Why Does It Hurt More to Lose?

Written by Catherine and Elva on 2020-08-14

Let’s play a game! Imagine that you have a chance to win $100 by flipping a coin. If it lands on heads, you win $100. If it lands on tails, you lose $100. So what do you say?

Theoretically, you have a 50/50 chance of winning or losing this game. However, most people will refuse to play this game because we tend to focus on losing $100 instead of winning $100. Why do we think this way?

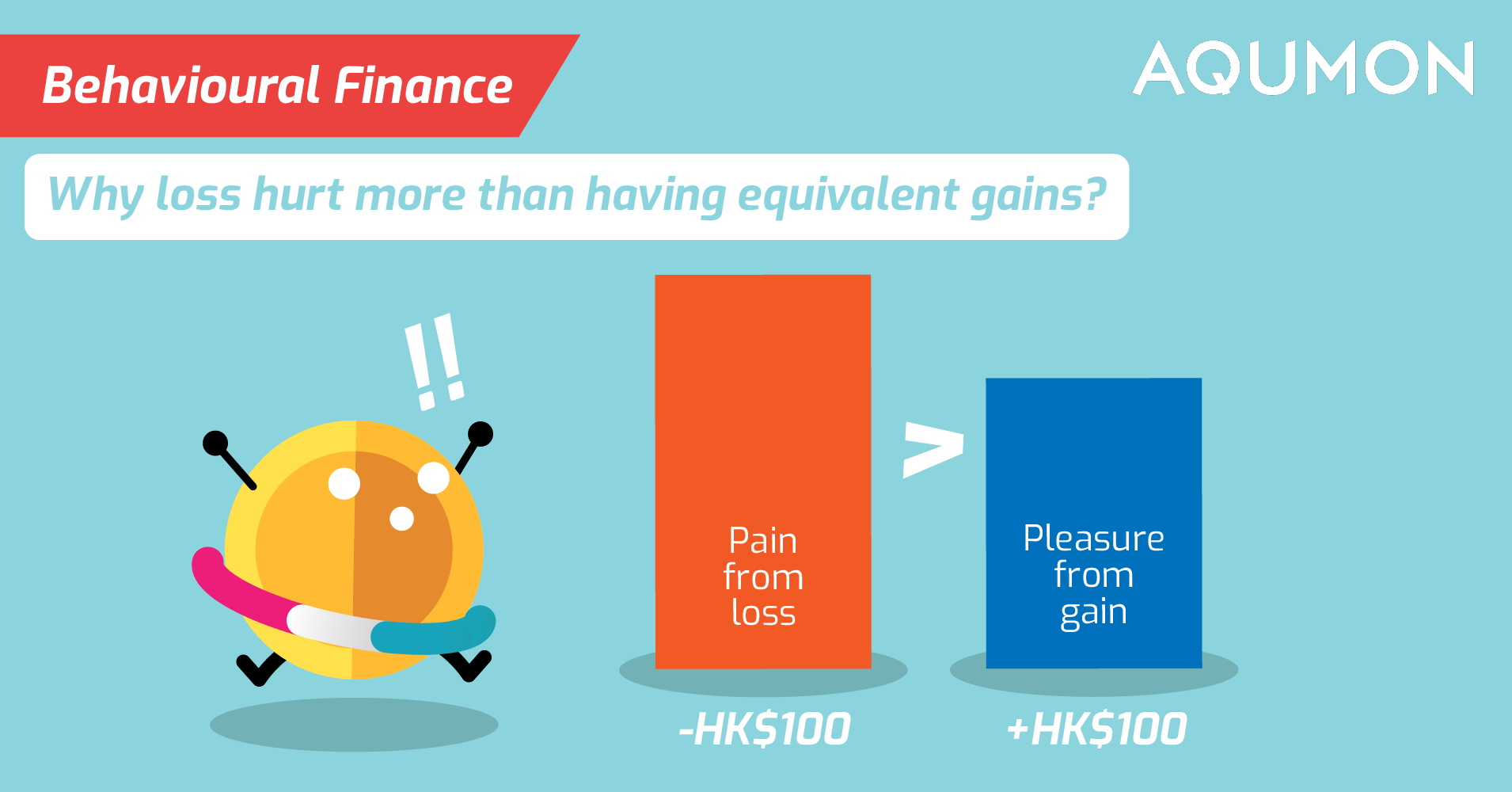

We have different perceptions of losses versus equivalent gains, and we tend to be much more sensitive to losing than winning. The pain of losing $100 is far greater than the happiness we would achieve from gaining $100. This is known in behavioral finance as "Loss Aversion Theory". Various research studies have found that in order to play this game, the amount you can possibly win should be at least two times greater than the amount you would lose. In other words, I’d have to give you at least $200 for you to play this game!

Loss averse is a common emotion. For example, if you make a $100 investment return, you won’t experience too much emotions, but if you lose $100, you will probably feel a huge headache.

Why do we have loss aversion

This innate human emotion stems from an ancient psychological mechanism of self-preservation. In times of extreme poverty, there is a big difference between losing and getting the same amount of food; losing food means you or your offspring starving to death, but getting the same amount of food just means you eat more. Negative events not only make us react faster, but they also affect us more deeply, so people are more sensitive to loss.

How does loss aversion affect investment decisions?

This mindset can lead people to make irrational investment decisions. Take your holdings of two stocks for example; one is going up by 20% and the other is going down by 20%. If you need to sell one of them, which one would you sell?

Most people will choose to sell the stock that's making money, so they can ensure the money goes to their pockets. However, such a decision does not take into account the chance it will continue to rise. On the other hand, most people find it hard to accept a loss. For the stock that is losing money, we always hope that it will rise again. Actually, the right decision is to sell the falling stock and prevent further decline. For example, my principal was originally $10,000, the stock fell 20%, and I have $8,000 remaining. At this time, it had to rise by 25% to recover the loss. What if the investor did not sell in time, the stock continued to fall to $5,000, then the stock price would have to rise by 100% to cover the loss.

In fact, loss aversion is an irrational behavior triggered by emotional biases, but it is hard to get rid of these emotions. It is quite unwise if your investment decisions are also influenced by them.

Find it hard to avoid emotional biases? Check out AQUMON! It’s free of human emotions, systematic and a highly transparent robo (investment) advisor to grow your wealth in the long run!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.