Where Should Investors Find Opportunity Post US Election?

Written by Ken on 2020-11-13

After a nail biting US election race coupled with positive vaccine news, the US’ S&P 500 index had one of its best weeks in 2020 +7.32% last week and +8.63% year to date. Global stocks all saw an uplift with the EuroStoxx 50, Nikkei and Hang Seng index +8.31%, +5.87% and +6.66% respectively.

AQUMON’s diversified ETF portfolios were +0.12% (defensive) to +6.02% (aggressive) last week and +2.39% (defensive) to +7.37% (aggressive) year to date. AQUMON’s SmartGlobal HK ETF portfolio, with more regional exposure to Hong Kong/China, was +1.19% (defensive) to +6.27% (aggressive) year to date. All asset classes in general sold off with Hong Kong technology stocks (+8.03%), emerging market stocks (+6.98%), India stocks (+6.01%) and gold (+3.94%).

Global markets were quite choppy this week post US election and a number of clients asked where they should position next. So we wanted to address 2 areas where we see potential (but not immediate) opportunity: cyclicals and emerging market stocks.

The rotation into cyclicals is still finding it legs

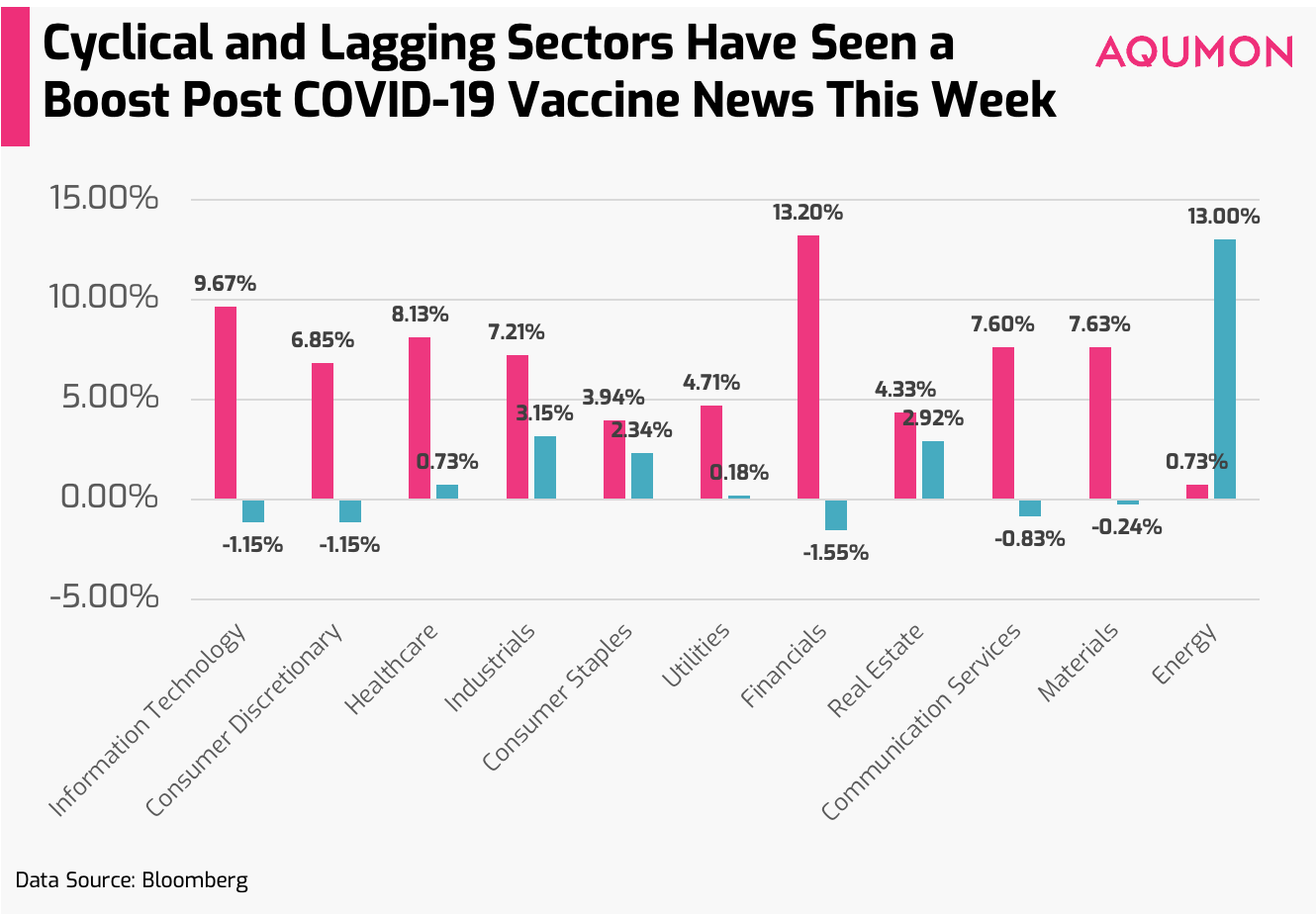

The big story this past week is the selloff in technology with a strong rotation into lagging cylicals such as industrials and consumer staples:

Investors need to be aware that the strong rotation earlier in the week out of growth stocks into cylicals only lasted a short while and then lost steam. What does this mean?

1) This cyclical rotation will be a longer trend into 2021

For those of us keeping close track, we’ve already seen such rotations out of growth into cylicals back in June, August and September this year but it has failed to find sustained legs yet. Why? Investors need to understand that what is driving cyclical sectors is the prospects of improved economic growth ahead and this is largely on the back of the positive COVID-19 vaccine news this week from Pfizer. Pfizer and BioNTech announced Monday their coronavirus vaccine was more than 90% effective in preventing COVID-19 among those without evidence of prior infection which caused cylicals to shoot up overnight. Even with a vaccine in place, with economies recovering at different speeds and furthermore with distribution speed of the vaccine to individuals also unclear, this rotation trend will likely play out longer and further in 2021.

2) Investors should be positioned for both growth and cylicals opportunities

What we can’t deny is that from a valuation perspective, cyclicals are likely oversold and will continue to see interest from investors as economic activity picks up. Then why should investors position for both? We think the runup for growth-orientated technology and healthcare stocks is not done yet even though valuations are on the higher end and we likely will see subsequent rotations back into these growth sectors. Although at AQUMON we take more of a diversified approach, it does make quite a lot of sense for investors to consider taking a more ‘barbell approach’ when looking ahead where a larger portion of your portfolio is exposed more to 2 sectors: growth orientated technology/healthcare stocks along with economically sensitive cyclical stocks. These sectors seemed to be best positioned when looking ahead.

Even though broad markets ran up significantly post US election (the MSCI World index is +6.51% post US election and +9.81% in November) we continue to remind investors that the road ahead will unlikely be that smooth heading into 2021 but investors should use these moments of weakness to accumulate since we continue to see upside into 2021.

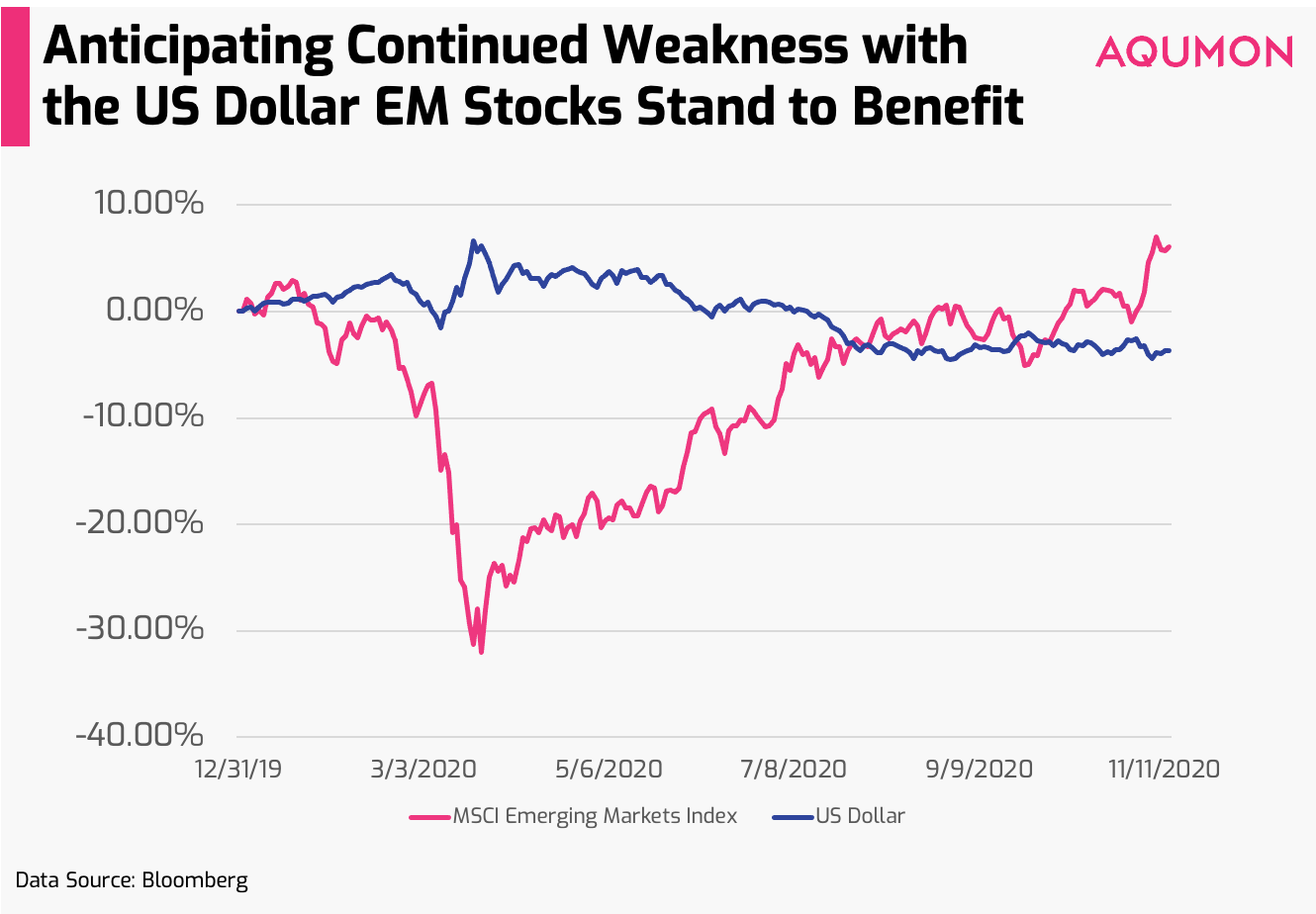

Continued weakening US dollar bodes well for emerging market stocks

Beyond cyclicals getting a boost another area investors should keep a close eye is emerging market stocks particularly regionally here in Asia:

Even though the US dollar has been on a downtrend -9.28% since March 23rd, we feel recent events along with looking ahead will put further pressure on the greenback. For example like what?

1) The US dollar is a traditional safe haven currency

Even though there still seems to be some back and forth in regards to the US election results, logically looking at the situation should yield the conclusion that it is a tough uphill battle for presidential candidate Donald Trump. Even when we approached the US election in early November, markets and investors alike started to price in less market uncertainty along with potential less trade tension with China. Even though uncertainties exist ahead, what we can say is we will more likely return to a period of more ‘geopolitical predictability’ which will weaken the US dollar.

2) US fiscal policy is not as supportive for the dollar

Traditionally speaking when the US economy is booming this attracts a lot of foreign capital and drives up the demand for the US dollar. On the flip side when things look uncertain investors will also flock to the dollar looking for safety. Considering the probable result of the US election is a divided government (with the Sentate going to the Republican party) this should create a situation where the amount of fiscal stimulus passed (to lift the economy) will be less than expected. With the US economy neither too boom or bust orientated, investors will look to diversify elsewhere globally weakening the dollar.

The biggest beneficiaries of a weaker dollar? Emerging market risk assets which typically outperforms during periods of dollar weakness relative to their developed market counterparts. Coupled with emerging markets (mostly in Asia) likely to emerge quicker out of the depths of COVID-19, we feel this is a good place for investors to hunt for opportunities as economies continue to slowly reopen.

If you have any questions, please don’t hesitate to reach out to us at AQUMON. We’re always happy to help. Thank you again for your continued support for AQUMON. Stay safe outside and happy investing!

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.