Markets Will Follow the Cash

Written by Ken on 2020-07-08

On the back of stronger than expected economic data along with more positive economic reopening news global financial markets surged with the US’ S&P 500 Index +4.02% last week and -3.12% year to date. After suffering one of the quickest bear market corrections in late February US stocks are almost back to being flat year to date. European markets also saw an uplift with the Euro Stoxx 50 Index +2.82% last week but -12.04% year to date. Locally Hong Kong’s Hang Seng Index and China’s CSI 300 Index was -3.35% and +6.78% last week.

AQUMON’s diversified ETF portfolios were +0.12% (defensive) to +2.87% (aggressive) last week and +1.84% (defensive) to -3.10% (aggressive) year to date. Last week all risk assets particularly stocks rebounded strongly particularly in China A-shares (+6.35%), emerging market stocks (+3.89%) and US technology (+4.98%). Safe assets like gold held close to flat +0.26%.

This week our focus will be looking deeper if markets are truly too pricey, why Hong Kong/China markets will receive some uplift in the short term and why investors should closely “follow the cash”.

Is the market too overvalued for me to participate in?

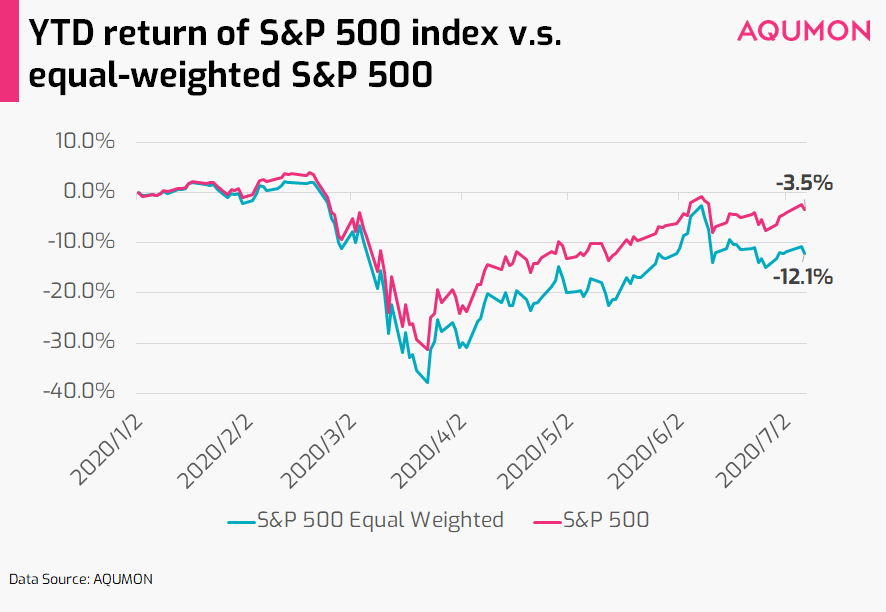

When we look from a high level perspective US stocks particularly after this recent rally do look more on the expensive side but we need to put this into perspective. A big part of this is because performance and valuations are driven up by the 5 largest singular companies in FAAMG (Facebook, Amazon, Apple, Microsoft and Google) which takes up 18.6% of the index. As a reminder, the US’ S&P 500 Index is a market capitalization-weighted index so numbers will be skewed when its biggest companies (in market capitalization) diverge from the rest of the companies in the index. To clearly see the divergence just look at how the index performance would be if we compare it to a n equal-weighted version of the index. As of Monday (July 8th) year to date (YTD) returns for the S&P 500 index is -1.58% versus -10.43% by the the equal weighted index:

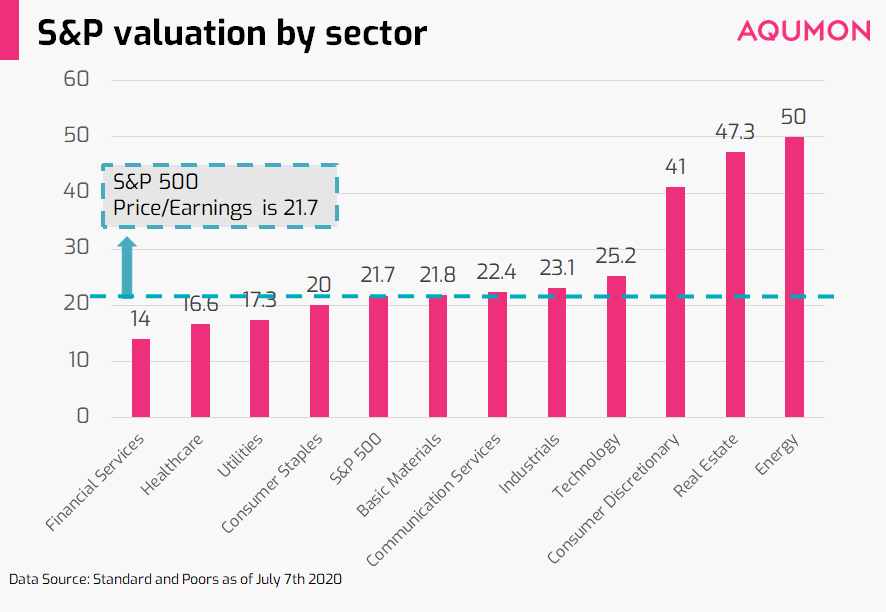

This 8.06% difference in YTD performance showcases that the vast majority of this recent market rebound and influx in valuations is concentrated in a small subset of the largest companies within the index. Outside of these stocks the majority of the other companies within the index are much more reasonably priced. When we also look at the 500 companies within the S&P 500 index on a sector level we still continue to see certain sectors still at lower valuations.

Investors need to be aware even though there is a heavy concentration in a few key sectors (technology, healthcare etc) and names (FAAMG) there are still quite a lot of attractive investment opportunities (particularly in more traditional sectors) still reasonably priced. This is something we are closely monitoring as well as a new inflow of funds continue to enter this market. Why? Because we are watching if investors continue to chase the same selective names/sectors or if there is already a more ‘healthy’ rotation whereby investors are more optimistic and taking notice of value buys.

Hong Kong and China stocks receive boost

There’s a lot of positives supporting Hong Kong and Chinese stocks right now:

1) Policy support: A big reason for this week’s surge in Hong Kong and Chinese stocks can be attributed to China’s state-owed media China Securities Journal announcing this Monday that investors should look forward to the “wealth effect of the capital markets” and the prospect for a “healthy bull market.” Much like the US’ Federal Reserve, Chinese investors saw this as the government’s indication it will backstop the market and a green light to accumulate their investment positions.

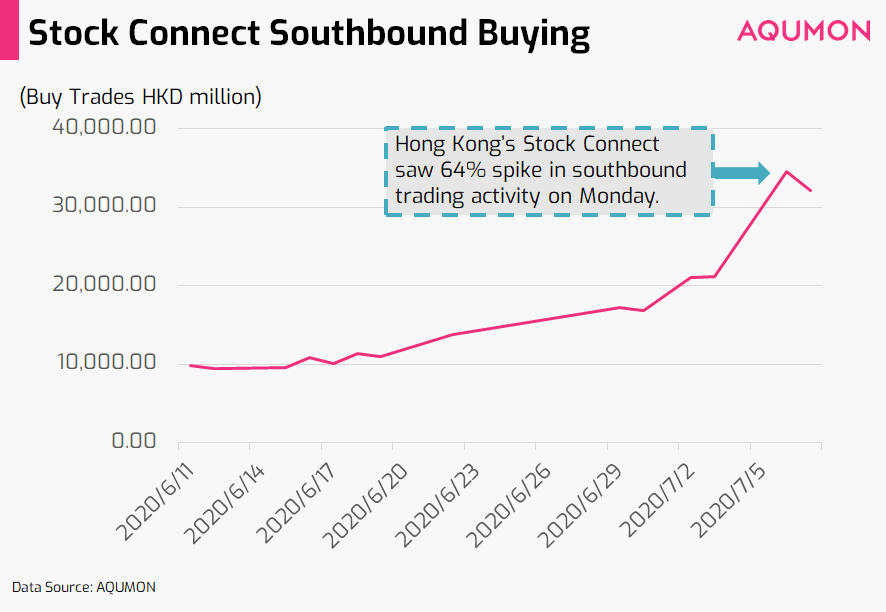

2) Investor fund flows: Hong Kong’s Hang Seng Index also received a nice uplift Monday from the euphoria from mainland investors also looking for investment opportunities across the border. Hong Kong’s Stock Connect saw 64% spike in southbound trading (mainland Chinese investors buying Hong Kong stocks) activity on Monday as a result.

Beyond money coming from mainland China locally here in Hong Kong 3.15 million residents receive their HK$10,000 from the government’s Cash Payout Scheme on Monday. This amounts to $31.5 billion of additional liquidity and it is no coincidence that the Hang Seng Index got a boost up 3.81% on Monday. This is the largest 1 day increase by the index since March 25th.

When markets become less dislocated it will likely be supportive of more economies like mainland China which are on a quicker road to recovery from COVID-19. Recent economic data released continue to show the economy is consistently recovering. In June the official as well as the private Caixin/Markit manufacturing Purchasing Manager’s Index (which shows activity in the manufacturing sector plus is a leading indicator for the Chinese economy) showed an expansion versus May. Valuations in both Hong Kong and China also are at more reasonable levels.

Markets will follow the cash. Investors should watch closely.

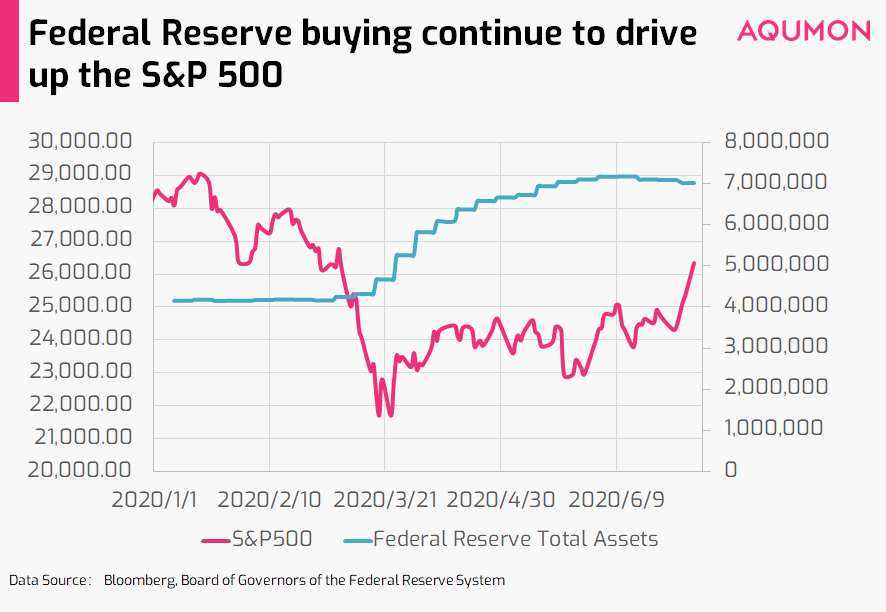

The past few months we’ve pointed out to investors ”don’t fight the Fed” (the US’ central bank) since the extra funds they and other central banks globally are pumping into financial markets are positively driving up stocks. We can see strong correlation between the additional market liquidity and performance of the US’ S&P 500 Index:

So what cash are markets following? There are 2 sources of cash investors should keep a close eye on:

1) Further central bank stimulus: Back in March, the US$2 trillion Coronavirus Aid, Relief, and Economic Security (CARES) Act provided US citizens with individual stimulus checks which played a sizable role in this recent market rally. Looking ahead the US$3 trillion Health and Economic Recovery Omnibus Emergency Solutions (HEROES) Act was passed in June which will send even more stimulus to families in the US sometime this summer. Analysts are anticipating we should get more details on this later this month. If this added stimulus becomes a reality we should expect markets to find further support if not have legs for another rally.

2) Still a lot of cash on the sidelines: One thing investors are talking less about is when looking at money market funds (cash alternative products) inflows we are currently at 25-year high levels. This means there is still a sizable segment of the investors who are underinvested. There is about US$5 trillion sitting in money market funds during this rally which would suggest a good amount of firepower is still left to provide support and drive markets to even higher levels (if these funds were to rotate into the market). So beyond the CARES and HEROES Act there may be a potential ‘3rd stimulus boost’ waiting in the wings. This is why we point out for investors to “follow the cash”.

When will this happen? Although sidelined investors might rotate in upon seeing markets continually grind up but more likely than not these funds may be unlocked after we see a 5-10% (or bigger) pullback first. Multiple houses are calling for buying on the dip but given how much polarizing news there is daily and how dislocated markets are to fundamental data, whether this dip materializes in the short term is still a question mark.

Even though markets continued to be dislocated from fundamental economic data we would still suggest investors be conscious of managing your portfolio’s risk in this current market environment. Oftentimes dislocated markets are like a game of Musical Chairs and no investor will want to be caught with little downside protection when the music suddenly stops. Continue to be careful how much you invest in this current environment, stay diversified and can consider accumulating (lowering your portfolio’s cost) if we see bouts of market weakness ahead.

If you have any questions please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON, stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s investors include Alibaba Entrepreneurs Fund, Bank of China International and HKUST.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.