2022 Evolving ESG Investment Trends

Written by AQUMON Team on 2022-02-11

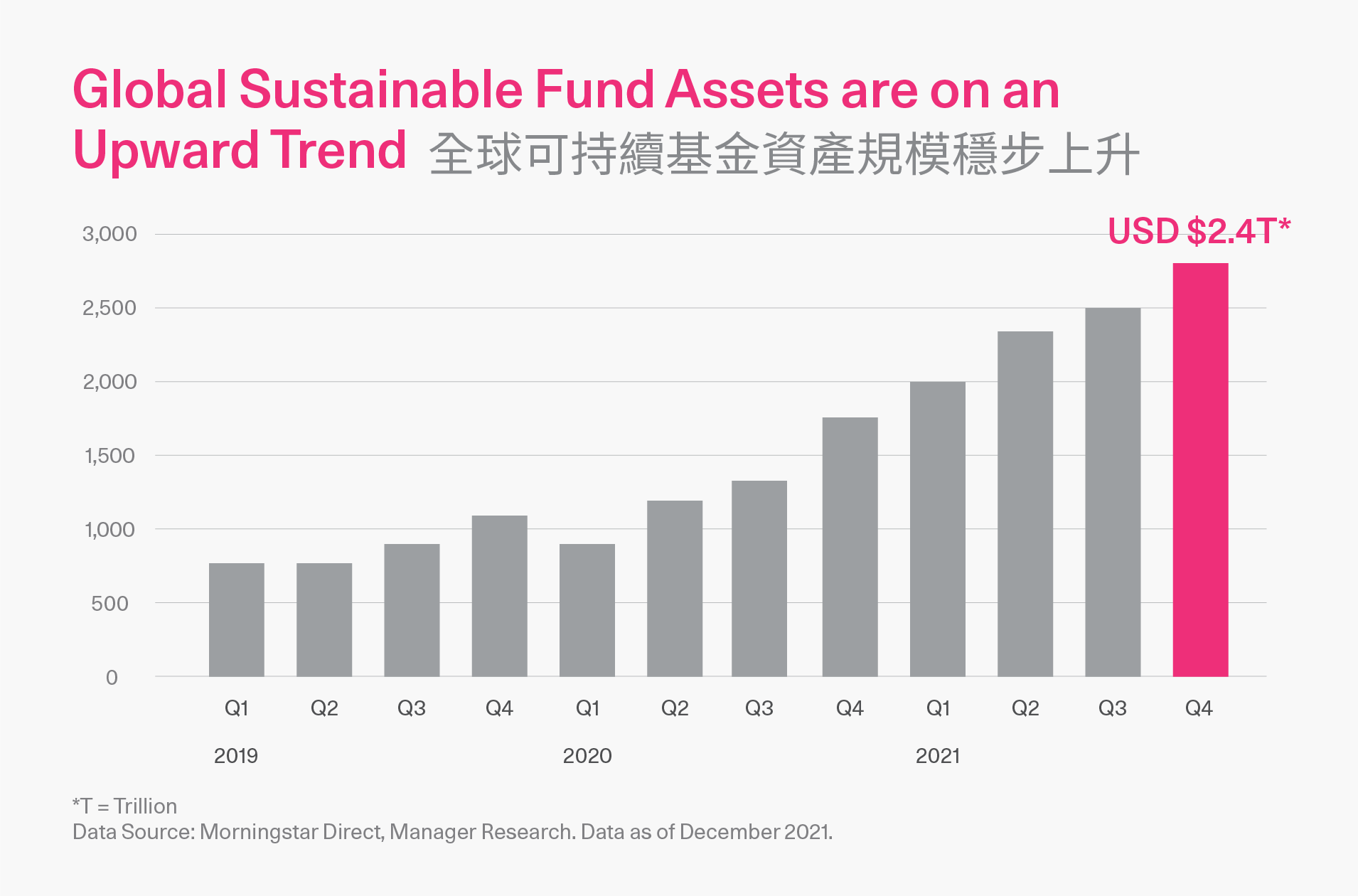

The latest investment trend shows ESG Investing (also known as Impact Investing) is gaining traction given that global sustainable fund assets have reached USD 2.74 trillion by the end of December 2021 according to Morning Star. Meanwhile, Moody’s latest ESGreport reveals the issuance of sustainable bonds is expected to hit a record USD 1.35 trillion globally in 2022.

How should investors integrate sustainability and impact investing into their portfolios? In this article, we will dive into the following topics:

1. What is ESG investing?

2. How do we measure ESG?

3. Is ESG investing profitable?

4. Top 3 ESG investing trends.

5. How to invest into ESG products?

Continue reading to see how your investments can also make an impact.

What is ESG investing?

ESG stands for Environmental, Social and Corporate Governance. This kind of investing puts your money to work in ways that promote sustainability, climate work, corporate accountability in hopes of investing into a better global future. Areas that fall under the ESG umbrella include:

A company that has outstanding performance in one or more of these three aspects is said to be a strong ESG company. As a result, these firms would typically receive high ESG ratings by third-party firms such as Refinitiv. Tech Giant Microsoft tops the list of the 100 Best ESG Companies of 2021 of Investor’s Business Daily.

Learn more about the basics of ESG investing.

But how exactly do we measure ESG?

Recent debates have surfaced identifying that there is no current consensus on an internationally adopted set of ESG indices and the fear of “greenwashing” by companies and funds.

“Greenwashing” describes the deceptive marketing of a company’s sustainability initiatives to seek a better valuation.

At AQUMON, we aim to go beyond the current indices and take a multi-factor strategy to assess a company’s ethics, commitment to environmental initiatives, and social progress. This is all in order to invest into accountable companies we believe will provide long-term value. Our underlying research is based on quantifiable data, eliminating as much as possible the influence of human subjectivity.

The evaluation index system has more than 40 factors in nine evaluation categories that feature all three key factors: environment, social responsibility, and corporate governance. Some of these factors include equality, injury rates, remuneration, renewable and clean energy infrastructure, carbon emission, green revenues, board diversity, director nominations and tax transparency among many others.

AQUMON’s algorithms then attribute weight to each of the factors to obtain the ESG score of the company and the overall ranking of the company amongst its peers. While ranking the ESG firms, AQUMON also excludes “Vice Businesses”, such as tobacco, gambling, non-renewable energy, defense, and military. Moreover, companies selected also have their fundamental factors, such as overall R&D investment and profitability, reviewed to ensure the companies we put forward are sound, operating businesses.

Is ESG investing profitable?

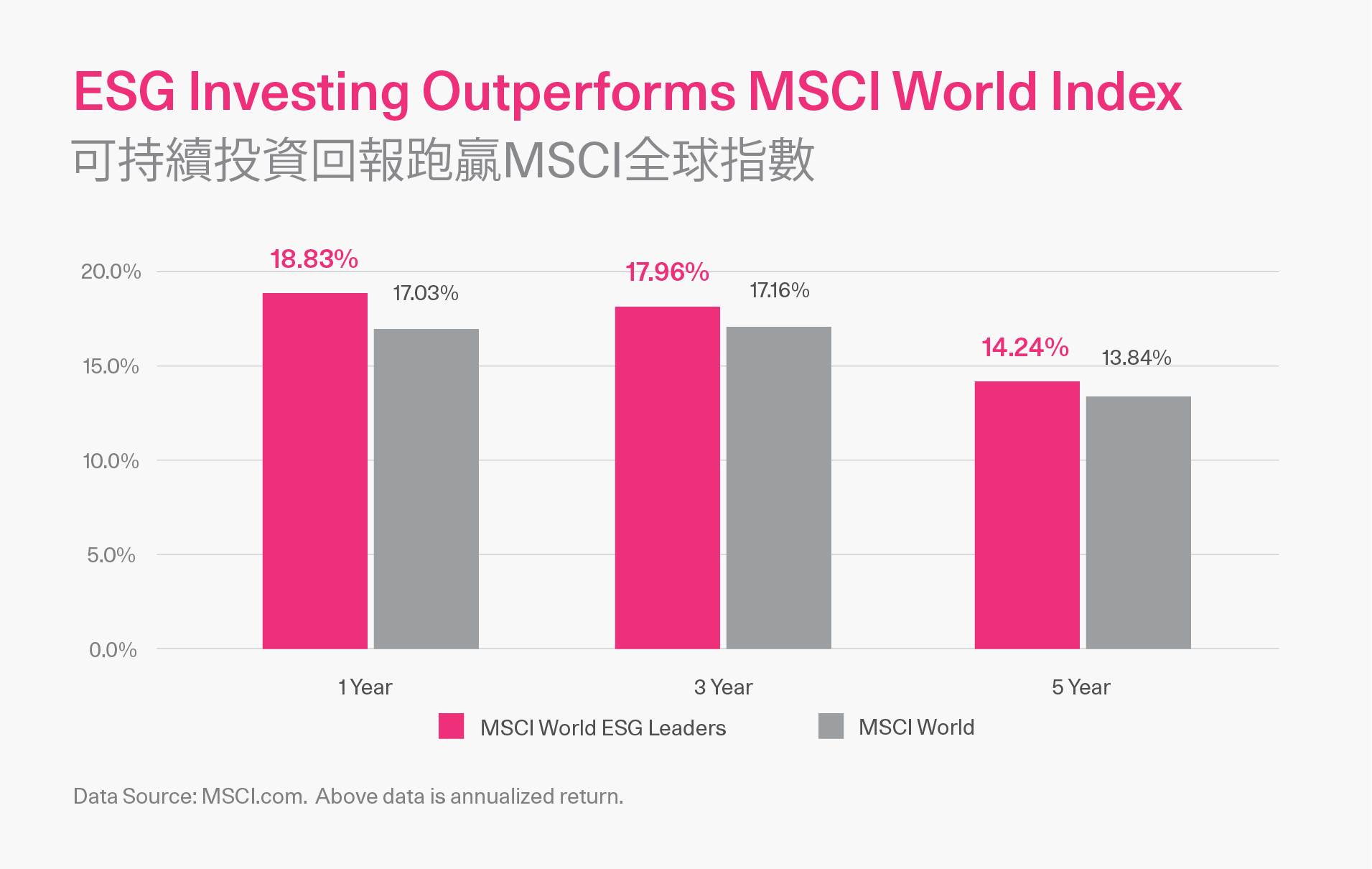

Worldwide, there are several indices that measure the financial performance of strong ESG firms, with the MSCI World ESG Leaders Index being one of the most popular. When comparing this ESG index with the general MSCI World index, ESG returns have consistently been higher in the past one, three, and five years in terms of annualized return.

Check out HERE to see how ESG investing performs financially.

Top 3 ESG investing Trends to watch for 2022

1. Social factor will play a more important role

Whilst the reflection on environmental (E) and governance (G) factors remains at the forefront of asset owners’ interests, social (S) issues such as health and safety, human rights and equality will be gaining more attention in 2022.

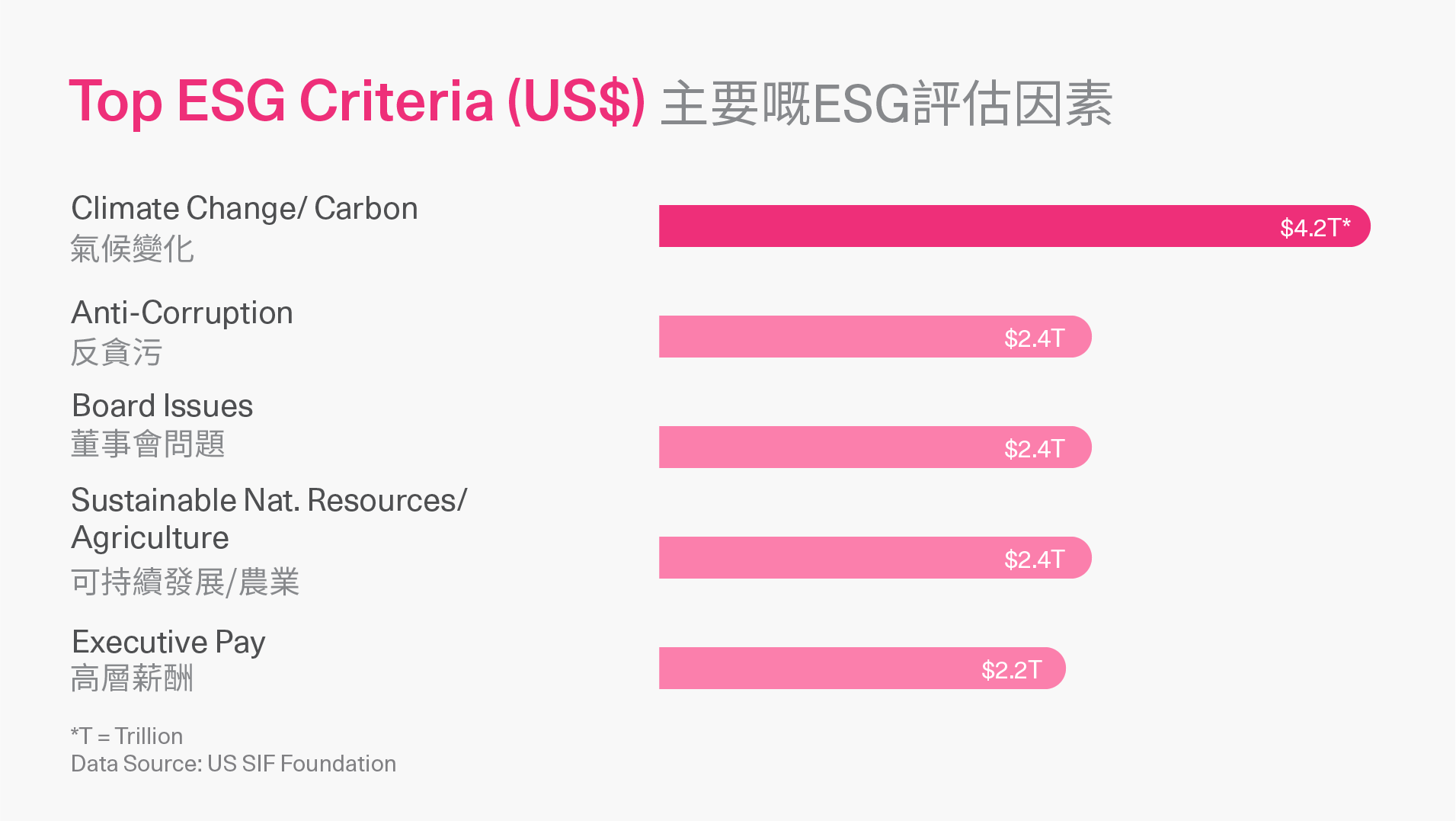

According to a research by US SIF, The Forum for Sustainable and Responsible Investment, 2 out of 5 top ESG criteria for money managers are Environmentally (E) related, of which Climate Change/Carbon is ranked first with total assets of USD$4.2T, outperforming the second top criteria Anti-Corruption, by USD$2T.

Yet, the social factor is expected to play a more important role in 2022. With reference to the 2020 ESG Manager Survey done by Russell Investments, it revealed an uptick in social factors, when compared to the previous years’ responses among the asset managers interviewed.

For example, in 2020, Bank of America committed $1B to causes supporting social and racial equality efforts.

Learn more about the ESG factors.

2. ESG will become more important in Asia-Pacific

ESG analysis and integration is becoming mainstream in APAC, and the rate of adoption has increased during the pandemic. According to the MSCI 2021 Global Institutional Investor survey, 79% of investors in APAC increased their ESG investments “significantly” or “moderately” in response to Covid-19.

In particular, APAC is leading the way on climate change-related considerations. Around 50% of investors in APAC countries consider climate change metrics for decision-making compared with the global average of 42%. Meanwhile, the Chinese Government has pledged to strictly control coal use as part of plans to reach carbon neutrality by 2060. This will further drive the investors' demand for ESG products.

3. ESG reporting will demand more credible corporate disclosures

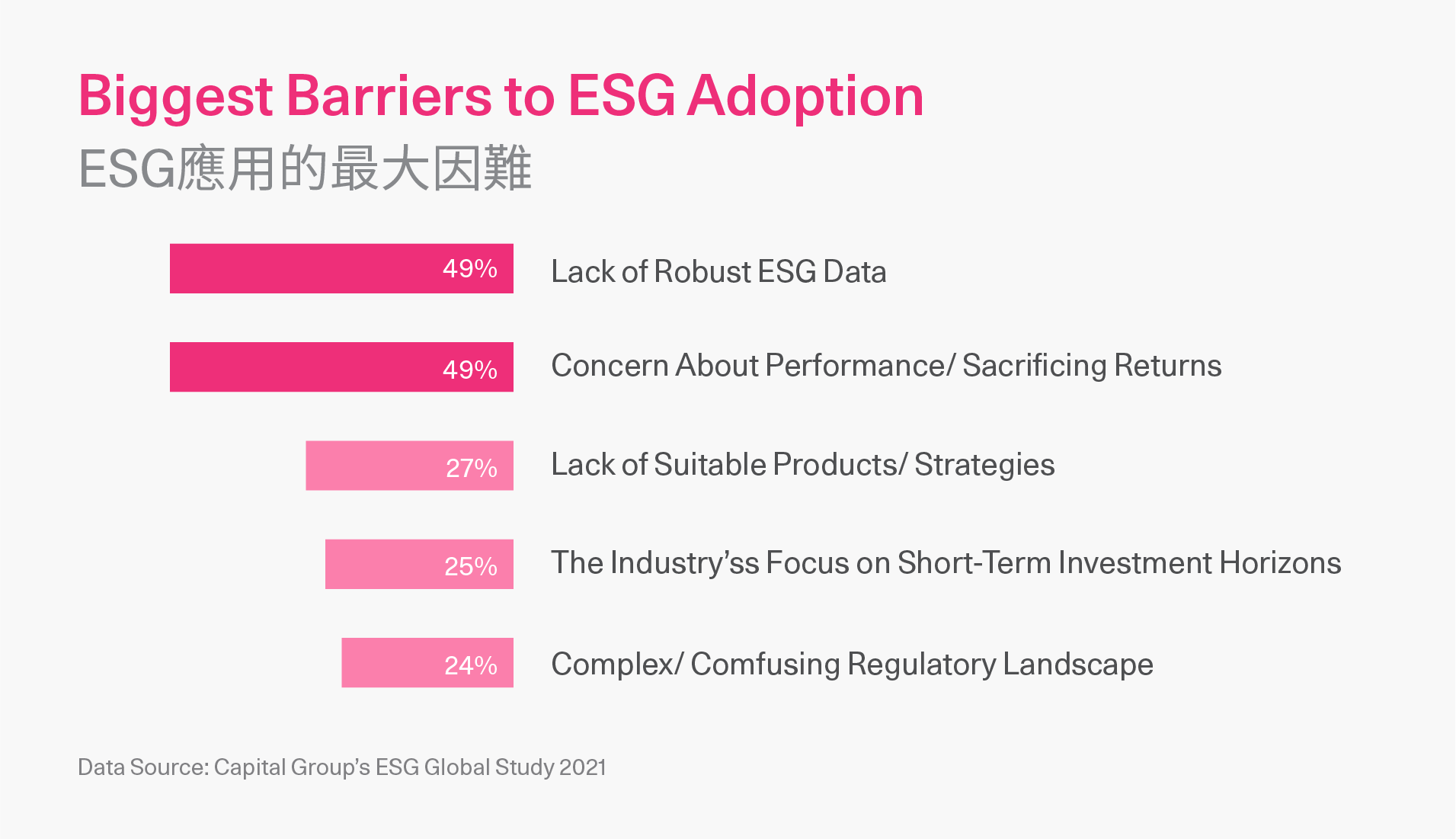

Finding common ground on what constitutes green or sustainable investments is a serious challenge for asset managers. According to the Capital Group’s ESG Global Study 2021, ‘lack of robust ESG data’ topped the chart as one of the biggest barriers in ESG adoption globally. While many large companies set sustainability goals and publish ESG-related data, investors, regulators, and the broader public are exercising greater scrutiny of corporate sustainability efforts, calling out what they perceive as “greenwashing”, where companies and funds make ESG promises that they cannot keep.

New global ESG-related standards will continue to evolve in 2022, while global standard-setting bodies such as the newly formed International Sustainability Standards Board can help address what may be the largest obstacle to accountability: the lack of a common baseline for disclosure standards consistent across jurisdictions and industries.

How to invest in Sustainability?

AQUMON’s 2 ESG portfolios ‘A Better World’ (US stock portfolio) and ‘ESG H.K.’ (HK stock portfolio) helps you invest with a social impact while having reasonable returns. These portfolios are built upon our proprietary algorithm technology and unique ESG scoring system, also taken into account of other financial factors such as R&D strength, profitability and cash flow.

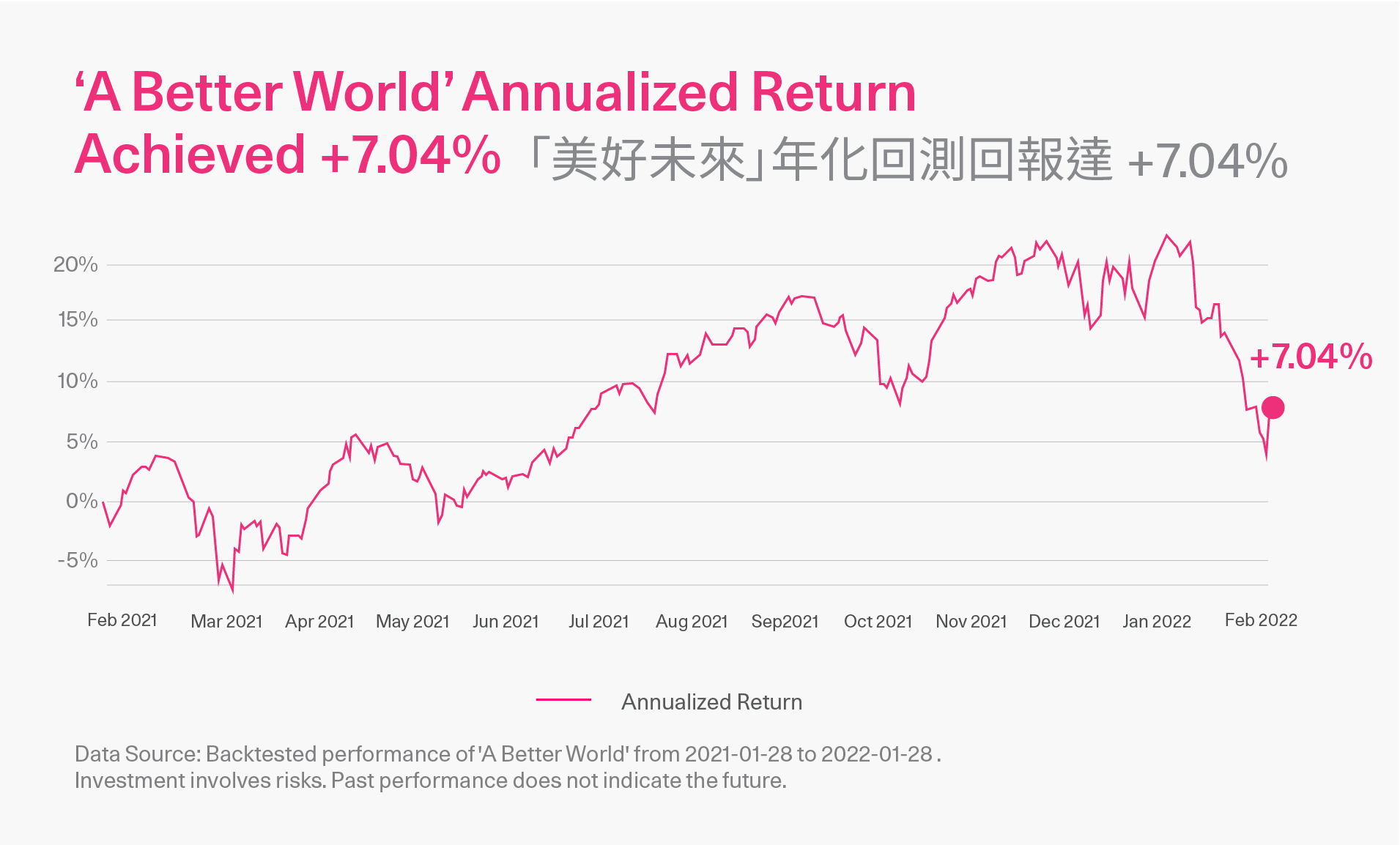

According to our backtested results, ‘A Better World’ portfolio (invest in US stocks, ESG focused), the annualized return achieved +7.04%.

Invest in social change with as little as USD1,000. We’ve selected 30 stocks with high-quality ESG factor performance to bring you an easy and comprehensive way to invest with conscience.

Click here to start investing in the future you want to see!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.