Where Does the Nobel Prize Money Come from?

Written by Catherine & Jobie on 2020-11-06

The Nobel Prize is considered as one of the most prestigious awards in the world; only a handful of people are honoured with the title of “Nobel Laureate” every year.

Founded in 1896 by the well-known Swedish industrialist, Alfred Nobel, the Nobel Prize consists of five separate prizes that are awarded “to those who, during the precedent year have conferred the greatest benefit to humankind” (Nobel, 1896).

The first Nobel Prizes were awarded in 1901 and still runs to this day. In 2020, the total amount of Nobel Prize monetary awards was 60 million SEK (~HK$53 million). Have you ever wondered why the Nobel Foundation has not run out of money even after 100+ years? Let’s take a look!

The Nobel Foundation

Nobel selflessly contributed HK$27 million (31 million SEK) to set up the Nobel Foundation after his death. Five prizes were established to crown the selected laureates for their outstanding achievements in Physics, Chemistry, Physiology or Medicine, Literature, or Peace. A sixth prize was established in 1968 in the field of Economic Sciences.

How the Nobel Foundation went from bankruptcy to riches

The will of Nobel stated that the foundation could only invest in “safe securities” like term deposits. Though low risk, the term deposit is a low returns investment option.

Until 1914, the tax was not excessively heavy, only 10 percent, but when a "temporary defense tax" supplement was introduced in 1915, the Foundation's tax burden doubled. On top of that, the profit from the Foundation’s investment could not keep up with the Nobel Prizes’ monetary awards every year. The foundation was on the brink of bankruptcy in 1953 and changes had to be made.

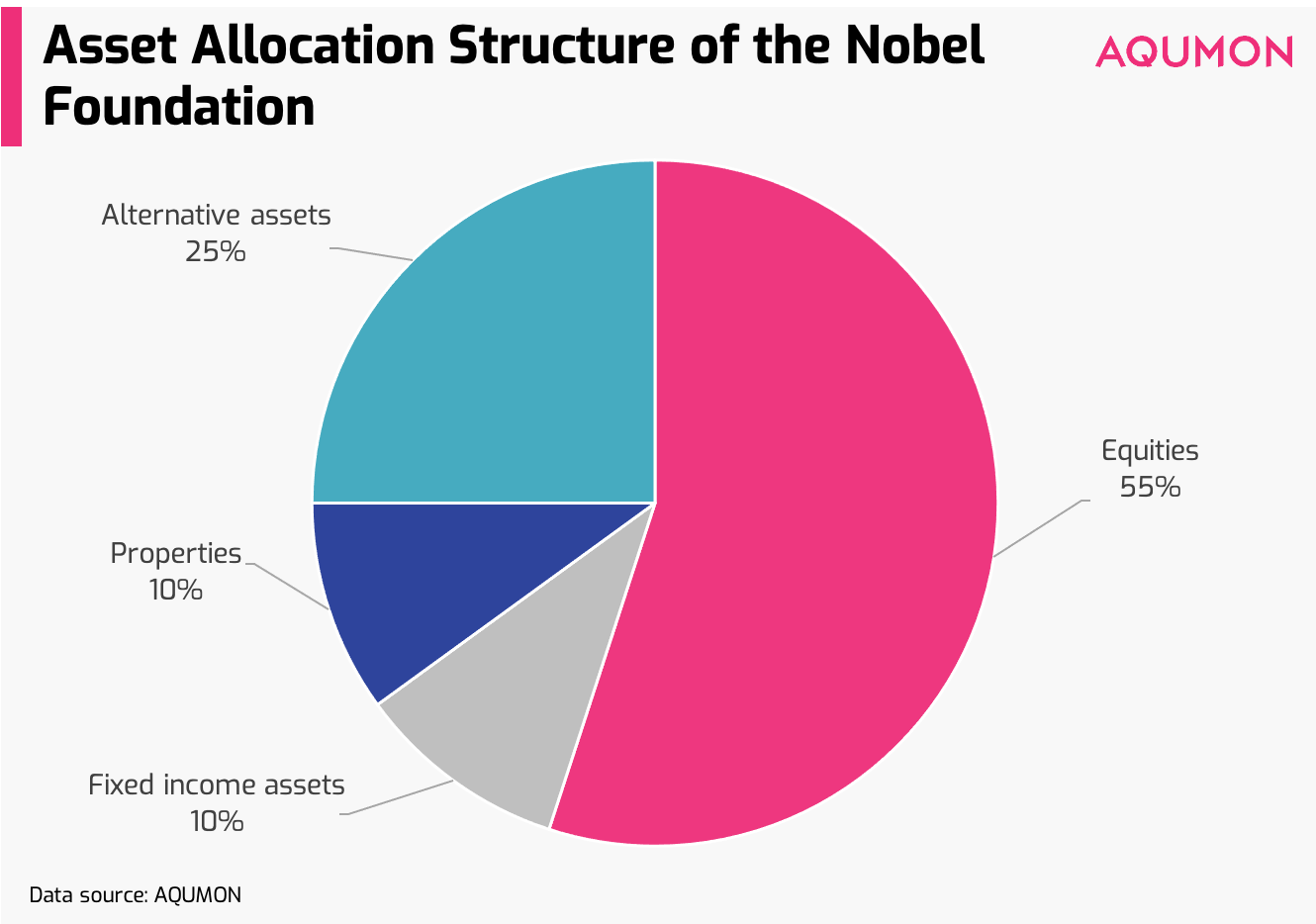

In response, the Foundation’s Board of Directors implemented a more modern style of investing in the late 1950s and started buying into stocks and REITs. Currently, the capital structure of the foundation is 55% in equities, 10% each in fixed income assets and properties, and 25% in alternative assets. The distribution can vary by 10% depending on the markets each year.

The major changes were that most of the Foundation’s equity holdings moved from active to passive; this was to reduce exposure to equity risk.

It was not until 1991 that the foundation managed to restore its original prize amount. According to the Nobel Foundation Annual Financial Report 2019, the total assets of the foundation now stands 3.48 billion SEK (~HKD3.1 billion).

Three golden rules of investing we learn from the Nobel Prize

1.) Diversification

Diversification is the most important component of reaching long-term financial goals while minimizing risk by allocating investments among different financial instruments and industries. It also aims to maximise returns by investing in different areas that would react differently to the same event.

2.) Global asset allocation

Different assets perform better at different times. This is not only due to variations in how assets behave, but also in response to changes in economic expectations, how companies perform in the future, and geographic nuances.

3.) Long-term investing

When your investment produces earnings, those earnings can be reinvested to potentially earn even more. The more time your money stays invested, the greater the opportunity for compounding and growth.

The Nobel Foundation’s investment strategy is simple yet effective. It follows the three golden rules of investing above. Focus on your long-term goal and start investing like the Nobel Foundation today!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.