Investors Look past Setbacks and Focus on the Positive

Written by Ken on 2020-06-30

Due to flare-ups with new COVID-19 cases globally financial markets pulled back with the US’ S&P 500 Index -2.86% last week and -6.86% year to date. European stock markets also followed suit with the Euro Stoxx 50 Index -1.99% last week. Locally Hong Kong’s Hang Seng Index and China’s CSI 300 Index was -0.38% and +0.98% last week.

AQUMON’s diversified ETF portfolios were +0.04% (defensive) to -1.60% (aggressive) last week and +1.72% (defensive) to -5.80% (aggressive) year to date. Last week nearly all regional stock markets sold off while safe assets like gold were more in favor +1.50% last week and +16.08% in 2020. Sector wise even US technology such as the NASDAQ 100 Index was -1.59% for the week.

This week our focus will be looking at the recent COVID-19 developments, how institutional investors are changing the positioning of their investments along with the impact from the upcoming US presidential election in November.

Investors continually look past COVID-19 setbacks and focus on the positive

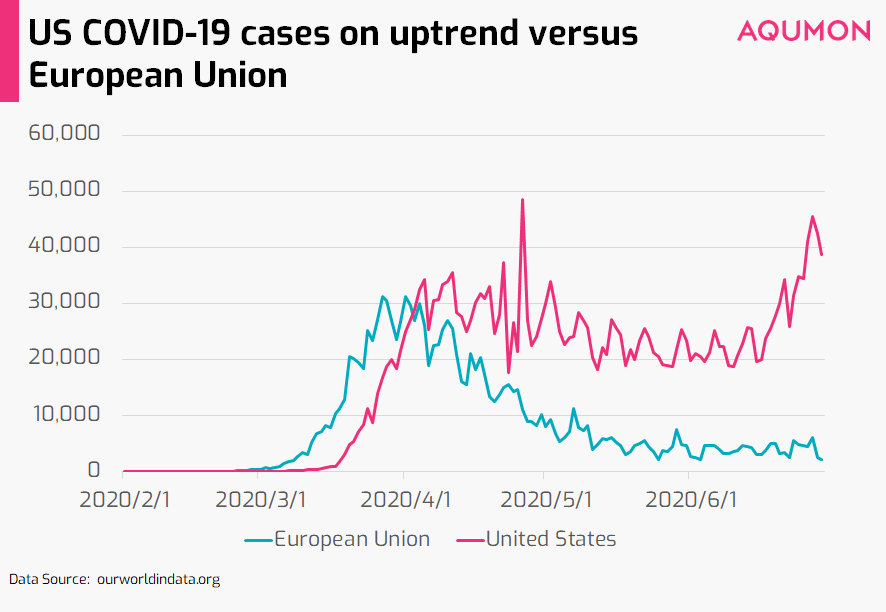

Even though markets were weakened by setbacks and multi-fold jump in cases particularly in certain US states like Florida, Nevada, South Carolina etc. the market has been digesting the negative news very quickly. Although the spike in cases is a negative result of reopening of certain states, experts agree more testing has also partially contributed to the recent jump in cases. As of Tuesday, total global COVID-19 cases have reached 10,408,433. A chart that jumped out at us this week was the comparison of daily COVID-19 cases in the US versus the European Union where we see the former is clearly still on the uptrend while the latter is just the opposite after an extended lockdown period plus stricter mask control:

Furthermore, markets were rejuvenated on Monday when US biopharmaceutical firm Gilead Sciences gave further clarity by announcing the pricing of a 5-day course of their COVID-19 treatment remdesivir at US$2,340 (~HK$18,136). As a reminder ‘treatments’ are meant to help sick patients recover more quickly while ‘vaccines’ prepare one’s body/immune system to fight off viral invaders. Remdesivir during earlier clinical trials has shown to help severely ill patients with COVID-19 recover four days faster. Although there has been a lot of debate whether this cost is fairly priced or not, what we can take away is that at this price level puts treatments like remdesivir out of the reach for the majority of COVID-19 patients. This may not negatively impact financial markets but on the ground may end up lengthening our global road to recovery.

Although this is not the most rational, if investors continue to overlook the negative fundamentals and focus on being optimistic we should find steady market support at current levels even while volatility remains heightened.

Institutional investors are also starting to reduce their bearish bets...

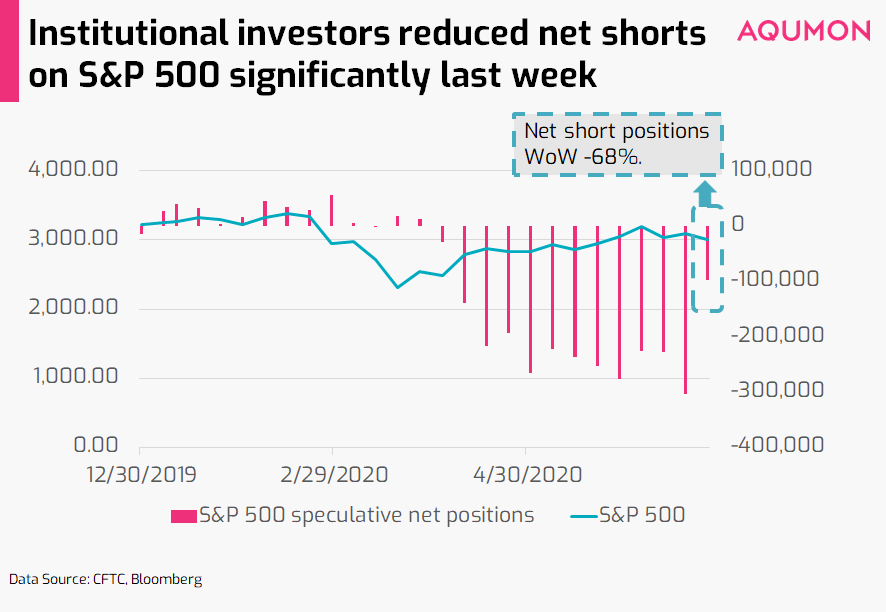

One thing this week we are seeing is hedge funds (funds that participate in more complex style trading with the ability to go ‘long’ or ‘short’ the market) and institutional investors starting to reduce their net short positions on the S&P 500. After seeing bearish bets at a 9-year high during the week of June 19th, short positions on the US’ S&P 500 index reduced by 68% in the week of June 24th:

Although short positions are greatly reduced it is important to point out that institutional investors are still ‘net short’ meaning they are expecting the S&P 500 to be lower when looking ahead. If we do see more institutional investors, who mainly have been shorting the market or standing on the sidelines during most of this rally, start to rotate into the market this could provide additional uplift and stability to financial markets. We will closely monitor this situation.

Is a Joe Biden victory an underpriced risk for financial markets? It’s not that simple.

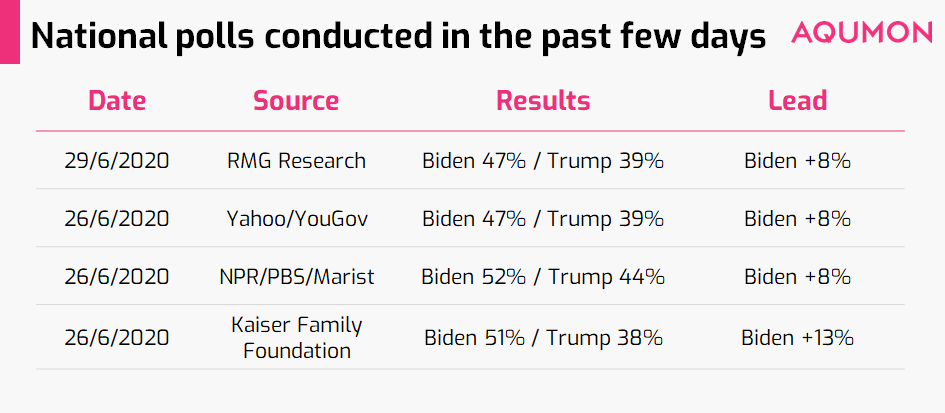

Although we are still 4 months (126 days to be exact) out from the US presidential election on November 3rd there is already quite a lot of chatter amongst analysts about how a potential win by Democratic nominee Joe Biden would be negative for financial markets. As per the most recent national polls conducted the past few days we continue to see strong Biden lead over US President Donald Trump with an average margin of 11%:

The prevailing narrative is that a Trump victory equates to continued tax cuts and deregulations which is in theory good for US corporations. A Biden victory? Just the opposite with tax increases along with more regulation which is said to be negative for corporates. Astute investors should understand it is not that simple. Here are a few things we feel investors should be aware:

1) It’s too early to tell who wins: Even though we continue to see Biden leading comfortably in the latest polls what we all learned most recently during the 2016 election is that even with Hilary Clinton receiving 2.87 million more votes than Trump it is winning the Electoral College and the votes of the Rust Belt swing states (Pennsylvania, Ohio, Michigan etc.) that will likely determine the next US president. Furthermore what we also know is people aren’t the most honest when it comes to polling so even with polls greatly in favor of Biden it doesn’t necessarily mean Trump’s base won’t come out in numbers to secure a win for him come election day.

2) Biden may actually help the US economy: One thing analysts rarely talk about is how a Biden victory could be positive for financial markets. Why? Biden and the Democratic party would likely be focusing on ‘trickle-up economics’ by increasing spending and reducing taxes on the employee level thereby returning the US labor market to higher employment levels. The US unemployment rate is currently 13.3% as of May, a far cry from February when it was only 3.5%. Even though this is the exact opposite of Trump’s ‘trickle-down economics’ approach of empowering corporations, Biden and the Democratic party’s approach may be a more practical and impactful adrenaline shot for the US economy and in turn financial markets.

3) It still depends on who wins the US Senate: Experienced investors know it’s not all about the US presidential elections. If the Republicans manage to hold on to the slim lead they seem to have for the Senate race it would result in a split government (Democrats currently control the majority of the House). A split government means that it won’t be easy for whoever is president (Biden or Trump) to pass through any meaningful legislation. If this happens, analysts see this as preserving status quo and neutral for financial markets. In the off chance we see a sweep (e.g. the Democrats winning the presidency, the Senate and the House) analysts would see this as negative for markets. So the US Senate race results also matter a lot.

So we hope our investors don’t only focus on the news headlines and understand this upcoming US election result could very well be an opportunity as much as it is a risk.

As we mentioned to investors last week as we end the quarter and inch into the summer months of July markets could see heightened levels of volatility due to: 1) higher than normal retail investor participation in markets 2) institutional investors continue to find their footing and start to rotate into the market. Don’t be too surprised there may be larger than normal selloffs when this happens but followed by faster rebounds. One more thing to keep a lookout for is potential further stimulus by the US government in July which will be a positive boost. For longer term investors managing your portfolio’s risk is key in this environment but do keep a lookout for buying opportunities to lower your portfolio’s cost if we see market weakness ahead.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.