Markets Boosted by Optimism around Virus Easing

Written by Ken on 2020-05-27

Due to positive news about a potential COVID-19 vaccine from American biotech company Moderna Therapeutics early last week the US’ S&P 500 Index enjoyed its strongest weekly gain since the week of April 6th +3.20% last week and -8.52% year to date. Specifically the market reacted positively to Moderna reporting all 45 participants in its recent Phase 1 vaccine trial had developed neutralizing antibodies against the coronavirus. European stocks also rebounded sharply with the Euro STOXX 50 Index +4.86% last week. Locally Hong Kong’s Hang Seng Index, due to the imposition of the new national security law, plunged 5.56% on Friday and ended -3.64% last week.

AQUMON’s diversified ETF portfolios were +0.22% (defensive) to -2.67% (aggressive) last week and +1.14% (defensive) to -9.13% (aggressive) year to date. Risk assets across our portfolios were generally up with US small caps leading the way +7.26% along with energy stocks +6.92%. High yield and emerging market bonds also enjoyed a positive week +3.20% and 3.28% respectively.

This week our focus is addressing more in detail what is driving global stock markets, US China trade tensions and its potential silver lining for Hong Kong and global development as economies reopen.

Stimulus continues to drive up US markets

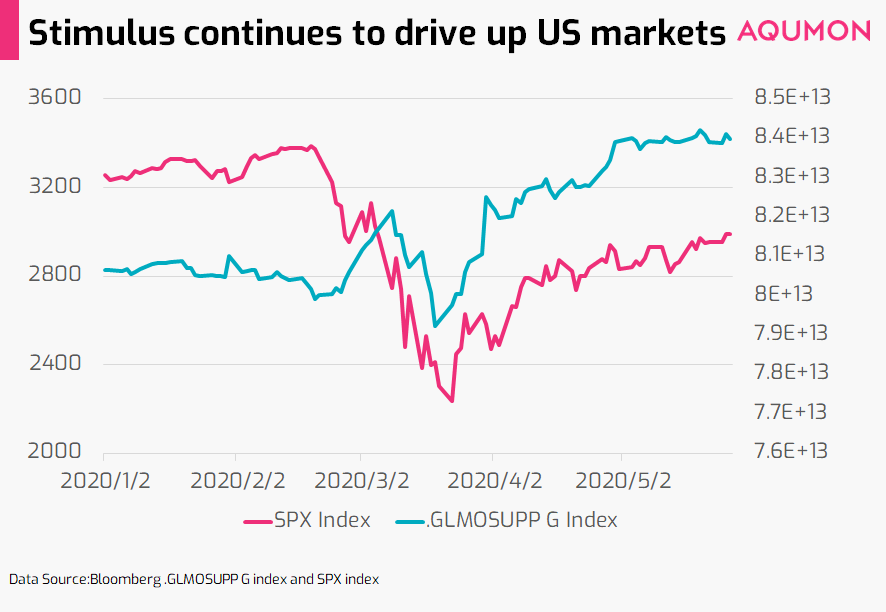

When looking at the US stock market like the S&P 500 Index you can see clearly in the chart below its high correlation to global liquidity pumped out by the respective central banks:

Central bank stimulus continues to drive up stock markets but are there market drivers on the investor level since many Americans are also receiving additional government stimulus? The data seems to suggest so.

Under the US government’s $2.2 trillion CARES Act to boost the COVID-19 affected economy individuals with annual income below US$75,000 received a stimulus check of US$1,200 (~HK$9,303.00) by the Internal Revenue Service (IRS). Married couples who filed taxes jointly and earned under US$150,000 would receive US$2,400.

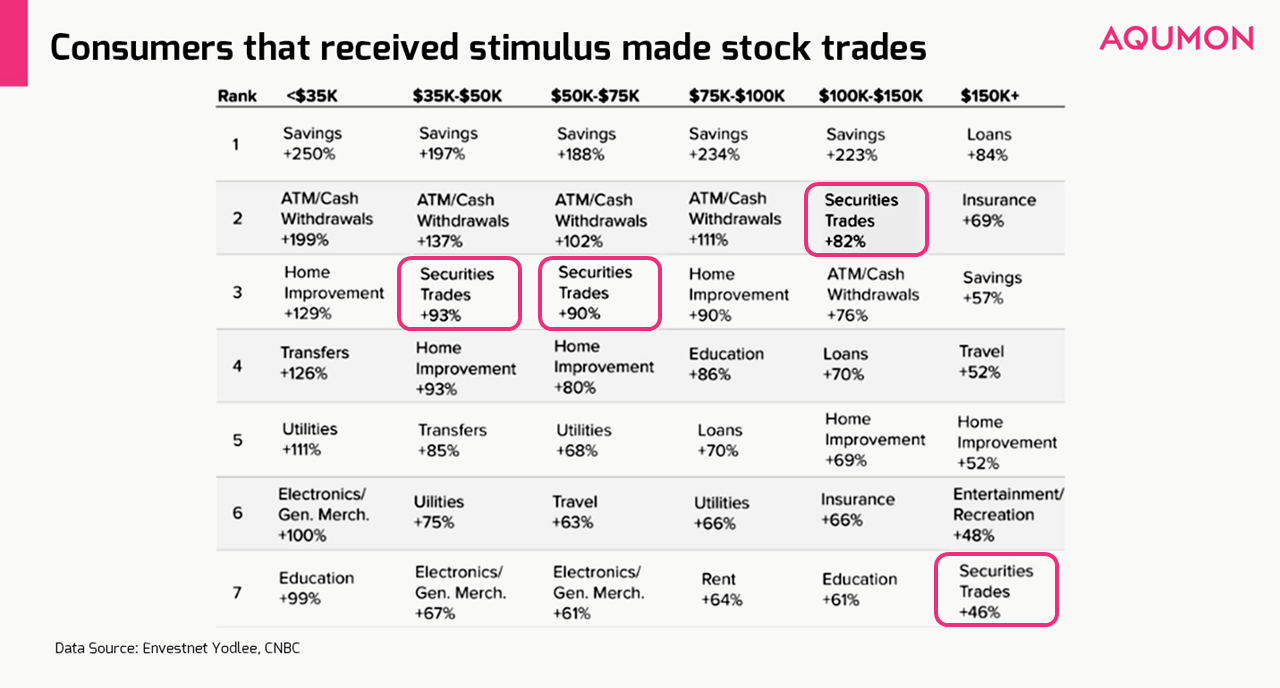

There was an interesting study done this week by software and data aggregation company Envestnet Yodlee which analyzed what 2.5 million Americans by income segments did with their recent US$1,200 stimulus check. What the study pointed out were a few things:

1) Investing into the market was one of the most common ways for Americans to spend their stimulus check for almost all income brackets only behind increasing their savings and cash withdrawals. “Securities trading” encompasses the buying/selling of stocks, exchange traded funds (ETFs) or adjusting their retirement accounts (401K).

2) Particularly middle class Americans earning between $35,000 and $75,000 annually (~HK$271,338 - HK$581,442) traded stocks about 90% more versus the week before receiving their stimulus check.

Due to the introduction of many newer investment platforms that now allow individuals to buy stocks in fractional shares many US investors are also investing for the first time during this recent market selloff. Trading apps like Robinhood in the US said its daily trades increased 300% in March with over half of all new users being first time investors.

With more first time and less experienced investors in the market currently it would partially explain why the market is more disjointed with macro economic data and more driven by headlines. Even though markets are up, when the market is driven by more inexperienced retail investors volatility inherently also increases. A good comparison is looking at the dynamics of the more institutional investor-orientated Hang Seng Index versus the mainland a-share market which is predominantly retail investors. This echoes the need for investors to thoughtfully manage their portfolio’s risk through asset and regional diversification.

China relations to remain in focus for markets until at least November

The Trump administration has been increasing its pressure and placing a large spotlight on its relations with China and analysts agree tensions will likely remain heading into the US presidential elections this November. The big question for markets is will this remain all talk (since both economies right now are in a weakened state) or will we see more extreme action in terms of increase in tariffs or defaulting on debt? China announced Friday during its Two Sessions meeting that it will withhold its upcoming Gross Domestic Product (GDP) forecast due to the impact from COVID-19. Furthermore, the announcement of China’s new national security law in Hong Kong drove the Hang Seng Index to sell off 5.56% last week. The Hang Seng Index has since rebounded 1.98% the first 2 days of this week.

The more interesting storyline developing is US President Donald Trump’s threat to forcibly de-list Chinese companies listed on U.S. stock exchanges including Alibaba, JD.com and more which could be a positive windfall for these companies to potentially relist on the Hang Seng Index. The Hang Seng Index also proactively announced last week it made rule changes to incorporate Chinese internet giants Alibaba, Xiaomi and Meituan Dianping into the index starting from August with a weighted cap of 5%. Early estimates from industry analysts such as Morgan Stanley suggest this action could bring additional passive fund flows of US$3.7 billion (HK$28.7 billion) into the shares of these 3 companies.

Investors should expect more US China tension driven volatility to remain in the short term but there may be a positive silver lining for local Hong Kong markets.

COVID progress positive since economies started reopening

Even though COVID-19 cases have topped 5,684,795 globally but as of Tuesday we have only seen selective (not sizable) pickup in new regional cases as economies reopen. Although there are still quite a lot of unknowns ahead this is positive news for both economies and their respective financial markets.

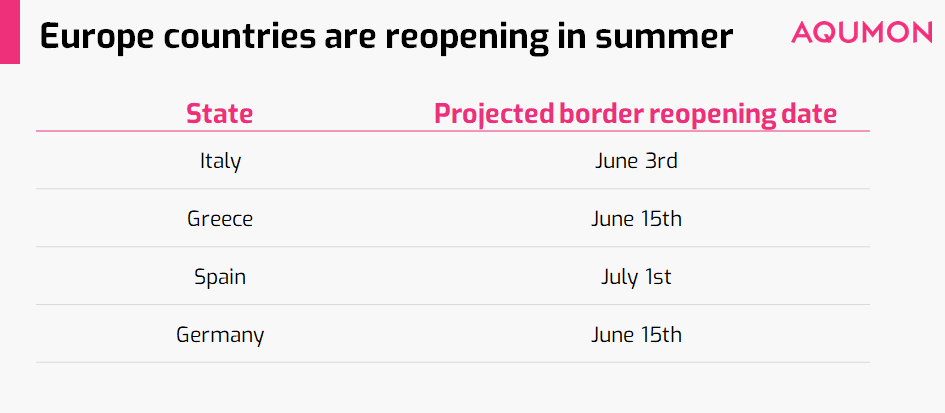

In the US, its hardest hit state, New York taking up 22% of all CVOID-19 cases, is ready to reopen with Governor Andrew Cuomo scheduled to meet with President Donald Trump on Wednesday to discuss a multi-phase reopening plan. Total US COVID-19 cases now stand at 1,725,275 as of Tuesday. New daily cases in New York state are down to under 2,000 cases daily this week which is a significant drop from the height in March of over 11,000 in a single day. Across Europe countries are reopening borders for European Union (EU) travellers in time for summer which is also a major step towards getting their economies back on track:

What has been more promising and supportive for markets this week has been on the vaccine front with first Moderna Therapeutics announcing positive Phase 1 trial results last week followed by fellow US biotech company Novavax reporting Monday is starting its Phase 1 human trial of its experimental Covid-19 vaccine. Novavax said they expect preliminary results from the trial in July. US broad markets after closing Monday due to Memorial Day responded strongly up 1.23%-2.17% on Tuesday.

As the saying goes “sell in May and go away” definitely rang true this past month with trading volumes being quite light in May. The S&P 500 Index’s trading volume has been steadily decreasing for 8-9 consistent weeks but as we approach June we definitely feel more of a revival buzz amongst investors in terms of interest in the market. As mentioned last week the feedback we get from investors is a heavier interest to buy but looking for the right price. Even though this may not affect long term investors in terms of your periodic allocations and accumulations to your investment portfolios but we feel it is important to give our readers a sense of investor sentiment,

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.