5 Tips to Get your Finances in Better Shape in 2022

Written by AQUMON Team on 2021-12-30

As the year wraps up, it's time to review our financial plans and set the coming new year’s resolutions. But did you know more than half of all resolutions fail due to impractical goal setting and insufficient planning? Looking for a fail-safe guide to shape up your investments in 2022? Check out the following five tips to better financial health!

1. Assess your Financial Situation

The world has experienced a massive change since the pandemic. Make sure your investment and financial portfolio has adapted to the new normal as your lifestyle changes. To kick start your financial plan, it is always good to have a clear understanding of your current financial situation. Outline your assets (e.g. salaries, bonus) and liabilities (e.g. mortgage, student loans, credit card bills, insurance plans) so that you can know your current financial balance. Would like some help with your finances?

Whether you're a new investor or an experienced professional, AQUMON provides customizable investment solutions that are scientific and tailor-made for you. Supported by the best financial, algorithmic, and big-data technology, we monitor both the financial markets and your portfolio 24/7 to ensure your investment returns are fully optimized.

2. Create a Budget

It is important to determine what expenses are absolutely necessary to you and what goal you are trying to save towards. Have a clear picture of your cash flow. Learn to prioritize saving before you spend instead of the other way around, you’ll notice you have much more savings this way.

Have no clue on how to properly budget? Try out the 50/20/30 budget rule which is used to assist individuals in managing their after-tax income:

50/20/30 Budget Rule

50% on needs (e.g. housing, utilities and other recurring payments)

30% on wants (e.g. dining out and clothing)

20% on savings/investments

There are quite a lot of budget templates available online. The one from Nerdwallet may be a good pick for you. Download a free budget planner template HERE to plan ahead your budget.

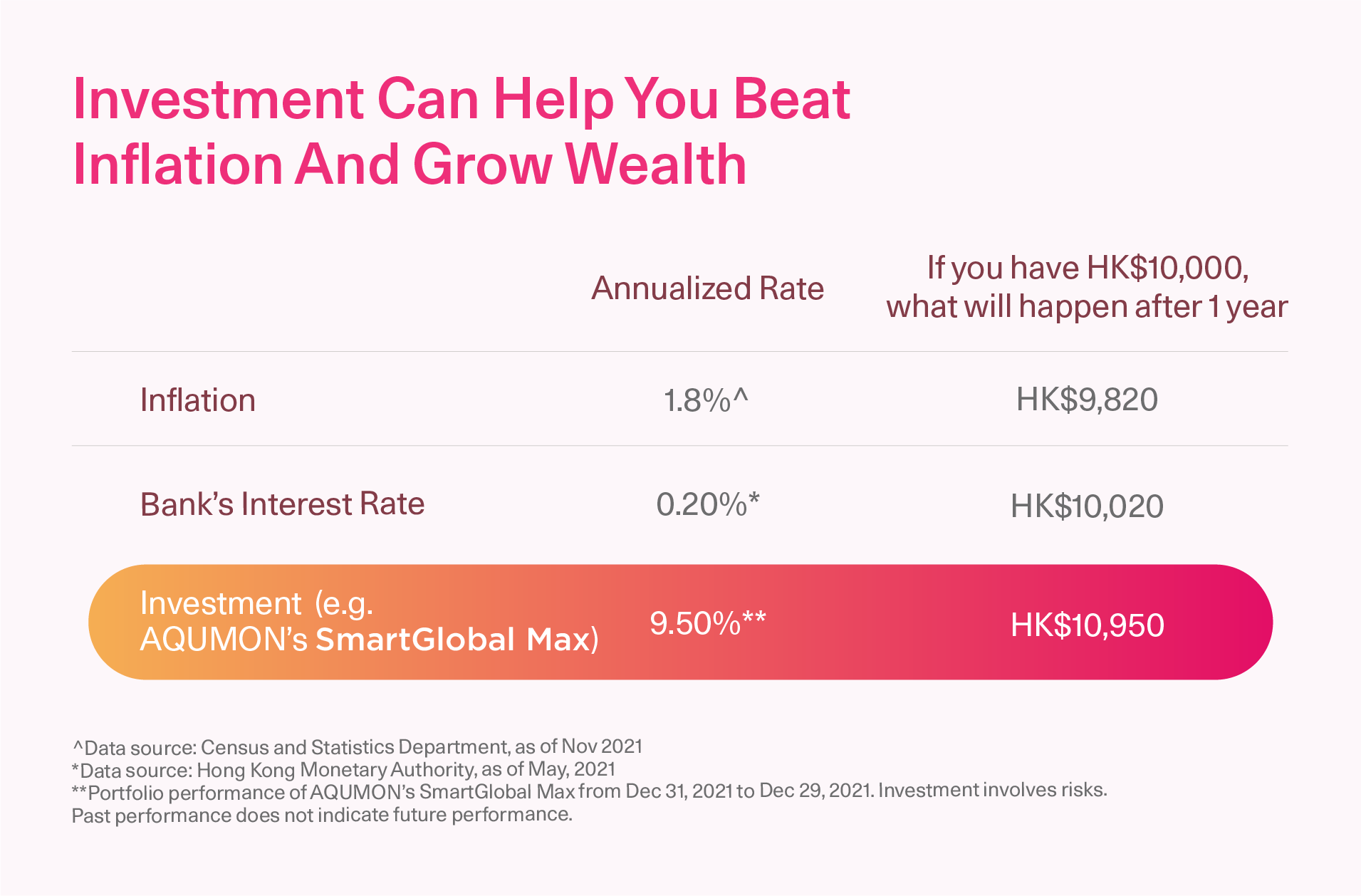

Also remember just saving is usually not enough to beat inflation over the years, money depreciates in the bank so what one dollar can buy now, might not mean the same 10 years later.

If you have no idea where to start or how to manage your money, AQUMON is a good place for you to invest. With the all-in-one AQUMON app, you are able to access powerful portfolios that make your money grow in less than five minutes. Get started and invest smarter with AQUMON.

Extended reading: ETFs - A Beginner’s Guide

3. Set your Financial Goals

According to the Hong Kong Deposit Protection Board, Hong Kongers save HK$6,600 per month on average. Do you save more or less than the average? Setting financial goals are important - whether it is short term or long to achieve it eventually. To properly set your goals (e.g. save for a wedding, buying your first house, education fund for your kids, start your own business etc.) You may use a SMART approach to help make it more achievable:

Specific: Well defined, clear and unambiguous

Measurable: Set a specific criteria which can measure your progress

Achievable: Attainable and not impossible to achieve

Realistic: Within reach and relevant to your life goal

Timely: Set a clearly defined timeline, including a starting date and a target date

4. Prepare for Unexpected Situations

It is always wise to save aside some cash for a rainy day… or an unforeseen circumstance. Under the pandemic, 46.7% of respondents suffered from reduced income according to the survey done by The Hong Kong Christian Service. The average monthly savings had also dropped 6% as reported by The Hong Kong Deposit Protection Board.

It is never wise to spend all your money or put all of your money into one single investment. Every household should prioritize the establishment of an emergency fund in the event of job loss, unexpected medical bills, or any other unexpected financial obligation. If an emergency fund is exhausted, you should prioritize replenishing the reserve as soon as possible.

5. Review Your Investments

In life and in financial markets, things are always changing, therefore it is crucial to check in with the financial plans you’ve set earlier and see if it’s time to re-adjust if there’s any deviation or setbacks. Perhaps you’ve suddenly landed a cushy promotion, now you have more disposable income to invest, or maybe you’ve got a baby on the way - it’s time to set aside more money to invest to provide for your growing family.

How to review your investments? Did you have a projected return from investing, are the gains higher or lower than your expectations? For example, China markets are not doing as strongly in 2021, therefore it’s time to rethink how much allocation you’ve invested into it. Likewise, if you previously favoured certain high-return, volatile sectors, you should reconsider your risk tolerance to determine if the strategy of extreme market highs and lows is still valid.

Don’t have the time or expertise to read the markets? AQUMON can help you invest and optimize your investments intelligently through our automated platforms. Check out the portfolio offerings here.

A new year is a new beginning. Get a fresh start by planning your finances well. For more information, please check out our website.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.