Halloween Series: Companies that Came Back from the Dead

Written by AQUMON Team on 2021-10-27

When we mention Halloween, what’s the first thing that comes to mind? Is it sparkling jack-o'lanterns decorating the homes, a day of mischief and treats or your favourite witch, vampire or other creatures back from the dead?

In fact, today we will be exploring two famous companies that have really magically "resurrected" from their earlier flops and business downturns. Some had run out of money and faced an impending foreclosure. Others were working in declining business sectors with low growth potential for years; their stock prices were consistently scraping the bottom.

However, through a series of making the right decisions and maybe a bit of luck, these waning companies rose from the ashes and turned around their businesses. Let us learn their secrets of resurrection, just in time for Halloween!

1) FedEx

Among all the stories of startups that made a turnaround, the one of the famous ones is definitely the story of FedEx. Fred Smith founded FedEx in 1971 with US$4 million in personal savings and US$90 million in financing.

Smith had lofty ideas and goals. He had a vision to establish the most efficient shipping express company in the world, delivering packages across the globe overnight. In the 1970s, the world's transportation was still dominated by trains and cars, since the cost of using airplanes to deliver parcels was ridiculously expensive. In order to realise FedEx’s mission, it had a huge obstacle to overcome.

After three years of operation, the company was still loss making despite being one of the highest funded new U.S ventures at the time. In another stroke of bad luck, the price of aviation fuel soared during this period, and FedEX's monthly net loss reached 1 million US dollars. The company bank account was down to its last 5,000 USD; FedEx was on the verge of bankruptcy. Smith knew that the company would have to pay for all outstanding payments and salaries by next Monday and he was desperate. Smith decided to continue looking for investors. He contacted major companies and investors such as GE in the United States, but there was no one willing to invest in FedEx.

Smith was at his wits’ end as he contemplated closing down the company, when he suddenly saw a group of people gathering around some slot machines inside a bar. The bright neon signs of Las Vegas flashed before his eyes, and he saw his one last chance for FedEx’s salvation at the casino tables.

The next day, Smith took out the remaining USD5,000 in the company account and boarded a plane to Las Vegas. He spent the weekend at the “Blackjack” tables and Lady Luck smiled down upon him. On Monday, Smith returned with $27,000 winnings to cover the company's $24,000 fuel bill. It kept FedEx alive for one more week.

The risky gamble with the company cash is still described by Smith as the most sensible decision he’s made; $5000 dollars couldn’t cover a lot of fuel anyway. Thanks to his grit in keeping the company afloat, Smith was able to raise an additional capital of 11 million US dollars shortly after. Although it was not a large amount at the time, it was enough for FedEx to continue its growth and development plans. Two years later, FedEx turned losses into profits for the first time, turning a profit of 3.6 million USD. After another four years, the company’s turnover increased by 1 billion USD and FedEx generated 40 million USD in profits.

"No business school graduate would recommend gambling as a financial strategy, but sometimes it pays to be a little crazy early in your career,” - Fred Smith.

2) Netflix

We believe you must have heard of Netflix, but did you know that Netflix originally provided DVD mailing service?

In 1997, Reed Hastings and Marc Randolph founded Netflix, which engaged mainly in "rental disc" services.

At the time, Netflix’s major competitor was the American film rental chain Blockbuster. Blockbuster operated in the traditional store rental videotape business. In 2000, it had 528 chain stores, 20 million subscribers and hired more than 4000 employees. During the same period, Netflix faced losses because of the “dot-com” bubble collapse when internet businesses started to fail. The Co-Founders even offered to sell the company to Blockbuster at the time!

In order to survive, Netflix began to adopt innovative business models to win the market. At that time, DVD technology was on the rise, the discs were smaller and lighter than traditional video tapes and more convenient for mailing. Therefore, Netflix tried to provide movie DVD rental services online and mailed them to customers across the United States.

Netflix would rent out two DVDs for as little as $10 a month. Customers could select DVDs they wanted to watch from the website, Netflix would mail the rental DVDs and returns were also easily mailed after the customers were done. The customers fell in love with this convenient and cheap way of borrowing DVDs. Netflix utilized customer-predicting technology in order to better estimate popular movies and improve their services. Eventually they made a monthly subscription based model for DVD rentals.

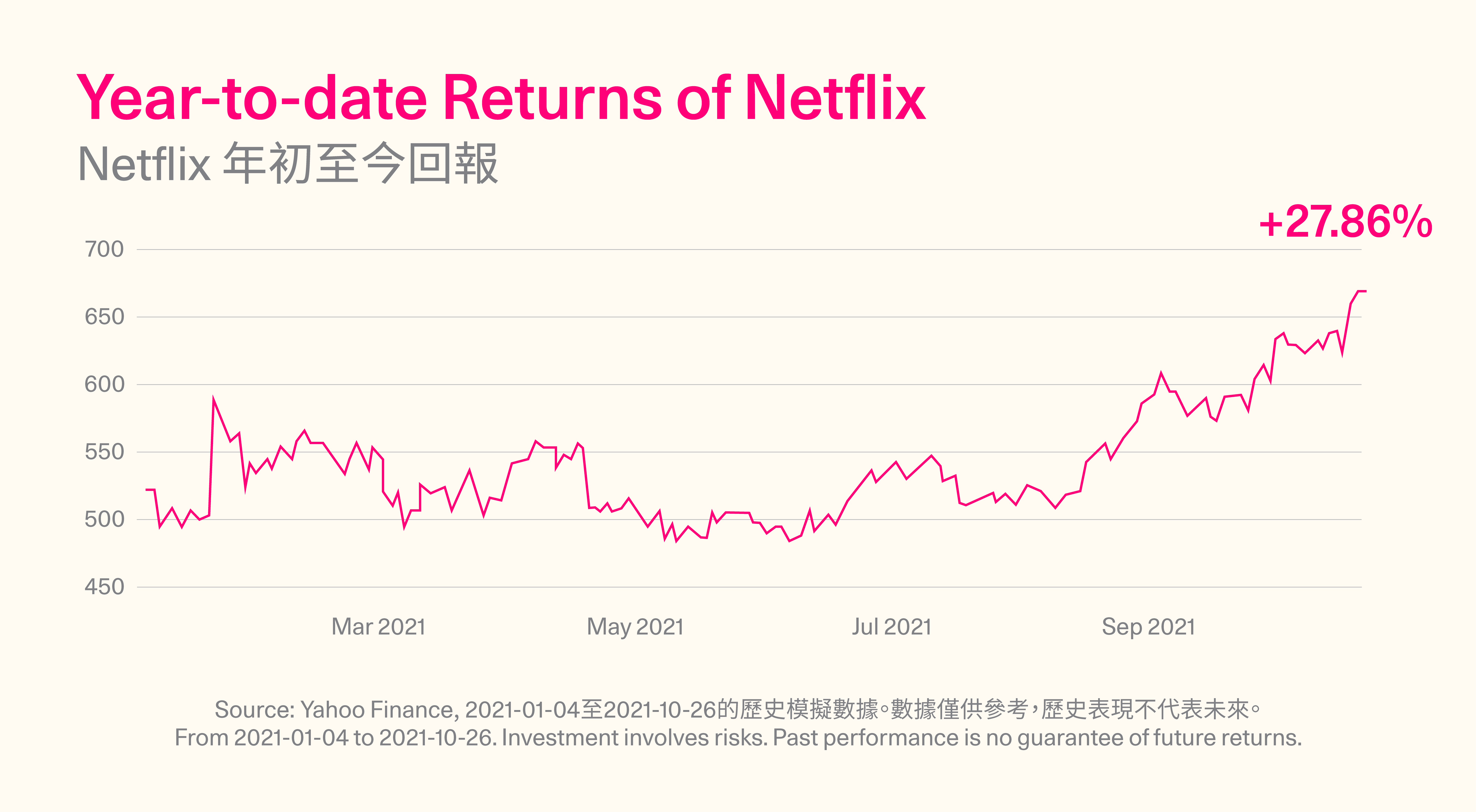

This innovative model became very popular and Netflix rose through the ranks to become an industry giant, however, this is not the end of the story. began to launch streaming services we currently love back in 2007. At the time, people did not believe it would work. Fast forward to 2021, Netflix offers a whole host of movie and TV series under multiple licensing deals and is also producing its own content under Netflix Originals. The recent release of the Korean survival game series "Squid Game" has become a global sensation, generating $900 million USD in value for Netflix. Its stock price has risen by +27.86% since the beginning of the year (as of October 26, 2021).

The key takeaway from the story? “Don't be afraid to change the model.” - Hastings

The stories of these two companies that made a comeback show that it is not “Magic” that keeps a great company running but rather a great company cannot last without thinking outside of the box. But often such innovations are not understood at the time and require a tremendous amount of persistence to succeed.

AQUMON also believes in using technology to empower investors, delivering more convenient, affordable and accessible investment services to everyone. Whatever your time frame and investment goals are, AQUMON will provide you with quality, customised financial services.

And on that note, AQUMON wishes everyone a happy Halloween!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.