Market Reactions of Past US Presidents' Health Shocks

Written by Ken on 2020-10-07

In hopes of potentially more stimulus along with improved economic data, US and European financial markets rebounded strongly last week. The US S&P 500 index’s up was +1.52% last week and +3.64% year to date. The Euro Stoxx index was also +1.02% last week but continued to lag globally returning -21.75% year to date. Furthermore, lagging and cyclical US companies slightly outperform technology companies last week with the Dow Jones index +1.87% while the Nasdaq was +1.48%. Hong Kong’s Hang Seng index was also +0.96% last week.

AQUMON’s diversified ETF portfolios were +0.02% (defensive) to +1.60% (aggressive) last week and +2.31% (defensive) to +1.99% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio with more regional exposure to Hong Kong/China is +1.01% (defensive) to +5.93% (aggressive) year to date. Last week’s main portfolio drivers were emerging market stocks (+2.35%), US small cap stocks (+3.09%), gold (+2.06%) and high yield bonds (+1.49%). Laggers were mainly energy stocks (-2.88%) while other asset classes stayed relatively flat.

We had multiple clients ask us about our view on how US President Donald Trump’s recent positive COVID-19 test results would impact the markets. Although we are aware of how this adds uncertainty to an already unclear market outlook, investors should understand that although politics may dominate news headlines, it is economic recessions, corporate fundamentals and monetary policies that truly moves the financial markets.

We believe October will continue to be a month of higher volatility but investors should not fear this. As we head further into Q4, clarity on key topics such as a solution on COVID-19, the US election results and economic recovery should elevate the markets. So investors should position ahead for this even though there may be chances of short term pullbacks.

Past US president health shocks have little impact on financial markets

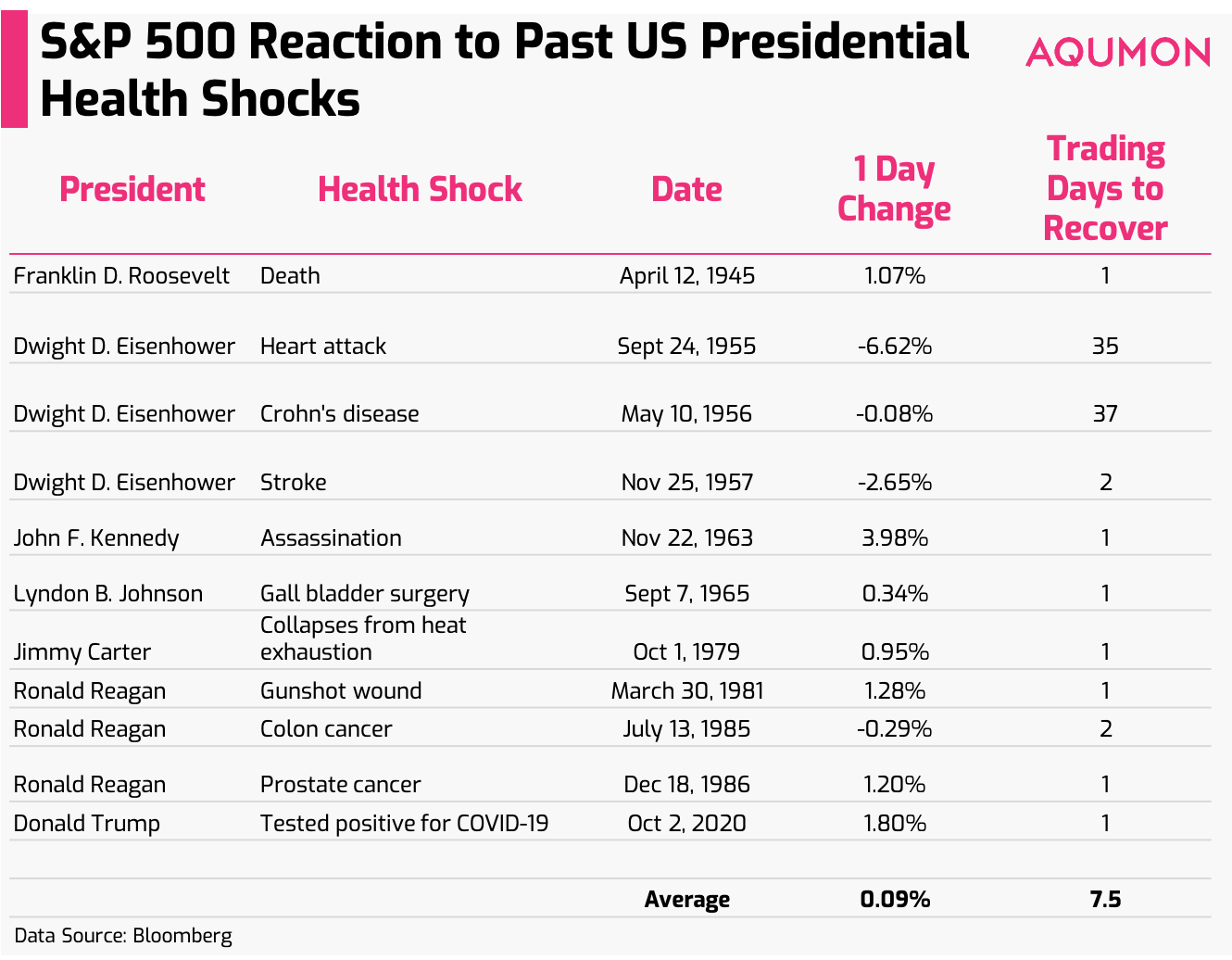

Let’s take a little history lesson. Do you know any US presidents who have suffered a series of health shocks which range from heart attacks, gunshot wounds to even deaths while being in office in the past 75 years? Even though these may seem like major events, their impacts on the S&P 500 index have been minimal:

Looking more closely, the S&P 500 on average has surprisingly returned +0.09% the trading day following these health shock announcements! When the markets did pullback on the news, how long did it take for the markets to recover to the previous levels? On average, recovery speed was within 1 1/2 weeks (7.5 trading days) and it only took 1.2 trading days for the markets to recover to the pre-announcement highs in 9 out of 11 cases. So this is a major reason why we continue to suggest to investors that although US election and political headlines will likely bring more volatility to markets, this should not be the deciding reason as to why investors should give into their fears and exit the market now. There are other ways to reduce risk - either via diversification, investing into safer assets or even holding a little more cash than exiting the market.

Stimulus talks ‘may be’ potentially on pause but the markets can still withstand this

For those who have been following our Market Insights know that we advocate investors to “follow the cash” as one of the major drivers for the market rebound since March is central banks and governments providing massive liquidity. In a somewhat abrupt manner, US President Donald Trump ordered Treasury Secretary Steven Mnuchin to stop negotiating with House Speaker Nancy Pelosi until after the November election on Tuesday.

Although this news is not positive for the markets (since we may be losing a potential catalyst), we suggest investors to focus on 2 things:

1) Markets will unlikely to ‘break’ if a new stimulus package is not passed.

Although we agree with US Federal Reserve Chairman Jerome Powell that failing to reach a stimulus package agreement could cause "unnecessary hardship" for Americans, markets’ reaction to the news on Tuesday (S&P 500 -1.40% overnight) shows that the markets can still withstand this result as it awaits its next catalyst. Furthermore, the current market expectation is a stimulus package will still likely to be passed after the presidential elections on November 3rd regardless of whichever candidate wins. Excluding Tuesday’s pullback, the recent rally in risk assets (S&P 500 is +5.00% since September 24th) is in part due to the market expectation of a new stimulus bill being passed sometime in Q4 (but ideally before the election). Why? Earlier, investors had become more optimistic on this happening due to the Democrat-led US House of Representatives passing a US$2.2 trillion (~HK$17.1 trillion) COVID-19 stimulus proposal last Thursday along with the US president Donald Trump showing support earlier to get a bill passed promptly. But all may not be lost...

2) Potential liquidity may happen in the form of handouts instead.

Within the 24 hours of the initial news of US President Donald Trump halting stimulus plans, he further communicated that they are in negotiation and potentially signing a Congressional bill guaranteeing a second round of US$1,200 handouts (HK$9,300) and US$135 billion (HK$1.0 trillion) to support small businesses. Analyst expectations is that although individual relief measures (like an airline bailout) may be possible, the likelihood of cash payouts are less likely, given this wasn’t on the table beforehand. Early indication by the US House Speaker Nancy Pelosi also suggested the Democrat party is more in favor of passing a comprehensive stimulus package over a piecemeal one. This is something we will be closely monitoring this month.

If passed (handout or otherwise), this should provide further positive uplift for the markets heading into the US election. If ultimately not passed or further delayed, though this won’t ‘break’ the markets, we could see a short-term pullback as the markets await its next catalyst. Given the negative impact of COVID-19 on the economy, we still believe a new stimulus package will likely to be passed sometime in Q4.

Historically, investors’ behaviors have negatively impacted their returns during an election year

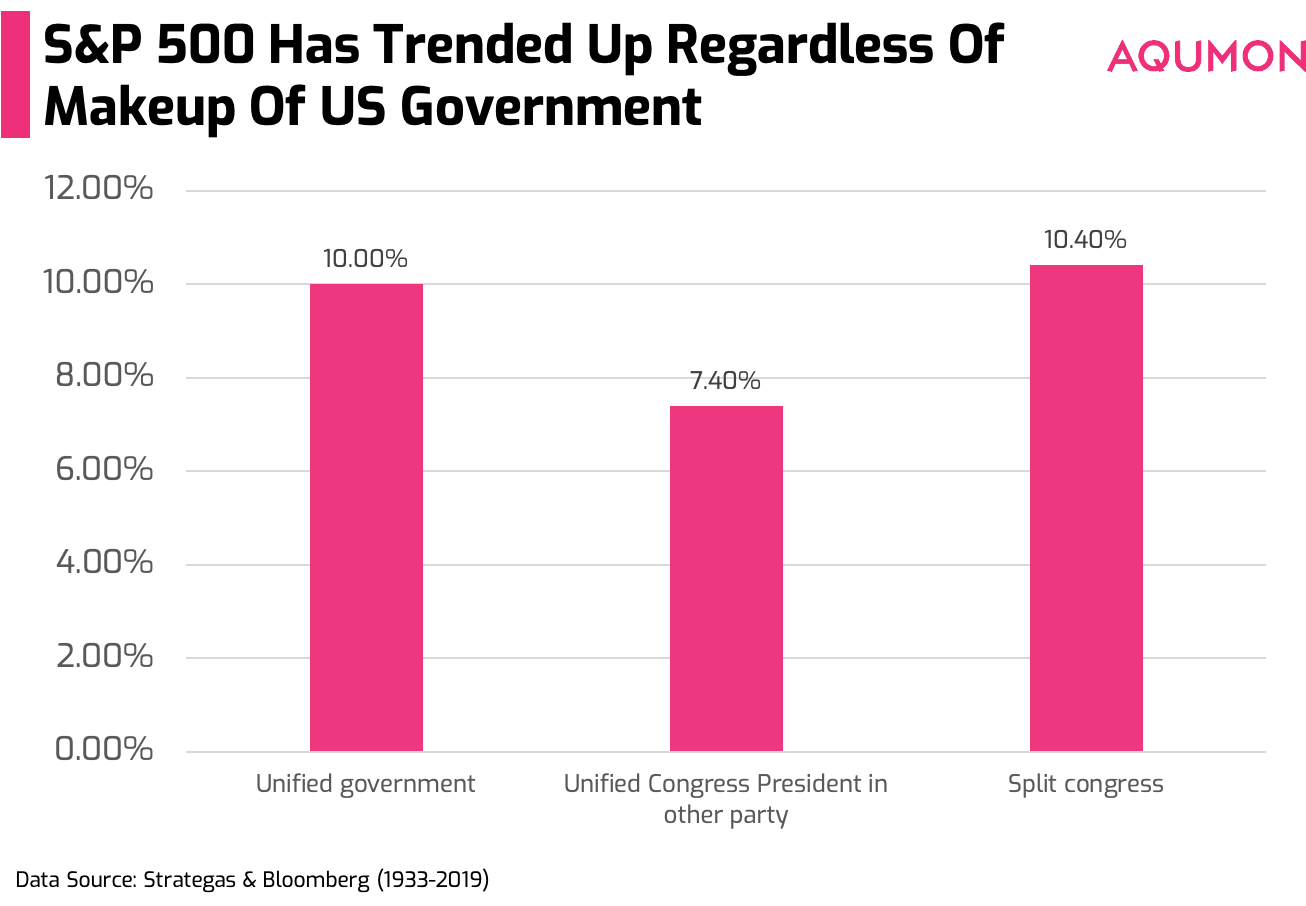

The data shows us quite clearly that we all have a tendency to be overly concerned with which political party (Democrat or Republican) will win more power and how unified the US government will be during an election year. There have been quite a lot of talks recently on the market impact from a ‘Democratic sweep,’ meaning Congress, House of Representatives and the president all belong to the same party.

The reality is tha financial markets in the medium to long term do not put much weight on either of these factors unless there is a sizable change in market-related policies. During the past 86 years, the S&P 500 index returned +7.4% to +10.4% regardless of who is in power and the makeup of the US government:

Some may argue that if we lengthen our investment horizon that the financial markets have always trended up in any political or non-political scenario and that’s exactly that point we want to drive home to investors. There is little certainty and control in life, so as a smart investor, let’s focus on what we can control.

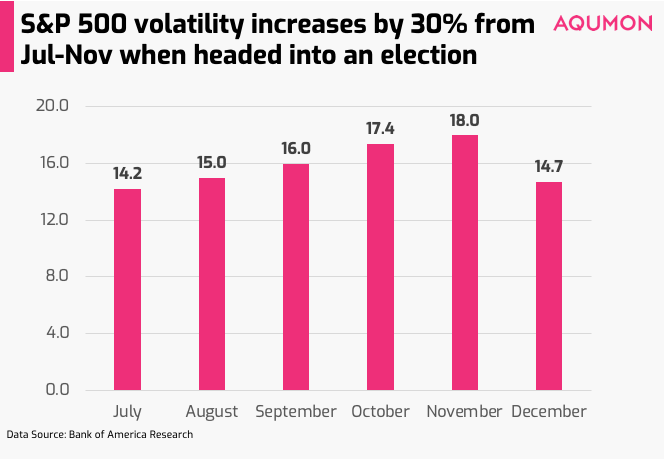

We know this is easier said than done, especially when we mentioned before that the volatility of the S&P 500 index (measured monthly by the VIX index) increases by as much as +30% from July to November (since 1928) during an election year according to Bank of America Research:

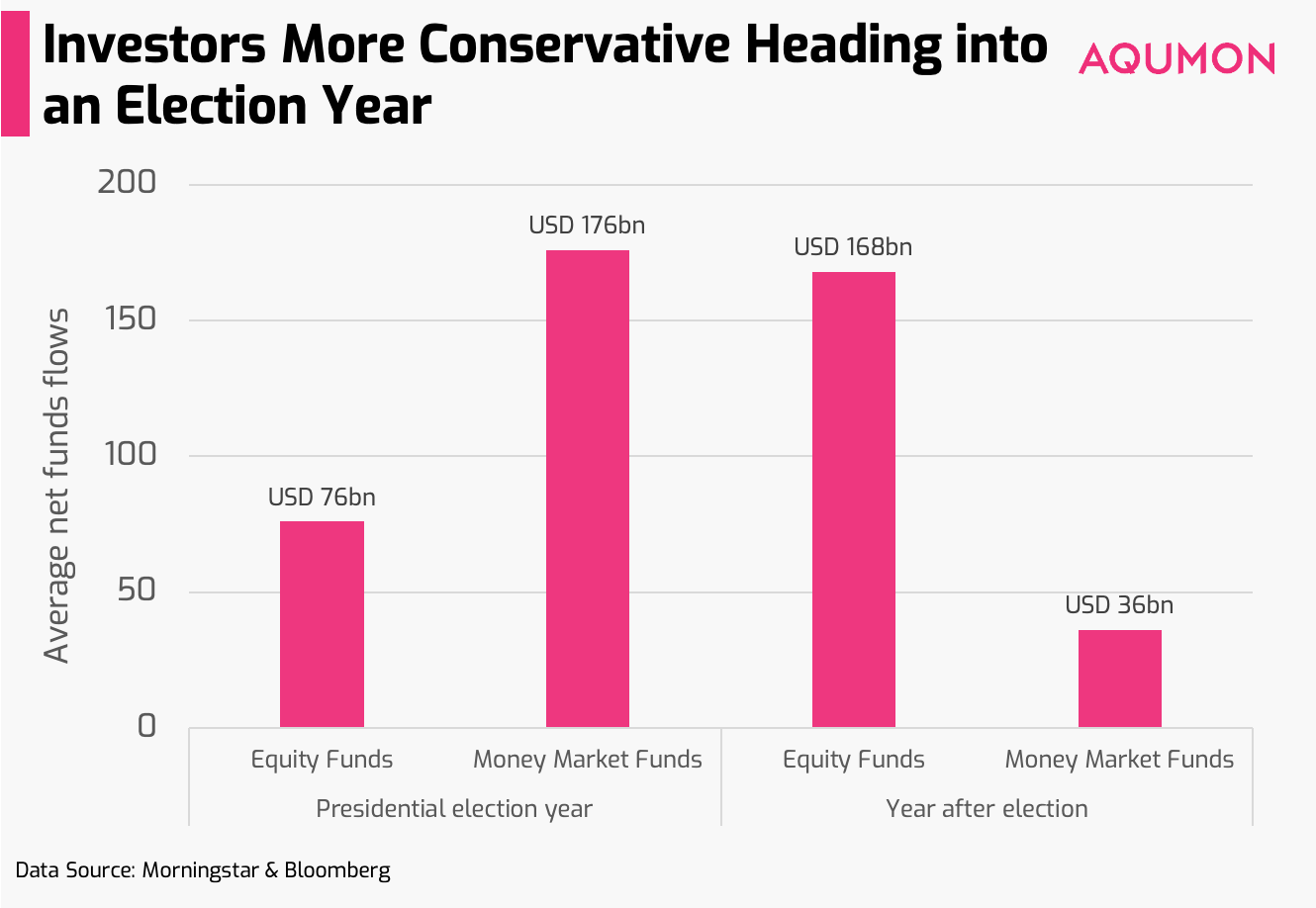

With higher market volatility coupled with sensationalist news headlines, we understand why investors may succumb more to their emotions. When we look at investor behavior historically, we see investors position much more conservatively during an election year:

But by looking at the data and knowing how other investors will likely behave, we tell investors to expect and ‘embrace’ the volatility heading into the US election. Although we do not have a crystal ball in terms of whether the markets will pullback in the short term, what we can say with some degree of certainty is that the markets will likely to receive an uplift as the unknowns like the results of the US election and the COVID-19 situation become ‘knowns’. Even though the markets may be choppy in the next 1-2 months, investors should carefully manage their investment portfolio’s risk during this time while positioning ahead for this market uplift.

If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.