How to Reposition Your Portfolio?

Written by AQUMON Team on 2020-04-03

AQUMON did an online sharing of market insights in period of turbulence for investors on March 31st. Below are some of the key points for this sharing:

钱世航(Victor Qian)

Head of AQUMON financial institution business.

Former equity derivative sales at Haitong International and UBS Group. Rich experience in investment consulting & cross-border business development. B.S. in Economics from Northwestern University

As both short-term and long-term interest rates in Western countries have reached the lowest level in history, staying out of the capital market and depositing money into a bank will surely depreciate your capital. This recent meltdown in financial market has caused a lot of assets to be priced as “fire-sale” level, creating huge investment opportunities for us.

Four U.S. stock market circuit breakers made March 2020 the most memorable month in the history of finance. In this article we will perform a market wrap from a different perspective, the investor sentiment perspective.

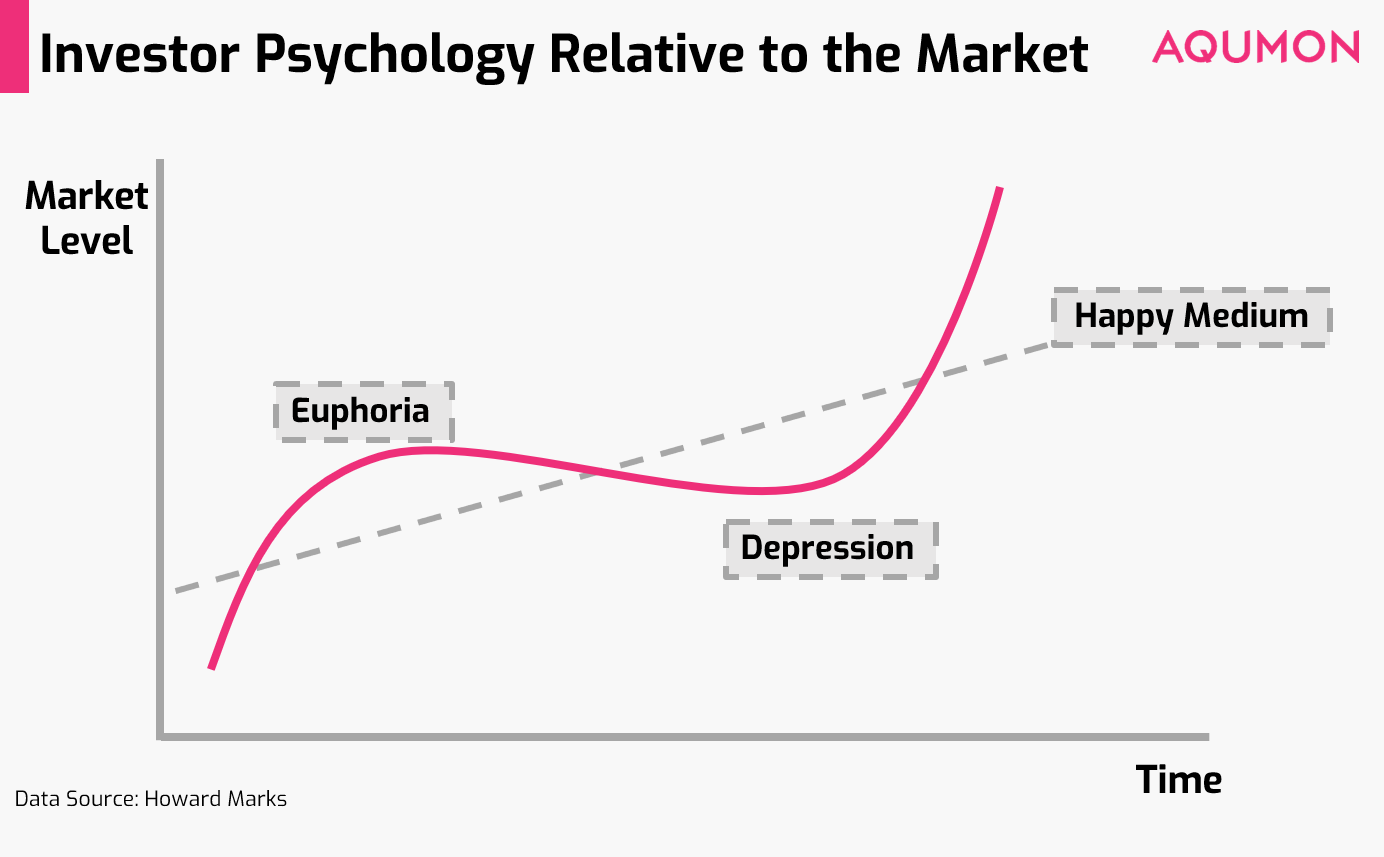

During the few weeks, investors’ sentiment are increasingly fragile, swinging up and down in a dramatic way. As Oaktree's founder Howard Marks portrayed in his book Mastering the Market Cycle, “investment markets make the same pendulum-like swing: between euphoria and depression. This oscillation is one of the most dependable features of the investment world, and investor psychology seems to spend much more time at the extremes than it does at a “happy medium.””

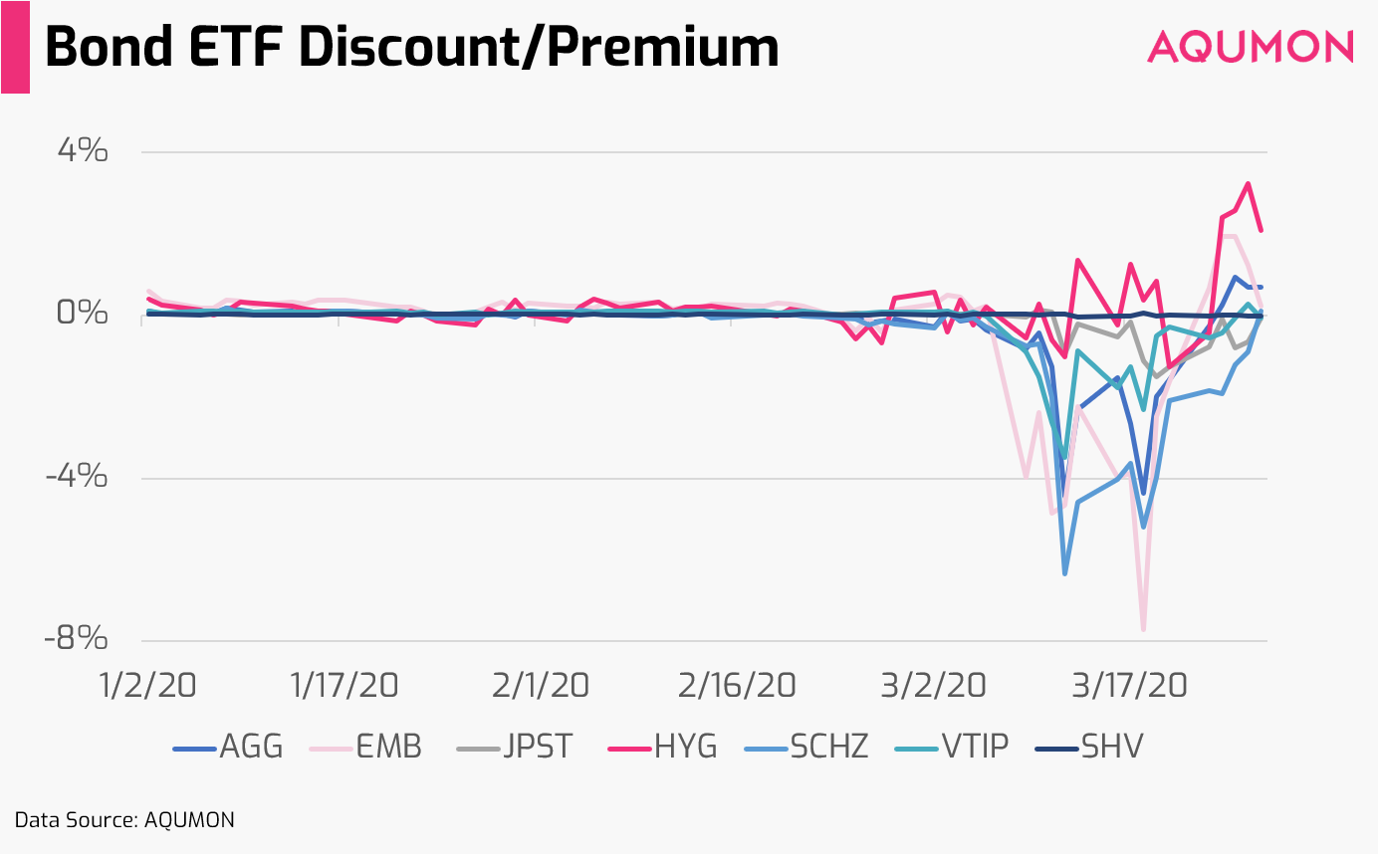

Another angle from which we can observe the extreme market turbulence and dramatic swing of investors’ sentiment is through the ETF market.

The chart above shows the spreads of some of the major U.S. listed bond ETFs. From this figure, we can see that during the middle of March, many bond ETFs were priced at substantial discount, as the market prices were lower than NAV for consecutive trading days.

This is a very abnormal market phenomenon since in normal circumstances, when market makers of ETFs see such spreads, they would arbitrage immediately, but they didn’t trade during this period.

Which implies:

1) The arbitrageurs didn’t not know how to price underlying bonds, nor how to calculate the risk, so they were unwilling to participate. Bonds are not as frequently traded as stocks and they require traders to price them manually. Recent market turmoil has made bond pricing even more difficult.

2) Arbitrageurs themselves had liquidity issues, and thus they were not able to participate in the market.

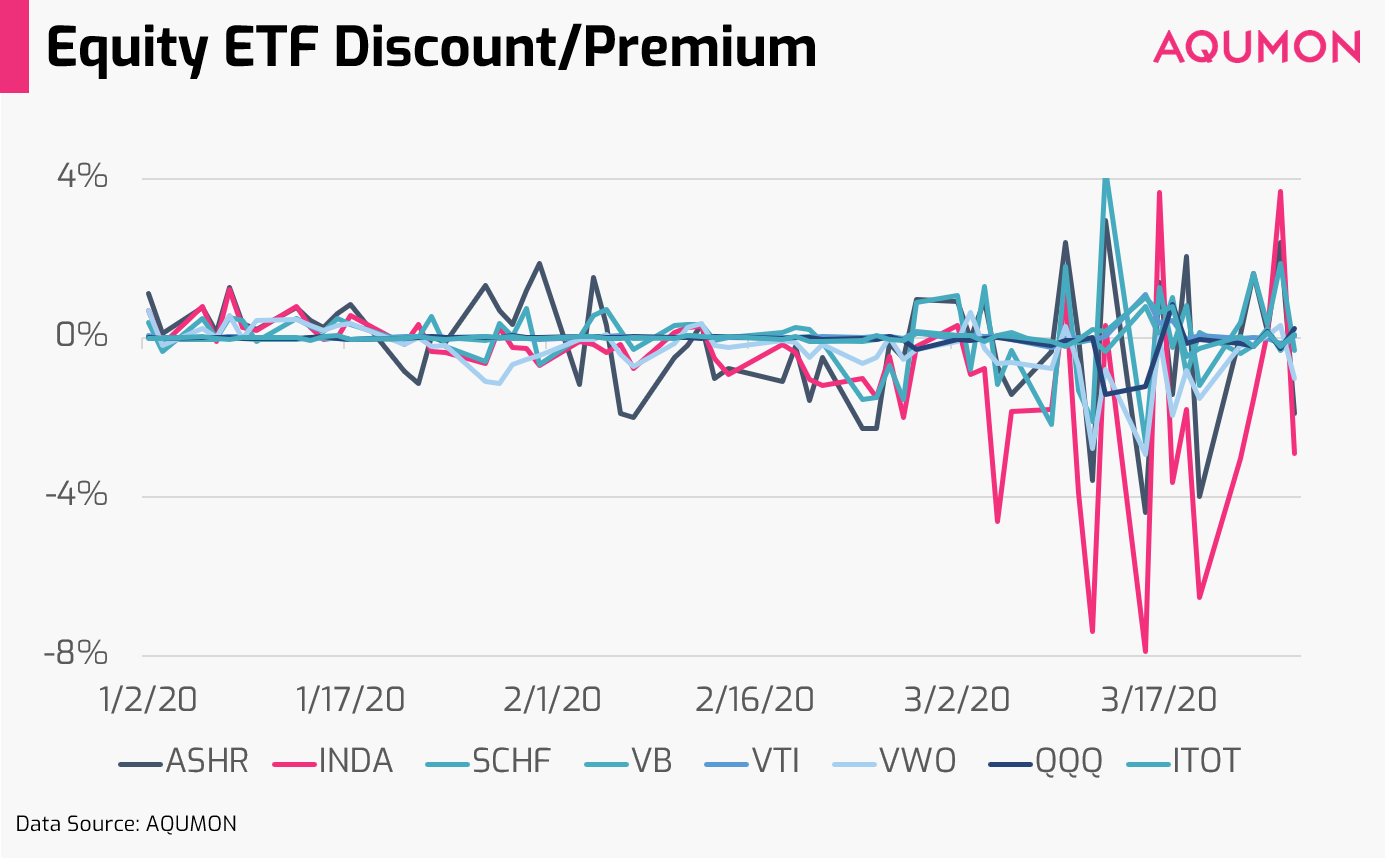

Similarly, the arbitrage mechanism also ceased to function in the equity ETF market. Although U.S. stocks have rebounded and we have seen the spreads start to decrease, during the days when the market is the most volatile, the spreads of some large-sized ETFs widened to around 2%, while in normal days they are around the level of 0%. The discount on MSCI India ETF (INDA) even reached 8% at one point.

The reasons behind are similar to those of the abnormality in bond ETF prices:

1) Arbitrageurs couldn’t assess the risk and thus were unwilling to enter the market.

2) The arbitrageurs themselves had liquidity problems.

Such phenomenon reflected an extremely pessimistic market sentiment, because not only speculators, but also the market makers (one of the most rational type of market participants) were unwilling to trade in the market.

In such an extreme environment, we should not try to time the market, trade frequently or put all our eggs in one basket. Instead, we should diversify our investment, manage risk by taking advantage of the low correlations between each asset class, and adopt a long-term investment strategy to weather through the market drawdown.

The Global Asset allocation strategy is the strategy that helps us to achieve those goals above.

The biggest advantage of asset allocation strategy is that it keeps us in the game.

Adopting asset allocation strategy is like weaving a sturdy tennis racket net:

When a “black swan” event occurred in early March, it was like a "tennis ball" hitting all the “strings” on the "net". Under the impact of extreme market event, all “strings” deformed, prices of all asset classes dropped, and the correlation between all major assets increased; however, after the shock, the low correlation between assets would quickly recover, and your portfolio will rebound from the short-term drawdown, which was like the "racket" hitting the "tennis ball" back.

Investors should remember that keeping themselves in the game is of the greatest importance. If you only invest in one asset, you won’t be able to hit the “ball” back with “one string”, and thus you will be knocked out of the game.

From an academic perspective, there are three main reasons why the asset allocation strategy has clear advantage compared to other strategies in the long term.

First, the correlation between asset classes is lower than the correlation between the underlyings within a single asset class;

Second, a stock can be delisted, a bond can default, but an entire asset class can’t just disappear unless under statistically impossible circumstances.

Third, asset allocation allows you to benefit from long-term economic growth. As long as you still believe that the long-term economic cycle is trending upward, and the human civilization will continue to move forward, then you should adopt the asset allocation strategy.

However, many investors still have concerns about such investment strategy. Here are our views on the three most frequently asked questions:

Q1. The return of a classic 60-40 asset allocation portfolio (replicated by combing 60% MSCI World index with 40% 10-year U.S. Treasury) will be quite different if you change the entry point. Does it still prove that asset allocation strategy is effective?

A: Such phenomenon applies to all investment strategies: different entry points will lead to different returns no matter what product you invest in.

But what we should pay attention to is that this 60-40 asset allocation portfolio are able to outperform the pure stock index if we extend our investment horizon. Thus, it’s one of the most effective ways to invest in the long run.

Also, in real life, asset allocation portfolios consist of more asset classes than just stock and bond. They are also constructed in a more complicated way.

Q2: Will the asset allocation strategy fail in bear market?

A: No. If we compare the performance of S&P 500 Index and that of the 60-40 portfolio in the worst one, three, five, and ten years of the market from 1976 to 2019, we will find out that that the balanced portfolio performed better than stock. In the worst year of the stock market, when the S&P 500 index fell 24.38%, the balanced portfolio fell 9.68%; in the worst three years of the market, when stock fell 11.42%, the balanced portfolio fell only 2.6%; in the worst five years and ten years of the market, the balanced portfolio even achieved positive returns.

Q3: During the post QE-era, stock and bond often move together, and correlation between stocks and bonds is increasing. Can you still diversify investment risk with the stock & bond combination?

A: The correlation between stocks and bonds are ever-changing but stay mostly within a reasonable bend. In fact, after the quantitative easing in 2009, the correlation between stocks and bonds was mostly between 0 and -0.5, a relatively low correlation level. If we look at a longer history, from 1930 to 2018, the correlation between stocks and bonds was mostly between +0.5 and -0.5. Thus, the relationship between stocks and bonds is in a healthy and low-correlated state.

In addition to stocks and bonds, we can also include more asset classes to further diversify risks and increase the portfolio’s resilience.

Recently, AQUMON is holding a series of webinars to exchange market views with you and answer your questions. Subscribe to our Email for more exciting activities!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.