Benefits and Drawbacks of Investing into the VIX Index.

Written by AQUMON Team on 2021-09-17

The VIX Index is often known as the US stock market’s “fear gauge”. As such, whenever there is high stock market volatility the discussion around the “VIX” and the ‘rising investor fear’ it represents goes viral.

But most people don’t really understand what the VIX is and its relationship with financial markets. Or how can investors utilize the VIX and its related investments to benefit their portfolios both from protection and gaining excess return standpoint?

We hope to answer that for you in this blog article. Scroll to learn more!

What is VIX?

Volatility, particularly in investing, is a measure of how much the price changes of an asset around its mean price. It is often seen as a measure of uncertainty that is directly tied to market sentiment, especially when trying to quantify the degree of ‘fear’ among investors.

The VIX’s full name is the CBOE Volatility Index, a benchmark to quantify market expectations of volatility around the US’ main stock index the S&P 500. The index is created by and maintained by the Chicago Board Options Exchange (CBOE). For investors, the VIX is not only a tool to assess market sentiment but it also provides investors forward-looking insights for further profiting opportunities because it represents the relative strength of the near-term price of the S&P 500 index (SPX). The VIX generates a 30-day forward-looking projection of volatility, allowing investors to gauge market risk and investors’ sentiments when making important investment decisions.

Therefore, if the VIX is high, this means investors currently have a high level of risk and fear, and the market might be bumpy in the near future. Vice versa, when most investors foresee the stock market to be more stable, the VIX Index will be lower than normal.

Is VIX a Reliable Crystal Ball? What is its Relationship With S&P?

You might have a question in your mind right now, if the VIX depends on the market’s swing, then why is there “volatility”?

Indeed, statistically, when the VIX rises it does not necessarily reflect that the investors have a negative sentiment towards the market itself. Still, what it does show is that investors expect the market will have more violent fluctuations in the foreseeable future.

If we review some of the past trends of VIX, we can see that when the VIX does rise it often has a strong correlation with the increase in negative news within the stock market, which is why it is called the Volatility Index. As a simple rule of thumb, in the past few years, if the VIX value is lower than 20, the market has been relatively stable. Yet, if the VIX value is higher than 30 or more, the market volatility is high, and the investors have to be extra careful with their decisions.

Let us look at some statistics from February 2020, the start of the pandemic. The VIX value was at 13.68, which is relatively low and reflected that investors were anticipating that financial markets would remain stable and likely had an optimistic outlook. Yet after a month in March 2020, the VIX value had risen to 66.07, suggesting investors have a high level of fear and stress in the market. At the same time, the S&P index declined 1000 points, which equated to the index dropping over 30%.

Therefore, the VIX can reflect the investors’ sentiment even during the highly unpredictable period like during the pandemic where we saw rapid market fluctuations.

How to Invest in VIX?

Even though it makes sense to want to ‘trade’ the VIX in reality investors can not directly trade the VIX. What they can do is two things:

1) To actively trade VIX futures:

Futures are more complex ‘derivative’ financial contracts that require parties to transact an asset at a predetermined future date and price. So investors that are looking to trade VIX futures can purchase VIX futures. Since futures themselves have costs and you can just buy and hold (so it will diminish in value over time) investors need to continually buy and sell VIX futures of different maturity lengths (1 year, 2 years etc) which can be quite difficult for individual investors.

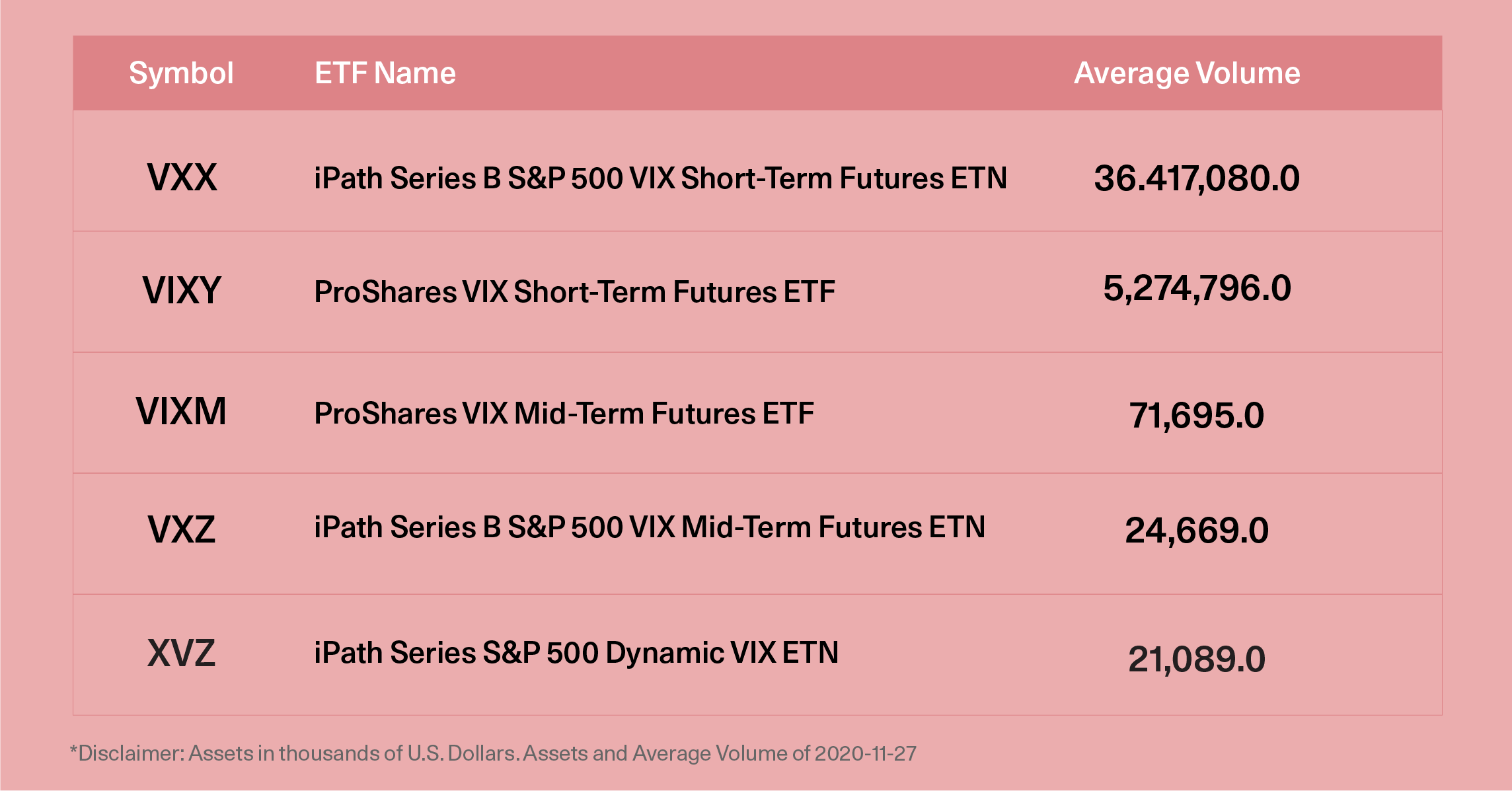

2) Look into Exchange Traded Funds (ETFs) products related to the VIX:

There are various corresponding ETFs with VIX options for investors to trade. Among all the ETF products, the VXX is the most actively traded and has the highest trading volume.

For instance, when investors are not optimistic about the market or unpredictable events look to be on the horizon investors can consider allocating part of their investment funds toward the VXX ETF which can help investors hedge (or reduce) their risk.

But before you jump into investing into the VXX, It is important to point out that the VXX is not suitable for long-term holding investors.

VXX tracks a series of the VIX short-term futures and is constantly ‘rolling’ buying more expensive slightly longer-dated futures (which are more expensive because they represent more uncertainty) because shortest dated (cheapest) futures are about to expire Constantly buying more expensive investments while selling cheaper investments means that the VXX ETF will naturally lose value over time.

How much value can it lose? Let’s look at an example. If you bought the VXX from the day it was listed back in 2012 with US$1000, you will now end up in September 2021 with US$0.7015. This means holding onto this ETF for 10 years resulting in you losing over 99% of your money. So investors can not just hold onto the VXX but need to more actively buy or sell to avoid the hedging cost (both with purchasing the VXX and continue holding the VXX) eating away into their returns.

But it doesn’t mean hedging is not needed for investors. The market is getting more volatile in these two years. The average closing price of the VIX during this time has been 19.76 ( the average closing price of VIX for the past 10 years was 17.08.) When market volatility is high, it makes sense to use hedging strategies to dynamically manage your portfolio, which can reduce the volatility of your portfolio and potentially seek our additional return opportunities.

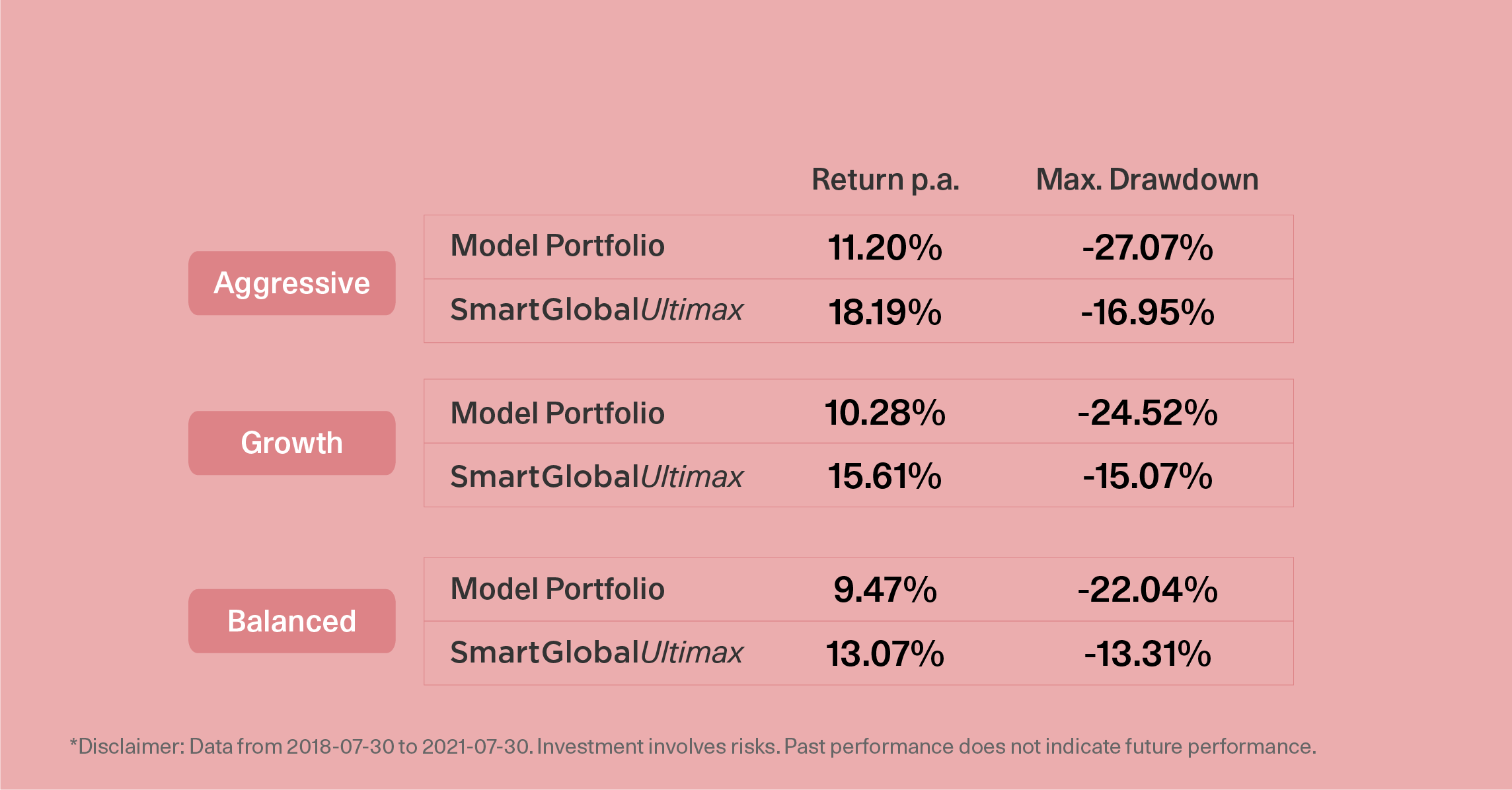

The data support this conclusion as well. AQUMON’s data suggests using our new smart hedging strategies can bring up to 4.64% of excess return for the investors on a three-year annualized basis.

SmartHedging is encompassed in AQUMON’s newly launched dynamic all-weather portfolioSmartGlobal UltiMax. AQUMON investment algorithms intelligently anticipate when markets are expected to fall and increase its hedging protection via investing into volatility index ETFs such as the VXX. This strategy actively manages your portfolio's risk while minimizing your investment losses.

Compared with the traditional global diversified multi-asset standard portfolio ( model portfolio), SmartGlobal UltiMax uses a more dynamic investment strategy, and the three-year annualized excess return is as high as 6.99% more per year. The maximum drawdown, which represents the largest drop in the return of the investment portfolio within a time period, reduces the downside risk up to 10.12% on a three-year annualized basis. The end result provides better returns and more stability for investors. Truly is the best of both worlds for investors.

Download the AQUMON APP now to learn more about SmartGlobal UltiMax to capture every investing opportunity.

Read More: 【New Product Preview】 SmartGlobal Ultimax

Read More: SmartGlobal UltiMax: Top Three Things You Need to Know

▼关于AQUMON

AQUMON弘量智投作为在亚洲金融科技行业领先的创业公司,通过金融、算法和科技三方面的结合,致力将透明、稳定、实时和低成本的革命性理财体验提供给更多机构和零售客户。 AQUMON弘量智投已与海内外一百间金融机构签订合作意向,包括友邦保险、招商永隆银行、华夏基金、广州农村商业银行等。目前AQUMON弘量智投的投资者包括阿里巴巴创业者基金、中银国际旗下附属机构和香港科技大学、郑和资本管理有限公司和香港数码港等。

AQUMON弘量智投为弘量研究的子公司,拥有香港 证监会1 号(证券交易)、4 号(就证券提供意见)牌照和9号(资产管理)牌照。AQUMON亦拥有美国证监会注册投资顾问( RIA)牌照以及中国证券投资基金业协会牌照。

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.