2022 Q2 Market Insights and Portfolio Performance Updates

Written by AQUMON Team on 2022-07-14

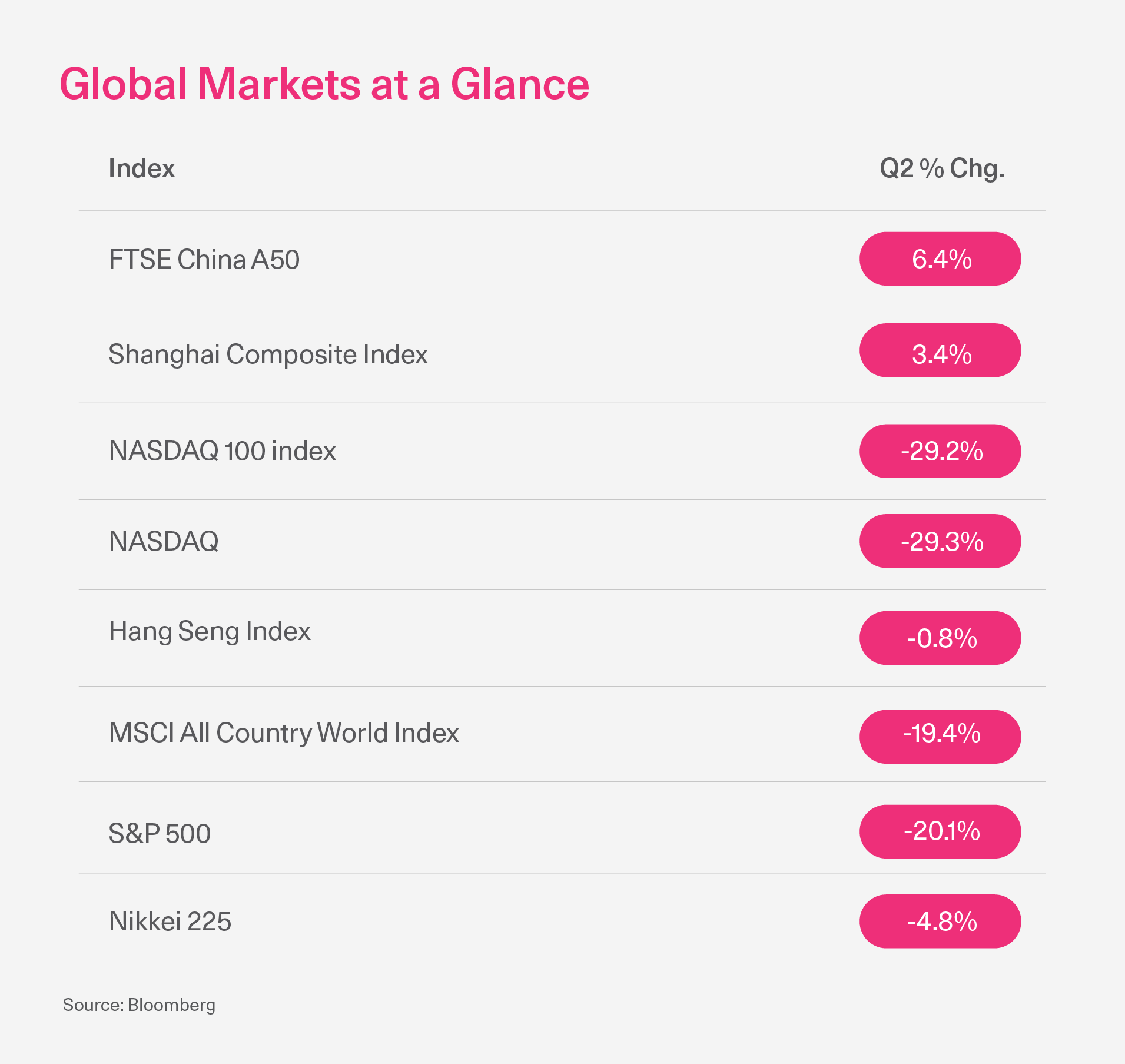

The second quarter of 2022 proved to be another difficult one for investors to navigate. High inflation and interest rate hikes continued from Q1, and the war in Ukraine and China's slow reopening of its major cities post-lockdown have continued to disrupt supply chains. Although the Chinese markets gradually bounced back from a low in Q2, recession fears began to emerge in North America and Europe. Market pessimism and concern remain high.

Under such extreme market conditions, how does AQUMON's portfolio perform? Can global asset allocation continue to perform stably? What can we expect from the financial markets in the upcoming third quarter? Continue reading to prepare for your investments.

2022 Q2 Key Highlights

The second quarter of 2022 continued several trends from the first quarter of 2022, with major asset classes under pressure. Overall key events were:

1. Inflation numbers in the US and the UK surged to 40-year highs, while Eurozone inflation reached a new record as well. The interest rate hikes that central banks have indicated they will pursue to tackle inflation have deepened recession fears in North America and Europe.

2. The US dollar continued to strengthen due to the Fed increasing interest rates, with other currencies weakening significantly against the dollar. The Japanese Yen has plunged in value as the worst-performing major currency this year while the Euro slid closer to potential parity with the US dollar.

3. The US stock market experienced a large decline, with the S&P 500 entering a bear market (down more than 20% from its January record) in June. US technology and growth stocks were the worst affected.

4. Crypto markets crashed from a historical high due to Fed rate hikes and reduced market liquidity. One notable event was the Terra/Luna stablecoin crash in May.

5. Chinese markets bounced back from a low in Q2 as major cities under lockdown gradually reopened, and China's loose monetary policy continued to deviate from more hawkish policy globally.

Global Markets at a Glance

How did AQUMON's Portfolios Perform?

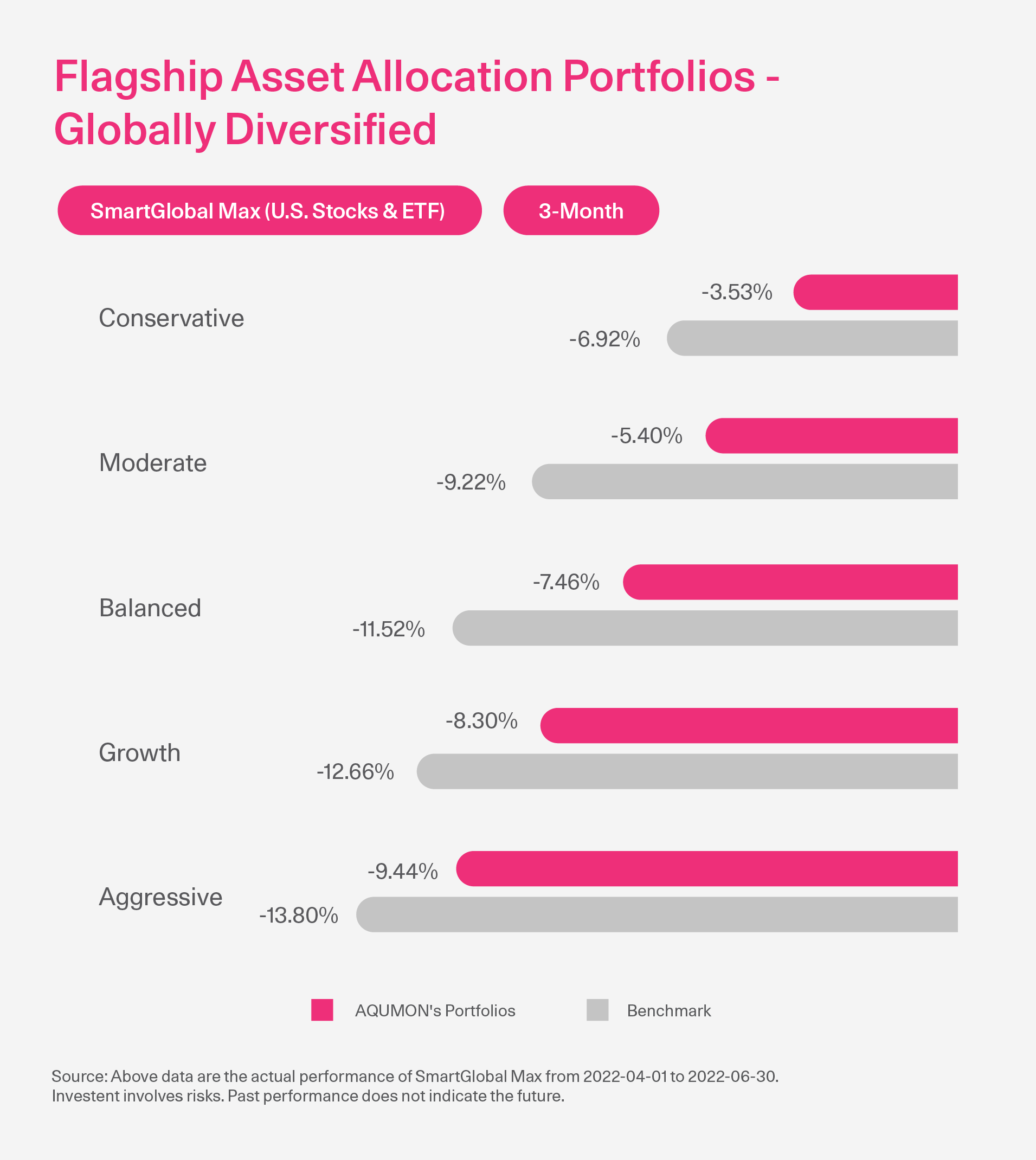

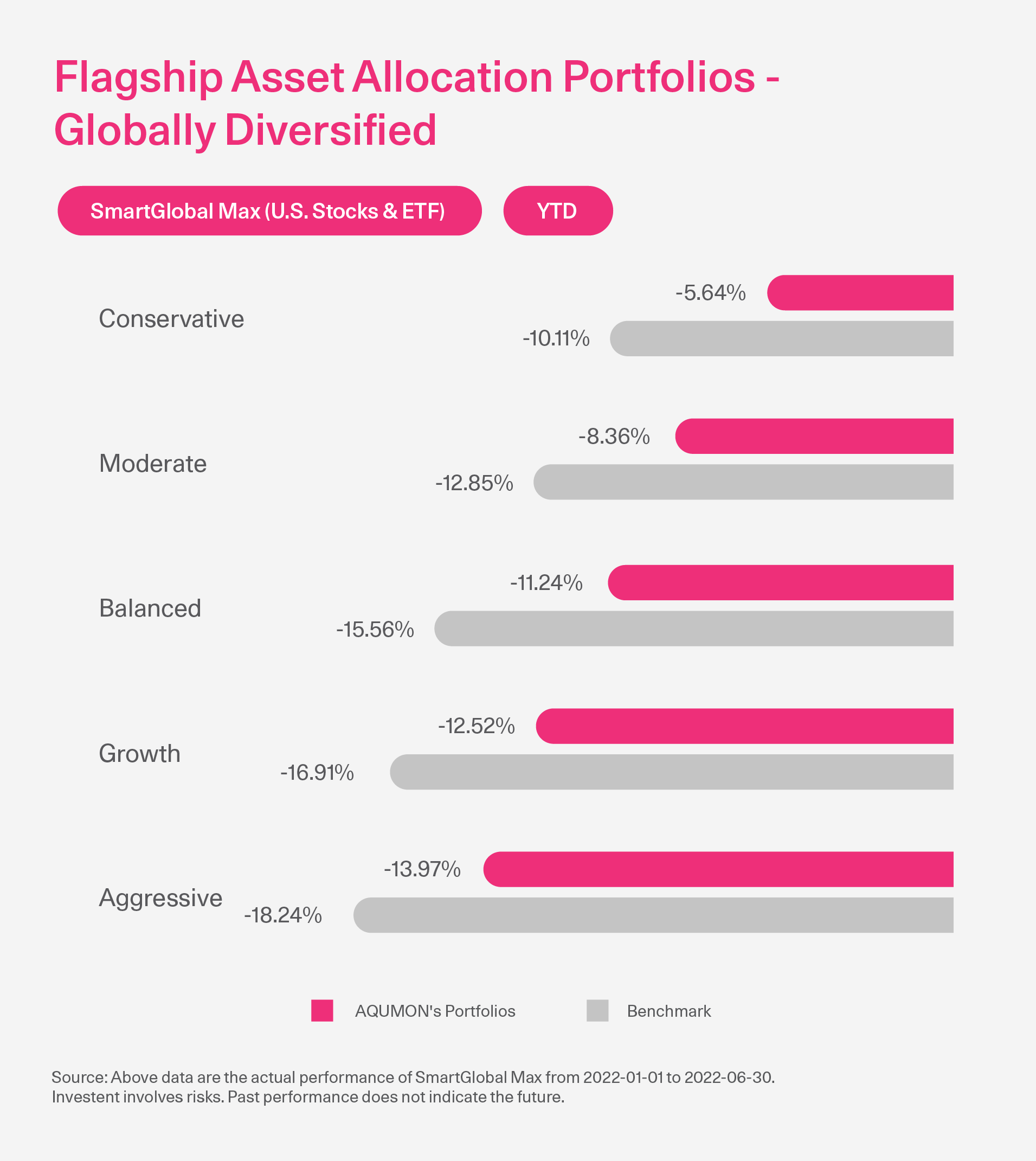

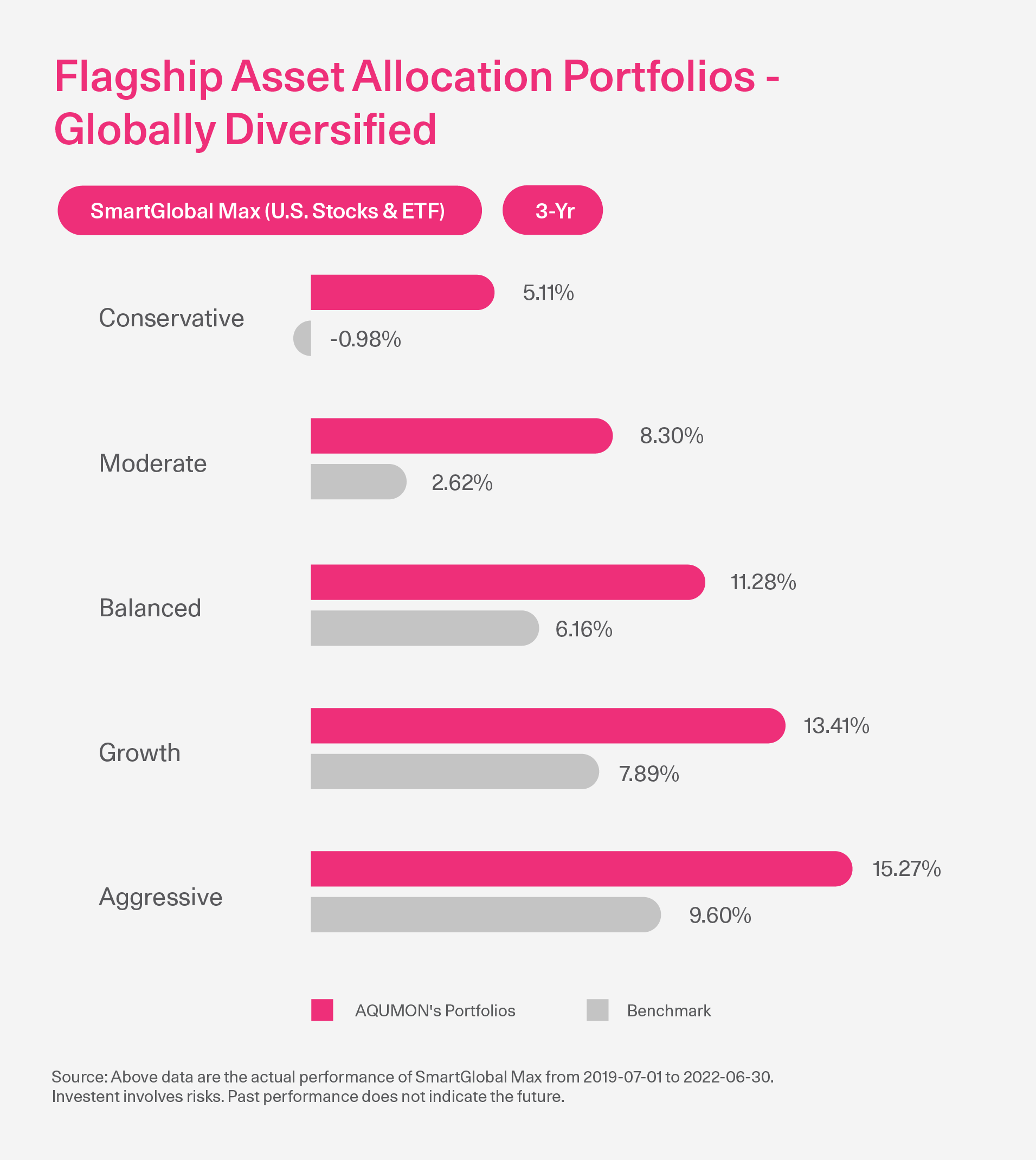

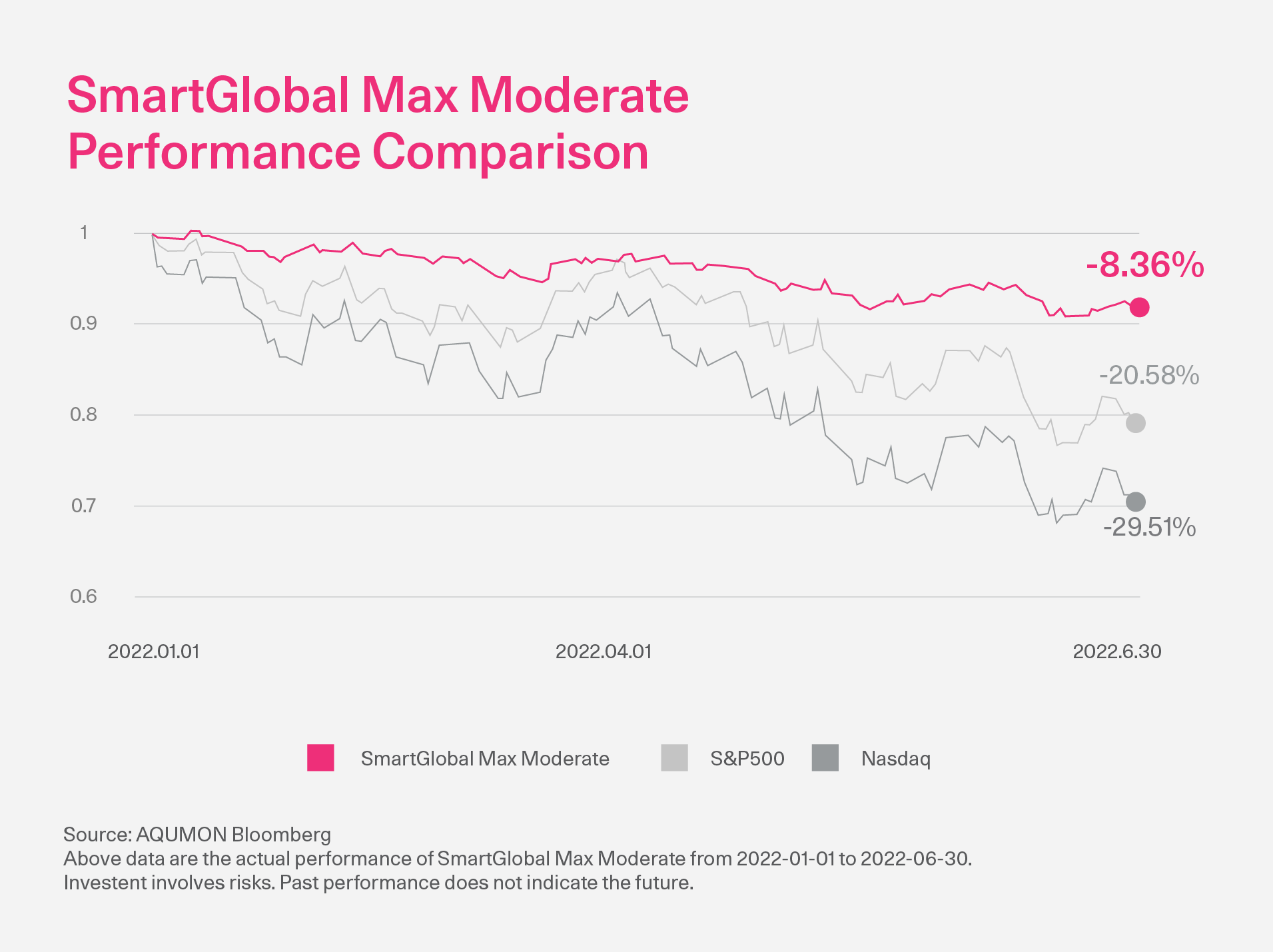

Adhering to scientific allocation, AQUMON's global asset allocation starts from big data and algorithms, and still brings stable performance to our customers. It continues to play a strong role in risk control and diversification of investment, helping our clients reduce risks and achieve reassuring investment. All portfolios outperformed their benchmarks by a wide margin. Let's take a look at the performance of the AQUMON portfolio this quarter:

Flagship asset allocation portfolio performance VS benchmark (2022 Q2, 2022 H1, Past 3 years)

The above charts show that based on AQUMON's unique global asset allocation strategy, whether it is short-term (3 months) or medium-term and long-term (3 years), we can help our clients maximize their returns as well as scientifically diversify the risks of different asset classes.

AQUMON's unique algorithm research continuously monitors the correlation between various major types of assets, uses the most advanced covariance matrix method to dynamically estimate asset trends, and cooperates with rigorous risk control to protect investors' assets when the market suffers falling. The chart below shows more clearly the advantage of asset allocation than a single asset:

Will it be better in 2022 Q3?

Q3 will likely bring similar market dynamics. Despite reduced Covid-19 spread, inflation and supply chain disruptions will likely linger, while the war in Ukraine will cause geopolitics to remain a major factor affecting markets. The risk of central banks overshooting interest rate hikes has caused the recession to be a possibility, adding uncertainty to markets. We foresee the following trends affecting investments:

1. Rising recession expectations may materialize in the form of an actual recession as economies suffer from high commodity prices and consumer demand is dampened by inflation and hiking interest rates.

2. Overall monetary policy is expected to be comparatively looser compared with the 1st half of 2022. Although central banks have continued their hawkish rhetoric, market expectations for major central bank interest rate hikes have weakened. Central banks will continue their monetary policy tightening but will likely avoid unexpected rate hikes that risk plunging economies into recession. However, there remains uncertainty over whether central banks can tighten while maintaining a "soft landing".

3. Global risky assets like cryptocurrency will continue to suffer from reduced liquidity due to monetary policy tightening, as the rate of return on safer assets (e.g. bonds) increases while the returns from risky assets are no longer attractive enough to justify the risk.

4. The US dollar will continue to strengthen due to the Fed increasing interest rates and investors seeking a safe haven in US government bonds to hedge against recession risks.

5. The Chinese economy will bounce back from the lows in Q2 with fiscal and monetary policy aiding residential consumption. Domestic economic growth is expected to reach the whole-year target of 5.5 % GDP YoY.

How should Investors Adjust their Asset Allocation?

Given that uncertainty will continue in the second half of 2022, investors should keep their defensive positioning by focusing on stable return vehicles. The best way to weather turbulence is through diversification.

- Drive up diversification on different aspects of the portfolio in the asset class, geographic location & sector.

- Remain relatively conservative while finding ways to enhance a portfolio's Sharpe ratio*.

- Place more weighting on Chinese or Chinese-linked assets, which will benefit from low valuations, a recovering economy, and supportive fiscal and monetary policy while other major global economies continue fiscal and monetary policy tightening.

*One of the widely used methods for calculating risk-adjusted returns. The higher the ratio, the greater the investment return relative to the amount of risk taken, and thus, the better the investment.

Hyper-personalized Investment Solutions-AQUMON Bespoke

A multi-asset portfolio with global exposure carrying a dynamic allocation pertaining to underlying economic growth could potentially offset current market turmoil, if a systematic approach is there to afford the right asset mix plus proper ongoing refinements. Schedule a free consultation with us to learn more about AQUMON's market-adapting solutions.

You may also contact us via 2155 2816, WhatsApp, or email bespoke@aqumon.com

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximize their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.