ESG Investing: Debunking the Myths

Written by AQUMON Team on 2021-08-16

As global ESG assets are on track to exceed $53 trillion* by 2025, representing more than a third of the $140.5 trillion in projected total assets under management, we can no longer ignore this soaring investing trend anymore.

*Source: Bloomberg Intelligence

In addition to the existing ESG US Stock Portfolio, AQUMON has just launched a new stock portfolio - ESG HK which utilizes an algorithm-based ESG rating system to select potential stocks.

AQUMON’s ESG US stock portfolio is one of our top five most popular portfolios in the first half of 2021, it has also delivered by achieving 14.67%* year-to-date returns.

*Data from 2020-12-31 to 2021-08-13. Investment involves risks. Past performance does not indicate the future.

We know investors have a number of questions in regards to ESG investing such as:

Is ESG investing solely environmentally friendly?

Is ESG investing popular in Asia Pacific?

Are ESG investments not as profitable as other investments?

Continue reading to learn about the 3 Key Questions investors may often encounter while looking into this “ESG” trend.

Myth 1: ESG = solely environmentally friendly?

No. ESG stands for 3 different investment factors: Environmental (E), Social (S) and Corporate Governance (G).

Hong Kong Exchanges and Clearing (HKEX) defines ESG as “matters related to a listed company’s sustainability, its impact on the environment and the wider society within which it operates”.

These three pillars are not statements of what the company does as a business, but guiding factors of HOW the company operates.

Extended Reading: What is ESG investing? The Ultimate Guide for Beginners

Are ESG equally attractive from a money managers’ point of view?

Although Environmental (E), Social (S) and Corporate Governance (G) are often treated as an inseparable combination of assessment factors when we talk about ESG investing, they do show individual differences when it comes to their ability in attracting investors’ money.

According to research by US’s Forum for Sustainable and Responsible Investment(SIF): Environmental (E) and governance (G) criterias are emerging as the main leaders in attracting capital, growing at 58% and 47%, respectively, since 2018.

In 2020, 2 out of 5 top ESG criteria for money managers are Environmentally (E) related, of which Climate Change/Carbon is ranked first with total assets of USD$4.2T, outperforming the second top criteria Anti-Corruption, by USD$2T.

Companies with AAA ESG Ratings

So how do we know which companies outshine their peers on their ESG performance?

Nowadays, different financial firms and consultancies conduct thorough research regularly on listed companies in terms of ESG. For example, MSCI ESG Rating is one of the key indicators. ESG Ratings range from the leader positions (AAA, AA), average (A, BBB, BB) to laggard (B, CCC).

Examples of ESG Stocks with AAA ratings: Nvidia (NVDA), Salesforce.com (CRM), Best Buy (BBY), ExpeditorsInternational (EXPD), and Microsoft (MSFT).

Myth 2: ESG Investing is Rare in Asia and Hong Kong

It is undeniable that ESG investing has been sweeping the global financial sector in recent years. How about the ESG investing trend in Asia and Hong Kong?

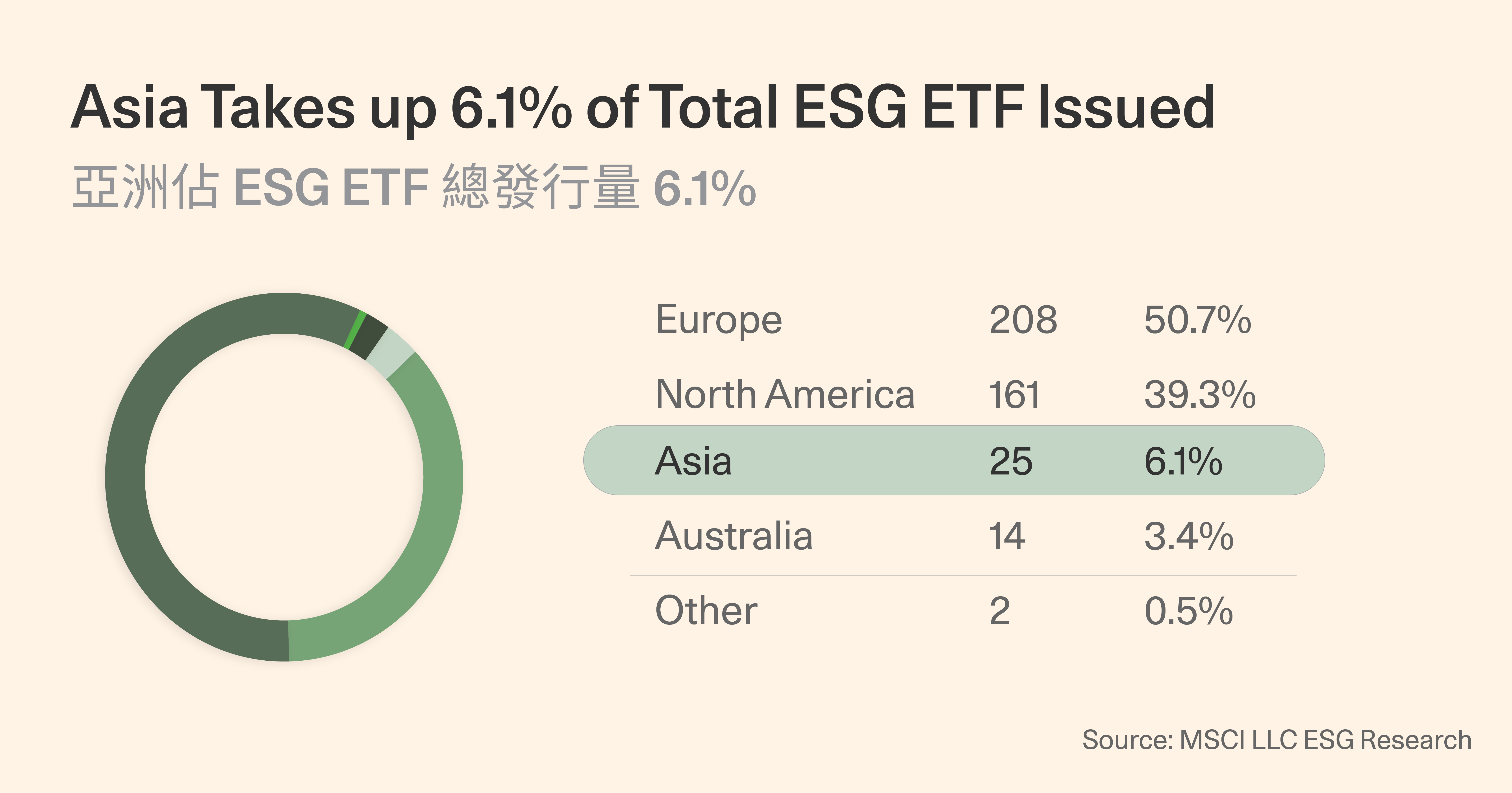

When we look into the number of ESG ETFs available in the global market, we can see that Europe and North America contribute up to 90% of the total number of ESG ETFs on the market, while Asia ranks 3rd.

Despite the fact that Asia, including Hong Kong, lags behind in ESG financial offerings for investors, there is a visible trend of increasing ESG investments in Asia-Pacific.

According to the MSCI 2021 Global Institutional Investor survey, around 79% of investors in APAC increased ESG investments “significantly” or “moderately” in response to Covid-19, which is slightly higher than the 77% of investors globally. This indicates that APAC as a whole has strong potential in developing ESG financial markets.

How about Hong Kong Investors?

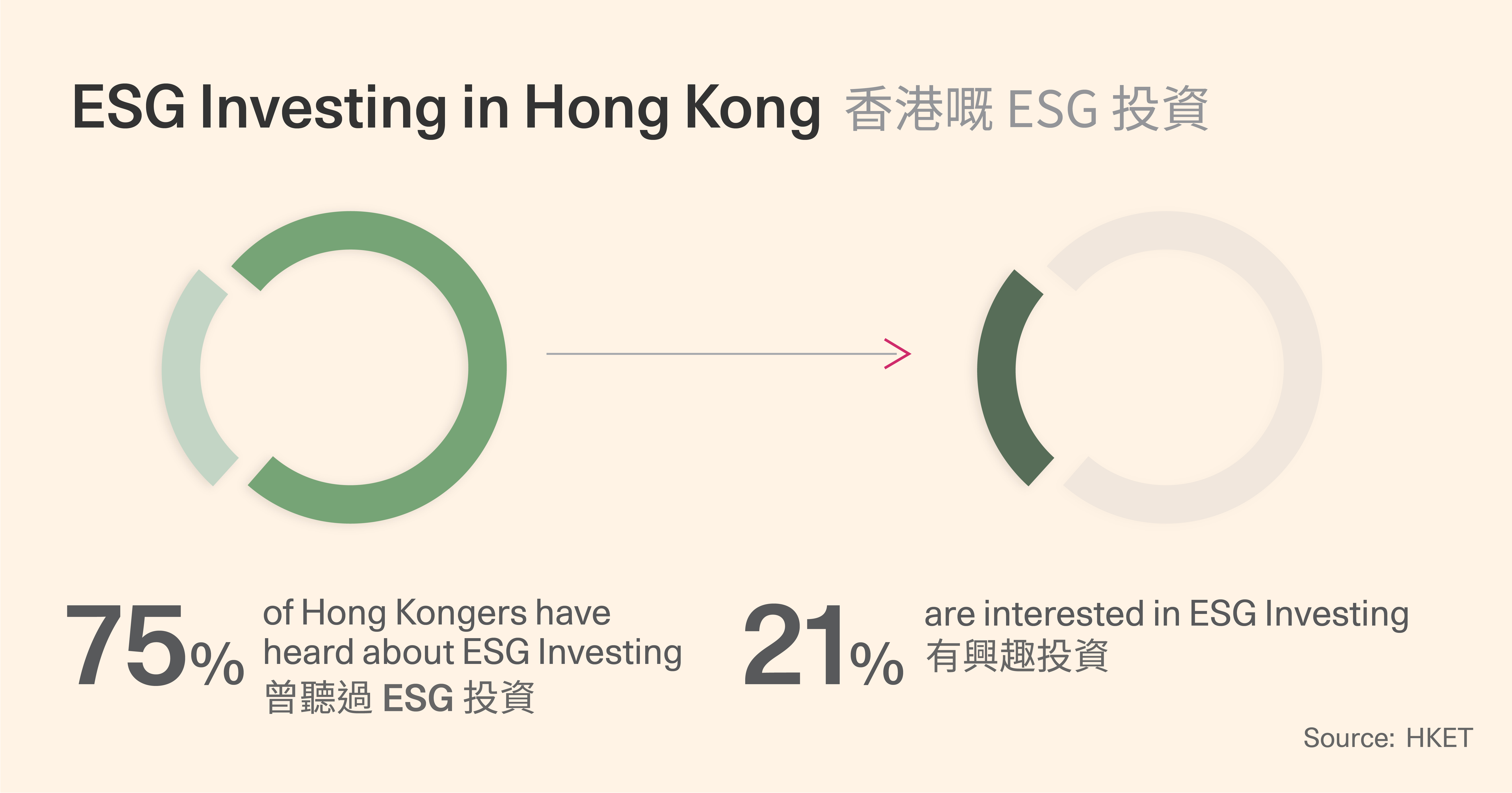

As of 1 Mar 2021, there are already 3 ESG ETFs listed in the Hong Kong market. According to an interview by HKET, 75% of the respondents have heard of ESG investing, while 21% of them are interested in investing into it. Certainly the education for ESG needs to continue, but there's a positive outlook on the growth of ESG investments locally.

Myth 3: ESG investing = not as profitable?

ESG investing doesn’t mean sacrificing returns.

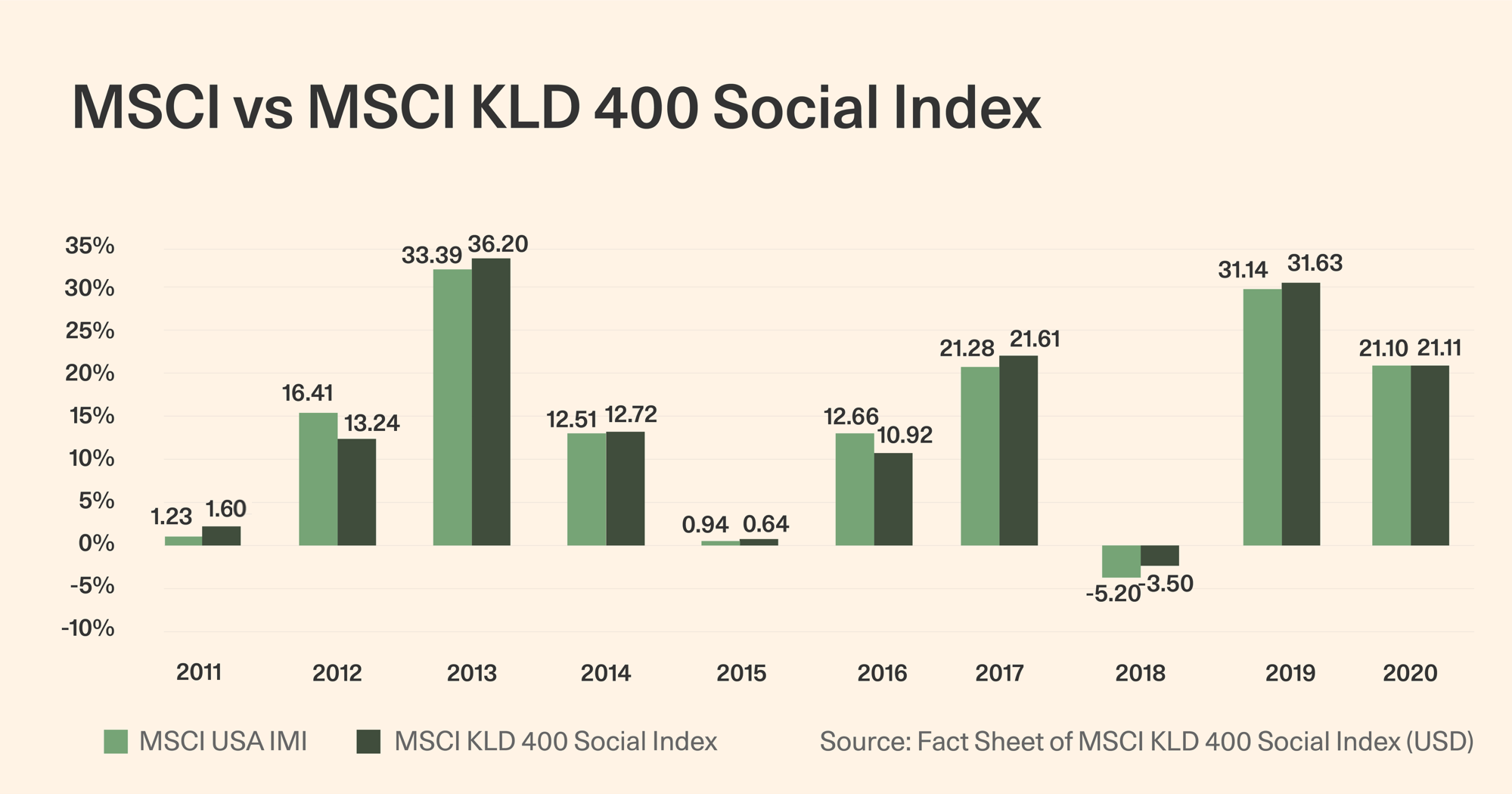

“MSCI KLD 400 Social Index (USD)”* an ESG orientated index outperformed its broad market parent index MSCI USA Investable Market Index 7 out of the past 9 years as of 2011-2019, disproving that ESG investing equates to less returns. Instead, it is possible, and highly likely for investors to invest sustainably and seek competitive return at the same time.

*Fact:

MSCI USA IMI Index = the performance of the large, mid and small cap segments of the US market.

MSCI KLD 400 Social Index = a capitalization weighted index of 400 US securities with outstanding ESG ratings and excludes companies whose products have negative social or environmental impacts.

How to start investing in the ESG trend?

Now that you have a better understanding of ESG investing, why not give it a try? You can check out our ESG portfolio to invest in social change. Available in both HK and US stock portfolios, starting points are as low as USD1,000. We’ve selected 30 stocks with high-quality ESG performances for you to invest in a better world, simply and affordably.

Click HERE to create social impacts with us!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.