Top Questions Asked About AQUMON’s Bespoke Investment Services

Written by AQUMON Team on 2022-03-15

"The markets have been volatile lately, how should I position my investments?"

"How does the system generate investment advice automatically? How does it provide customized recommendations?"

"Bespoke service sounds very advanced. Is the investment threshold very high and are there high fees?"

AQUMON Bespoke exists to offer hyper-personalized wealth management services for our clients looking for extra sophistication in their investment strategies as well as exclusive benefits. Our Bespoke services help clients capture market opportunities while mitigating the risks, tailored specifically to their individual needs.

Since our launch in December 2021, AQUMON Bespoke has received tremendous support and queries from clients. To address your questions, such as “How to join Bespoke and enjoy personalized investment services? How does Bespoke manage my investments scientifically? What are the exclusive benefits upon joining Bespoke?”, AQUMON has compiled 8 frequently asked questions to help you learn more about Bespoke services!

Service-related

1. What is AQUMON Bespoke?

AQUMON Bespoke is a hyper-personalized investment service, especially catered to those who want more sophisticated portfolio management capabilities and exclusive 1-to-1 services. Through our dedicated Relationship Manager team, we will analyze your investment needs and preferences. Through our proprietary data algorithms known as “SmartAdvice” system, a scientific and tailor-made investment plan will be generated to optimize your return. Running with the main mandate to achieve long-term capital gain, AQUMON Bespoke helps clients capture market opportunities without compromising on the risk control factors.

Learn more about AQUMON Bespoke's services.

2. What are the differences between AQUMON Bespoke and private banking services?

AQUMON Bespoke is suitable for investors who are looking for long-term capital gain with an investable amount of HK$2,000,000. Based on our automated algorithmic data analysis, Bespoke can help reduce various costs such as manpower, which lets AQUMON return cost saving back to our customers l. While for private banking services, there are a lot of high overhead costs due to the human-resource heavy model. Due to the high overhead costs, in Hong Kong, most private banks require their clients to have investable assets of at least USD 1 - 2 million.

In addition, it is common practice for fund managers to promote products that have a greater commission share, rather than placing the client's interests as the sole consideration. On the contrary, AQUMON's wealth managers are not incentivized through commissions and the recommendations are completely based through scientific analysis performed by AQUMON’s quantitative engines.. Therefore, our services can prioritize clients’ interests in a more objective manner. Combining both the macro economic markets and scientific analysis, AQUMON Bespoke formulates an asset allocation investment plan for clients that is tailored to their needs.

Right now, clients can enjoy complimentary smart investment advice (“SmartAdvice” Service) from Bespoke, the only fees incurred are the existing advisory fee within the platform.

Find out more about our fee details here.

3. After making an appointment for AQUMON Bespoke, what happens next?

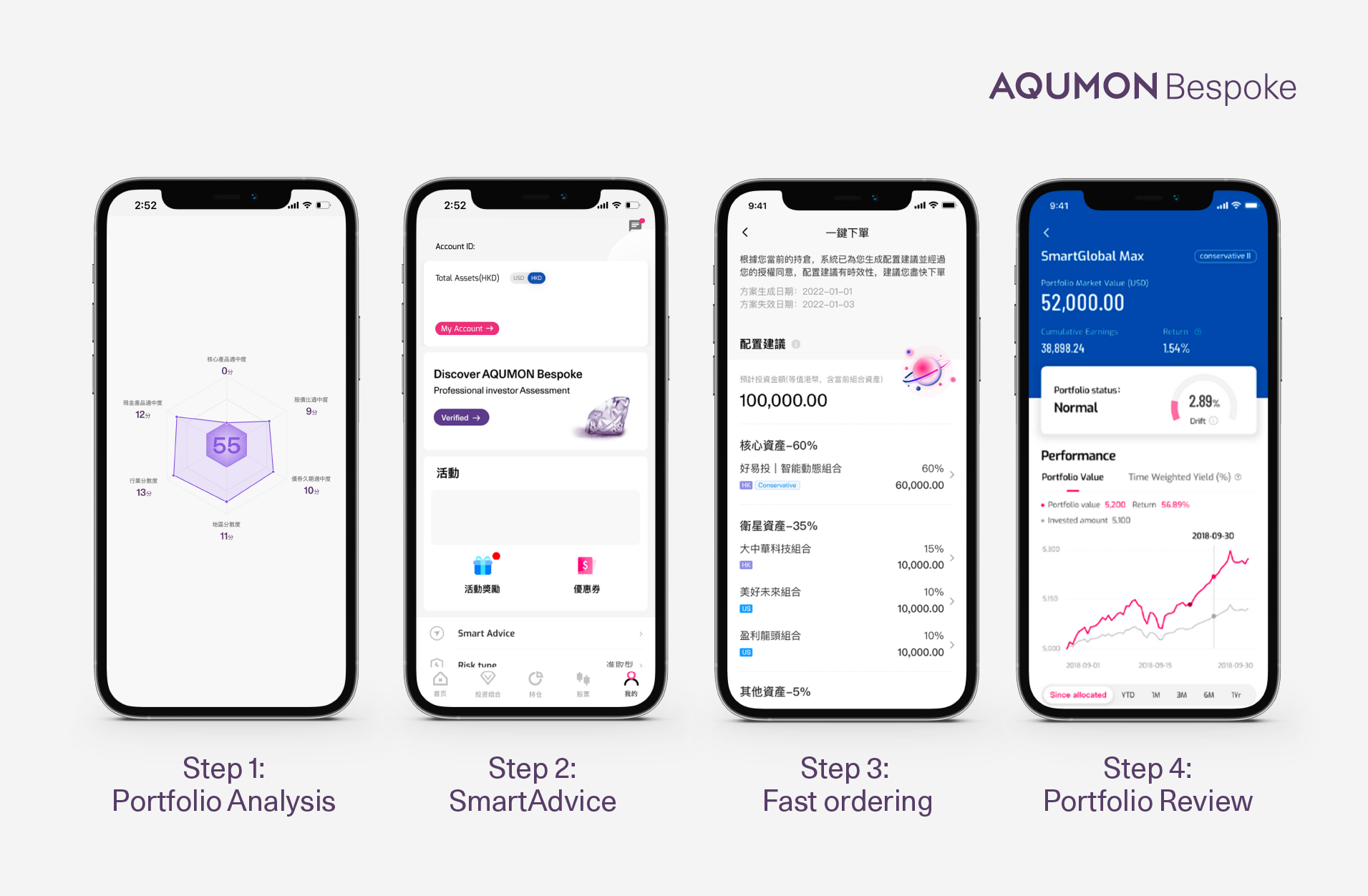

Once you have expressed interest in the AQUMON Bespoke service, a dedicated wealth manager will be appointed to you who will conduct a 1-on-1 consultation and monitor your portfolio closely. The whole procedure can be explained in 4 main steps:

1) First, your wealth manager will schedule a meeting with you to understand your investment needs and preferences. Based on our proprietary algorithms, a preliminary investment analysis will be automatically generated based on your current holdings.

2) Through the SmartAdvice system, we will recommend investment advice based on your holdings, investment needs, preferences, and current market conditions.

3) If you would like to invest based on the SmartAdvice recommendation, you can simply place an order simply through the AQUMON app.

4) You can check your investment performance in the app, anytime, anywhere. Your wealth manager will have a quarterly review with you and advise you on rebalancing when needed.

4. What factors are considered during the portfolio analysis?

Leveraging on our SmartAdvice’s proprietary algorithms, your portfolio will be analyzed and rated comprehensively from the aspects of investment returns, the diversification of industry and regional exposures as well as the ratio of equity-bond allocation etc.

One point to note is that the scoring only represents the overall evaluation of the investment portfolio and does not guarantee any investment returns.

5. What investment products are available in AQUMON Bespoke?

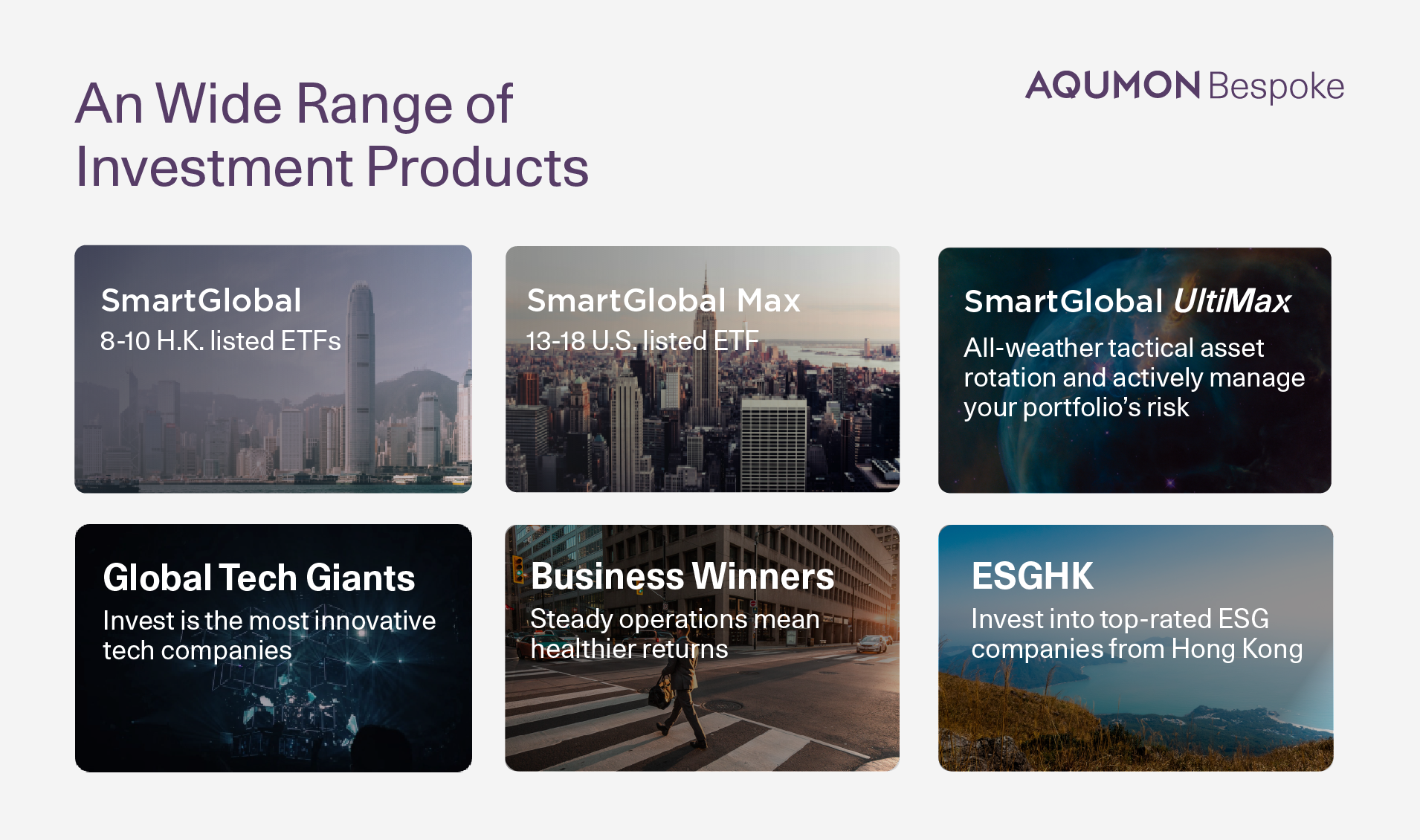

We will recommend the most suitable investment plan to our clients based on the results generated from SmartAdvice, the product selection includes:

- Global Asset Allocation Strategies - SmartGlobal Series

- Thematic stock portfolios (e.g. global tech giants, ESG)

- If you qualify as a Professional Investor (PI), you can enjoy a wider range of investment products that is exclusive for PI only.

For details on PI verification and exclusive investment products, please contact our wealth manager for more details. Optimize your wealth, schedule your 1-on-1 consultation today.

What is SmartAdvice?

SmartAdvice is an intelligent advisory system that utilizes algorithms to automate investment recommendations for clients. It is an exclusive service available only through AQUMON Bespoke. Let’s dive deeper into SmartAdvice:

6. What is SmartAdvice's investment philosophy?

Investors who often follow the markets tend to pay more attention to short-term gain. When the market is rising steadily, it is easy to get good returns; however when the market fluctuates, investors will find it more difficult to maintain their expected returns and can lead to portfolio loss, a less satisfactory investment experience..

AQUMON SmartAdvice is based on the principle of "core-satellite investment". The core investment portfolio will provide you with long-term and stable capital gain, while the satellite investments can help capture market opportunities.

The core portfolios in SmartAdvice consist of AQUMON's flagship asset allocation portfolio SmartGlobal series. As a long-term investment, core investment should not be affected by short-term market events, but should be formulated according to investors' own investment goals. Based on the Nobel Prize-winning theory, AQUMON's globally diversified flagship asset allocation portfolio can help investors achieve steady wealth growth.

Satellite portfolios can help offer greater flexibility and capture market opportunities across different sectors and themes the investor wants to explore. These portfolios include AQUMON's thematic stock portfolios and excessive return strategies (exclusive to the Professional Investor only).

Learn more about AQUMON Bespoke SmartAdvice.

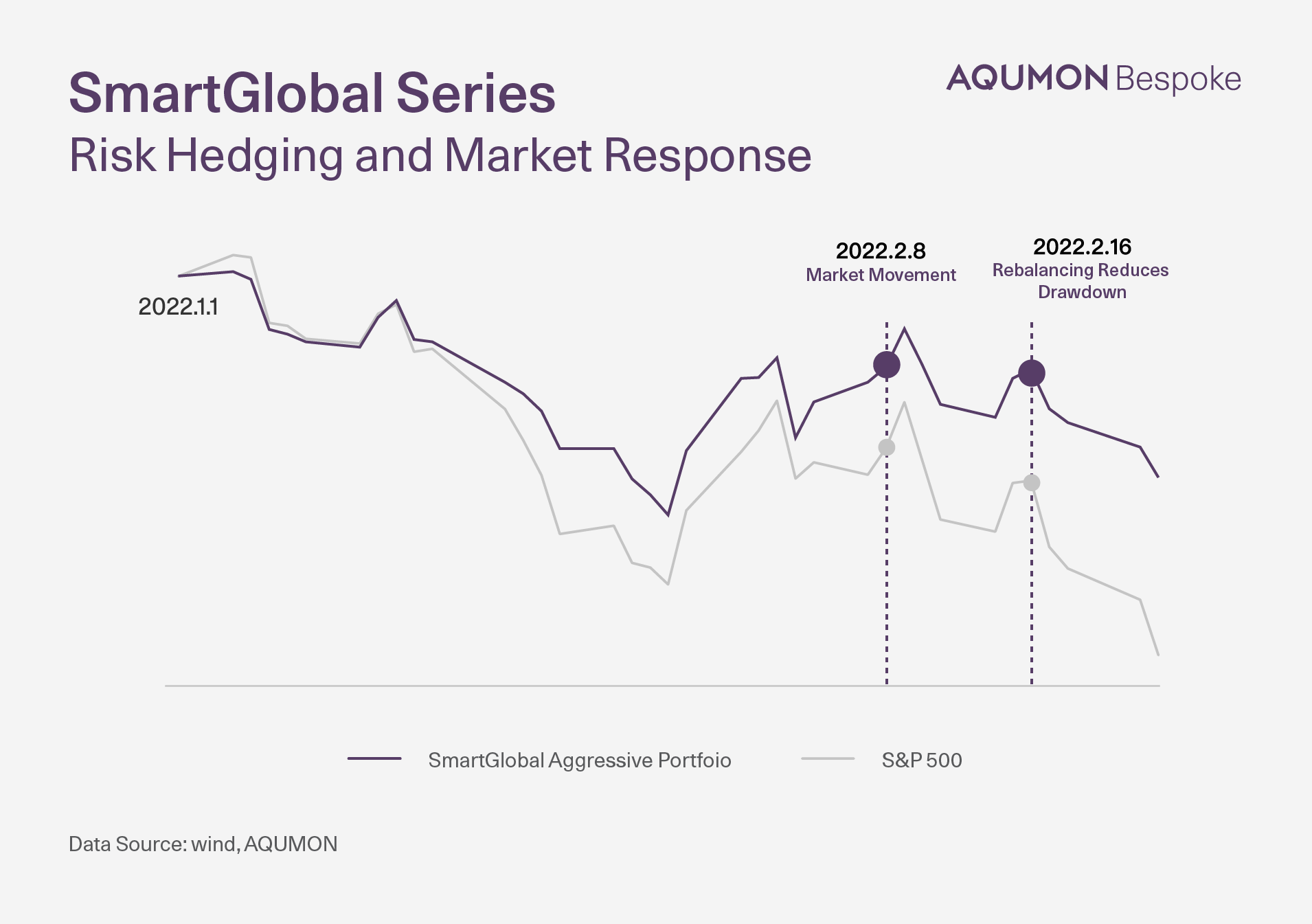

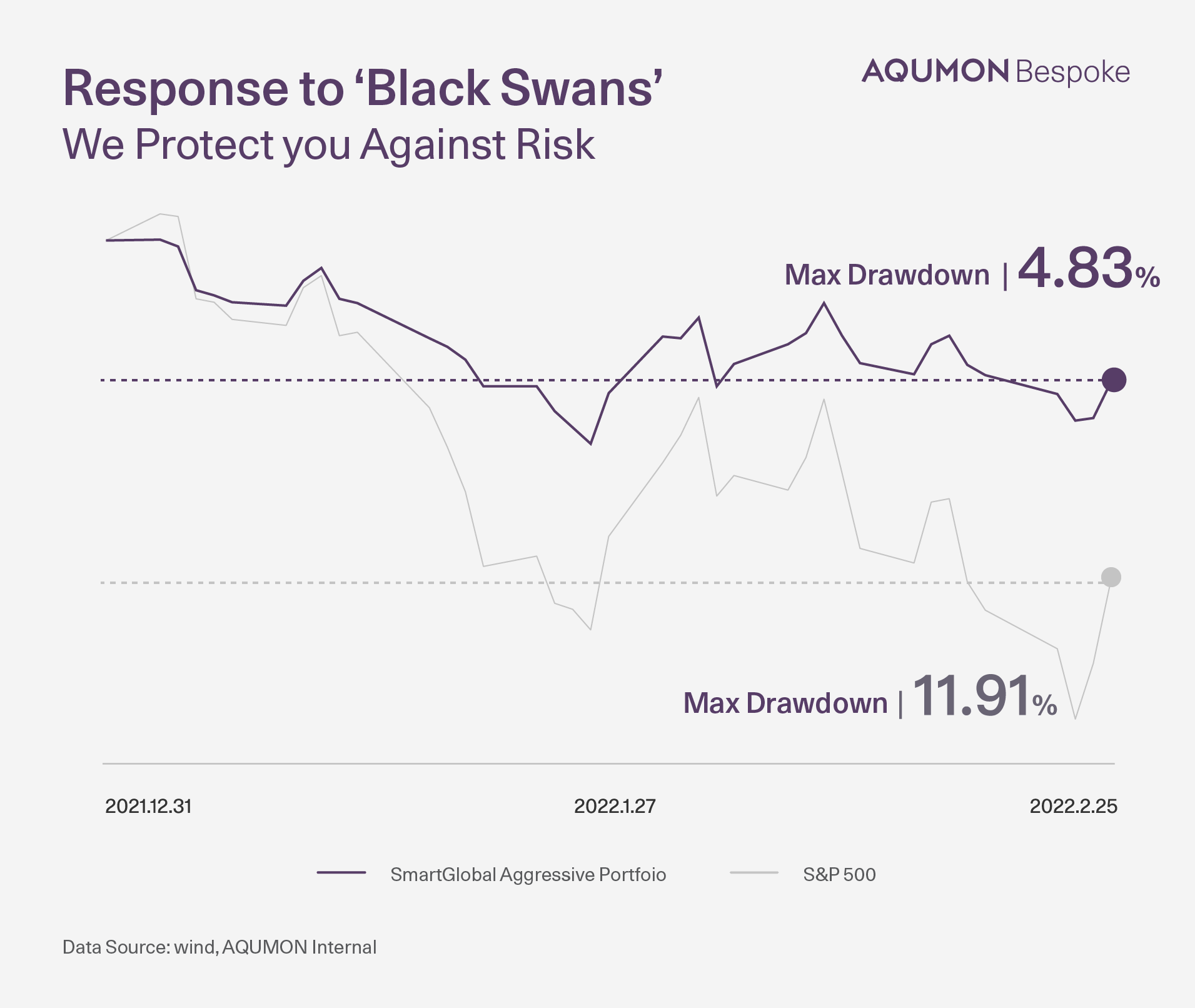

7. Will SmartAdvice make investment adjustments given heightened market volatility?

In view of the current global conditions, we have made corresponding adjustments to different investment portfolios to reduce risks and increase the portfolio’s resilience. Most of our investment portfolios are currently still outperforming the benchmark indices.

In recent weeks, we have appropriately increased the proportion of core asset allocation in SmartAdvice to reduce risks in certain sectors; stock portfolios have also been adjusted to diversify the exposure of different regions and sectors.

After the Ukraine-Russia war and the confirmation of Fed's interest rate hikes at the end of March, we will assess different categories of value equities that can balance theinvestment portfolio while capture market gains.

AQUMON's investment team and data scientists carry out quarterly reviews with clients, going through the market trends and portfolio performance. If needed, rebalancing will be triggered to keep the portfolio at its optimal level.

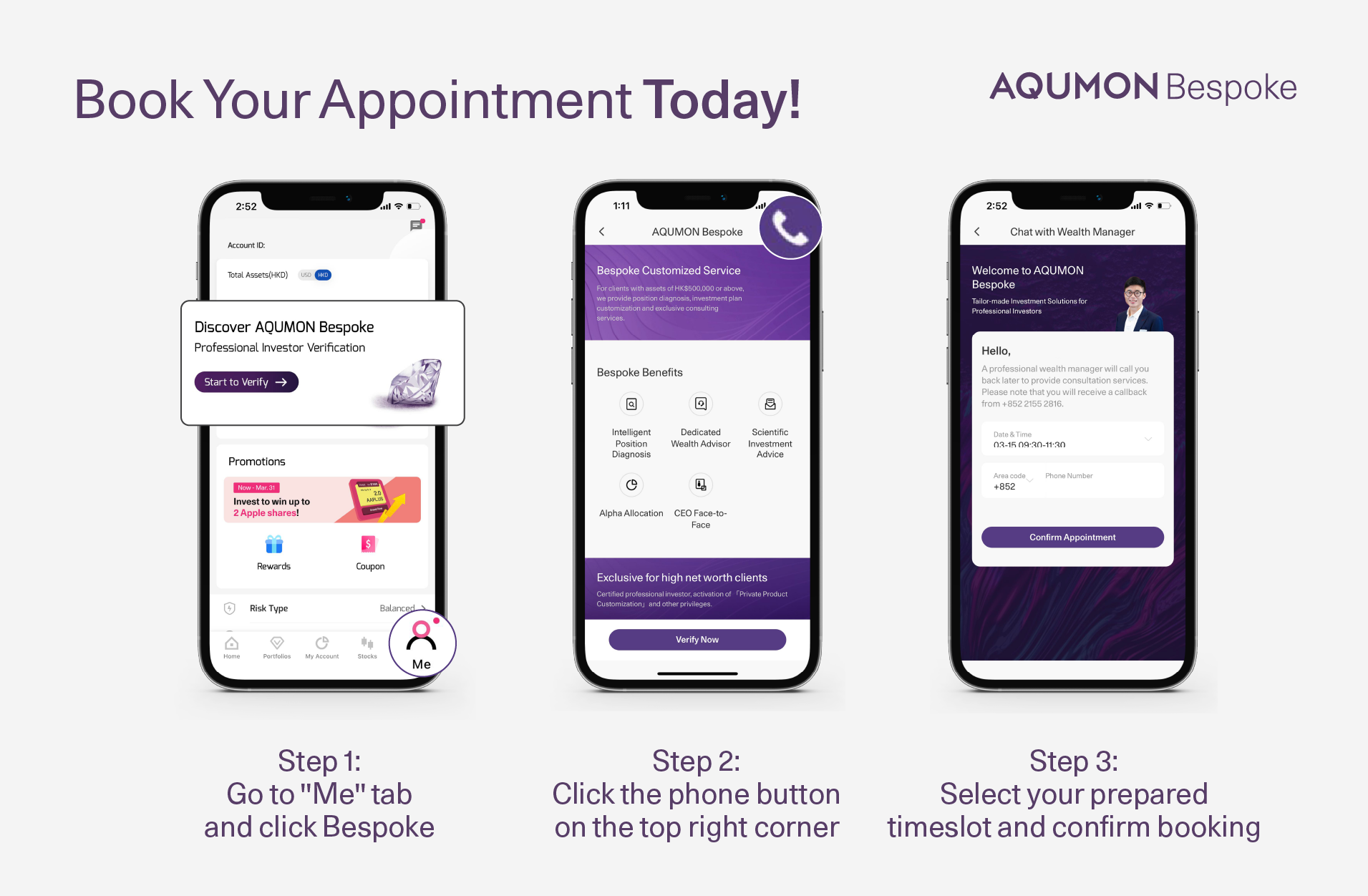

8. How to sign up for AQUMON Bespoke?

The minimum threshold for Bespoke service is HK$500,000, and the minimum investment threshold to activate SmartAdvice is HK$2,000,000. If you wish to learn more about the details, you are welcome to book an appointment.

You may also contact our Wealth Manager via phone (2155 2816), WhatsApp or email bespoke@aqumon.com.

Hyper-personalized, data-driven, try AQUMON Bespoke today. Grow your wealth with AQUMON - your trusted wealth advisor.

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.