Manual stock-picking vs AQUMON SmartStock portfolios

Written by Catherine & Jobie on 2021-01-11

2021 has got to be a better year -- AQUMON has started 2021 fresh with a thematic SmartStock portfolio launch, so if you’re looking to start investing into stock markets this year, our products might come in handy!

Picking out individual stocks yourself, though has its advantages, is rather time-consuming. Before we tell you about all the good things about our SmartStock portfolios, let’s have a look at the pros and cons of investing in stocks.

Pros of investing in stocks:

-

Annualized returns up to 10%

According to the Hong Kong Census and Statistics Department, the annual inflation rate in December 2020 is +2.9%*. On the other hand, stocks have an annual return of 10% on average historically** -- better than the average annualized inflation rate of 2.9%.

*source: HKET

**source: Finra

-

Easy to buy and sell

It is relatively easy to buy shares of a company through a broker or financial planner… and now, you can even invest in stocks through AQUMON!

Cons of investing in stocks:

-

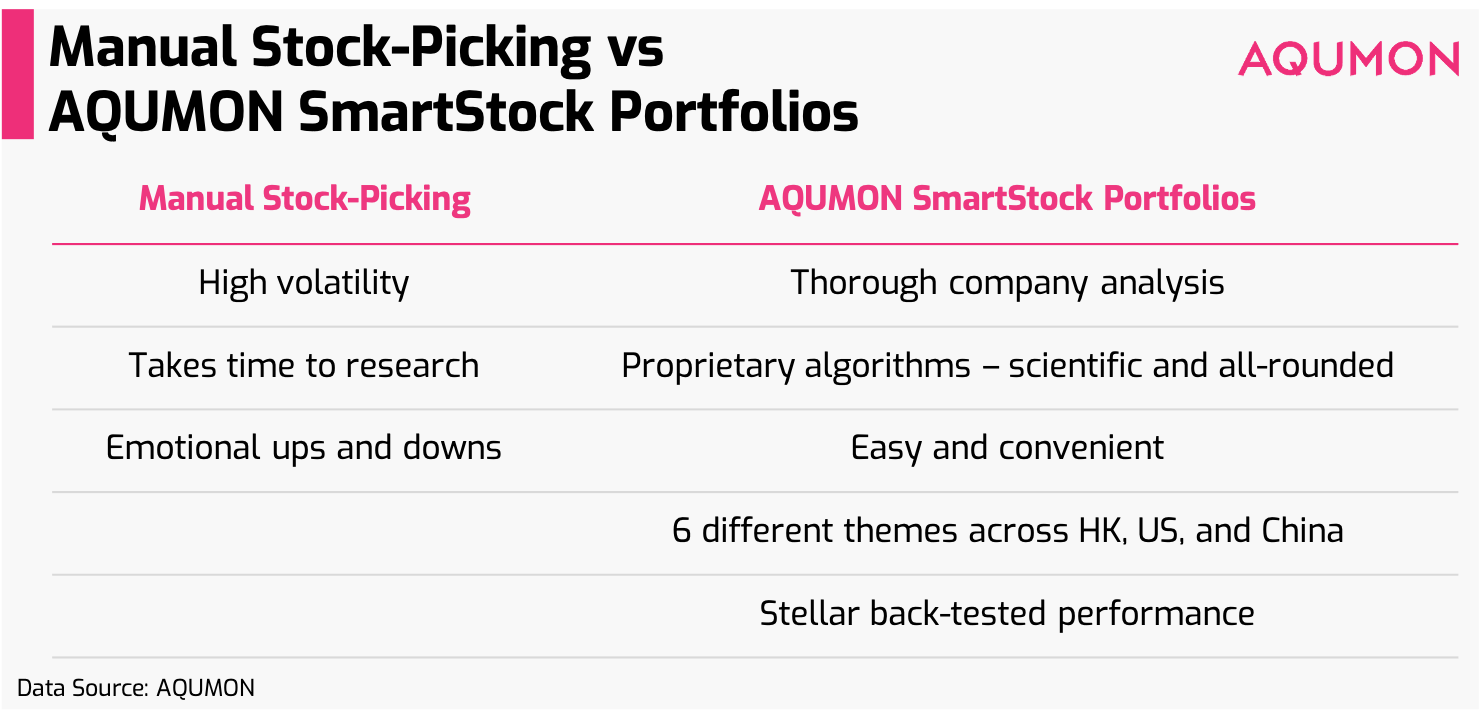

High volatility

There is a lot of idiosyncratic risks when investors only invest in one stock -- even a company with a solid foundation can be affected by controllable factors or unforeseeable events.

-

Takes time to research

You must research each company to determine its profitability before pulling your faith and money into it. You must learn how to read stock charts, financial statements, and annual reports.

On top of that, you’ll have to follow the news and monitor the stock market yourself.

-

Emotional rollercoaster

Stock prices rise and fall second-by-second. Don’t be constantly looking at the graphs, just be sure to check them regularly

This is when AQUMON smart stock portfolio comes in. We eliminate all these disadvantages of investing in stocks while giving you all the pros of it!

-

We do company analysis for you

We understand that for individual investors, researching a company can be time-consuming and you might be unsure of the accuracy and effectiveness of your research. But worry not! AQUMON’s SmartStock portfolios do all the company analysis for you through proprietary algorithms.

A University of Indiana study further highlighted that the buy recommendations of robo-analysts outperformed those of human analysts, suggesting robo-analysts seem to make better stock recommendations*.

-

Scientifically explore all factors: analyze each stock in a more comprehensive way

There are currently over 600 known factors, meaning individual investors do not have the time or resources to analyze everything themselves. You may choose to focus on a few key indicators, but do they give you the full picture?

With our PowerFactor algorithms, it analyzes each stock more comprehensively: we screen over 9,000+ stocks to pick the top 10+ stocks that give you the optimal returns.

-

Easy and convenient

Just like any of our products, we monitor your SmartStock portfolios 24/7 and trigger auto-rebalance alert when needed.

-

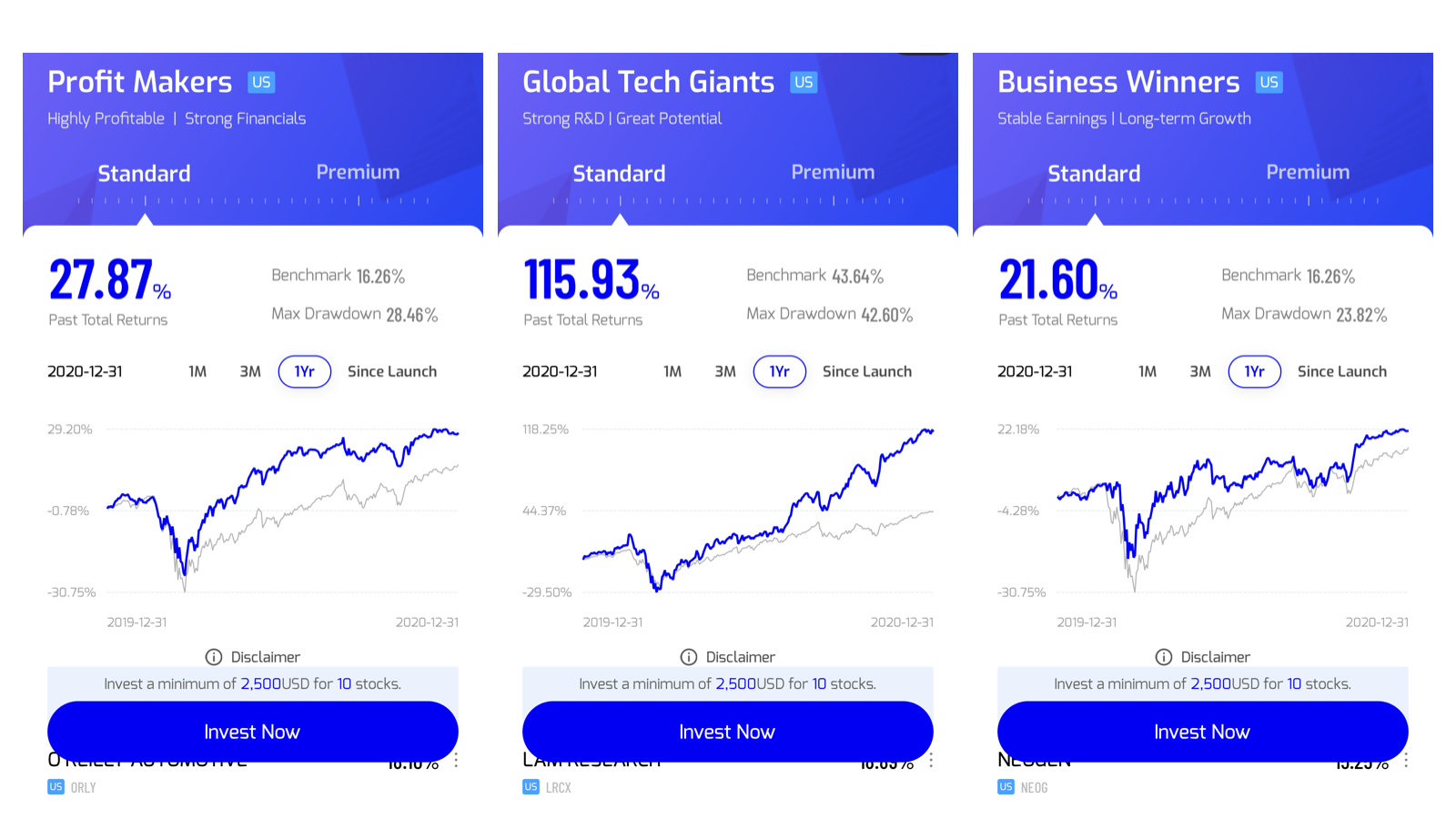

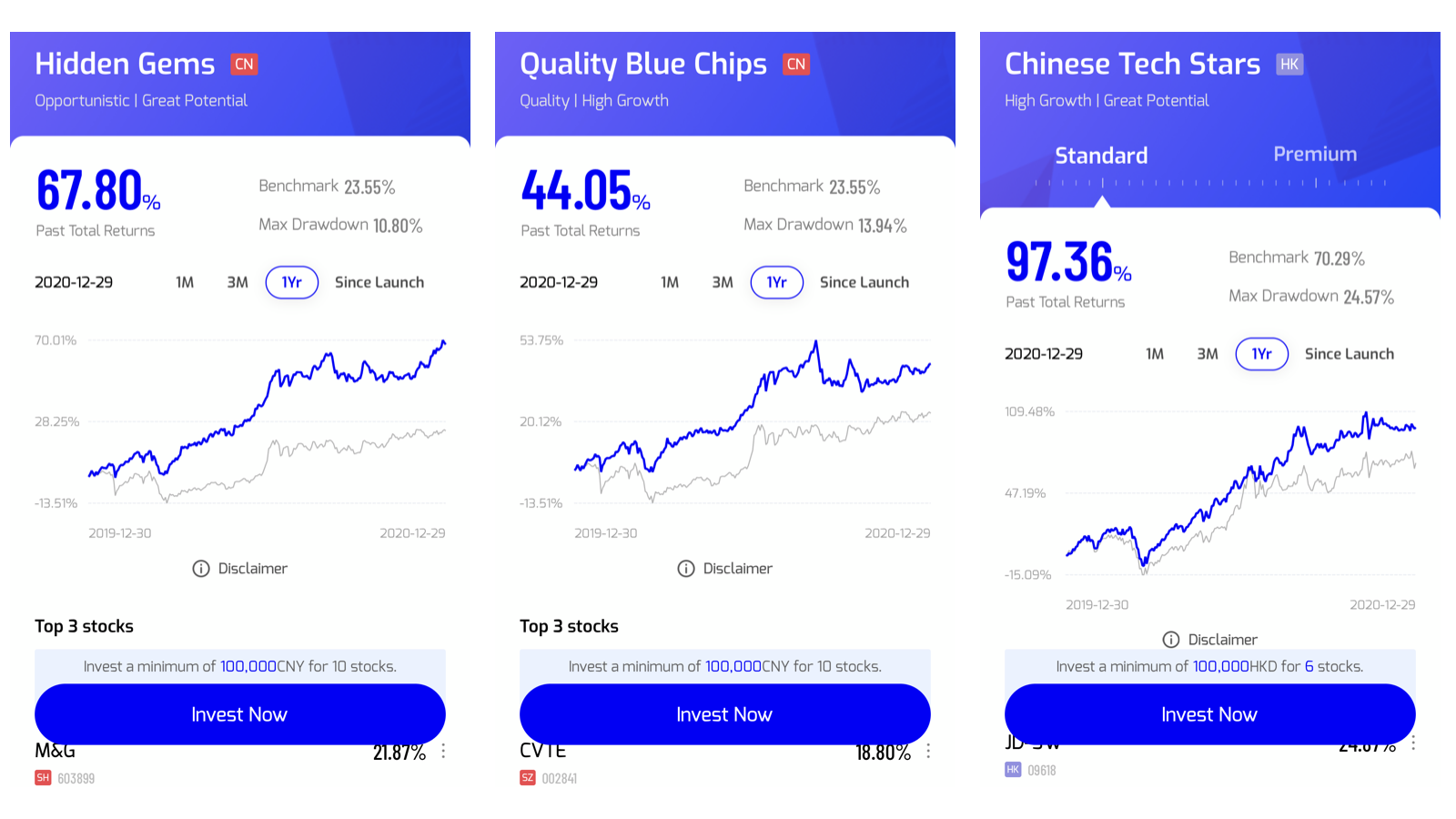

6 different thematic portfolios

AQUMON's SmartStock portfolios give investors more flexibility to get more concentrated access to regions, sectors, and themes that they gravitate towards.

-

Stellar performance

Our portfolio’s back-tested performances have outperformed major benchmarks -- showing promising returns.

For instance, our Business Winners, a US Stocks Portfolio, has an annualized return of 25.2%* -- +17% compared to US S&P 500!

*The above result is the back-tested performance from Oct 31, 2017 to Oct 31, 2020 with 0.05% transaction cost included. Investment involves risks. Past performance isn’t indicative of future returns.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.