Top Asked Questions about ESG Investing

Written by AQUMON Team on 2022-02-18

As one of today’s most discussed investment trends, ESG’s meteoric rise certainly deserves a more thorough analysis. AQUMON hosted a webinar, Understanding ESG Investing for a More Sustainable World on Feb 16th, 2022 to explore the following topics in depth:

- What is ESG Investing?

- What does the current ESG market look like?

- How to rank ESG scoring and pitfalls investors should be aware of

- Top 3 ESG trends to look out for in 2022

- Performance review of AQUMON’s US and HK ESG portfolios

Key Takeaways:

- The asset under management (AUM) of ESG Investing is expected to grow from the current US$ 2.7 trillion to US$ 50 trillion by the end of 2025.

- Although Europe has been leading the world in terms of ESG investment, Asia-Pacific, especially Hong Kong and Mainland China is anticipated to have a greater uptick in coming years.

- More universal and standardized formats will come through in the future.

- ESG portfolios are foreseen to have greater potential for value investment. Investors should view this category as buying into global sustainability initiatives and long-term capital gain.

If you would like to watch the full playback, please scroll down to the bottom of the article.

Quick poll results:

Have you ever invested in ESG portfolios before?

35% have already started investing in ESG and the other 65% of the respondents have yet to invest in any ESG portfolios.

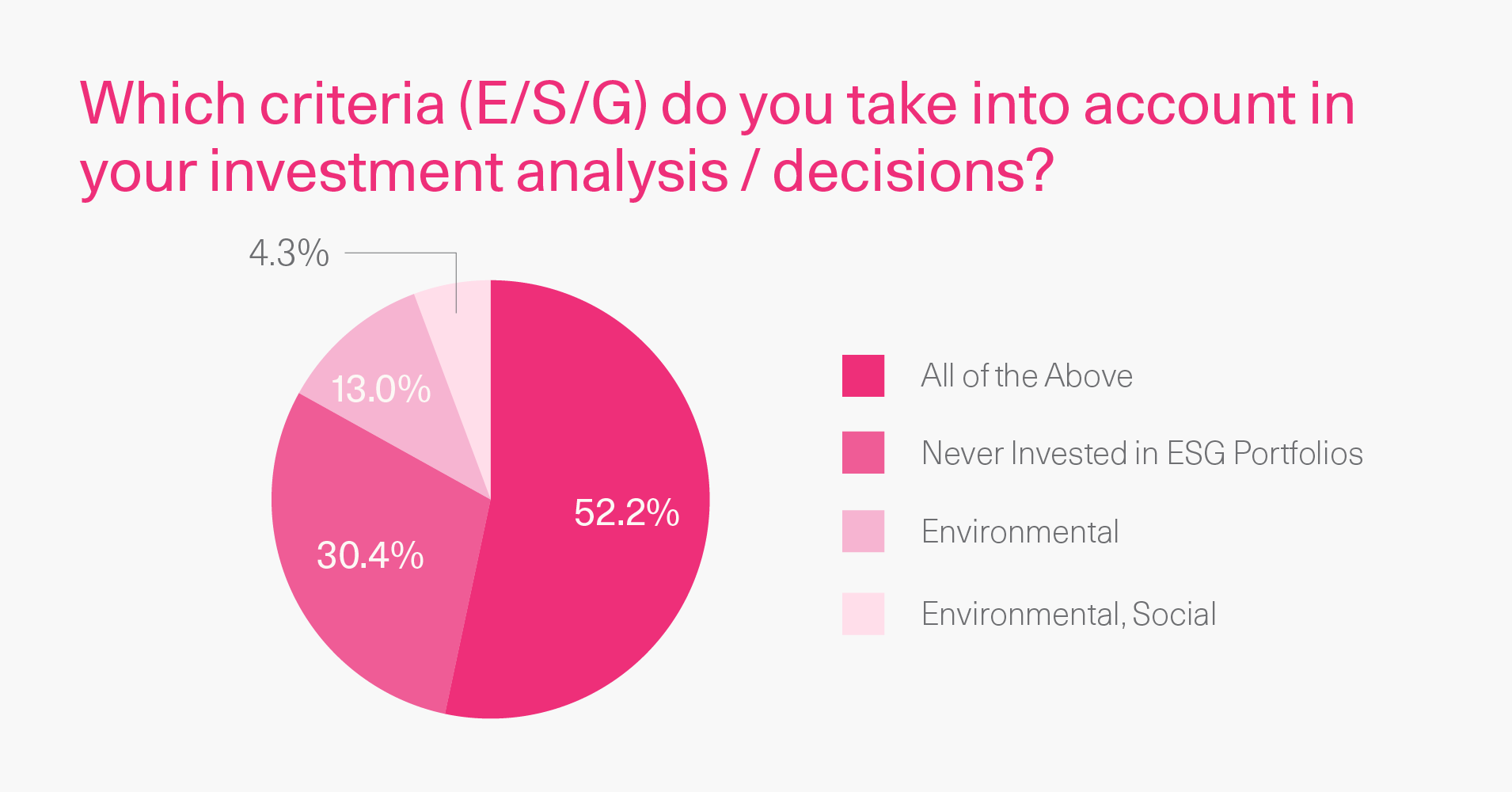

Which criteria (E/S/G) do you take into account in your investment analysis / decisions?

Over half of the respondents consider all three criteria when they are making an investment decision.

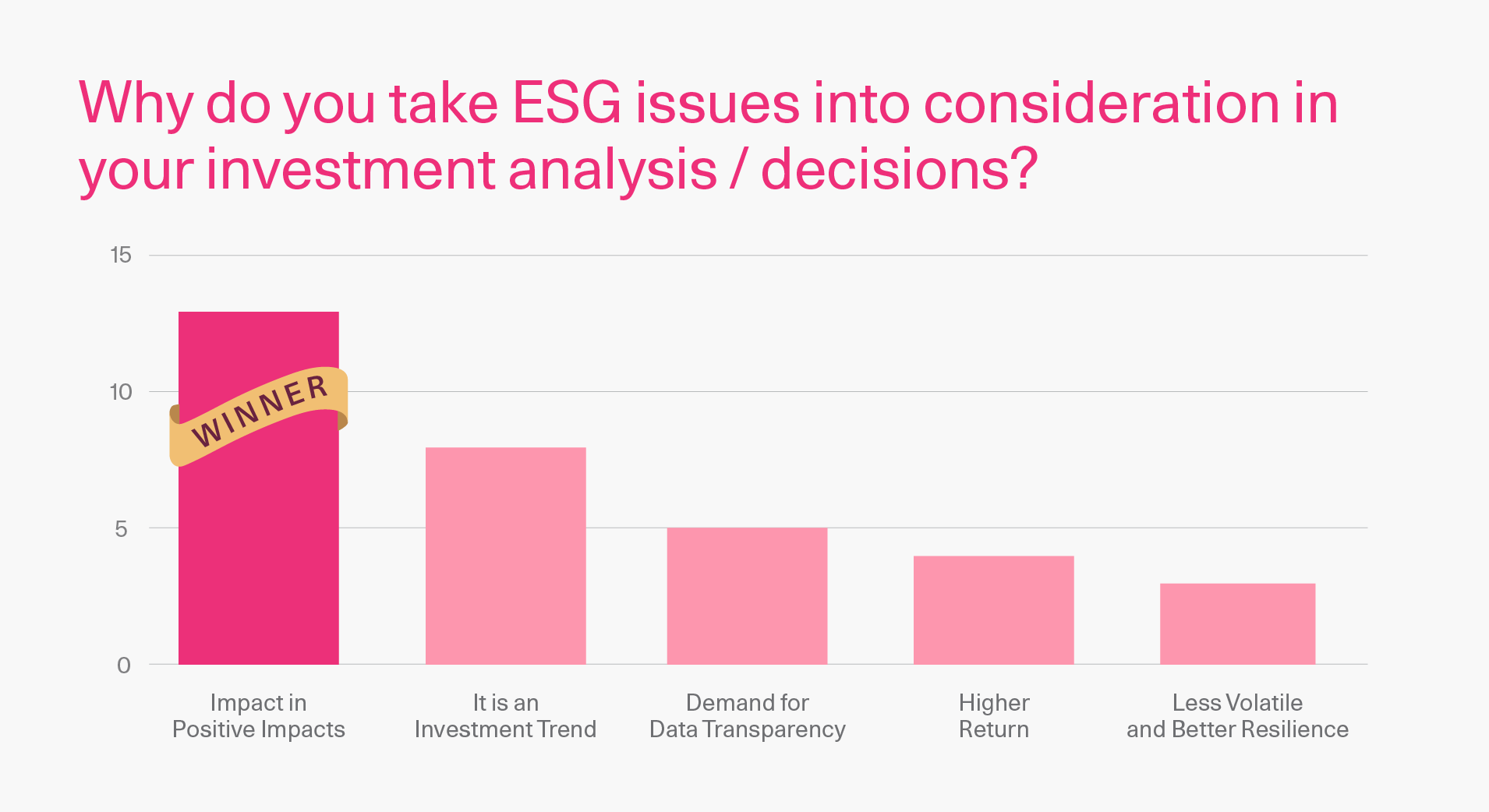

Why do you take ESG issues into consideration in your investment analysis / decisions?

“Impact positively” is the top consideration when making ESG investment decisions.

Top Asked Questions:

Here are some of the top asked questions regarding ESG investing that may inspire you.

Q: How do you correlate the ESG scoring of a company to its investment return? Obviously, high ESG scoring does not imply a higher return, is that true?

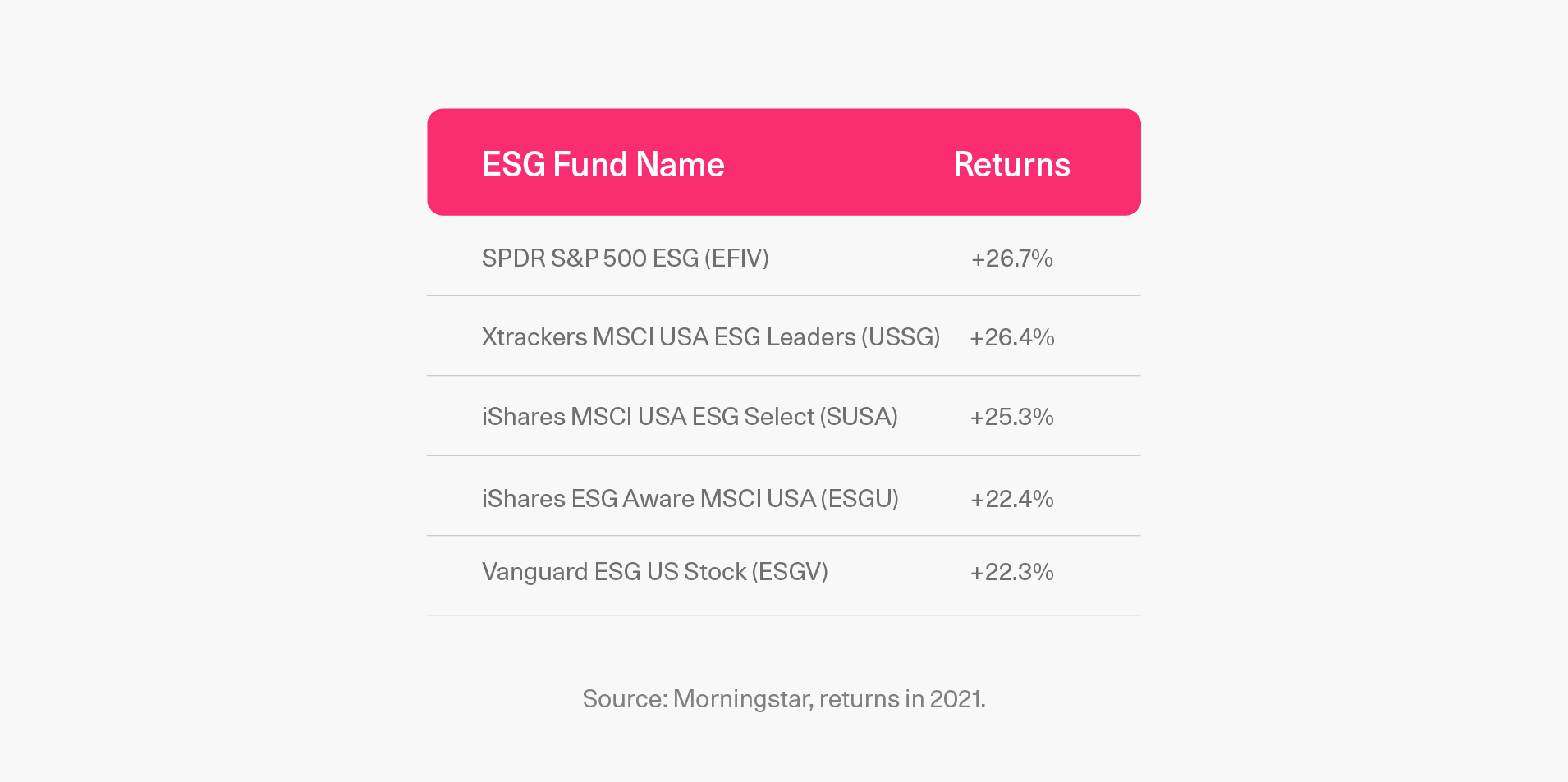

A: ESG returns have consistently been higher compared with the general MSCI World Index. While looking at the performance of different ETF trackers, ESG investing does not sacrifice financial returns at the expense of sustainable development.

For example, the SPDR S&P 500 ESG (EFIV) and Xtrackers MSCI USA ESG Leaders (USSG) achieved +26.7% and +26.4% respectively in 2021.

Extended reading: Debunking the myths of ESG Investing.

Q: What are the pitfalls and challenges of the existing ESG rating system?

A: There are 3 common pitfalls we observed:

No standardized methodology for data collection and analysis: there are over 200 sets of standards for reports and assessments in recent years. Regulators, companies or financial institutions have no coordination. ESG reporting is also costly for small firms.

Not tracking the right metrics: Some market leading rating systems are using subjective human scoring for ESG evaluation. Some ESG rankings also include controversial industries such as gambling, tobacco, military defense and metal mining.

Greenwashing: Companies may use deceptive marketing to make sustainable initiatives for the sake of better valuation.

Top evolving ESG Investing trends that investors should look out for.

Q: How does AQUMON look into the ESG rating system?

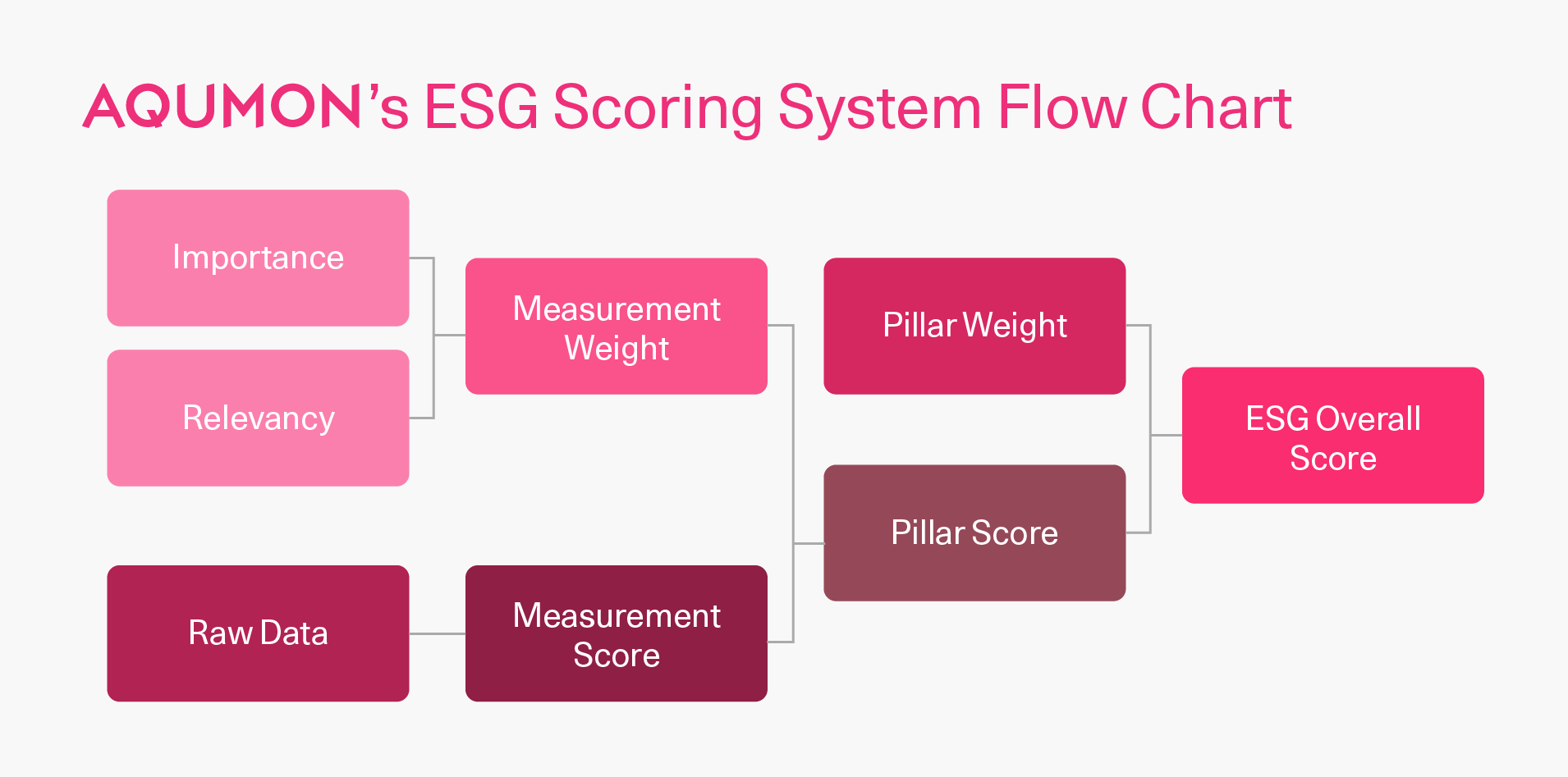

A: Our underlying research is based on quantifiable data, eliminating as much as possible the influence of human subjectivity. The evaluation index system has more than 40 factors in 9 evaluation categories that feature all three key factors: environment, social responsibility, and corporate governance.

We have a framework for our ESG rating system. The importance and relevance of each ESG rating factor differs from industry to industry. For example, Internet companies do not have the issue of waste dumping. Thus, in AQUMON ESG rating universe, we will adjust the weighting to reflect how relevant a factor is to a particular category. The approach is not a one size fits all.

We also exclude “Vice Businesses”, such as tobacco, gambling, non-renewable energy, defense, and military. Moreover, companies selected also have their fundamental factors, such as overall R&D investment and profitability, reviewed to ensure the companies we put forward are sound, operating businesses.

Learn more about AQUMON’s ESG rating system.

Q: What ESG portfolios does AQUMON offer?

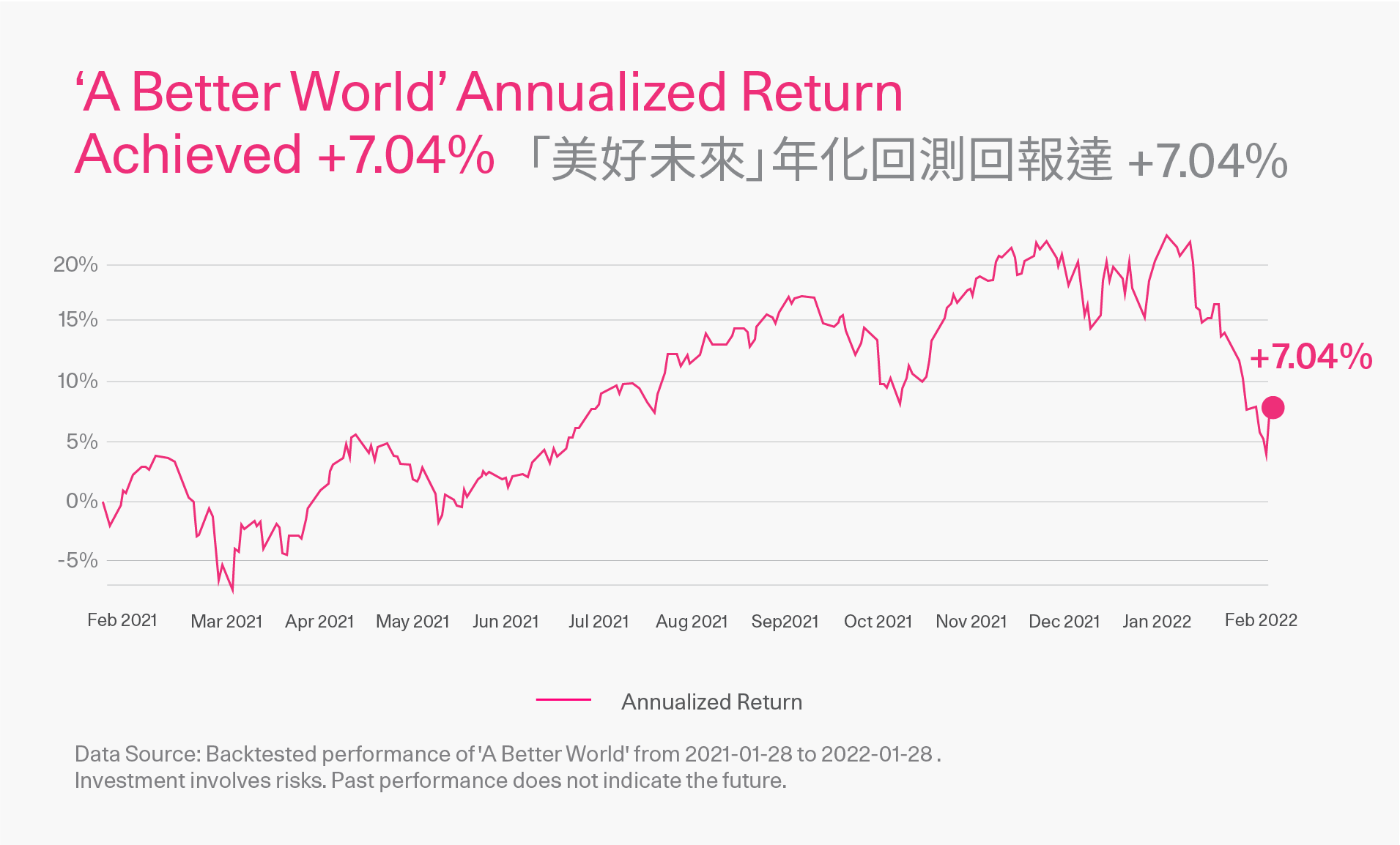

A: AQUMON offers both Hong Kong and US ESG portfolio, namly ESG H.K. and A Better World. Take A Better World as an example, its backtested annualized return achieved +7.04%.

As most of the stocks in the ESG portfolios are in the sectors of new energy and technology, which are experiencing a correction given the rate hikes and inflation, we’ve seen recent volatility in its performance. But looking forward, these portfolios all have a solid underlying that our researchers and algorithms have detected, therefore we see these investments as value-driven and will show a good growth potential.

Q: There's research showing that brown firms earn higher returns than green firms in the long run, is that true?

A: When we look at the historical performance, these types of stocks did have better performance than green firms in certain periods. However, we are looking forward to a future where the governments and the general public are more conscious about ESG practice, not only in the investment space, but also in corporate agenda. For example, we will be using more renewable energy than fossil fuels. That being said, in the future, the renewable energy firms will have a much better performance than those who sell traditional types of energy due to the innovation and investments they are putting in now.

Ultimately, ESG is for the longer term, and is propelled by forward thinking, therefore yes brown firms are at times doing better, however we should not be looking at this point in time but much further into the future, we are investing in a change we want to see.

Q: Any view on upcoming Q2 ESG trends and direction?

A: We have a positive outlook of ESG investing in Q2 2022. Last year, ESG portfolios did not perform very well given the overvalued stocks and uncertainty of rate hikes. When the rate hikes take place in March 2022, there will be more certainty in the market. That being said, ESG portfolios (where it invests heavily into new energy and tech sectors) will have greater opportunities.

Video recap of the webinar

Listen in to dive deeper into the world of ESG investing with AQUMON’s Chief Economist and Lead Quantitative Researcher, Dr. Arthur Lei along with our Head of Corporate Communications, Ms. Caroline York. Check out the evolving trends of ESG investing in 2022.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.