Stimulus Drive Markets Higher: Here's What to Watch

Written by Ken on 2020-03-30

Global financial markets had one of the strongest rebounds in recent history with the Japanese and U.S. stocks leading the way. The Nikkei 225 Index and the U.S.’ S&P 500 Index spiked up 17.14% and 10.26% respectively last week and are -18.04% and -21.34% year to date. Hong Kong and China stocks were rather muted in comparison +2.98% and +1.56% last week and returning -16.69% and -9.44% for 2020.

AQUMON’s diversified ETF portfolios are +0.37% (defensive) to +8.39% (aggressive) and -0.72% (defensive) to -18.68% (aggressive) year to date. Last week all asset classes saw an uplift with U.S. stocks, high yield bonds and energy stocks leading the way up 10-12%.

Why did markets rally that much last week?

2 simple words: government(s) intervention.

U.S. President Donald Trump signed into law late last week a historic US$2 trillion stimulus package to help American citizens, workers, small businesses and industries fight against the economic disruption caused by the coronavirus. This is by far the largest emergency aid package in U.S. history.

Globally, governments and central banks beyond providing liquidity stimulus through asset buying are also further providing safety net programs to help those financially impacted by this virus situation. Stock markets worldwide in general reacted positively with the U.S.’ S&P 500 Index up +17.19% in the middle of last week.

Although U.S. government yields continue to slide which would suggest that a portion of the market did not share that same optimism. In normal cases, where there is a ‘risk-on’ effect with investors favoring stocks over bonds, government bond yields would rise to attract investors. The U.S.’ 10 year treasury yields dropped from 0.854% to 0.683% last week.

Does it mean we are in the clear with this global government intervention?

No so fast. There are still a few things investors should watch out for:

(1) Coronavirus infections still not yet peaking globally

For western nations that only started tackling the coronavirus situation in March the big question is: when will infections peak and people can return to normalcy when starting so ‘late’?

Italy is officially 20 days into its countrywide quarantine and is still at best only seeing new infection cases ‘stabilize’ around 5,000-6,000 daily cases for the past 10 days. Italy currently has over 97,689 cases. For now it doesn’t look like even a more aggressive countrywide quarantine approach has not yielded a slowdown in virus transmission after 3 weeks.

The big news out of the United Kingdom was Prime Minister Boris Johnson also testing positive for the coronavirus and in a letter sent to 30 million U.K. households last week the Prime Minister warned stricter restrictions could be put in place if necessary. The U.K. had stepped up its measures last week banning public gatherings of more than 2 people and the closure of shops selling non-essential goods. England's deputy chief medical officer Dr. Jenny Harries suggested today that it could be 6 months before life in the U.K. returns to "normal" (although they will be reviewing the situation every 2-3 weeks).

U.S. President Donald Trump announced Monday morning Hong Kong time that he is extending nationwide social guidelines in the U.S. until April 30th. Guidelines are currently more suggestive in nature asking Americans to avoid eating out in restaurants, for elderly people to stay home and to avoid social gatherings of more than 10 people. More detailed guidance will be announced Wednesday Hong Kong time. Trump said he felt June 1st would be “the bottom of the hill” and for Americans to return to normalcy. The U.S. now leads globally in total infection cases at 140,960.

Effectively management of the coronavirus, as we’ve seen with successful countries like South Korea or China requires aggressive quarantining/social distancing and constant testing. In simple terms it is like trying to put out a forest fire: beyond extinguishing the fires you see (like quarantining the sick and asking people to social distance) you also need to systematically seek out the remaining dangerous embers (like testing patients for the virus) to minimize the forest fire coming back via a relapse.

If Italy and other European countries is any indication, the U.S.’ approach of ‘softer’ quarantine measures will likely drag this out longer than Trump’s timeline that the coronavirus infections will ‘peak’ in 2 weeks' time. This may not particularly bode well for the U.S. considering they are starting later into the virus’ transmission cycle.

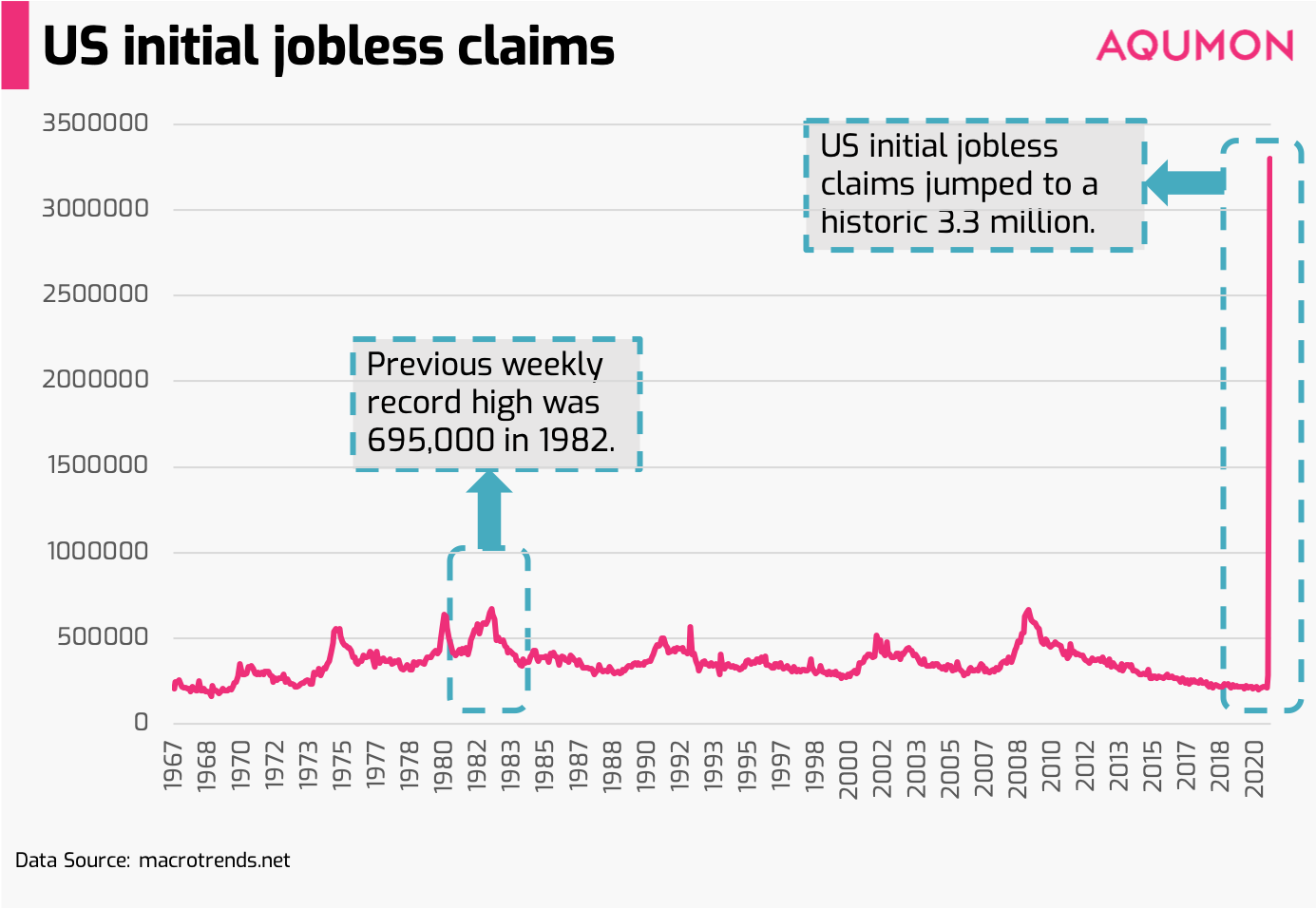

US unemployment surged last week to a historic weekly high

As we alluded to last week, investors should watch out for U.S.’ initial jobless claims (Americans applying for initial unemployment benefits). That surprised a lot of investors by jumping a historic 3.3 million in 1 week. The previous weekly record high was 695,000 in 1982. This first wave of jobless claims likely hit more hourly workers and employers of small and medium businesses first while larger corporations are relatively speaking less affected at this point. Currently small to medium business employees take up close to 50% of the U.S.’ private workforce.

Although the market largely looked over this figure and rallied Thursday on the back of the U.S.’ government stimulus package we feel investors should be aware of its short to medium impact. The President of the St. Louis branch of the US Federal Reserve Bank James Bullard last week estimated that the U.S. unemployment rate could reach 30% in the second quarter, then this week’s reading could be just the tip of the iceberg. If that were to become a reality this would put close to 47-50 million people in the U.S. out of work.

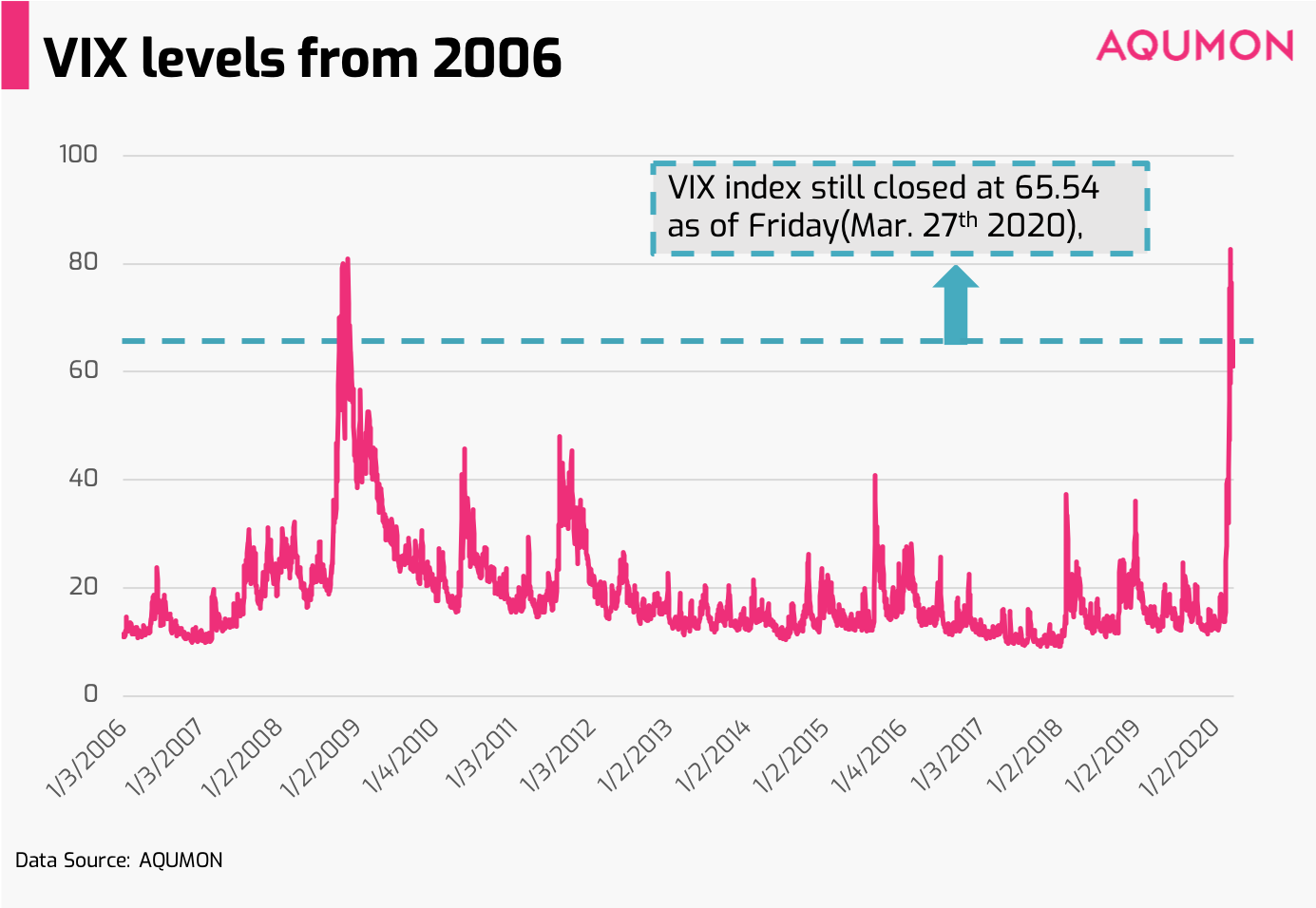

This week is a relatively heavy week in terms of U.S. economic data release with March’s consumer confidence (Tuesday), manufacturing PMI (Wednesday), weekly initial jobless claims (Thursday) and non-farm payrolls (Friday). These figures will likely be more on the negative side so this may give added pressure to financial markets to test lower this week (unless there are further stimulus plans). Coupled with the VIX Index still closing at 65.54 as of Friday we expect volatility to remain high during this period so staying diversified and managing your portfolio’s risk should be every investor’s top priority.

As we've mentioned on multiple occasions the main street (retail investor) selloff potentially happening down the road from increased unemployment and the worsening economic climate is definitely a concern investors should beware. This could put sizable downward pressure on markets but will ultimately benefit those investors with ample liquidity.

If you have any questions please don’t hesitate to reach out to us at AQUMON. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.