3 Reasons Why Markets Continue to Rally

Written by Ken on 2020-05-12

Due to easing US-China trade tensions along with news of economies slowly reopening amidst the coronavirus pandemic, global financial markets rallied last week. The U.S.’ S&P 500 Index was +3.50% last week and -9.32% year to date. US markets started to stabilize this past week with the VIX (US’ Fear Index) -24.76 last week and now back at a level of 27.98 which was last seen late February before markets sold off. Hong Kong stocks conversely was -1.68% last week and -14.05% year to date.

AQUMON’s diversified ETF portfolios were +0.05% (defensive) to +3.48% (aggressive) last week and +0.77% (defensive) to -9.45% (aggressive) year to date. The biggest return drivers last week were Chinese stocks (+7.73%), US technology stocks (+5.70%) and energy stocks (+8.17%).

On an economic front headlines were dominated by the US’ jobs report where it highlighted that there were 20.5 million jobs lost in April along with the U.S. unemployment rate surging to a record 14.7%. This week we will explore why financial markets continue to rally when we as investors constantly see negative economic data and headlines. We know investors are interested in this and we hope to provide some insight.

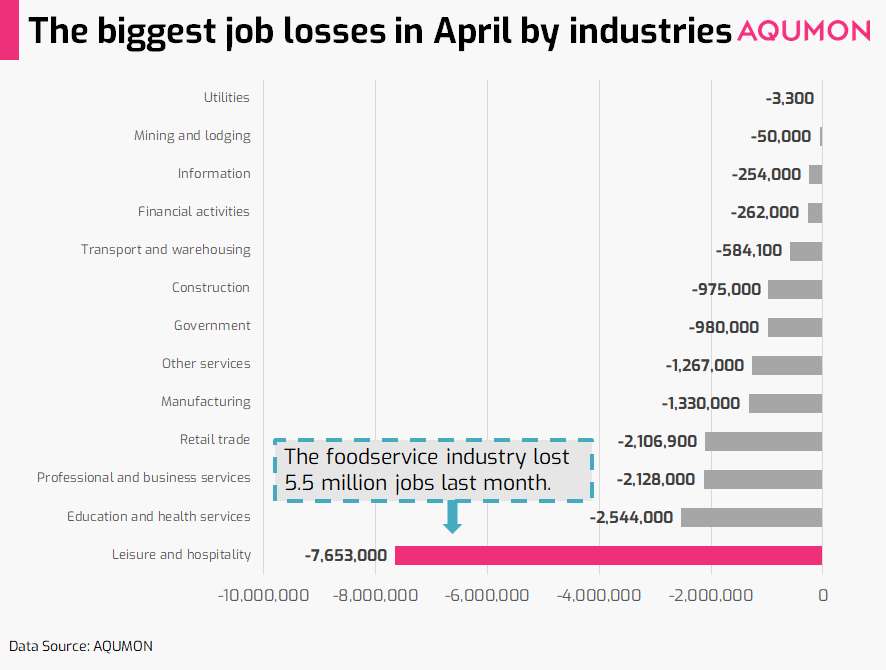

Breaking down the US’ April jobs report

When we look deeper which industries were hit hardest? The vast majority of job losses were within the leisure and hospitality industry (47% of all jobs lost in April) particularly in the food service sector with 5.5 million jobs lost amongst restaurant staff. This is understandable since once US stay at home orders were implemented in early April many restaurants (depending on the state) were immediately not allowed to have dine-in services (limited to takeout, pickup or delivery only). This has been a big blow to the sector.

So the big question is why are markets up? We think there are a few reasons:

1) 78% of jobs lost in April seen an temporary

In a household survey of 23 million Americans who had lost their jobs (including those lost in April) showed that 18 million people (78%) saw their layoff as temporary in the form of being ‘furloughed’. Being furloughed is considered a temporary (but unpaid) leave of absence from work, with the assumption the employee will be brought back at some point if things improve. Permanent job losses jumped to 544,000 April which makes it a little more palatable than 20.5 million. With the expectation that things will improve as we start to see individual states relax their stay at home orders investors continue to believe jobs would be restored relatively quickly. This would partially explain why markets were up last week even amidst such weak economic data.

2) Government and central bank actions continue to prop up markets

Whether you agree with it or not the recent stimulus provided by both the U.S. government and Federal Reserve (Fed) in the past 2 months is effective in stabilizing markets...for now. Here’s a friendly reminder of what happened:

The U.S. congress in March passed the CARES Act which provided US$2.3 trillion assistance to individuals in terms of stimulus payments furthermore businesses received loans and grants to retain their employees.

The bigger shot in the arm for financial markets came when the Fed made it clear they were willing to do whatever it takes to prop up the market. The reason why we were seeing a recent resurgence in bond markets earlier is largely due to investors ‘following the Fed’s’ and buying up specific assets before the Fed does. Specifically the Fed expressed they were willing to buy a range of credit products which included treasuries, corporate bonds, asset backed securities, collateralized loan obligations along with high yield bond exchange traded funds (ETFs) if things were to worsen. Analysts estimate this could inject more than US$6 trillion into the economy.

How does this help markets? Establishing that there is a major player like the Fed who is willing to essentially backstop the market gives investors added confidence to invest into risk assets during this period. Beyond this it is also now easier for corporates to raise money via the credit market (by issuing bonds and loans) to get them through these difficult times.

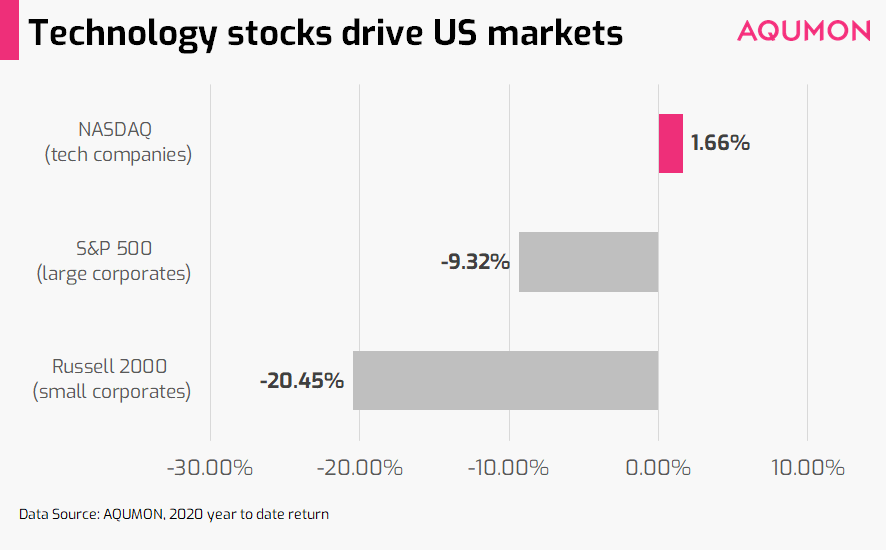

3) US stock markets are highly driven by technology stocks

When you look closely at the deteriorating economic data you can see the brunt of the impact is directed towards small-medium enterprises and not towards large corporates. Why? A good indication would be the job losses we mentioned earlier hitting mainly SMEs like restaurants within the food service sector. Impact to larger corporates is somewhat minimal and even with multinational firms vowing no lay-offs during this coronavirus pandemic. This is very clear when you look at the the difference in terms of year to date return between the NASDAQ 100 Index (US technology stocks), the S&P 500 Index (largest capitalization US companies) and the Russell 2000 Index (smallest capitalization US companies):

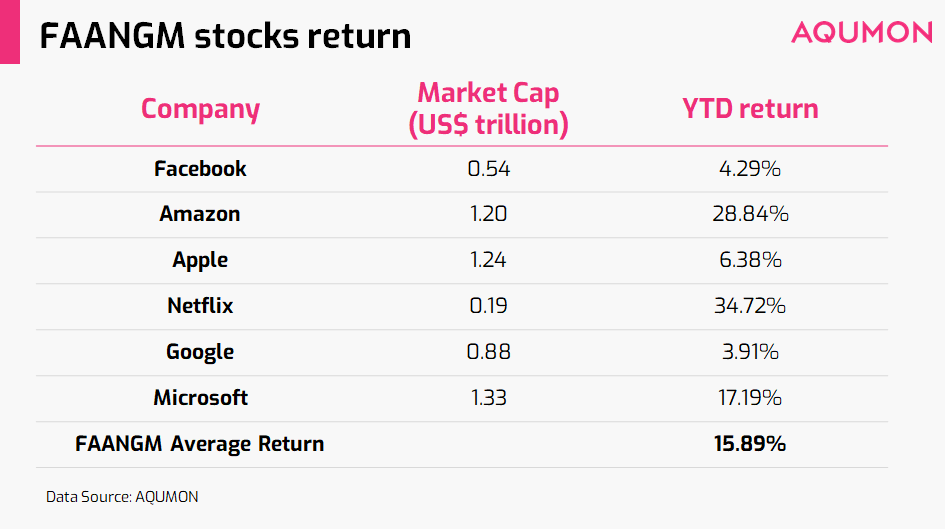

Large U.S. corporates (represented by the S&P 500) are outperforming small corporates by over 10% year to date. With technology stocks the outperformance is even greater at over 22%. Not only are technology firms outperforming because investors feel they are best positioned to weather this pandemic but did you know that just 6 technology companies represents 25% of the S&P 500 Index’s total market capitalization (US$21.4 trillion as of Friday close)? These companies are Facebook, Amazon, Apple, Netflix, Google and Microsoft (FAANGM). This means that broad market indexes like the S&P 500 Index are highly influenced by the performance of mega cap technology companies.

Market action is still supportive of these technology companies and larger corporates so broad markets continue to rally. On the flip side investors should also be aware this type of concentration in technology companies could result in large sized broad market sell-offs if these firms start to run into issues.

So what does this mean for investors?

We get a lot of investors asking us is now a good time to get into the market. First let's understand the risks. There are a few immediate headwinds for investors they should be aware of:

1) Markets have rallied 22%+ since the market bottom and valuations aren’t that cheap (above 20).

2) There is quite a lot of optimism baked into the market with investors anticipating a quick recovery with minimal setbacks for economies reopening. Markets could see weakness if the recovery process is longer than anticipated.

3) There are other unknowns such as the ongoing trade and oil war that could further make the outlook for markets unclear.

Even with financial markets and economic data being dislocated due to central bank intervention (technically it always dislocated just maybe not at this degree) this shouldn’t deter investors from carefully contributing to their investment portfolios for their longer term wealth building purposes.

Here are a few tips investors should take note:

1) Understand what investments you own: It is in your best interest before carefully reviewing your investments to at least know what you own. If not it is like trying to find your way out of a room blindfolded which we all agree is ineffective. Once you clearly understand what you own then you can start making educated decisions in terms of adjustments to your portfolio (potentially trimming underperformers and topping up on investments your feel has good long term value).

2) Squeeze out every bit of return in a safe manner: Staying liquid is key in this current environment but just don’t just have your cash sitting in your savings account earning next to nothing. In a low to 0% interest rate environment it is to your benefit to explore short term time deposits and lower risk bond solutions. Furthermore be conscious of your investment cost. If there are areas where you can achieve similar returns for less cost this results in more money in your pocket.

3) Let compounding do its magic: One of the tried and true ways to effectively build your wealth is to leverage the power of compounding. Meaning even if you contribute not much every month the consistency of your contributions will add up in a greatly positive manner over time. We’re not saying to blindly invest especially when you don’t feel comfortable in a certain market environment but you can control your emotions by reducing your contribution amounts or adjusting what you invest in. Contributing consistently (even small amounts) will improve the health of your investment portfolio.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.