive) to -15.12% (aggressive) year to date.

The #1 question we get from investors is “is it the market bottom yet?”.

Although no one has a crystal ball, with 15+ years of investment experience our instincts tell us this is not the bottom. Why?

(1) Investor confidence is still very weak

This morning we woke up to news of the U.S.’ Federal Reserve cutting an unprecedented 1% off interest rates to zero and launching a massive US$700 billion quantitative easing program (large-scale asset purchases by central banks) to help prop up financial markets. How did the U.S. futures market respond? As of 3pm Hong Kong time the S&P 500’s futures are -4.79% which suggests tonight’s U.S. market will open up weaker. This is a sign investors are not sold that this will help markets.

(2) Coronavirus development unclear

As we mentioned on Friday we are closely watching the coronavirus situation develop particularly amongst the U.S. and Western Europe. The next 2 weeks will be very telling if Italy’s hard quarantine approach is effective or not. The U.K. to avoid overwhelming their healthcare infrastructure (like we are seeing in Italy) looks to be taking a more extreme ‘herd immunity’ approach of slowly infecting their lower risk people to protect higher risk people. There are 169,531 infected globally as of Monday and all these regions continue to see 20%-30% daily increases in new infections meaning cases are doubling every 3-4 days. Unlike Asia, for these regions they are still in the early stages in terms of impact from the coronavirus.

Everyday Americans are feeling it more closely on their level this week seeing major sports leagues suspending their seasons. The Centers for Disease Control and Prevention (CDC) also recommended against holding any events or group gatherings of 50 or more people. The big question is how will this impact them both on a health and economic level when more Americans are asked to stay home and the majority of Americans’ jobs do not have an option to remotely work from home. According to the U.S.’ Bureau of Labor Statistics as of 2018 close to 70% of Americans had no experience to work remotely. With very limited savings by U.S. households as we saw first hand during the U.S.’ government shutdown back in November 2019 this may put added pressure for U.S. retail investors to sell their investment holdings when squeezed for cash. Furthermore as we experienced in Hong Kong first hand consumption patterns will change significantly with everyone staying home. This is a developing situation.

(3) Bond market under liquidity stress

Due to recent major pullback in oil prices (WTI crude oil was down over 20% last week) this has put a lot of stress on the bond market. Where this is felt most right now is amongst lower level investment grade bonds (BBB rating) which account for 40% of the U.S. and European investment grade bond universe. The corporations that issued these bonds if met with a real extended crisis may have trouble paying them back. Furthermore bond ETFs are starting to see dislocations where the cash prices of the ETF is trading at a discount to the underlying assets which is very unusual. Both these issues could cause liquidity problems down the road.

Is this all gloom and doom? No!

A once in a decade buying opportunity is coming up

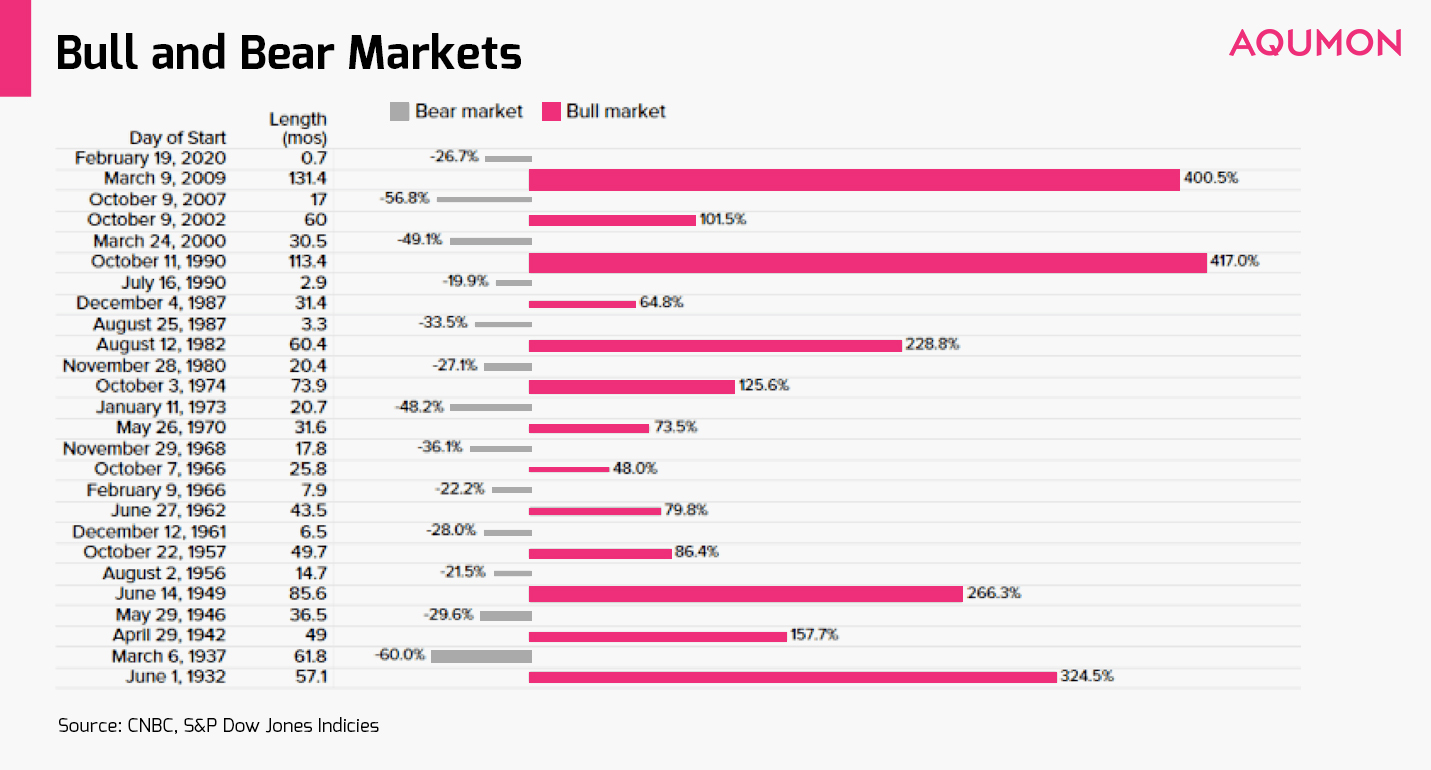

For those of us in the financial industry who’ve seen a few market cycles (good and bad times) we know as investors we truly make money when we are able to take calculated risk during periods when others are not willing to do so. Much like in 2008 during depths of the Global Financial Crisis the S&P 500 Index saw a pullback of -56.8% but was then followed by a subsequent 11-year bull market run of 400.5%.

When we finally come out of this current financial downturn (could be 3/6/12 months from now) we will likely be greeted with an opportunity to buy all our favorite high quality investments at a fraction of the price. Start preparing and taking action.

What we as investors should do is:

1) Set aside some extra cash for this opportunity: Beyond keeping yourself liquid in case of emergency issues during the current challenging financial environment, keep some more cash handy for this upcoming buying opportunity. Staying liquid is key.

2) Risk management is top priority: With likely more volatility ahead assessing your investment portfolio’s risk is an important topic. Are your investments diversified enough? Do you feel certain investments may run into liquidity issues (hard to convert quickly back into cash)? The past week should be a pretty good indication which investments of yours are positioned to weather this storm well or not. If your investments are not up to par it’s important to potentially tune down your risk or reallocate to better investments.

3) Remember your long term investment goals and periodically top up: We know it is a bit scary to top up during this volatile period but you can control your risk and emotions by topping up a little less. The amount you top up shouldn’t put stress on your finances but should keep you invested in this market and use the most important superpowers in investing: the power of time and compounding returns. Remember building your wealth is a long term lifestyle and not a short term trend.

If you have any questions please feel free to reach out to us at AQUMON. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.