2021 AQUMON Half-Year Performance Review

Written by AQUMON Team on 2021-07-19

Market Review

Overall Performance

Looking back at the first half of 2021, global markets showed an overall upward trend despite periodic drawbacks: equity indices in almost all markets ended in the positive returns.

Two Highlights of 2021 H1: Economic Recovery and Rising Inflation

There were increased vaccination rates and better pandemic control in the first half of 2021, lockdowns were gradually lifted in many countries across North America and Europe. Therefore, demand for commodities (e.g. coffee, gold, wheat etc.) rebounded as the economies started to recover.

The economic recovery also caused the energy demands to increase sharply. With a return of 44.32%, Brent Crude oil became the best-performing asset class of the first half of 2021. Other top performers in the U.S. market were primarily in the oil and gas, transport, and steel sectors. In fact, four of the top five rising stocks in the S&P 500 were energy stocks. Among them, Marathon Oil (MRO) came out on top with a half-year gain of 105.56%!

Moreover, in an effort to promote economic recovery, U.S. President Joe Biden actively promoted several large-scale infrastructure projects. This further promoted growth in the steel sector.

For example, Nucor steel soared 80.4% in the first half of the year, and U.S. steel rose more than 40%. Hong Kong stocks, the oil sector also performed well, PetroChina surged 62%, major institutions still continue to look at high oil prices in the future performance. Within Chinese A-shares, the steel and mining sectors led the way, soaring 25.22% and 22.48%. This further indicates economic recovery is boosting stock markets around the world.

Jumpstarting the world economies also caused a rapid increase in demand for semiconductors (think technology appliances). This led many companies to experience a “chip shortage” problem in the first half of the year. Given all this demand, the semiconductor and related industries grew by over 38% while downstream companies underperformed.

"Rising inflation" has also been one of the key highlights in the 2021 market so far. Since the outbreak of the pandemic in early 2020, the Federal Reserve has been vigorously pumping money into the economy (these are known as Quantitative Easing Strategies - Econ 101).

This injection of money into the market has undoubtedly pushed up prices. Consumer Price Index (CPI) data released by the U.S. Department of Labor showed that the CPI surged 5% year-over-year in May. This was higher than the expected value of 4.7% and is the largest increase since the summer of 2008. The core CPI (excluding food and energy) rose 3.8% year-over-year. This was higher than market expectations of 3.5% and is the largest increase since 1992. Given both indicators exceeded market expectations, this indicates that the Fed is likely to raise interest rates in the future to curb the risk of inflation and put some pressure on the stock market.

AQUMON’s Investment Strategy

In light of the current economic environment, AQUMON's thematic SmartStock portfolios have increased exposure in some aggressive growth sectors and reduced some investments in defensive sectors as part of our strategies. Let's have a look at a few select SmartStock and ETF portfolios:

Hong Kong SmartStock portfolios:

The Chinese Tech Stars portfolio is primarily invested across a broad spectrum of technology companies, with some investments in select consumer sectors and healthcare that also have technology exposure.

The Hong Kong Market Leaders portfolio in comparison has successfully captured some of the best performing sectors in the first half of the year, including energy, utilities and raw materials, all of which are important sectors benefiting from the economic recovery.

Related Reading: H.K. Stocks 2021: The 2 Best Ways to Find Top Performing Stocks

U.S. SmartStock portfolios

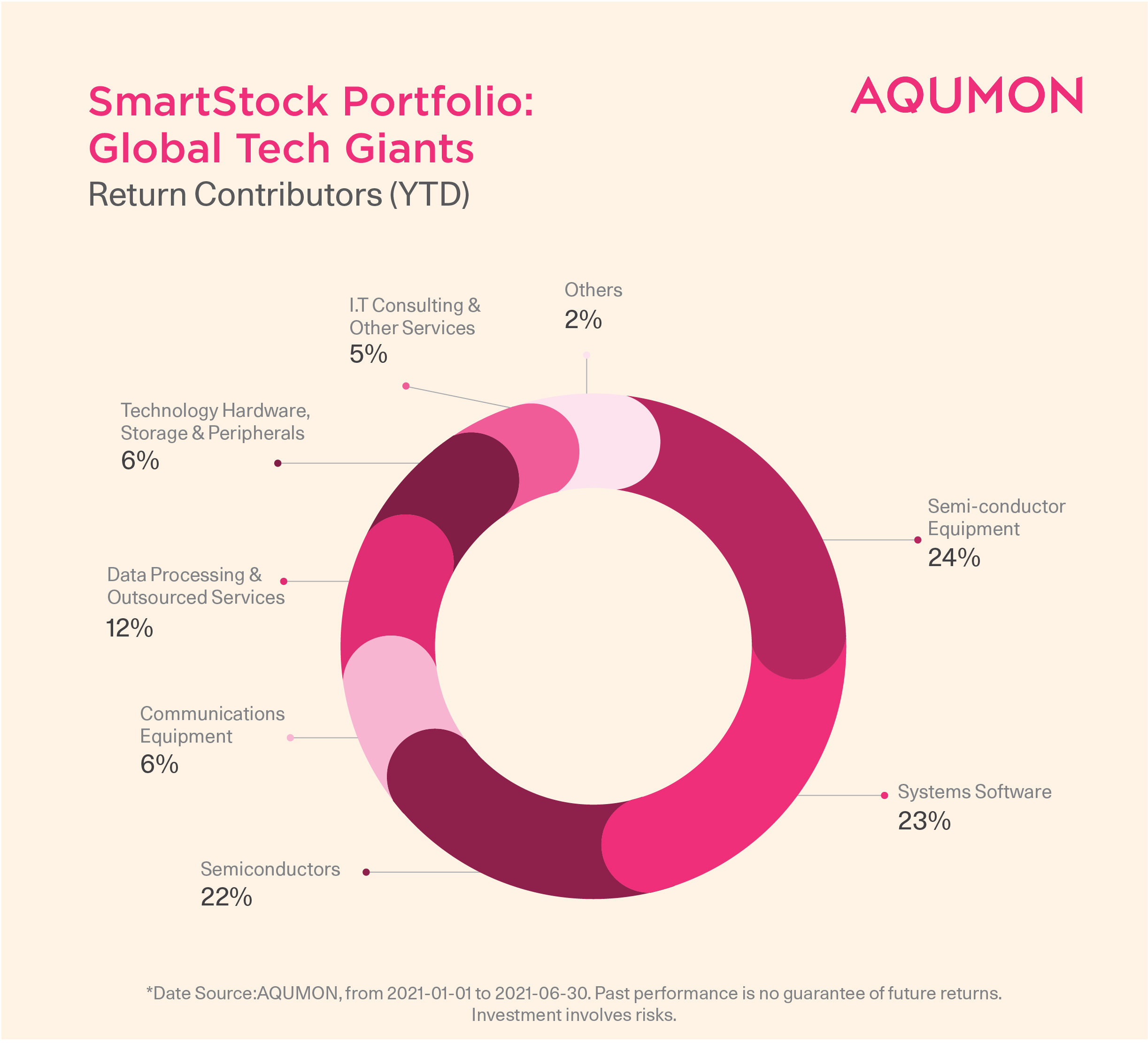

The Global Tech Giants portfolio was more highly allocated to broad semiconductor and semiconductor equipment orientated companies. Mainly benefiting from the wave of chip shortages during the economic recovery, semiconductor stocks saw large rains returns as a result.

Exchange traded fund (ETF) portfolios

In terms of our ETF asset allocation strategy, we have also made some adjustments to our flagship SmartGlobal portfolio series taking into account the trend of "increasing inflation".

Take SmartGlobal Max (investing into U.S. ETFs) as an example.

In terms of bonds, we have added an anti-inflation ETF called Vanguard Short-Term Inflation-Protected Securities Index Fund ETF (VTIP) to the scope of the original global asset allocation to counter raising interest rates in the near future. To curb inflation, we have also reduced the portfolios’ long-term US bond ETF called Barclays Capital Aggregate Bond Index’s (AGG) proportion.

In terms of stocks, as the global economy recovers, the style of the US stock market is expected to change and we anticipate value stocks will perform better. As a result we have increased the allocation to the value stocks using the Vanguard Value Index Fund ETF (VTV) and increased the proportion of the better performing Asia-Pacific and European region via the Vanguard FTSE Pacific Index Fund ETF (VPL) and the Vanguard FTSE Europe Index Fund ETF (VGK). Lastly, we have reduced our allocation to the underperforming Chinese A-share market through the Xtrackers Harvest CSI 300 China A-Shares ETF (ASHR).

How Has AQUMON Performed?YTD Gains as High as 18.48%!

SmartGlobal Flagship ETF Portfolio

Launched in 2018, the SmartGlobal series uses renowned Nobel Prize winning theories (Markowitz Efficient Frontier Curve, Black-Litterman model) to develop portfolios with the best return to risk ratio.

The series is divided into SmartGlobal Max (which includes U.S. ETFs) and SmartGlobal (which includes Hong Kong ETFs). Both portfolios achieved positive returns in the first half of 2021.

AQUMON’s portfolios are designed to add value to clients' assets from a long-term perspective. Each client invests in a different portfolio depending on their risk type. The higher the risk, the higher the proportion of risk assets in the portfolio that are in equities. For clients with lower risk tolerances, a greater proportion of portfolio assets are in bonds.

Over a longer performance period, the portfolio's one-year annualized return reached as high as 28.46%, making it the preferred investment choice for new clients seeking stability.

SmartStock Thematic Portfolios

AQUMON launched our thematic SmartStock portfolio series (covering Hong Kong stocks, U.S. stocks and A-shares) in January 2021.

Incorporating the industry's cutting-edge factor investment technology, we use our independently developed PowerFactors® investment strategy to quickly identify high-potential stocks and assemble them into quality stock portfolios.

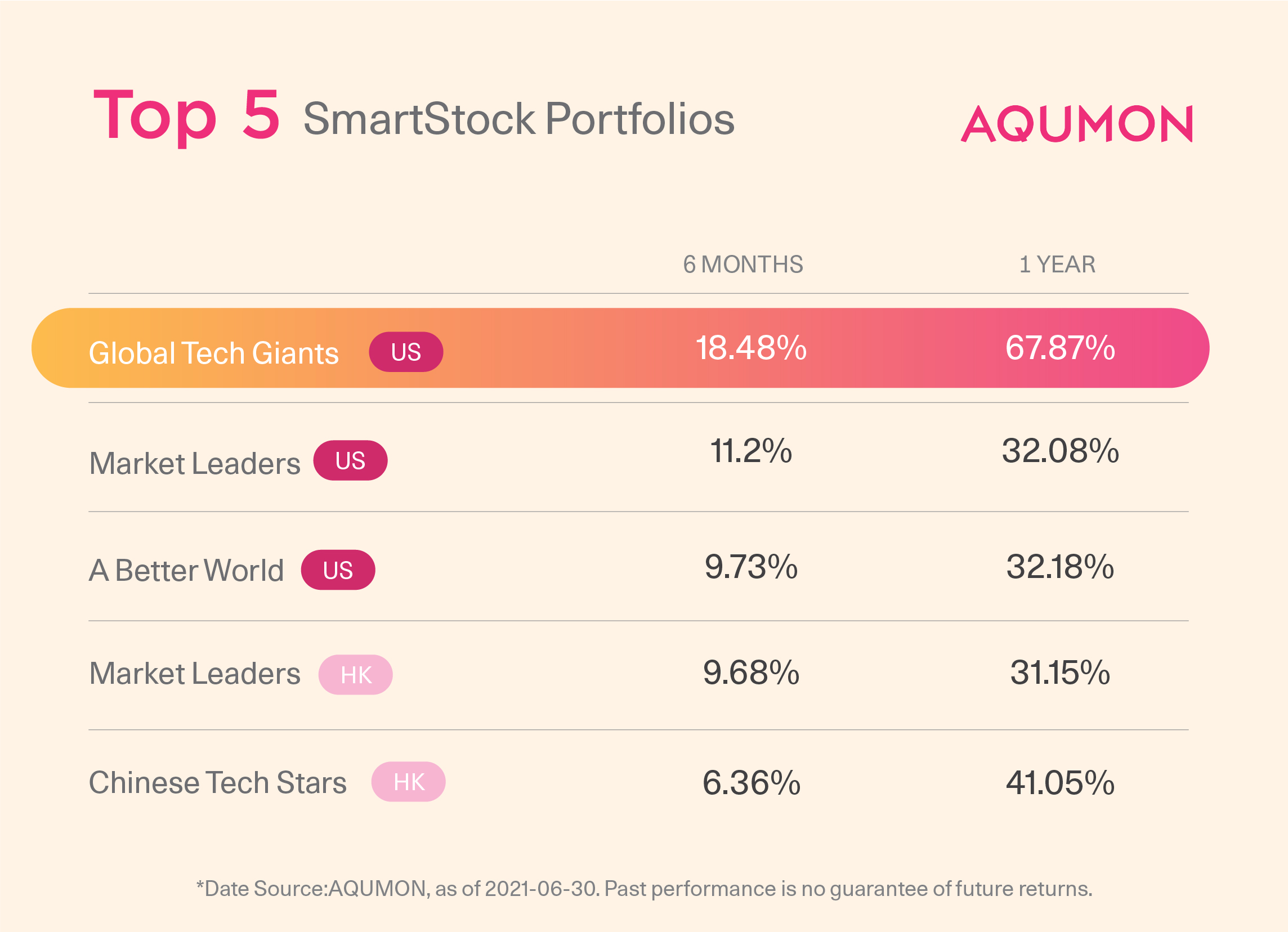

Below are our top 5 most popular stocks purchased by our clients:

Top 5 Most Popular SmartStock Portfolios

*Scientifically backtested data as of June 30, 2021

AQUMON's Hong Kong and U.S. portfolios have achieved positive returns across the board. Different thematic portfolios cater to different industries, risk types, and investment strategies. As such, you’re bound to find something that suits you from our thematic portfolios.

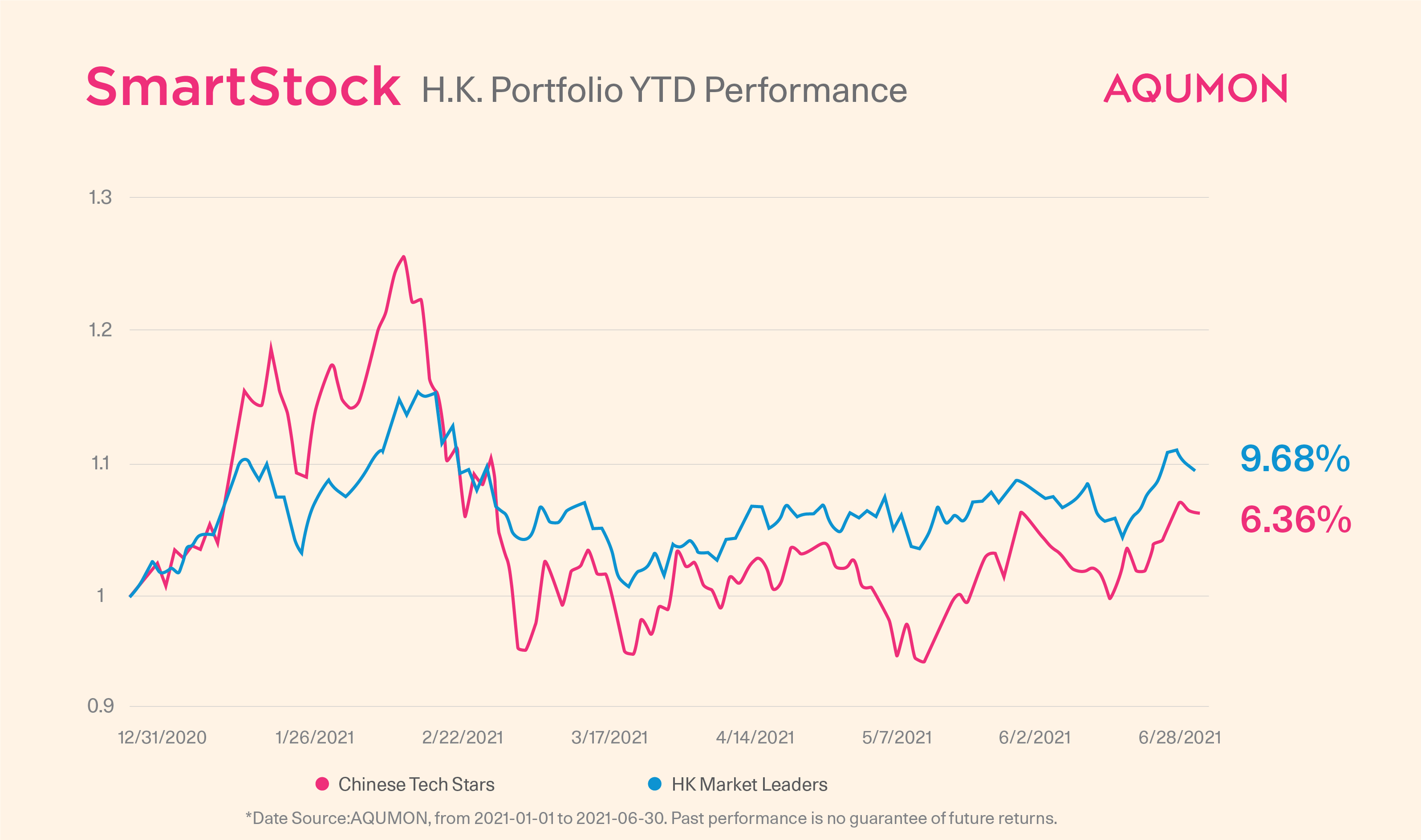

If you are interested in Hong Kong technology stocks, investing in AQUMON's Chinese Tech Stars portfolio has a considerable gap with the U.S. technology stocks: up 6.36% in the first half of the year. With the Hang Seng Technology Index -3.2% year-to-date return, the Chinese Tech Stars portfolio outperformed by almost 10%.

Related Reading: Ranking the Most Profitable US Tech Stocks in 2021

AQUMON’s ability to outperform the benchmark is also due to our thorough stock screening and investment ratio control through multiple factor data. When investing in technology stocks, we not only measure the company's stock price performance, but also its profitability, R&D capability, cash flow, balance sheet ratio, and other indicators. Our algorithms will periodically adjust the stock positions in the portfolio based on market conditions.

One thing to note is that although technology orientated growth stocks can deliver higher returns, they are also inherently more volatile. Even though Chinese technology stocks soared on average 25% in the first 2 months of 2021, they have also fallen following the 2021 Chinese New Year market drop and thus our Chinese Tech Stars portfolio also retraced as a result.

During the same period, the performance of the Hong Kong Market Leaders portfolio, which has China tech exposure but also is more heavily allocated towards the more blue-chip orientated Hang Seng Index stocks, has been more stable and less volatile in comparison.

In terms of the specific reasons for these gains, stocks in the energy and utilities sectors contributed nearly 60% of HK Market Leaders portfolio’s gains. In addition, the raw materials, industrials, and telecommunications sectors also performed well. Other sectors such as consumer goods and real estate contributed 1% cumulatively.

It is recommended that investors consider both their risk tolerance and thematic preferences when choosing the right stock portfolio for them. AQUMON is committed to earning high returns for you while also closely following the benchmark index.

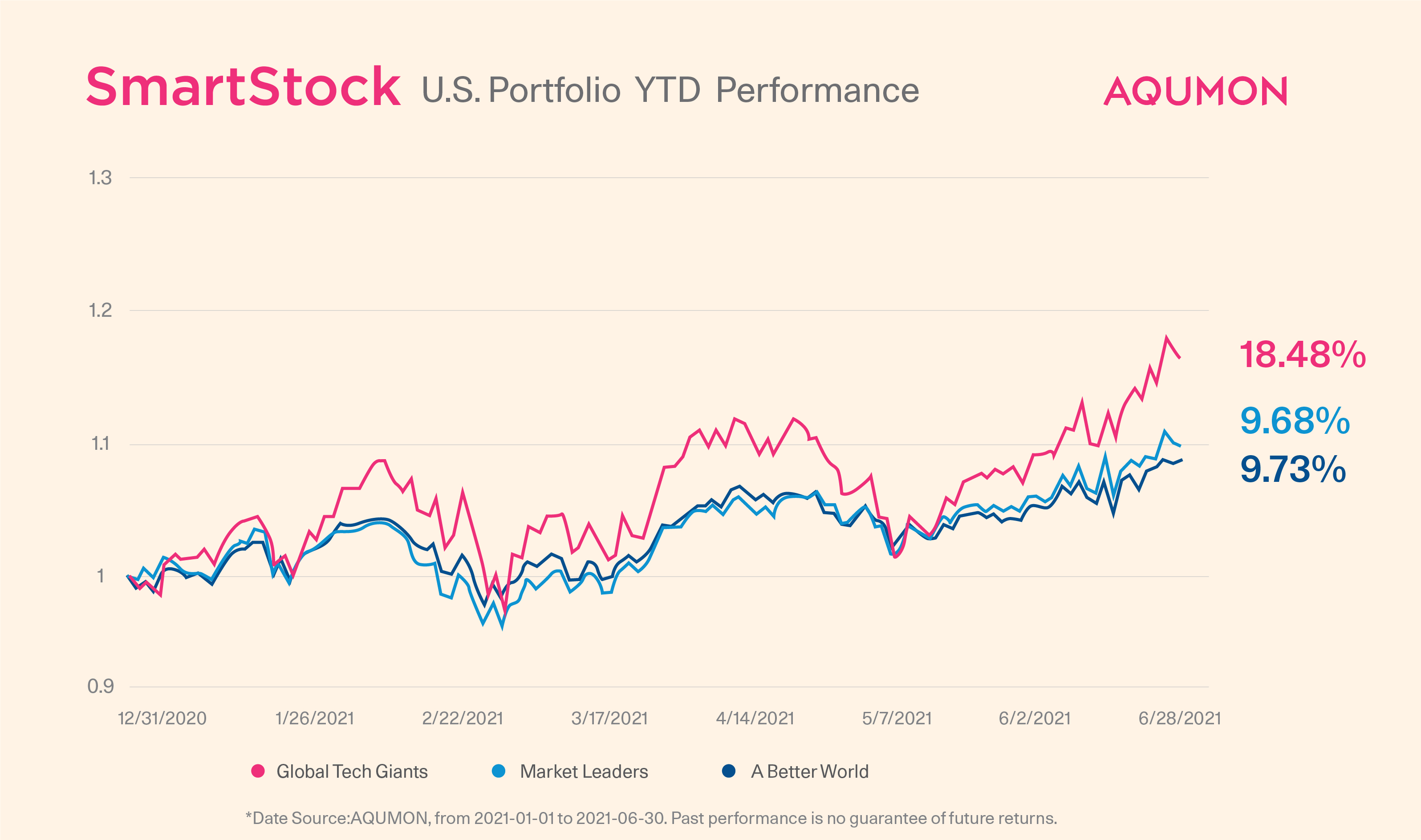

Looking at the performance of the U.S. portfolios, the Global Tech Giants portfolio has been more volatile but has also yielded better returns. Global Tech Giants was the best performing portfolio with a year-to-date return of 18.48%.

Related Reading: 2 Smart Ways to Pick Quality Tech Stocks in 2021

The semiconductor, semiconductor equipment, and systems software sectors contributed the most to the portfolio, accumulating 70% of the gains. Due to economic recovery, the global chip shortage undoubtedly boosted the rise of related technology sectors. With rising market sentiment of the whole technology sector, the Global Tech Giants Portfolio successfully captured the chip sector, which is a worthy position in the technology industry, and achieved considerable returns in the first half of the year.

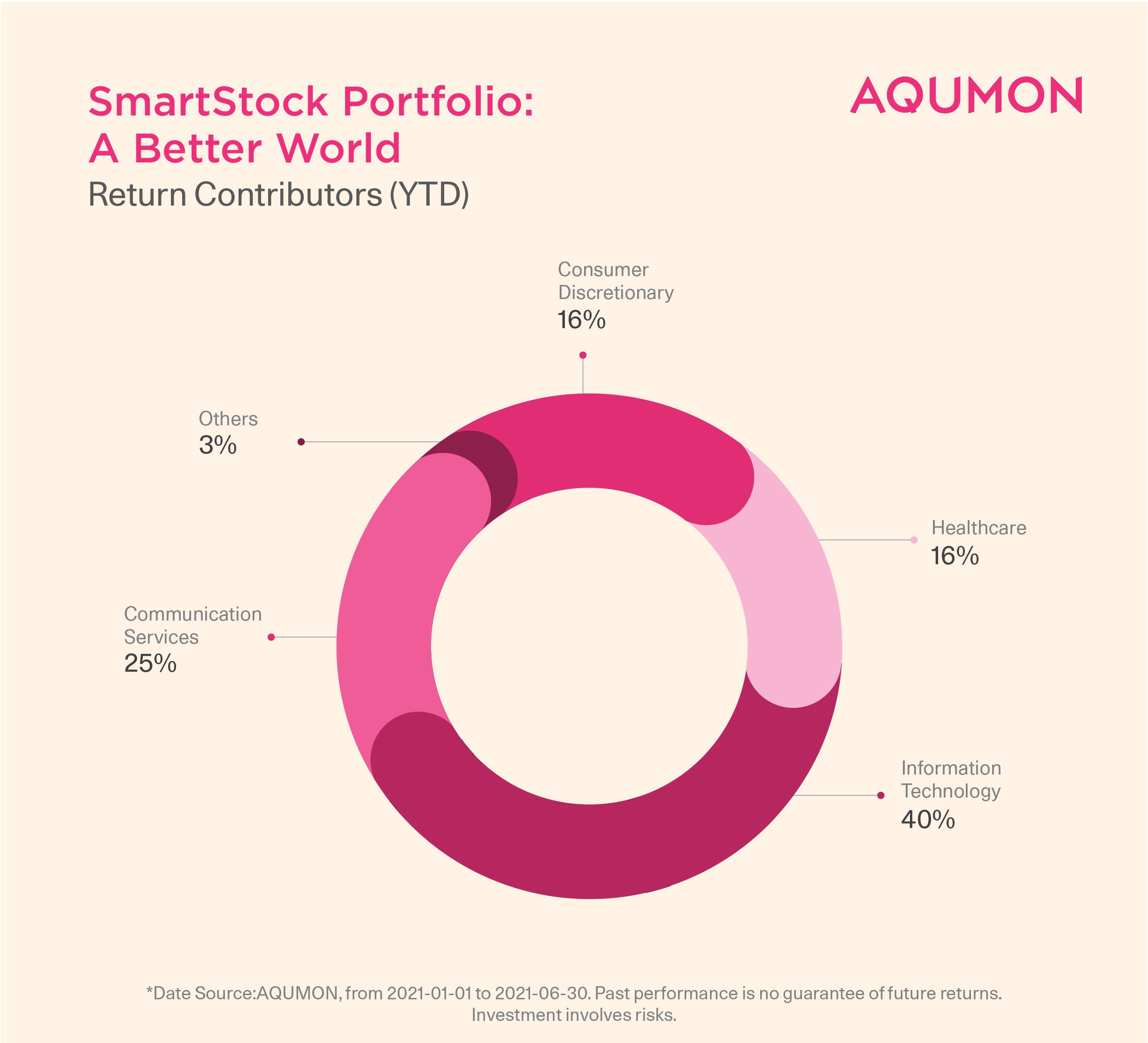

ESG is this year’s hot investment topic! Investors can support good causes by investing in "green investment" themed companies. “A Better World” is a portfolio developed by the AQUMON team specifically for investing in ESG-themed companies.

Besides only considering companies with higher ESG scores, AQUMON also excludes companies in specific industries, such as tobacco, coal and oil production, defense and military. Furthermore, we select high quality companies based on fundamental factors such as overall R&D strength and profitability.

Related Reading: What is ESG investing? The Ultimate Guide for Beginners

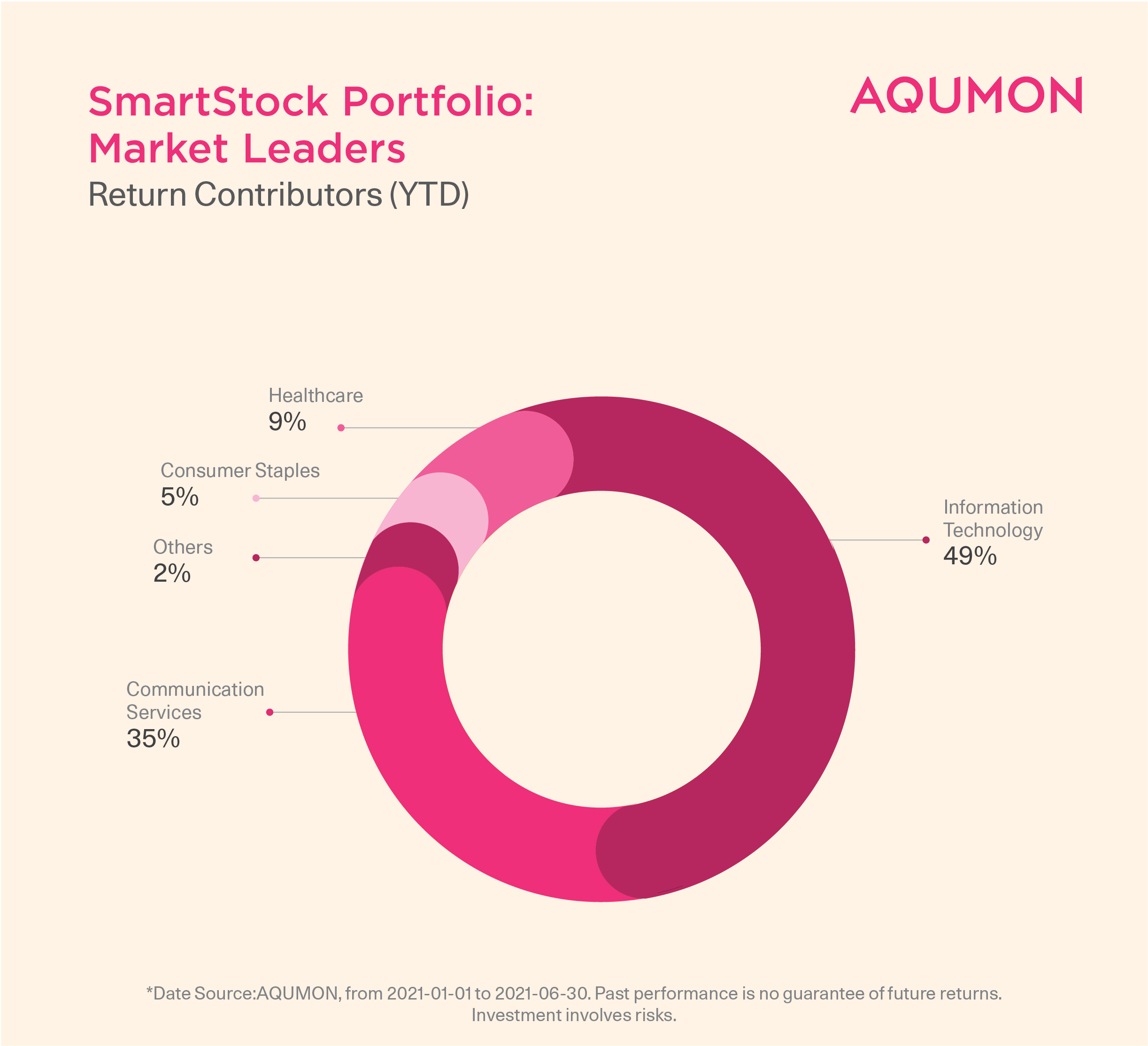

The U.S. Market Leaders is a large collection of quality companies from all industries in the U.S. stock market.

Compared to technology stocks, the U.S. Market Leaders and A Better World portfolios have a more consistent performance, which are suitable for more stable investors. In terms of returns, they have both gained nearly 10% year-to-date with the technology, telecom and healthcare sectors being the main return drivers.

Outlook for 2021 H2

The economy is improving, but watch out for the Fed and pandemic recovery risks

The general market expectation is that the stock market will continue to rise in the second half of the year as the economy recovers. However, stock market gains in the second half of the year may not be as strong as in the first half.

The Fed may begin to discuss slowing the pace of bond purchases, which could have a short-term impact on U.S. stock market sentiments. Although the time frame for the bond repurchases is uncertain, many investors expect Fed officials to discuss it at the Jackson Hole annual meeting in late August.

As for the impact of COVID-19, analysts are relatively optimistic despite the Delta variant spreading in dozens of countries around the world and causing some countries to restart or extend their lockdowns. However, the world has already started to promote COVID-19 vaccination while organizations around the world are more experienced and prepared to deal with the outbreak. Even if the pandemic returns later this year, the impact on the economy will be much smaller than in 2020.

AQUMON’s Future Plans

AQUMON will continue to uphold the mission of empowering investors with technology in the second half of 2021 and continue to bring "new upgrades" to our clients!

Starting from July, AQUMON customers can trade Hong Kong, U.S., and A-shares in the AQUMON app and experience our one-stop investment service. In the coming months, we will focus on the following features: portfolio financing function, smart investment, improved customer experience, and more data algorithm-driven investment strategies.

Related Reading: 【Product Upgrade】US Stock Trading is Live!

In order to cope with the ever-changing market, we all need a scientific and effective investment approach. As the economy recovers and the market continues to improve, we recommend that investors take a long-term approach to investing!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.