Ranking the Most Profitable US Tech Stocks in 2021

Written by AQUMON Team on 2021-03-19

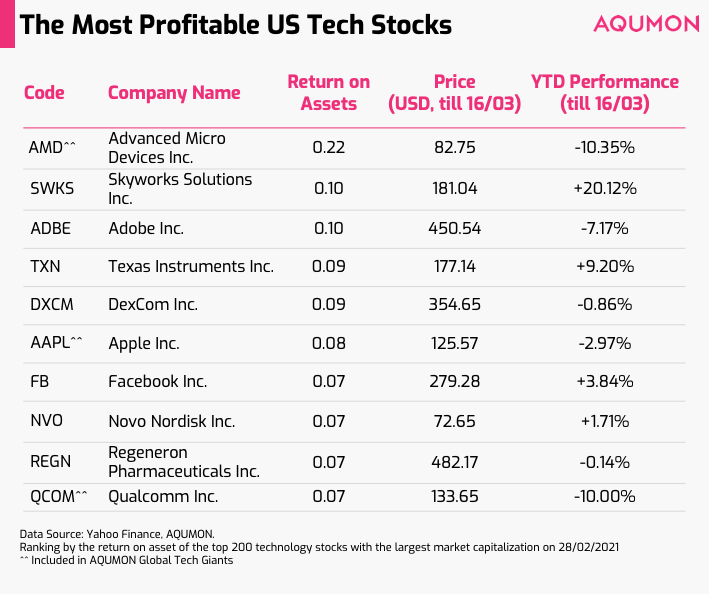

The most profitable technology stock goes to...? Hey, why is Apple (APPL) only ranked sixth? The most comprehensive list of 2021’s most profitable US tech stocks is now out! (updated to March 2021)

This past year it has been an absolute roller-coaster ride for US technology stocks. The US’ NASDAQ Composite Index was +9.37% in the first 6 weeks of 2021 only to tumble -10,54% 3 weeks after. In the past 2 weeks the index has rebounding +4.02%. Year to date the index is still positive +1.77% (*as of March 18). It’s been a roller-coaster ride indeed!

The stock market in 2021 has proved to be more volatile than last year, especially for technology stocks, yet many investors see potential buying opportunities in quality tech companies from the recent market corrections and increase their positions bit by bit.

We know that many of our customers are interested in technology stocks. Therefore, the AQUMON team has compiled a list of the most profitable US technology stocks in 2021 thus far. Some of the companies featured in this list are also included in our "Global Tech Giants" SmartStock Portfolio.

(*The "Global Tech Giants" SmartStock portfolio was launched in Jan 2021, allowing investors to invest in high-quality global technology stocks.)

"AQUMON is a leading digital wealth management platform in Asia. We use big data and algorithms to recommend investment portfolios based on the risk-tolerance level of each investor. This article introduces financial knowledge in a neutral manner. "

Why does a company’s profitability matter?

Particularly in the current period where inflation worries are driving investors to sell out of tech names due to future profitability and cash flow concerns, tech names with strong fundamentals will be able to weather the storm better. Profitability is a key metric used to determine if a company has healthy or unhealthy fundamentals. Let us explain further.

Sales revenue is a basic criterion used to evaluate a company.

Better sales performance is linked to healthier corporate growth. This relationship ultimately contributes to the long-term growth of a company’s stock price.

Regardless of how a company was founded or how staggering their user metrics are, companies have a fiduciary responsibility to generate revenue for their shareholders. This mandate is what ultimately keeps companies running in the long term.

Which technology stocks are the most profitable? How many of them are you familiar with?

The following ranking is based on the Return on Assets (ROA) of each stock (as of February 28, 2021)

RoA shows how efficient a company is at using its assets to generate earnings and is a strong indicator of a company's profitability.

*Income and stock price data are as of March 16, 2021

^^ This stock is included in AQUMON's SmartStock portfolio of global technology giants

More about the Top Ten U.S. Technology Stocks:

Advanced Micro Devices (AMD): The world's leading semiconductor company, which sells computer processors and graphics cards. Due to the rising demand for games and personal computers, the company's net income doubled in 2020.

Skyworks Solutions Inc. (SWKS): An analog semiconductor company and a cell phone chip manufacturer. One of its largest customers is Apple (APPL). SWKS can be categorised as a 5G concept stock.

Adobe (ADBE): A computer software company that has shown rapid growth in the past ten years. It was not significantly affected by the pandemic.

Texas Instruments Incorporated (TXN): The world largest supplier of analog chips as well as a semiconductor company with strong demand in the industrial and automotive markets.

DexCom, Inc. (DXCM): A medical device company. It is the world largest diabetes medical service provider, focusing on designing, developing and commercializing blood glucose monitoring systems.

Apple (AAPL): Manufactures and sells smartphones, personal computers, tablets, wearable devices and accessories.

Facebook (FB): The world’s largest social media platform. Its e-commerce business are becoming stronger under the pandemic.

Novo Nordisk (NVO): A multinational pharmaceutical company that focuses on diabetes medical services such as diabetic care, the provision of insulin delivery systems and related products.

Regeneron Pharmaceuticals Inc. (REGN): A biopharmaceutical company that develops, manufactures and sells drugs for the treatment of serious medical diseases.

QUALCOMM Inc. (QCOM): One of the world’s top two mobile phone chip manufacturers covering 3G/4G/5G chips. In the era of 5G networks, 5G mobile phones are becoming more popular, which benefits its business.

In short, most of the top ten companies with the highest return on assets (RoA) are those in the pharmaceutical industry and the chip industry.

These two industries have high technical barriers, requiring longer time and resources for research and development (R&D). With more investments into R&D, technological development is poised to grow in the future.

Despite the importance of RoA, we cannot assess the profitability of a company simply by looking at this metric. There are other important factors we have to consider when assessing the profitability of a company.

Investing in a technology stock is akin to buying into a “future accomplishment”. Why? Many growing or hot technology stocks currently operate at a loss. With the substantial amount of resources they put into R&D however, these firms are building up strong technological foundations in preparation for rapid growth in the future.

How do you assess the R&D strength of a company?

We know it is hard. Let AQUMON do the job for you! AQUMON utilizes big data and algorithms to filter and select potential stocks in a comprehensive and scientific manner. Each SmartStock portfolio includes multiple stocks, helping you diversify your downside risks.

AQUMONʻs Latest Product Upgrade:

Are you unsure about which stocks to buy? Do you have limited investment capital to diversify market risks? Consider investing in AQUMON’s SmartStock portfolios that cover US, HK or A-shares stocks.

In light of the recent market corrections, some technology stocks have dropped by more than 10% year-to-date returns (as of March 16). On the other hand, AQUMON's "Global Tech Giants" successfully diversified market risks and has delivered a positive YTD return (as of March 19) of 2.44%.

Starting from April 1, 2021, the investment threshold for AQUMON's "Global Tech Giants" portfolio will be lowered from US$2,500 to US$1,000! The number of stocks included in this portfolio will also increase from 10 to 30 stocks!

We’re excited to bring you higher quality investing at a much more affordable price point!

Download the AQUMON app now to start your smart investment journey!

If you have any questions, please feel free to contact AQUMON.

Related: Manual stock-picking vs AQUMON SmartStock portfolios

Related: 2 Reasons to Consider More International Exposure in 2021

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.