What are REITs and How to Invest in Them

Written by AQUMON Team on 2021-06-10

If you ask a random Hongkonger what their long-term financial goals are, chances are they’ll say: “I want to own my own apartment!”. Not only does owning property provide a stable place to call home, but it also serves as a great long-term investment option. However, many of us do not have the financial means to purchase our own property yet. That’s where the world of REITs can help you. REITs are a great, hassle-free way to reap the benefits of real estate investing without breaking the bank!

Related: What is ESG investing? The Ultimate Guide for Beginners

Related: Ranking the Most Profitable U.S. Tech Stocks in 2021

What are REITs?

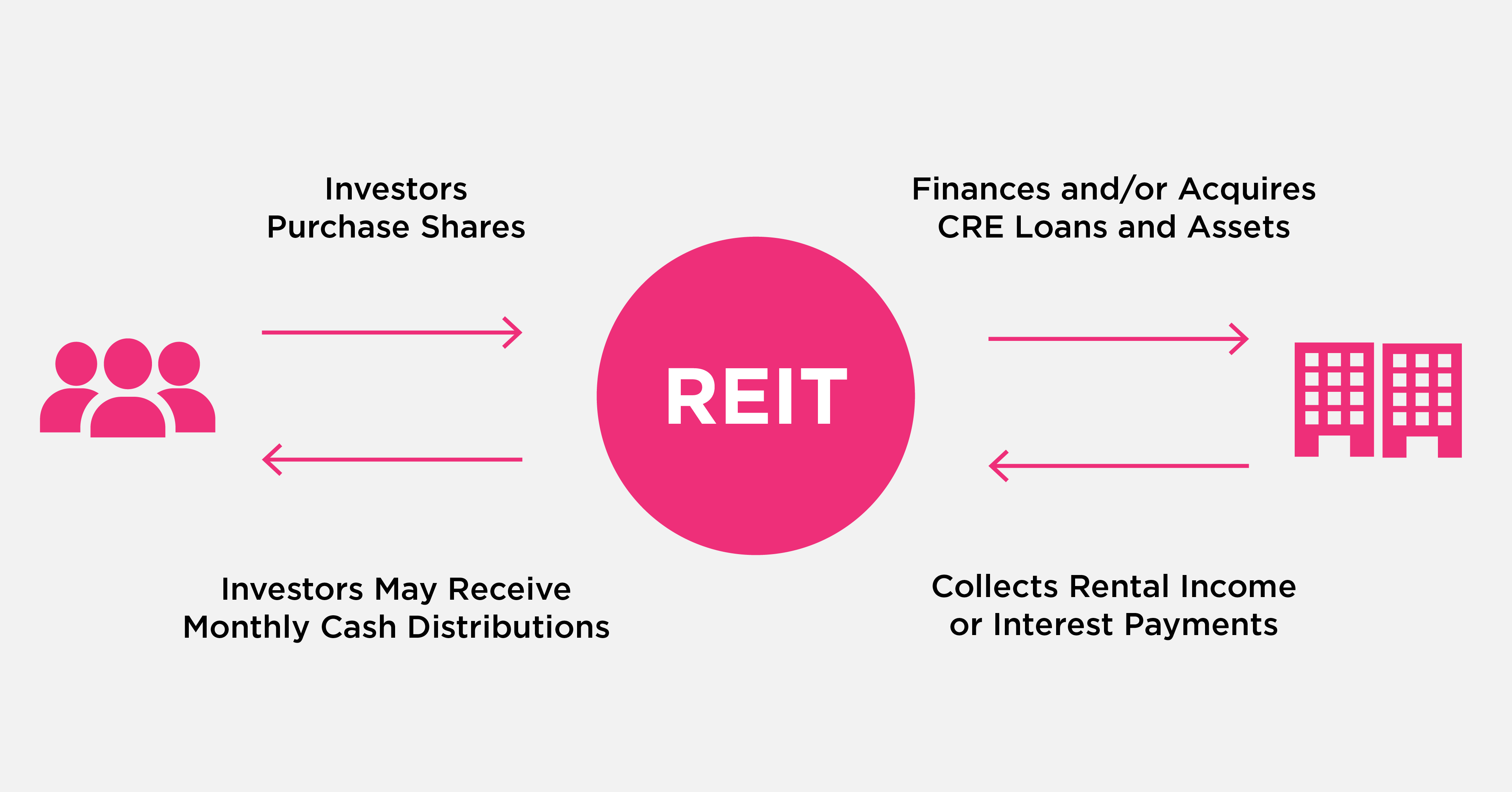

REITs, or Real Estate Investment Trusts, are companies that own, operate, and/or finance income-generating real estate properties. Similar to a mutual fund, REITs pool capital together from many investors. Afterwards, the REIT purchases properties to manage and lease out. Rent and interest payments are the main source of income for most REITs. Investors earn on their investments when the share price of a REIT increases. REITs in certain countries are also required to distribute monthly dividends to shareholders!

REITs vs. Traditional Real Estate Investing

So what makes REITs different from traditional real estate investing? One unique characteristic of REITs is that they are traded publicly like stocks, which allow investors to freely buy and sell their holdings throughout the day. This also allows investors to easily invest in multiple REITs across different regions and industries. As such, REITs are much more liquid and low-risk than physical real estate investments.

REITs can also be categorized by property and asset types. Different types of REITs may have different revenue sources and investor returns. Below are the two broad categories of REITs:

1. Equity REITs, which own or manage income-generating properties such as office buildings, data centers, residential apartments, shopping malls, etc. These REITs primarily generate income from rent charged on tenants.

2. Mortgage REITs (mREITs), which finance income-generating properties by purchasing or originating mortgages and mortgage-backed securities. These REITs primarily generate income from interest payments.

Why should I Invest in REITs?

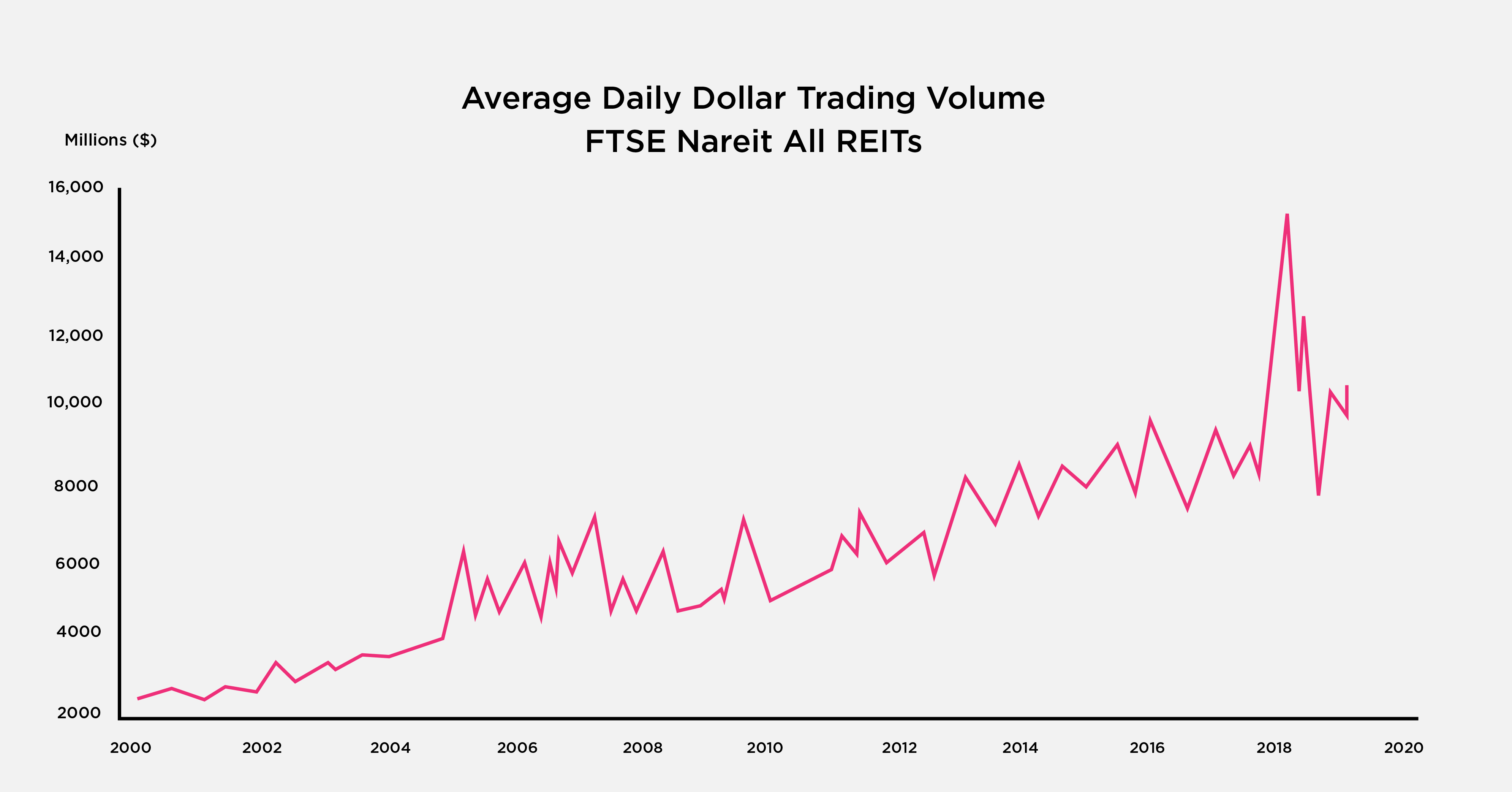

REITs are a rapidly growing asset class that have yielded historically high investment returns. Low investment minimums, increased diversification, liquidity, and high dividend and investment returns are all advantages that have attracted investors to REITs!

1. Easy Access to Real Estate Market

We all know that investing in physical real estate requires a large amount of capital. For many retail investors, the high cost of real estate inhibits them from investing in the market completely. REITs solve this problem by significantly reducing the minimum investment threshold. For example, with AQUMON’s “Property Moguls” REIT portfolio, you just need HK$10,000 to start investing in top real estate projects in Hong Kong and abroad!

2. Increased Portfolio Diversification

REITs are also a great way to diversify your portfolio! Specifically, they diversify portfolios by unlocking sectors of the real estate market that retail investors previously couldn’t access. For example, it is almost impossible for an ordinary retail investor to purchase a skyscraper or residential apartment. However, thanks to office and residential REITs, retail investors are now able to invest in all kinds of property types!

This, in turn, also diversifies and reduces portfolio risk. Real estate in general is an important asset class that all investors should consider incorporating as part of a well-diversified portfolio. REITs have historically demonstrated low correlation with other assets and the broader market.

3. Liquid and Hassle-free

As previously mentioned, REITs are much more liquid and hassle-free than traditional real estate investing. Publicly listed REITs can be traded throughout the day at flexible quantities of your choosing. Overall, REITs investing is much more time efficient, convenient, and low-cost than buying physical properties!

4. High Dividend and Investment Yields

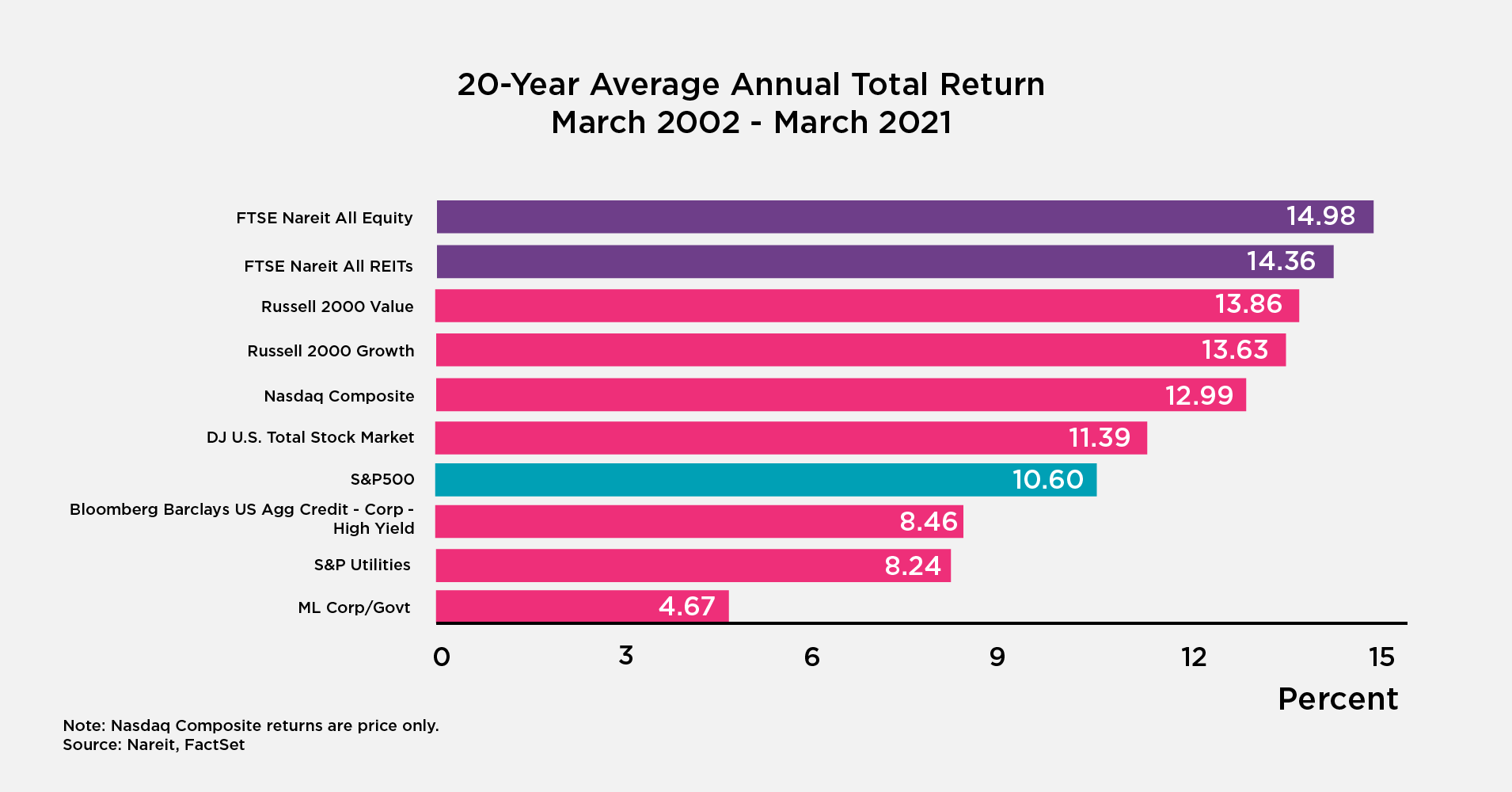

Lastly, REITs have high returns and are a fantastic form of passive income. REITs have historically outperformed many major stock indices such as the S&P 500 and Nasdaq Composite. This means that investors can expect large returns simply from trading REITs.

Moreover, investors can also enjoy regular REIT dividends. According to SFC regulations, Hong Kong listed REITs are required to distribute at least 90 percent of their annual taxable income as dividends to shareholders. This policy also exists in the U.S. for U.S. listed REITs. Thus, shareholders can expect to receive substantial dividend payments from their REIT holdings.

How can I Invest in REITs?

Want to start investing in REITs? Thankfully, REITs investing is as simple as opening a brokerage account. Since many REITs are publicly listed, retail investors can buy and sell REITs like any other stock throughout the day. REITs are a fairly popular asset type that are available in North America, Europe, Asia, and many other markets!

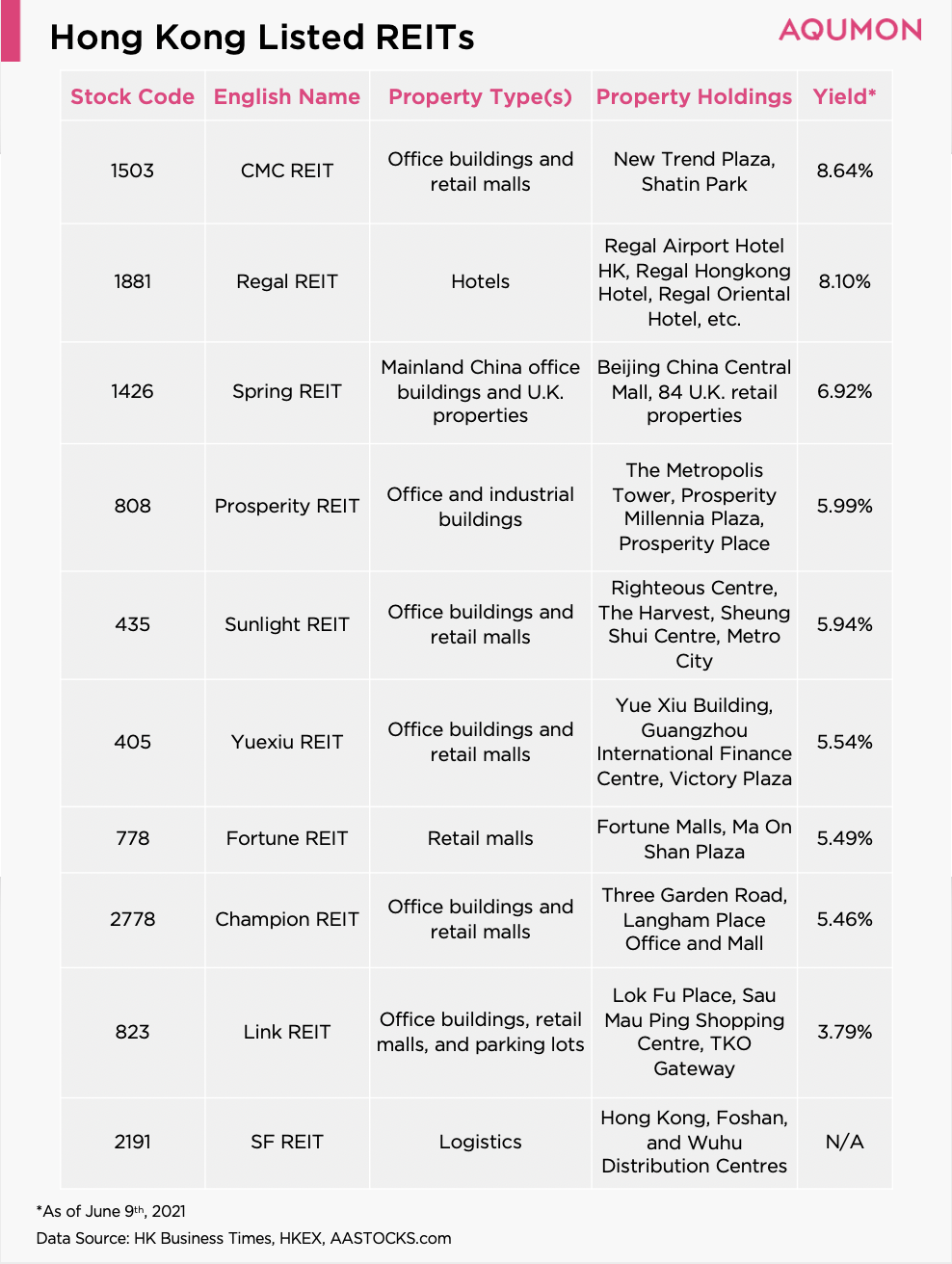

Hong Kong Listed REITs

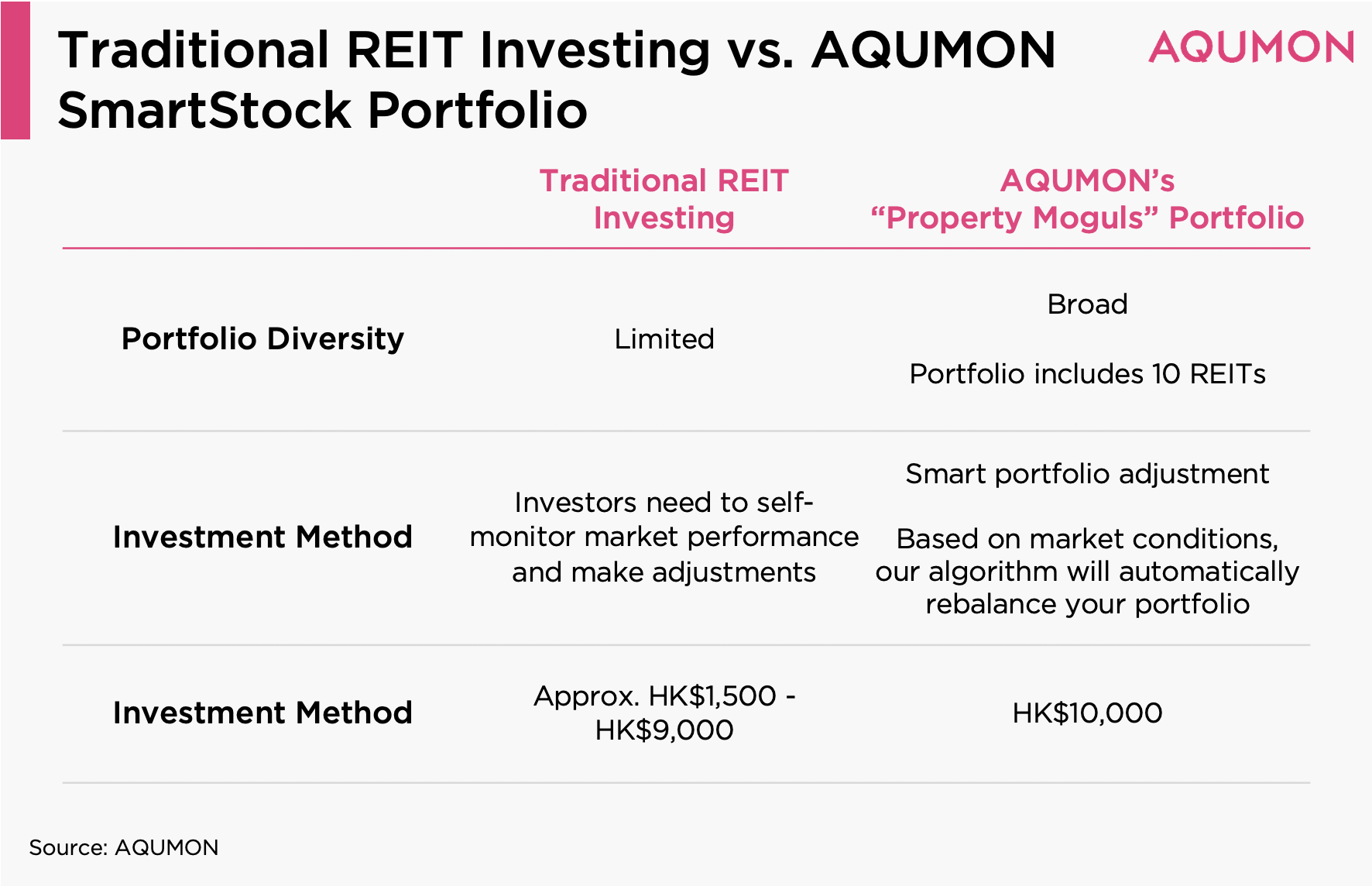

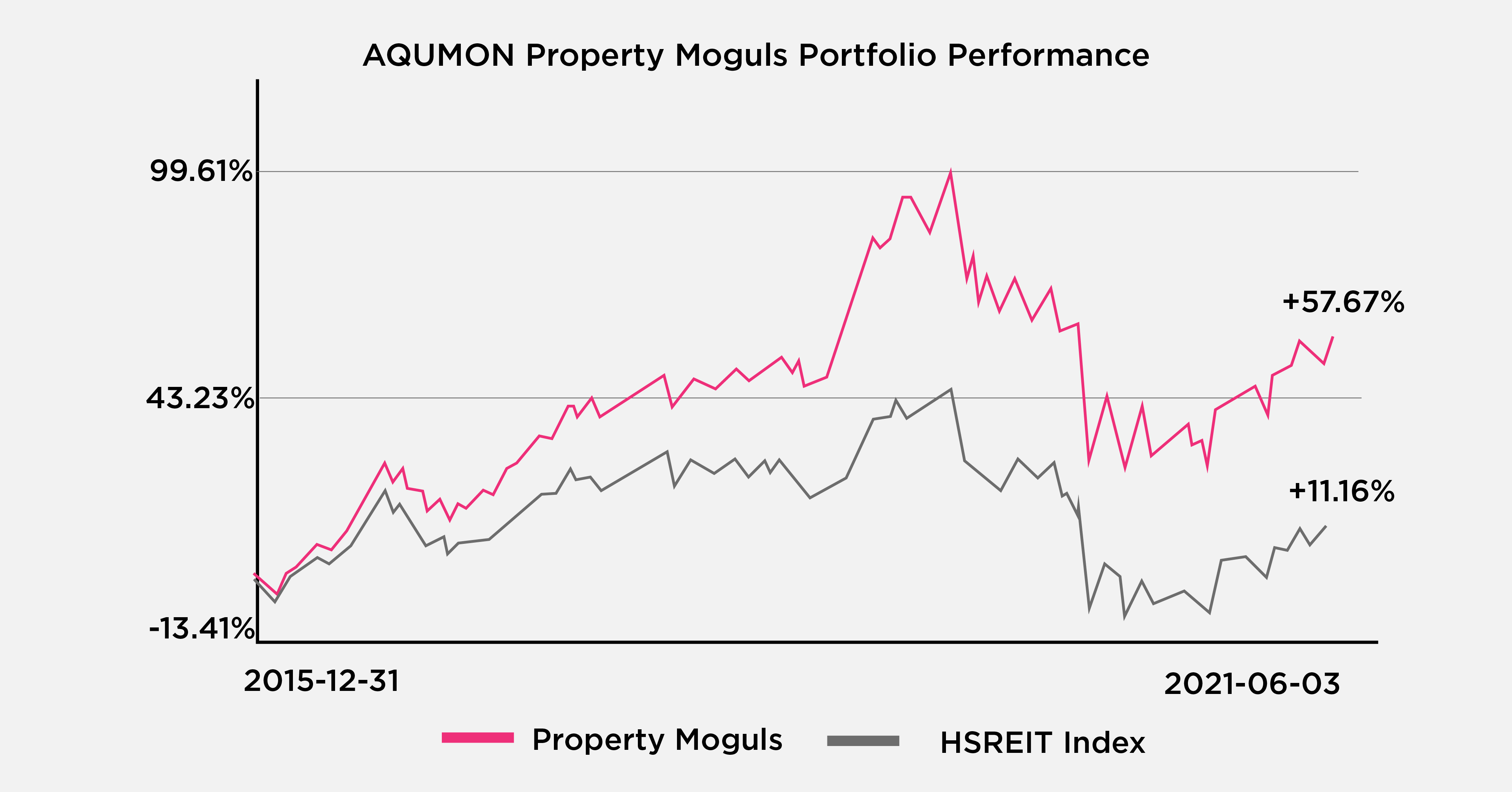

Needless to say, there are a lot of REITs available on the market! If you’re unsure of where to get started, try out AQUMON’s “Property Moguls” REIT portfolio! With just HK$10,000, you can invest in top real estate properties in Hong Kong and overseas. Our portfolio, which consists of 10 Hong Kong REITs, has consistently outperformed the Hang Seng REIT index and other real estate indices.

Related: AQUMON's Flagship Products and SmartStock Portfolios

Compared to investing in individual REITs, our “Property Moguls” portfolio promotes risk diversification and optimizes returns and volatility. AQUMON’s thematic SmartStock portfolios use big data and proprietary algorithms to help investors achieve their investment goals at a lower cost. The portfolio is also managed by AQUMON’s professional analytics team according to the most up-to-date market information for a better investment yield.

Related: Manual stock-picking vs. AQUMON Smartstock portfolios

Related: Catalysts on the Horizon but Bumpy Ride in 2021

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.