2022 Q4 Market Insights and Portfolio Performance Updates

Written by AQUMON Team on 2023-01-13

2022 Q4 Insights and Portfolio Performance Updates

2022 was a difficult year. However, global markets made strong gains at the end of this year. Asian shares were boosted by China’s relaxation of its zero-Covid policy, while European equities also advanced strongly. Government bond yields edged up towards the end of Q4, which reflected some market disappointment at major central banks reiterating plans to tighten monetary policy, even as inflation showed signs of peaking. Commodities gained in the quarter, led by industrial metals.

In a volatile situation, how does AQUMON's portfolio perform in Q4? Does global asset allocation continue to perform stably? What will happen to markets in 2023?

2022 Q4 Global Financial Markets Key Highlights

Stock markets rounded off a tumultuous year with gains in Q4. Overall key events were:

-

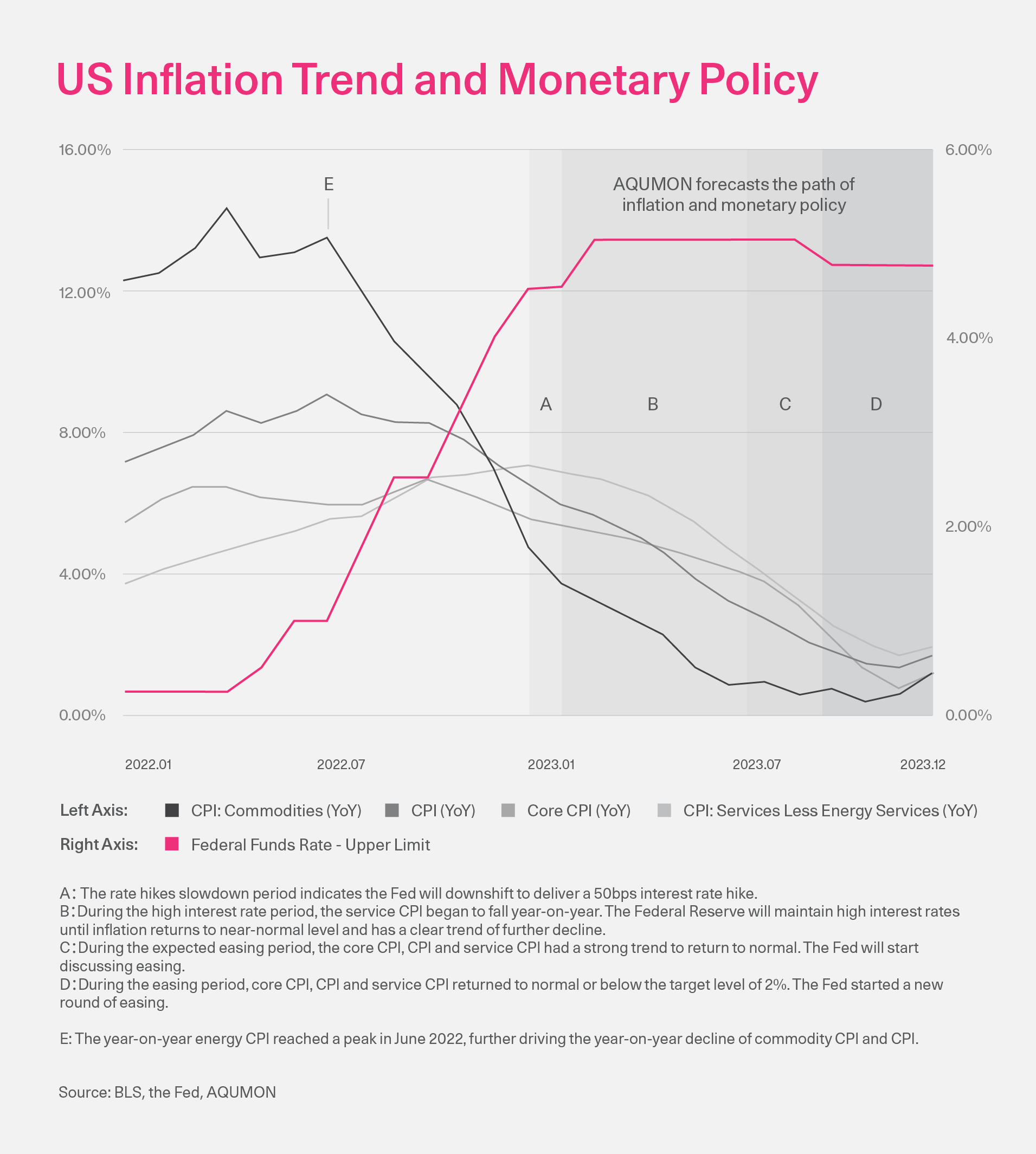

Central bankers raised rates an aggressive 425 basis points in 2022 to rein in inflation, which cooled to 7.1% in November. Powell has already signalled the central bank will keep monetary policy restrictive through 2023, with plans to hike rates to 5.1%.

-

The People’s Bank of China made a broad-based cut to its reserve requirement ratio by 25bps, injecting RMB 500 billion in liquidity. China’s COVID-19 cases hit a new high as official messaging suggests the country is gradually moving toward re-opening. Asian exports showed signs of further moderation. China’s October export growth declined by 0.3% y/y. Asia factory activity also slowed in November as global demand weakened.

-

Eurozone shares notched up a strong advance in Q4, outperforming other regions. Gains came from a variety of sectors, notably economically-sensitive areas like energy, financials, industrials and consumer discretionary. More defensive parts of the market, such as consumer staples, lagged behind the wider market’s advance.

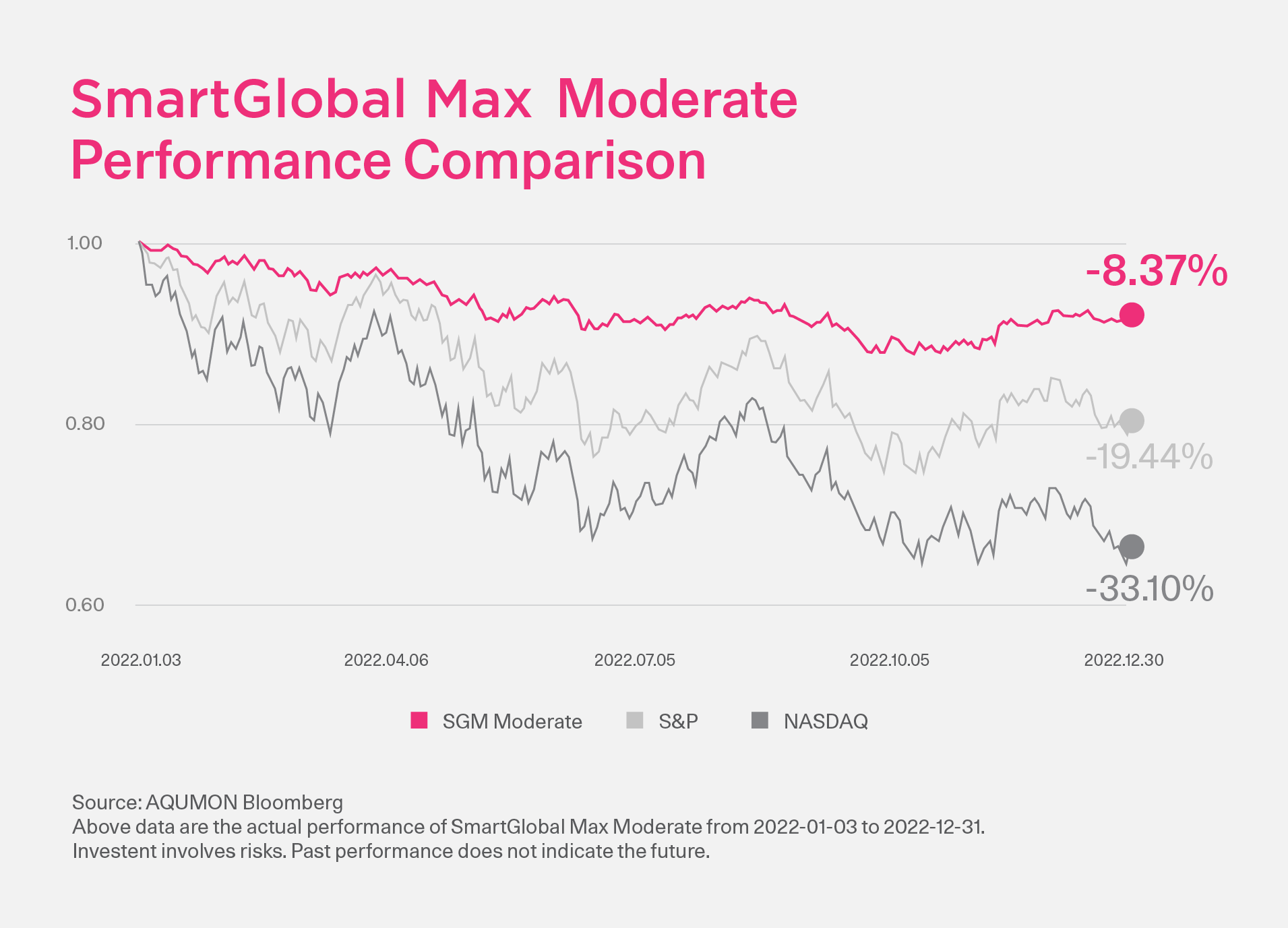

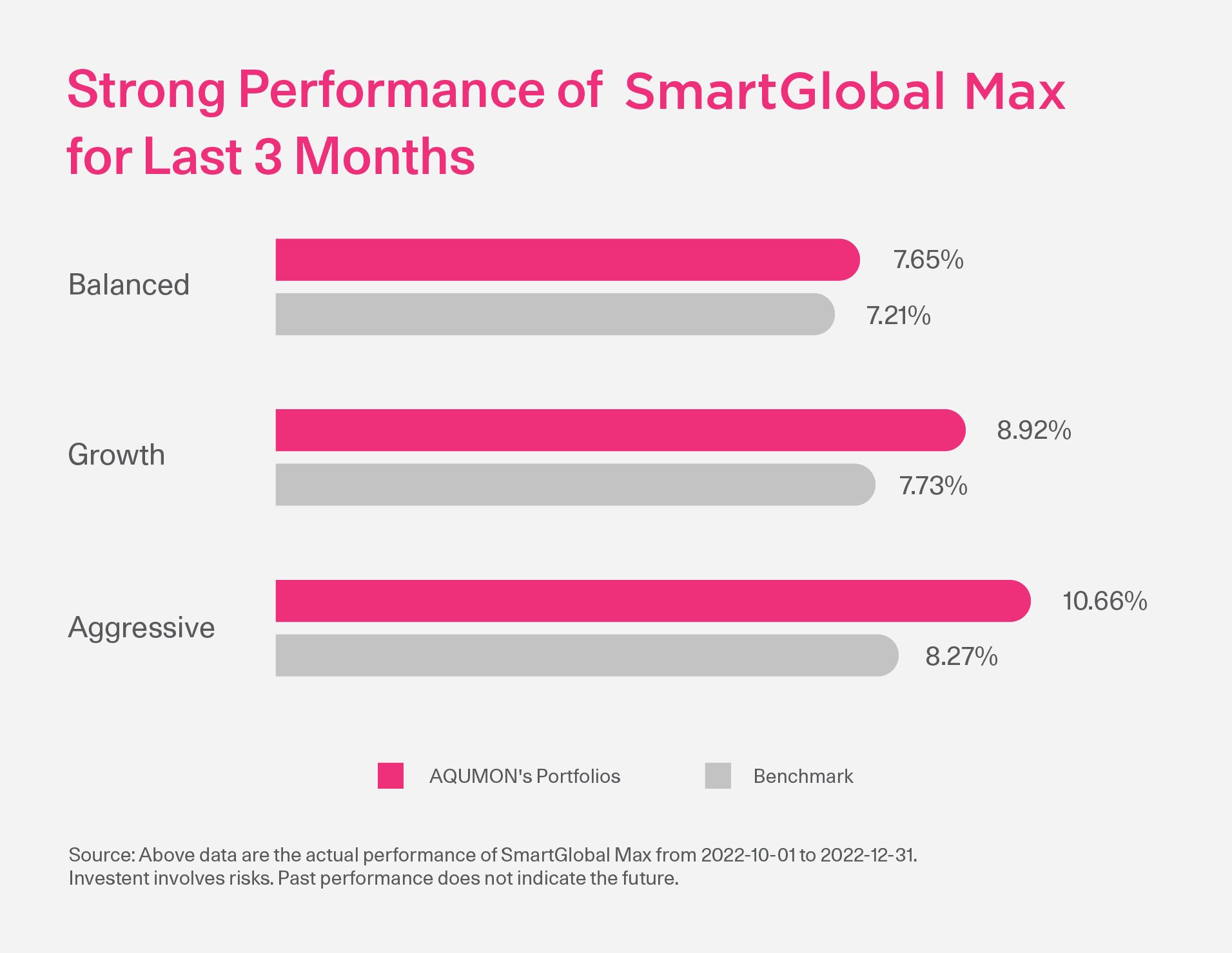

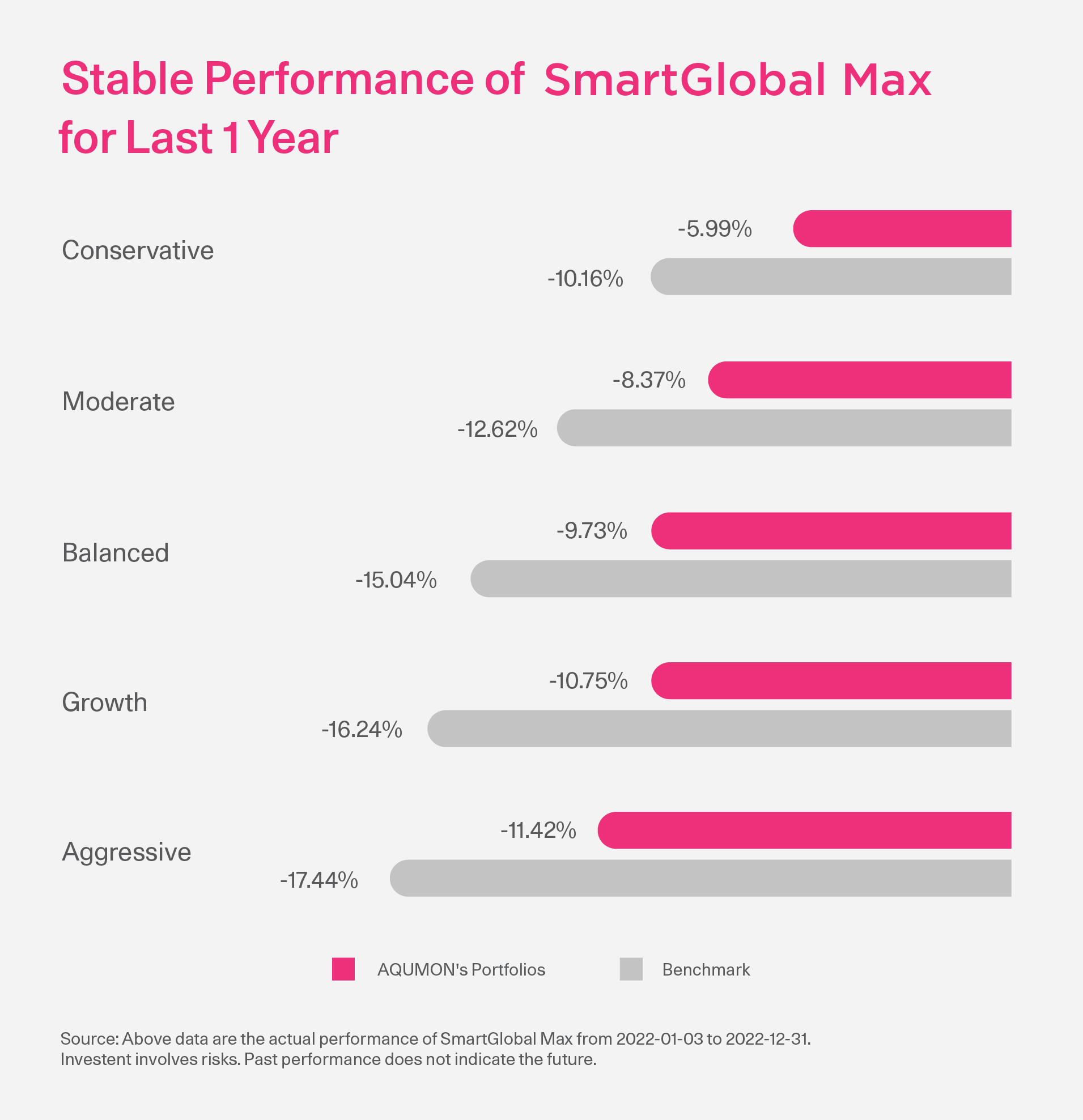

How Did AQUMON’s Portfolios Perform?

Actual performance of the flagship ETF asset allocation portfolio compared to the benchmark in 2022. AQUMON's unique global asset allocation strategy has outperformed the benchmark in terms of returns, maximizing benefits for investors and demonstrating strong resilience to market volatility.

Will It Be Better in 2023 Q1?

-

The end of China’s zero-COVID policy is poised to boost China’s equity markets. China's recovery could provide some fresh momentum in Asia's demand.

-

Chinese consumption has dampened during the COVID-19 resurgence. The pent-up demand in China has significant potential. Chinese households holding RMB 116.5 trillion in deposit accounts, 42% higher than the pre-COVID-19 level. This may represent large growth opportunities across Asia.

-

The government has recently become more supportive of the property sector. China’s State Council calls for the implementation of property market rescue measures to buoy the bruised real estate sector by unveiling a raft of measures. The cabinet will also support private firms, the platform economy and the construction of major projects, according to the script of a meeting.

-

The US stock market may continue to drop and a recession is the most likely outcome in the next 12 months. Inflation and the Russian-Ukraine war dealt a devastating one-two blow for equity markets.

-

The inflation will likely fall slowly as the Federal Reserve tries to cool it, with consumer prices worldwide rising at a 4.6% average in 2023. At the last Fed meeting, the central bank signalled the inflation rate would be from 5% to 5.25% in 2023.

How Should Investors Adjust Their Asset Allocation?

Given that uncertainty will continue in the first quarter of 2023, investors should keep their defensive positioning by focusing on stable return vehicles. The best way to weather turbulence is through diversification.

-

Drive up diversification on different aspects of the portfolio in the asset class, geographic location & sector.

-

Remain relatively conservative while finding ways to enhance a portfolio's Sharpe ratio*.

-

Place more weighting on Chinese or Chinese-linked assets, which will benefit from low valuations, a recovering economy, and supportive fiscal and monetary policy, while other major global economies continue fiscal and monetary policy tightening.

*One of the widely used methods for calculating risk-adjusted returns. The higher the ratio, the greater the investment return relative to the amount of risk taken, and thus, the better the investment.

Hyper-Personalised Investment Solutions-AQUMON Bespoke

A multi-asset portfolio with global exposure carrying a dynamic allocation pertaining to underlying economic growth could potentially offset current market turmoil if a systematic approach is there to afford the right asset mix plus proper ongoing refinements. Schedule a free consultation with us to learn more about AQUMON's investment products and market-adapting solutions.

You may also contact us via 2155 2816, WhatsApp, or email bespoke@aqumon.com

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximize their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.