How to Position for Upside and Manage Your Risk

Written by Ken on 2020-10-16

Driven by a rotation back in technology names and more positive COVID-19 vaccine news, the global financial markets saw one of its strongest weekly rebounds last week with the S&P 500 +3.84% and +7.63% year to date. The Nasdaq index led the way +4.56% last week and +29.06% in 2020. Both European and Hong Kong markets rallied +2.58% and +2.81% last week but are both in negative return territory for the year.

AQUMON’s diversified ETF portfolios were +0.01% (defensive) to +3.22% (aggressive) last week and +2.32% (defensive) to +6.02% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio with more regional exposure to Hong Kong/China is +1.13% (defensive) to +9.58% (aggressive) year to date. Last week’s main portfolio drivers were energy stocks (+5.05%), Chinese growth stocks (+4.29%), Asian stocks (+2.60%) and emerging market bonds (+1.90%). Safe assets remained flat last week.

With the markets being more volatile lately, this has created some uneasiness amongst investors heading into the US election (18 days away). We wanted to highlight to investors 2 things they can do with their investment portfolios which we feel will offer additional upside potential while helping them to manage their risk. Let’s first get a heat check in terms of what other investors are thinking:

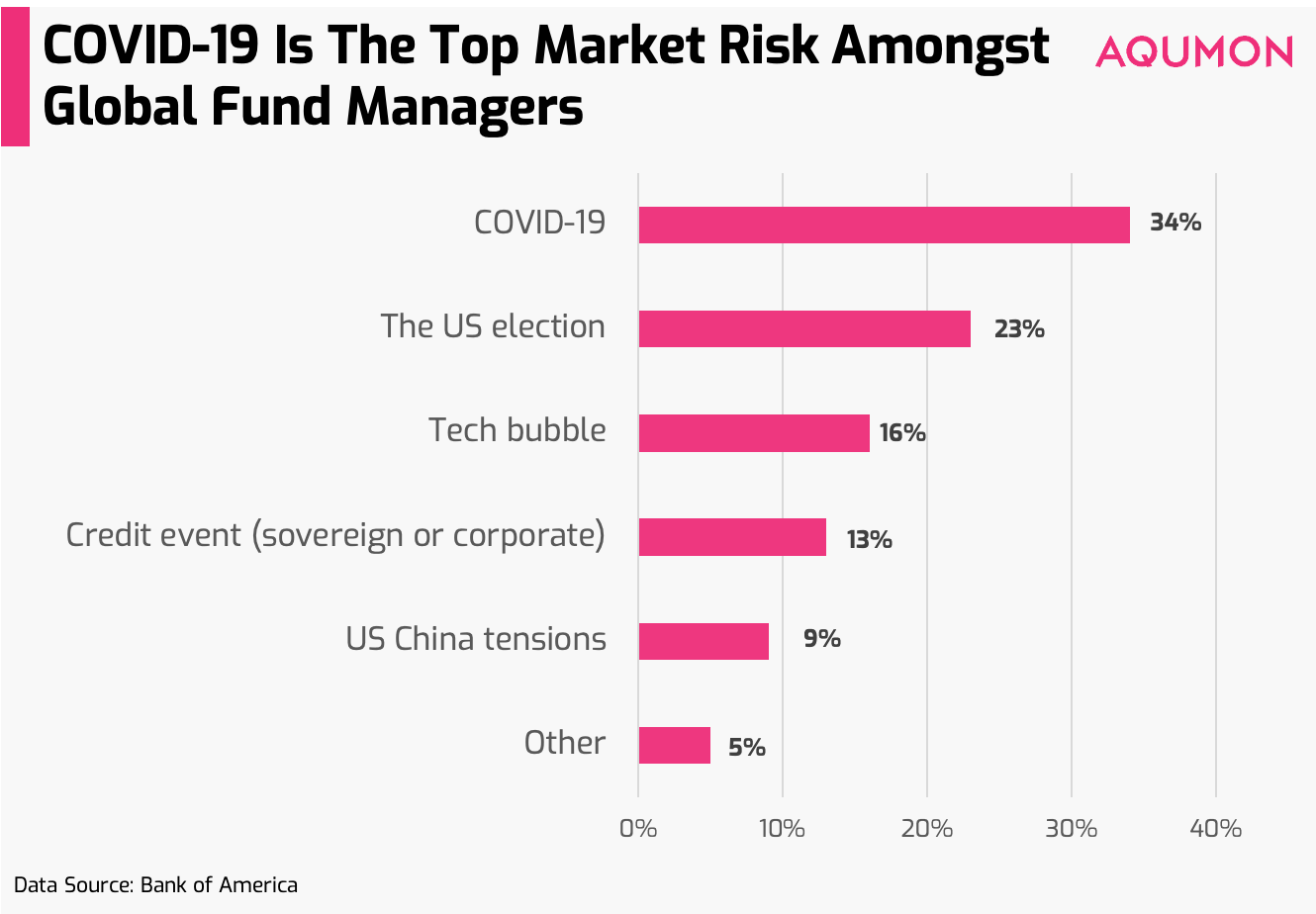

Fund managers believe COVID-19 and the US election are the biggest market risks

Although many investors focus on the US elections, the biggest risk amongst fund managers’ mind is the impact of COVID-19. Bank of America monthly global manager survey shows 34% of the surveyed 224 fund managers says COVID-19 is their top tail risk:

The big question amongst fund managers is how long it will take for economies to open with 30% of managers anticipating a ‘W’-shaped recovery, which means they anticipate more volatility ahead and slightly slower recovery duration versus a ‘U’ or ‘V’ shaped recovery. This will make it tougher to gauge when better-valued cyclical sectors (COVID-19 recovery plays) start to outperform growth sectors such as tech.

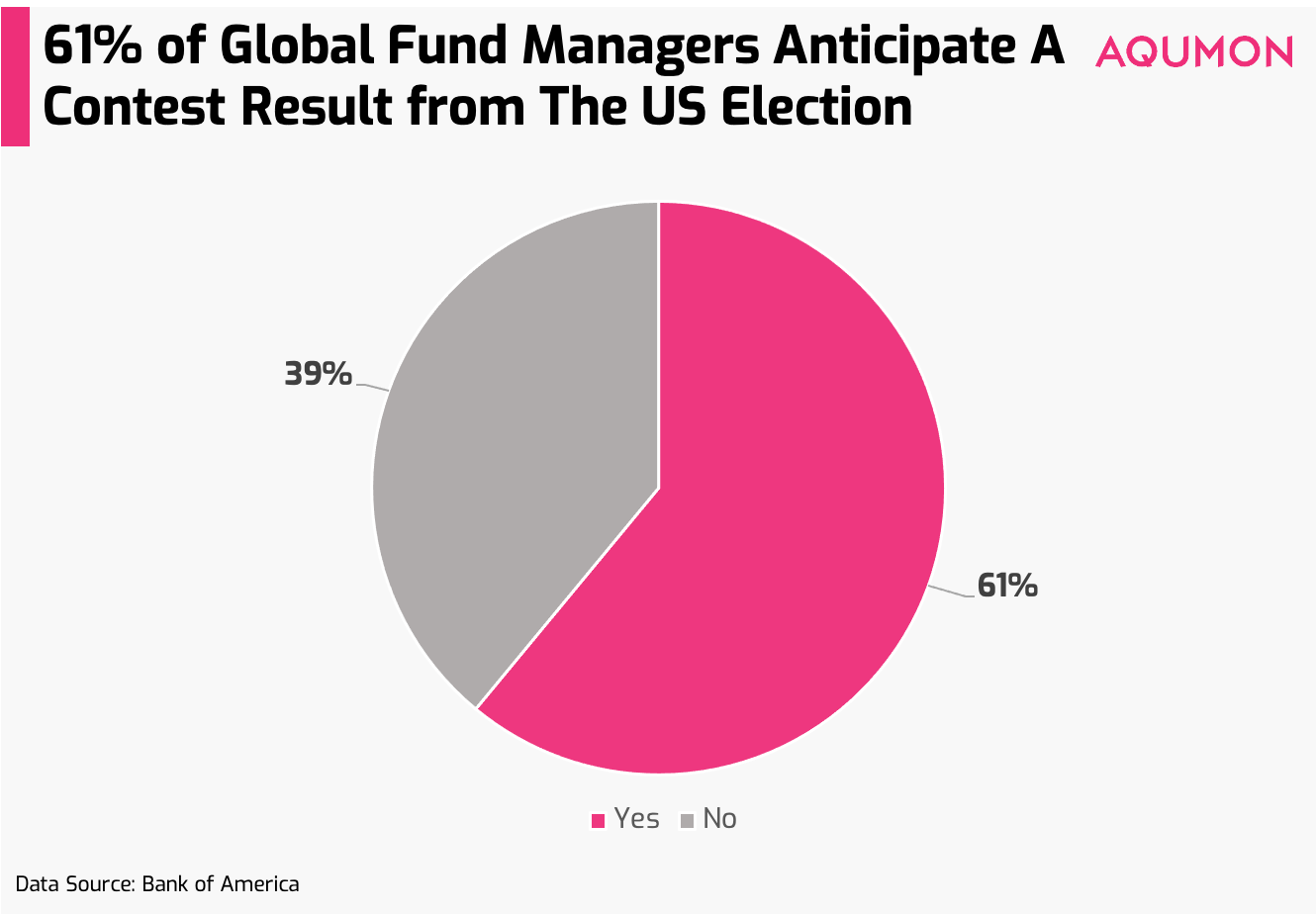

Looking ahead to the US election on November 3rd, 61% of the surveyed managers believe it will be a contested outcome and 74% believe this outcome will cause the most market volatility (versus a democratic sweep, a split government or a win by current US president Donald Trump):

What we can see from this survey is that investment outcomes and implications are now becoming more unpredictable and binary for investors. We understand these markets can feel scary at times, but those who have stayed the course with their investments this year have been rewarded for their patience. Even in a traditionally volatile month of October (particularly during an election year), investors need to be aware that the S&P 500 is still +3.58% this month.

During these uncertain times, we suggest that investors focus on things they can control. We have listed 2 things all smart investors should diligently do:

#1 to do: Reduce the fee erosion to your investment portfolio

The #1 thing you should do is assess performing and non-performing assets in your portfolio, especially the fee impact on non-performing assets. If there are assets (such as certain mutual funds) that you feel are underperforming, it makes a lot of sense switching it out for a more cost effective alternative such as an exchange traded fund (ETF).

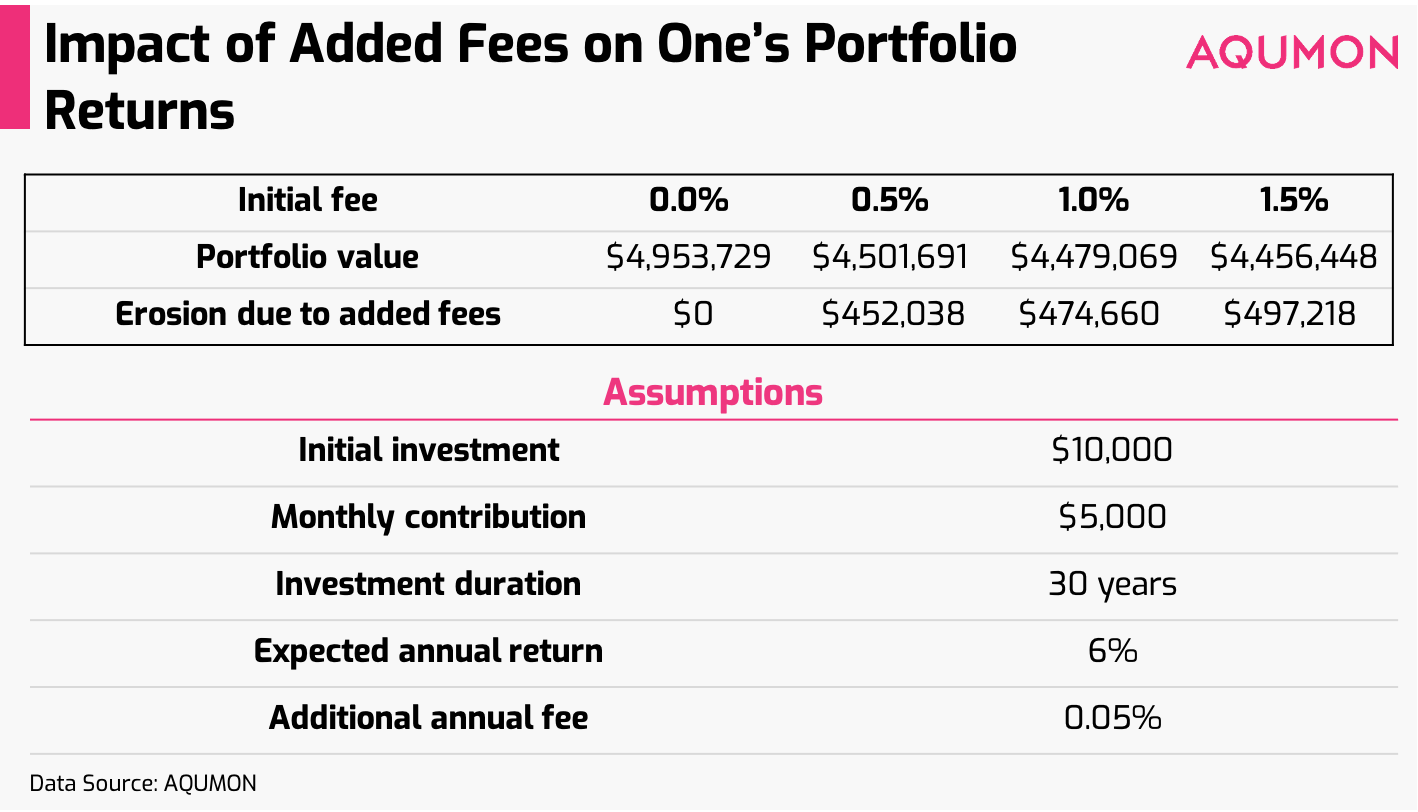

Typical upfront costs associated with a bond mutual fund is about 0.5% - 1% while for stock funds the fees are generally 1-2%. Both are calculated as a percentage of your invested amount. Cost associated with passive index funds such as exchange traded funds (ETFs) are closer to 0.2%. So that could be a cost saving of up to 90% for every time you invest! The total cost (not just upfront) difference will likely be even higher. 1% in additional fees may not sound like a lot but compound over an extended period of time like 30 years makes a big difference to your investment portfolio:

You can see a simple 1% extra upfront fee (assuming annual fee stays the same) will have HK$45,180 of extra returns eroded from your investment portfolio. So by reducing your costs, you are essentially putting some much needed extra money in your own pocket when the markets are volatile.

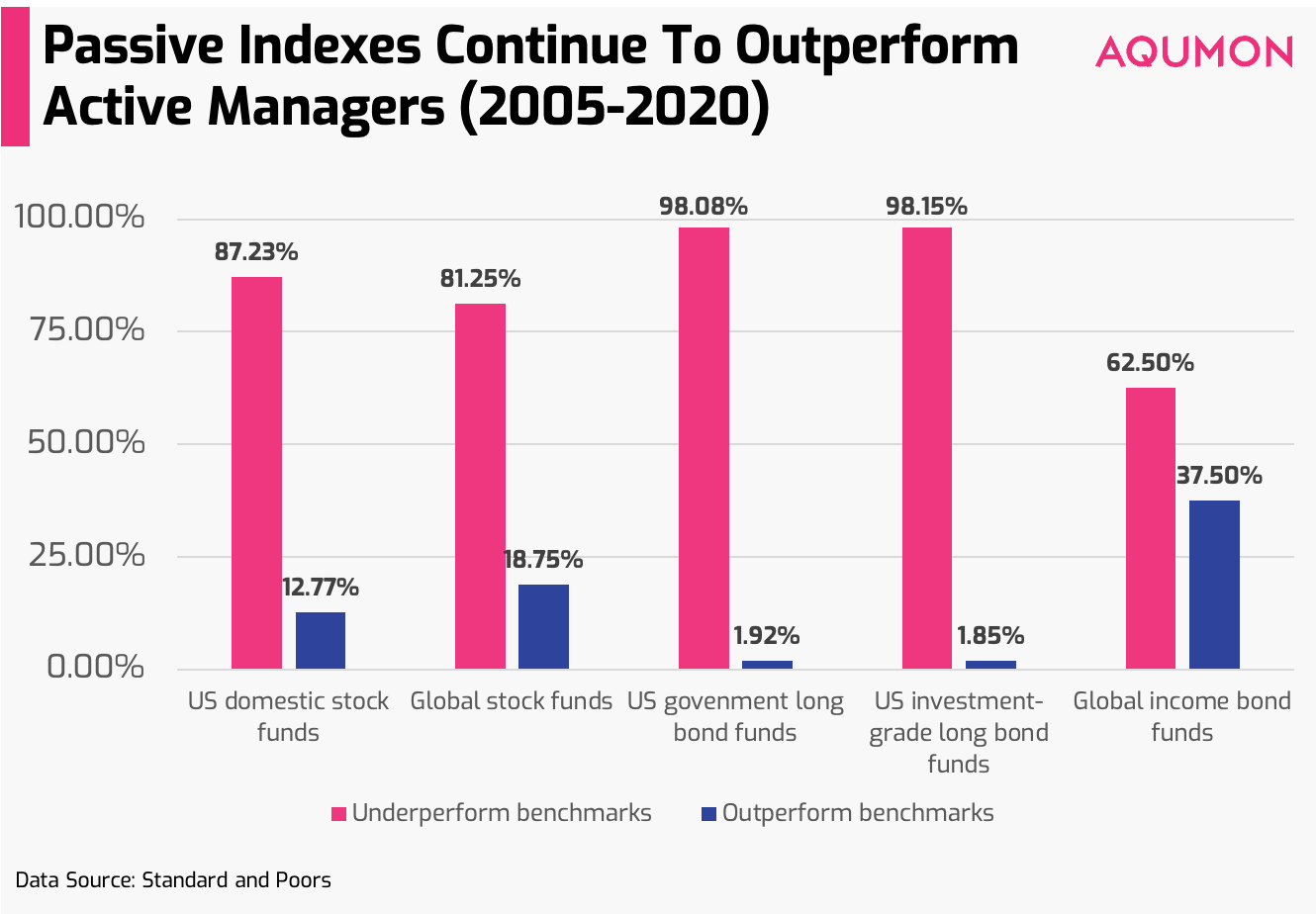

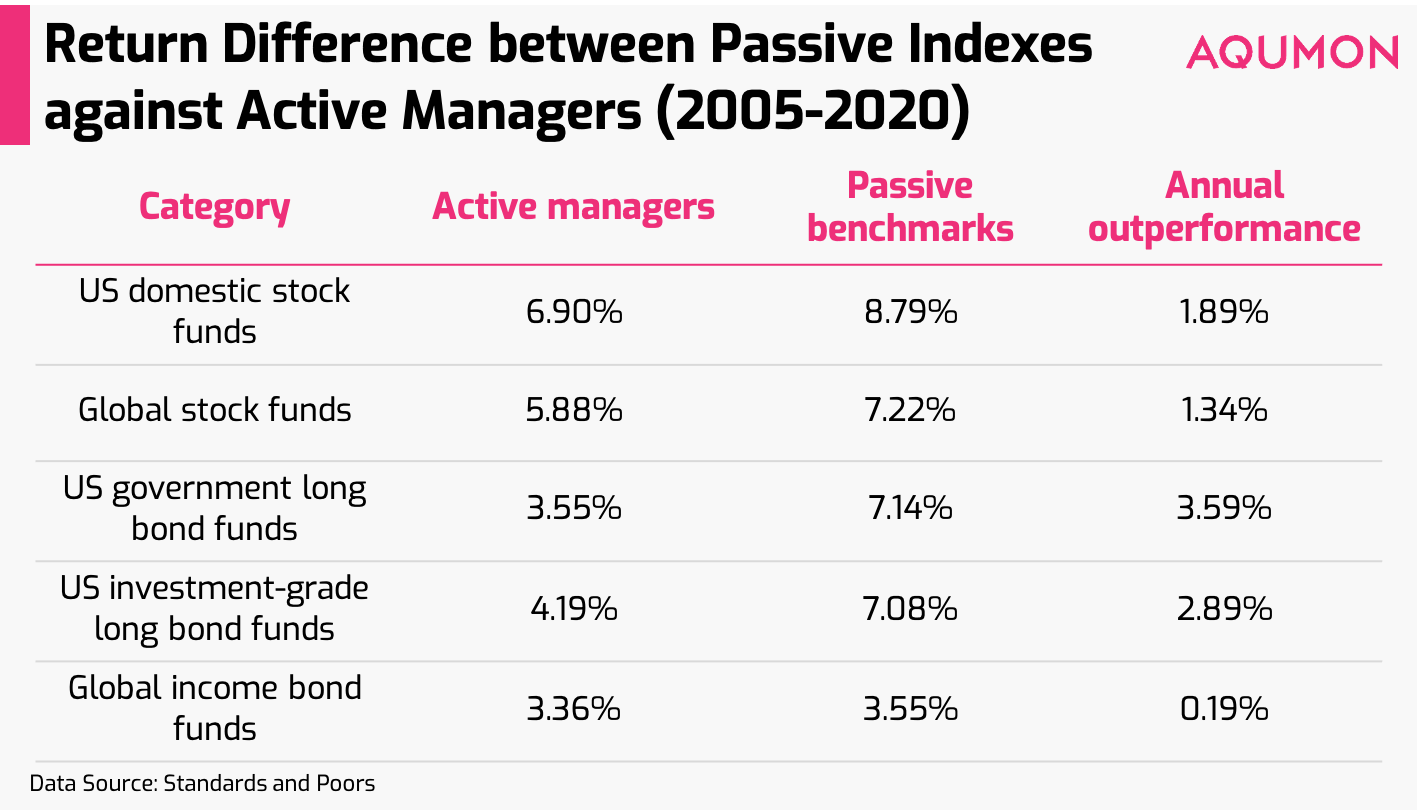

Beyond costs, passive type indexes have also shown to outperform active mutual funds consistently. S&P Dow Jones Indices recently published its latest installment of the SPIVA (S&P Indices Versus Active) Scorecard, which compares active fund managers performance against their passive benchmarks for the first half of 2020. Looking at the past 15 years (June 2005 - June 2020), 87.23% of US stock mutual fund managers underperform their respective passive market index (the S&P 1500 index):

The same S&P survey looked at 36 stock and bond fund categories and found that 100% of active funds managers underperformed their passive benchmarks in the same 15 year time horizon. Experts like us agree that when the time horizon is this long, it is tough for the majority of active managers to beat passive indexes due to one simple reason - consistent performance erosion due to higher fees. When the investment time horizon is longer, it is extremely difficult for active managers to outperform year after year.

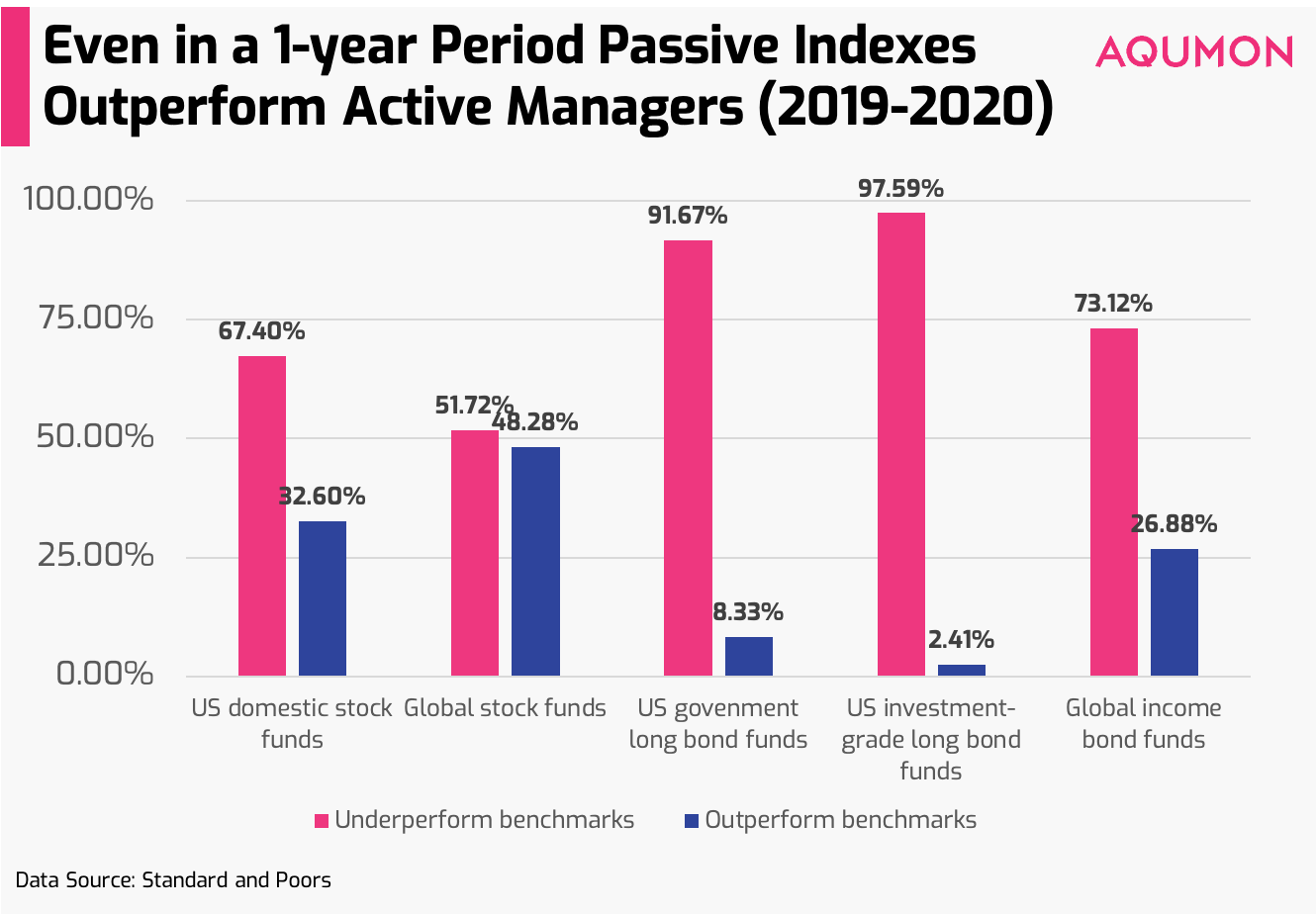

To be fair, when looking at a shorter time horizon of 1 year, the impact from fee erosion is less apparent but 67.40% of US stock fund managers still underperform their passive benchmarks:

We are not advocating that mutual funds are bad because they definitely have their place both in terms of successful fund managers who continue to outperform, relatively low investment minimums and the ability to do the heavy lifting of investing for you, but it may come at an elevated cost.

Given the current zero/negative interest rate environment, future investment returns will likely be compressed so smart investors should be most cost conscious. So it would be in your best interest to switch out underperforming assets to lower cost passive investing assets.

#2 to do: Diversify your portfolio both to manage risk and to capture opportunities

We understand most investors may already understand this concept to reduce their investment portfolio's risk, but we believe there is a greater tactical reason nowadays as to why you need to diversify your investment portfolio. The current three big investment trends that we see in the market are:

1) COVID-19 recovery plays:

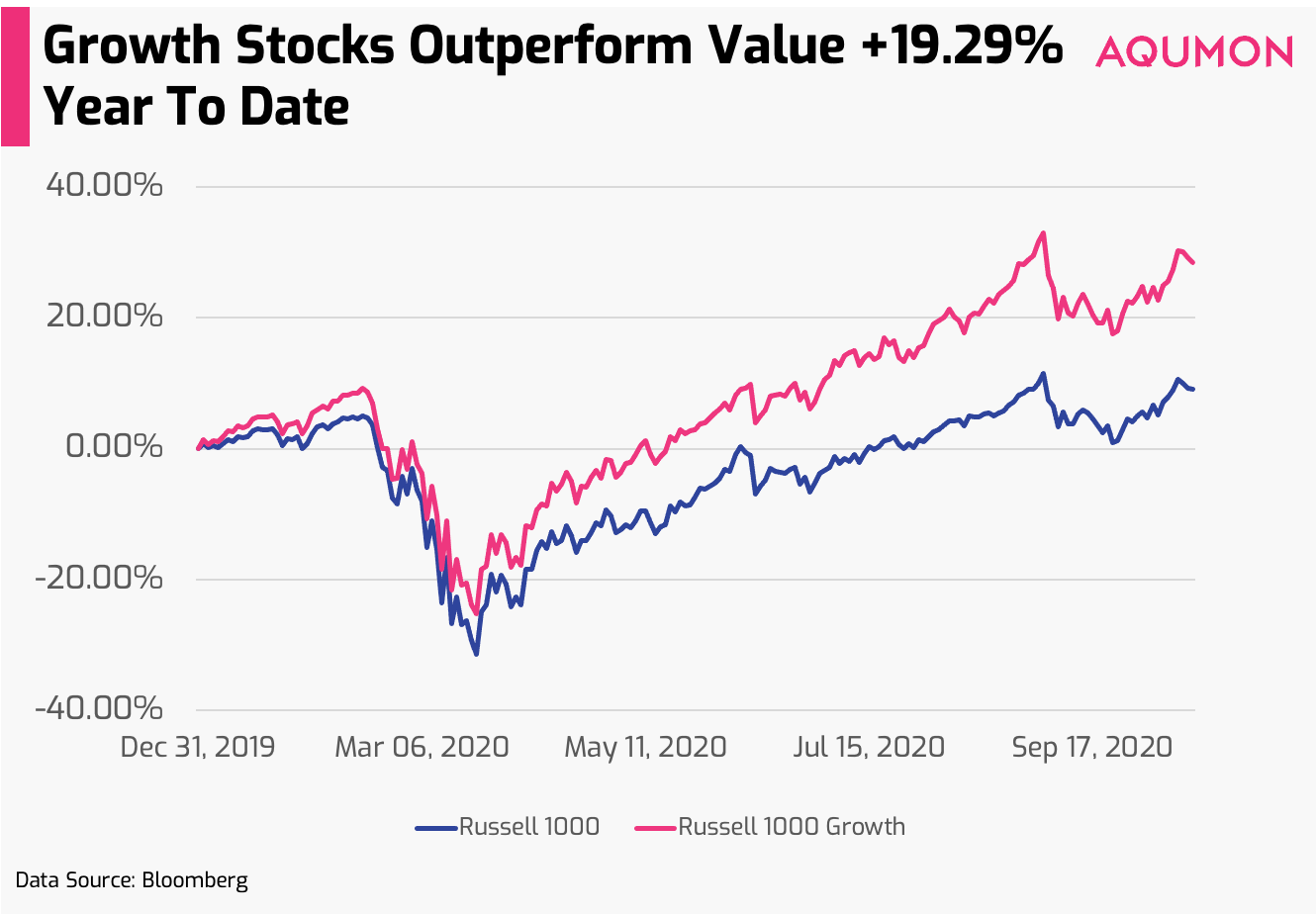

Although we have started to see some rotation into lagging value/cyclical sectors over growth sectors (like tech), this has not been consistent enough due to COVID-19 setbacks witnessed in Europe and the US. When looking at growth stocks, they have outperformed by +19.29% year to date over value stocks:

While economies are still unable to reopen properly, technology and growth names will still see upside even though valuations are on the higher end. Goldman Sachs this week announced they believe the market will be poised for a rotation out of growth into cyclical stocks, given the improving economic conditions and rising bond yields especially if a vaccine is announced.

They further highlighted that since the financial crisis in 2008, there have been 15 rotations into cyclicals (like financials and the auto sector) with it lasting for 4 months on average and resulting in a +15% outperformance for cyclical stocks. Although we also believe cyclicals and laggers will start to be favored by investors, when this will happen is still a big question mark with so many big “ifs” and unknowns.

2) US election plays:

Even though the latest poll shows US presidential candidate Joe Biden leading 54% to 43% against current US president Donald Trump, the 2016 election has taught us that pre-election polls are not a great indicator of actual election day results. Just looking back 4 short years ago, US president Donald Trump won the electoral college vote but lost the majority vote by securing 46% of total votes.

So looking at the current poll numbers, the result may not be so certain. Given different election scenarios: a democratic sweep, a split government or a win by current US president Donald Trump can yield quite different investment beneficiaries, we suggest focus on what both candidates have indicated they will offer post election instead and that is more monetary stimulus. Risk assets such as stocks should continue to see uplift if we see further injection of liquidity into financial markets.

Given the added unpredictable nature and when we will see rotation into these investment trends, it makes a great deal of sense for investors to be tactically diversified so you can manage your downside risk while positioning for upside.

If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.