2022 Investment Outlook: Data Driven Insights and Trends

Written by AQUMON Team on 2022-01-24

2021 has been a volatile year for investors. Yet, we’ve weathered through several market retractions and surges, the rise of meme stocks, China tightening regulations on Tech companies, supply chain shortages and more. As we move into 2022, what is expected for the year ahead and how can investors position their investments in a smarter way?

AQUMON hosted a webinar on Jan 19, 2022 to share insights on the financial markets from the perspective of data analysis. Check out the key takeaways below or watch the full video HERE.

Summary

1) 2021 Market review

US - Overheated economy but suffering from slow recovery

- In 1H of 2021, the US Fed believed that inflation is transitory and persisted with expansionary monetary policies (i.e. unlimited quantitative easing to increase the money supply in the market) to stimulate the market.

- As a result, the US stock market was inflated with a lot of liquidity and hot money inflow.

- The CPI (Consumer price index, i.e. average change in prices over time that consumers pay for a basket of goods and services) was recorded at 7% YoY in 2021, the highest level over the past 40 years. US 10 year treasury yield oscillated upwards to 1.8% as the market is in fear of potential interest rate hikes.

China - Economic growth slowed down in 2H 2021

- China enjoyed rapid economic development in early 2021 given a full control of the pandemic in 2020.

- Though the production recovered, GDP YoY in the second half of 2021 dropped to around 4-5%, which indicated a slowdown in economic growth. The key driver for the slowdown is weak domestic consumption characterized by a slump in year on year Retail Sales of Consumer Goods.

- To boost economic growth, China thus took an expansionary monetary policy.

- The stock market in China was volatile throughout the year given its tightened regulatory framework, while the bond market boomed.

2) What are we expecting for 2022?

US - Market liquidity is expected to shrink

The Fed is expected to raise interest rates 3 times in 2022 and even a balance sheet runoff if inflation continues. Market liquidity (i.e. ability to efficiently buy or sell securities without causing a substantial change in the price of the asset) may well drop and thus the US stock market will be under great pressure, especially the US Growth, Tech and Healthcare stock.

Chinese and Hong Kong markets - Positive outlook

China is adopting an expansionary monetary policy and conducted a rate cut on January 17th 2022, which might lead to a potential bull market (markets will look optimistic).

As for the Hong Kong market, assets are generally undervalued in 2021 and thus might have growth potential.

3) How should investors position their investments?

Rule of thumb - Global asset allocation and long-term investing

Investors should be expecting another year of uncertainty brought by the pandemic, geopolitical tension, rise of new industries that may lead to market volatility. Global asset allocation is vital to decentralize risk and to deliver steady returns. Another way is to focus on the time spent in the market, not timing the market.

4) How did AQUMON’s portfolios perform in 2021?

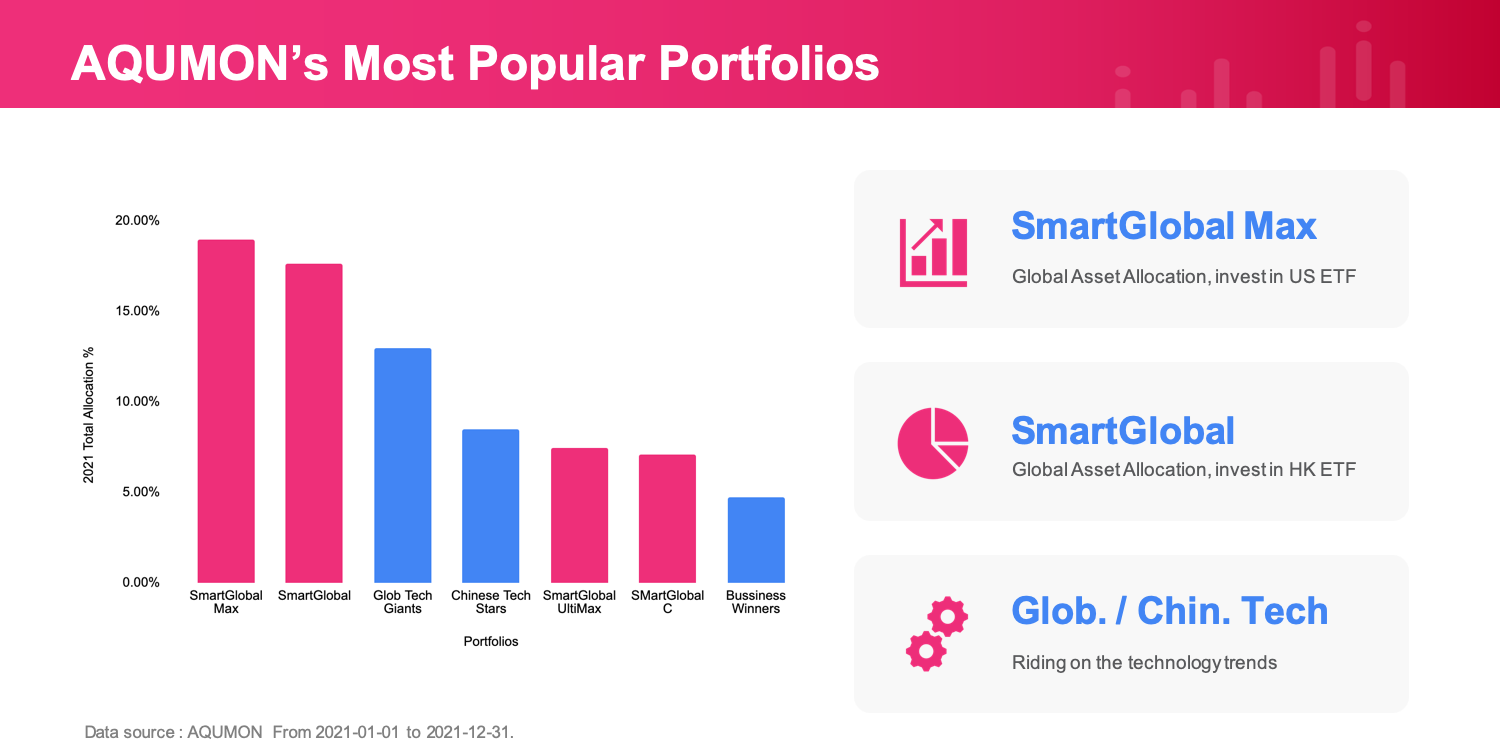

AQUMON leverages machine learning algorithms to construct robust investment portfolios, ranging from globally diversified portfolios to thematic stock portfolios.

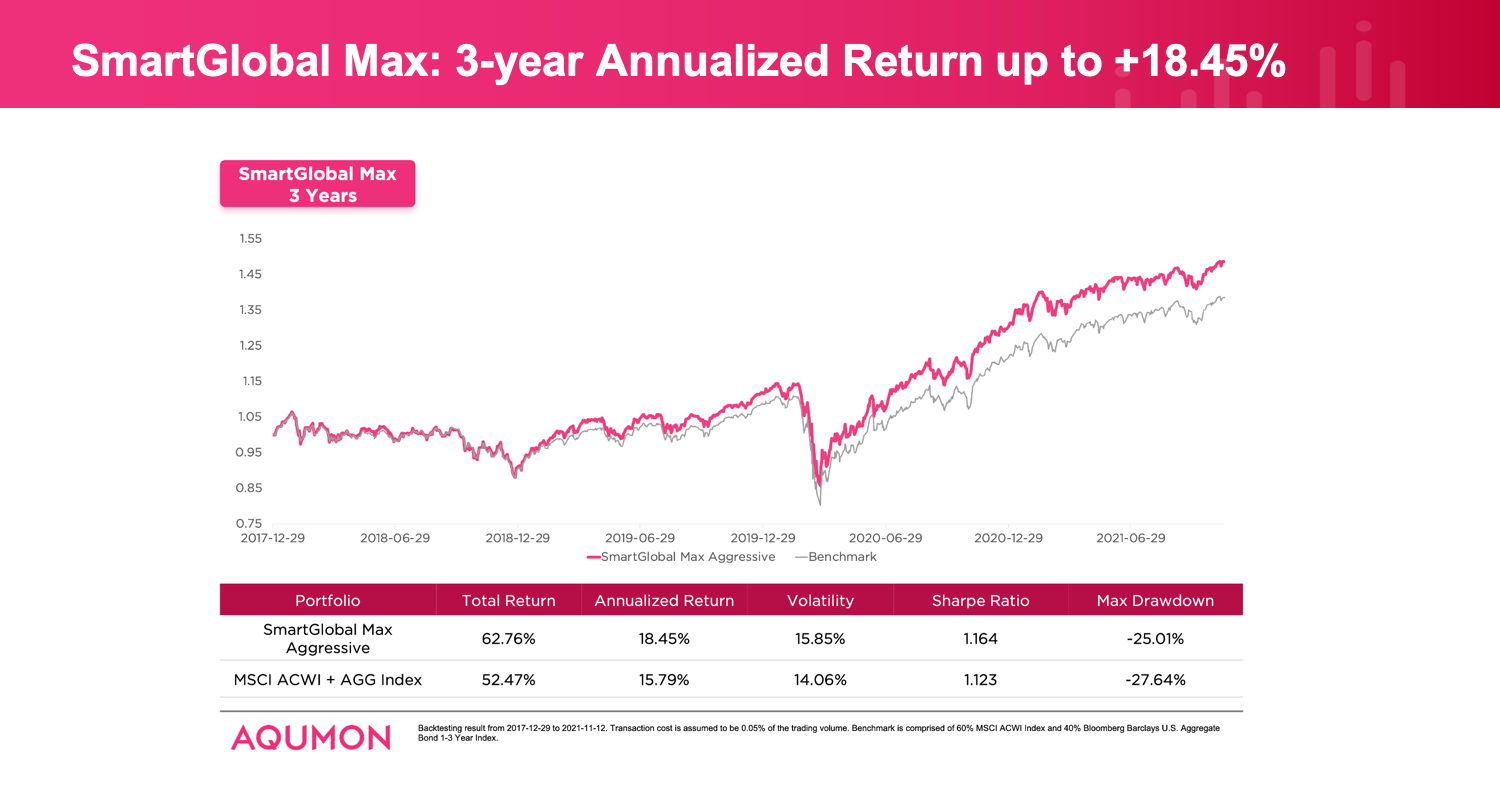

Over the past year, AQUMON's renowned flagship globally diversified portfolio, SmartGlobal Max (invested in US ETF) is one of the most popular investment portfolios. With its global asset allocation strategy, it helps investors achieve long-term wealth growth.

SmartGlobal Max achieved a 3-year annualized return of +18.45%*.

*Data is the backtested performance of SmartGlobal Max, aggressive from 2017-12-29 to 2021-11-12. Investment involves risks, past performance does not indicate the future.

5) Upgrade your service to AQUMON Bespoke wealth management solutions

AQUMON Bespoke is a hyper-personalized and comprehensive wealth management service, exclusively tailored for discerning investors who seek out the exceptional in investments.

If you have invested, or are planning to invest, over HK$500,000 with AQUMON, you are eligible to join the Bespoke service. With Bespoke, we combine the best scientific solutions and personalized services. Clients can enjoy a custom-tailored investment plan that will be driven by our quantitative SmartAdvice engine. In addition, you can consult and adjust your investments quarterly with a dedicated investment manager.

Read more about the Bespoke service:

Bespoke: Exceptional Investments for the Discerning Investor

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.