You asked, We Answered - Breaking Down the Most Asked Questions

Written by AQUMON Team on 2021-11-16

Over the past couple of months, AQUMON has held several online seminars to address your questions regarding our investment portfolios and the latest global market happenings. We’ve compiled a list of the top most asked questions for easier reading. If you still have more questions, feel free to contact our customer service team, we are more than happy to help!

Mission Related

Q1) There are many competitors to AQUMON in Hong Kong, especially when it comes to investing. What’s the difference between AQUMON and a regular stock trading app? How does AQUMON differ from other robo advisors?

Traditionally, securities firms have created mobile trading platforms for clients to purely buy and sell individual securities. What makes AQUMON different is that we’re data-driven in order to provide algorithms to power our investment portfolios; 70% of our employees are PhD holders and mathematicians. Through our technology, we can recommend professional investment portfolios that are tailored to your needs, providing you a service that was traditionally reserved for only very wealthy private bank clients.

At present, assets managed by robo-advisors account for less than 0.5% of Hong Kong’s entire wealth management industry. With only a handful of competitors in the market, there is a lot of room for growth by automated wealth management platforms like AQUMON.

Many financial institutions are also showing interest in adopting robo-advisory practices into their investment ecosystems as they are looking towards digitizing customer services. Doing so helps them accelerate digital transformation, providing more accessible financial education and recommendations to their clients.

Product Related

Q2) What kind of securities are included in AQUMON investment products? Which benchmark index is used?

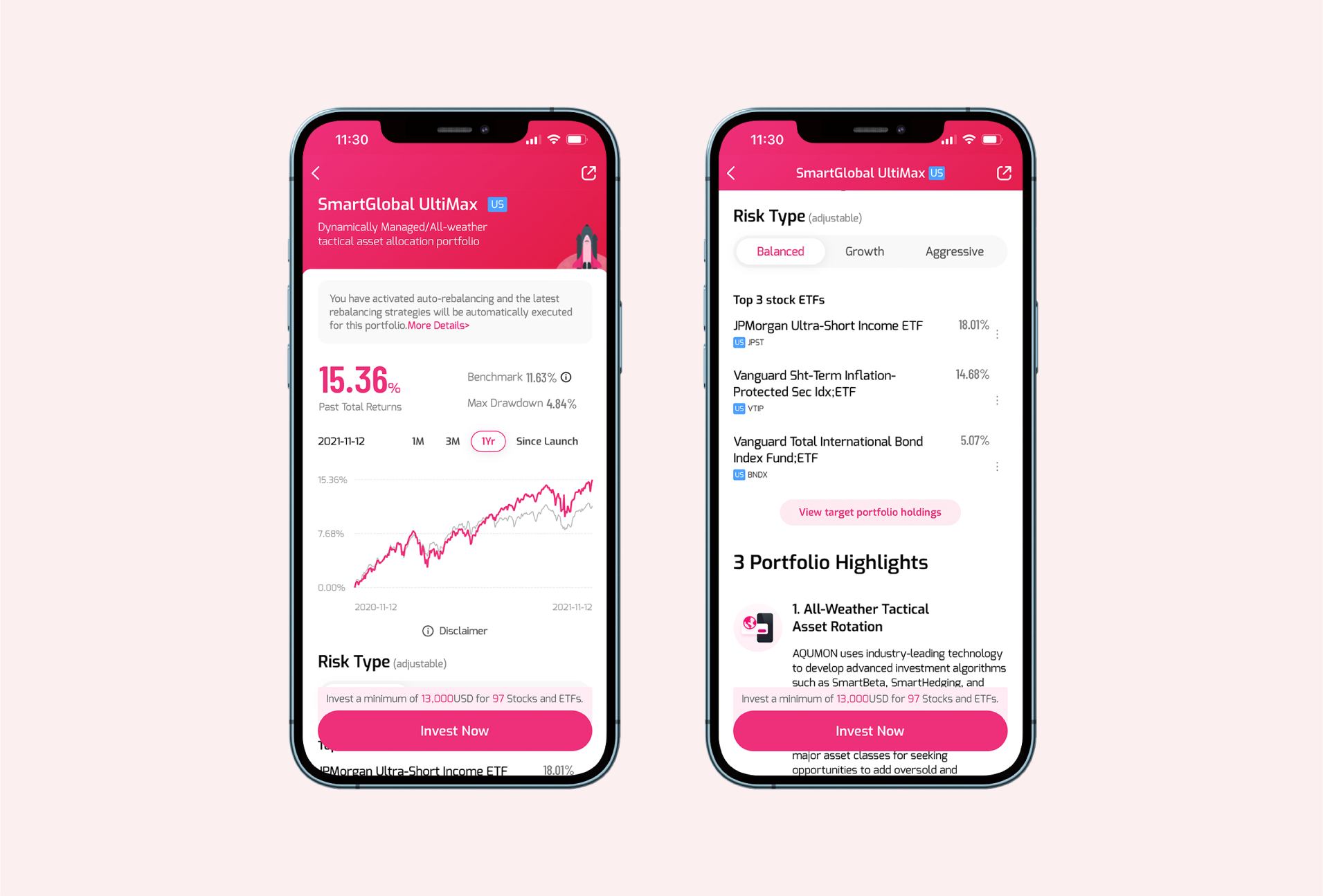

Each of our investment products include a different range of securities, but they are all chosen by our proprietary investment strategies and algorithms based on a combination of themes, objectives and risk preferences. For example, our newly launched SmartGlobal UltiMax portfolio contains 60-90 stocks and exchange traded funds (ETFs). The list of securities may change from time to time as the system reviews and recommends new securities to replace the old ones.

To view a list of the individual securities in your investment portfolio, you can directly visit your portfolio on the AQUMON app and the list is updated and transparent for viewing at all times.

As AQUMON portfolios are diverse in nature; investing in different securities and industries, each portfolio is paired against a different benchmark index to provide you with an accurate point of comparison. To learn more about the benchmark of each AQUMON investment portfolio, please download the AQUMON app.

Q3) Do AQUMON portfolios consistently outperform their benchmark indices?

Most of our portfolios do outperform their respective benchmark indices, but like any investment portfolio in the market, this is not always a guarantee. Since customers buy into their portfolios at different times, there will be instances where the returns of the investment portfolio lag behind those of the benchmark.

However, this phenomenon does not mean that your portfolio will not outperform its benchmark in the long run. Since our investing philosophy is about investing in long-term growth to achieve goals that might take more time to reach (for example, saving up for a vacation or to buy an apartment), we should look for returns and gains on a longer time horizon. During your first few months of investing in an AQUMON portfolio, there is a chance that you might experience negative returns. But this is mostly due to short-term volatility in the financial markets; treating your AQUMON portfolio in a similar manner as you would with your regular savings account would help allay these concerns about negative short-term returns.

Let’s use the SmartGlobal UltiMax Balanced portfolio as an example. If you invested in this portfolio on October 15 2021 and held it for a month, your portfolio return would be 0.83%^ higher than the benchmark*. However, if you invested in the same portfolio on November 13 2020 until now (holding for a year), your portfolio return would be 3.63% higher than the benchmark. And if we extend this to over two or more years, the chances of your portfolio achieving even higher returns over the benchmark index would increase substantially. This is the beauty of long-term investing; your projected returns over the benchmark increase as you keep invested for longer.

*Benchmark is 50% MSCI World Index + 50% Bloomberg Barclays 1-3 Years Global AGG Bond Index

^Investment involves risks. Past performance does not indicate future.

Q4) SmartGlobal UltiMax contains several investment strategies concurrently. How do they help optimise my portfolio?

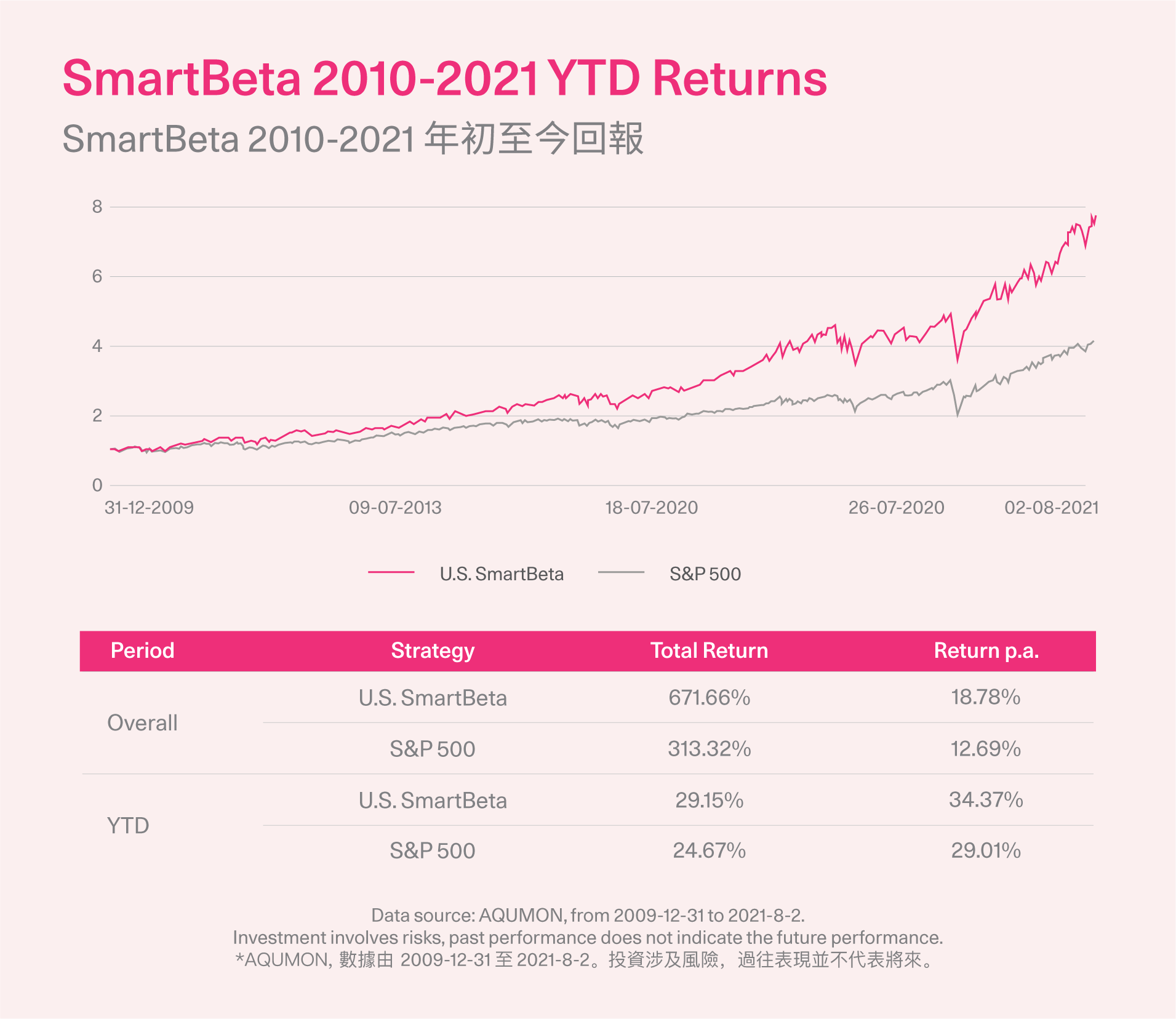

SmartGlobal UltiMax contains three of our proprietary investment strategies: SmartBeta, SmartRotation, and SmartHedging.

SmartBeta selects stocks through fundamental and factor analysis to improve your risk-adjusted returns. This strategy results in annualised returns that are approximately 3% higher than the those of the S&P500 Index.

SmartGlobal UltiMax mainly focuses on the US stock market, with sector-specific focus being adjusted according to prevailing market conditions. Currently, the largest holdings of SmartGlobal UltiMax are Apple (AAPL), Google-C (GOOG) and Johnson & Johnson (JNJ).

SmartHedging utilises quantitative scientific methods to predict future trends in the economy and to hedge against the US stock market. When the market goes through bouts of volatility, SmartHedging will be activated to protect your investment portfolio. Because hedging is often difficult and costly for the average investor to perform themselves, SmartHedging provides your portfolio with an affordable and simple way to protect your portfolio.

Q5) I currently own a SmartGlobal Max portfolio. Can I directly transfer my money from my SmartGlobal Max portfolio into a new SmartGlobal UltiMax portfolio?

No, at the moment. You will need to liquidate your SmartGlobal Max portfolio before buying a new SmartGlobal UltiMax portfolio. This entire process should take T+2 (two business days) to execute.

Q6) ESG seems to be a very popular investment topic these days. Does AQUMON have an ESG offering?

ESG refers to how well a company does on three fronts of sustainability: environment, social, and corporate governance. AQUMON offers you the ability to invest into two ESG-themed portfolios: “A Better World” made up of US-listed stocks, and “ESG Hong Kong” made up of HK-listed stocks.

Q7) What happens if I make a portfolio order after trading hours?

Hong Kong stock portfolios: Will be processed on the next business day

US stock portfolios: If an order is placed before 8:00PM (HKT) on a normal trading day, it will be executed that night.

Q8) What are the AQUMON portfolio fees?

SmartGlobal, SmartGlobal Max and thematic SmartStock portfolios are subject to a tieredannual advisory fee ranging from 0.5-0.8%.

SmartGlobal UltiMax is subject to annual tiered advisory fees between 0.7 - 1.0% depending on how much you’ve invested.

Stock Trading: Subject to commission and platform fees.

For more details, please click HERE to refer to our official fee schedule.

Q9) Will I be charged extra for deposits and withdrawals?

If you deposit and withdraw in HKD, there will be no additional fees. If transactions are performed in USD, your bank may charge a handling fee. Should you decide to purchase a US stock portfolio, we recommend that you deposit HKD into your AQUMON account, then use our free currency exchange function in the AQUMON app to avoid incurring any additional fees.

Q10) Can money be automatically deducted from my bank for the purposes of periodic investing?

Short Answer: No. But we are always developing exciting new capabilities for the AQUMON app. Periodic investing will be made available to all AQUMON clients in the second to third quarter of 2022.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.