How Does Factor Investing Work?

Written by Ria & Jobie on 2020-12-28

You’ve finally decided to start investing, but before you start putting your hard earned money into buying a company’s stock, it is vital to do thorough research. Therein lies the problem where it is difficult for an individual investor to:

1) Identify what research and data to analyze

2) Ensure the accuracy and effectiveness of your analysis

AQUMON is looking to solve these pain points for investors by launching 6 new thematic SmartStock Portfolios (expecting mid-Jan 2021) that focuses on automatically selecting portfolios of companies with outstanding performances across different industries.

So, what happens if you want to do the company analysis yourself?

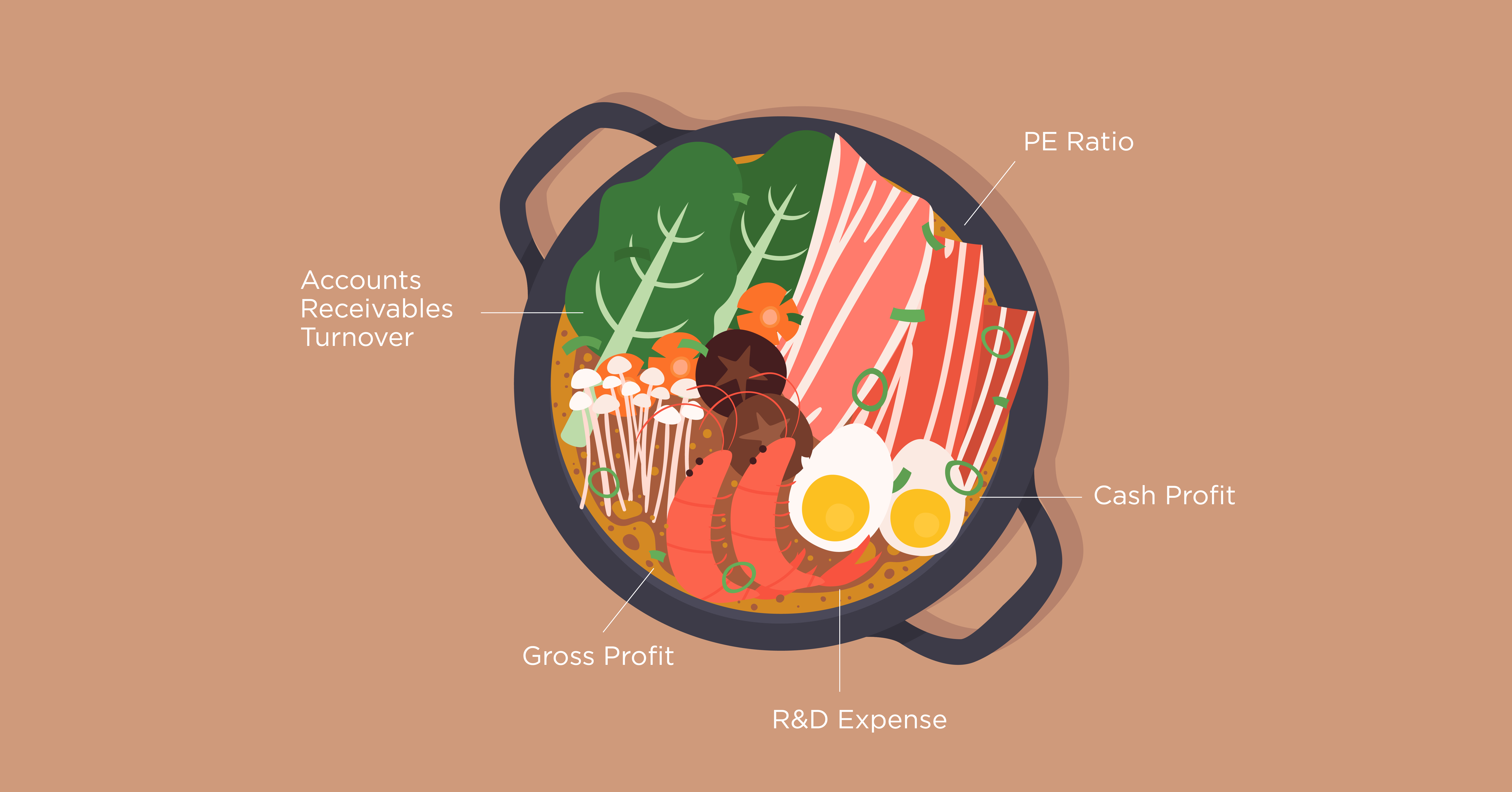

Let's put this back into a more easy to understand and relatable example. Imagine yourself as a foodie who wants to invest in an up and coming hotpot restaurant. What are the data and variables we should look at to comprehensively determine if this restaurant is worth your investment?

Here are a 6 factors we think you should consider:

Factor #1: Price-to-Earnings Ratio (aka P/E Ratio)

What does it measure: P/E ratios are used by investors to determine the relative value of a company's value in a like-for-like comparison against its historical record or against similar companies.

Why do you need to analyse it: Before you consider buying any company the basic question you need to ask yourself is...is this company valued fairly or are you over/under paying for this company. In the case for our hotpot restaurant suppose it has an annual earnings of HK$100,000 for but the price tag is HK$1 million, then its P/E ratio is 1,000,000/100,000 = 10. If a similar hotpot restaurant for sale only earns HK$50,000 but is asking for the same HK$1 million price tag (so P/E ratio of 20) then we know our initial restaurant is more reasonably valued. Everyone loves a great bargain!

Factor #2: Market Capitalization

What does it measure: Market capitalization is the total market value of a company in dollar terms. Normally companies are categorized as mega cap (>US$200 billion), large cap (US$10 - 200 billion), mid cap (US$2 - 10 billion), small cap (US$300 million - US$2 billion) and micro cap (US$50 - 300 million).

Why do you need to analyse it: This is a direct way to assess the size and indirectly the stability of a company so the larger the hotpot store likely the larger the total market cap. Although not always the case if the company is larger normally this will positively impact their business stability.

Factor #3: Gross Profit and Gross Profit Margin

What does it measure: The gross profit margin is a metric that indicates how efficient a business is at managing its operations by assessing the performance of a company's sales relative to its cost (technically this cost would be called “cost of goods sold”).

Why do we need to analyze it: A high gross profit margin indicates that our company is more successful in producing profit over its costs relative to its competitors. For example due to its successful brand image and popularity, our hotpot restaurant can be selling the same ingredients as its competitors but with a higher markup price than its competition. Who doesn’t want a business that can do that?

Factor #4: Account Receivable Turnover

What does it measure: This is a measure used to quantify a company's effectiveness in collecting its short term debt owed by clients to be paid or collected.

Why do we need to analyze it: A company with a high account receivable turnover means more of their customers are of high quality customers that pay their debts quickly. Assume our hotpot restaurant has a popular payment system among its members where they can pay for their meals in one single payment the following month. If this payment system is not run properly, although great for customers, it may negatively impact the ability for our hotpot restaurant to receive payment quickly and effectively. If a portion of the customers are delinquent in their payments this clearly is not a good sign for the restaurant.

Factor #5: Cash Profit

What does it measure: Cash profit is the profit recorded by a business that is based on cash payments.

Why do we need to analyze it: Although cash may not be as fashionable nowadays they can be an effective way to more accurately assess the hotpot restaurant’s profitability. Sometimes digital payments can result in fraud or deception so double checking their actual cash profit is a smart approach.

Factor #6: Research and Development Expense (R&D Expense)

What does it measure: R&D expenses are directly related to a company's effort to develop, design, and enhance its products and services. The more a company invests in R&D for business development, the greater the potential it has for growth.

Why do we need to analyze it: Innovation is happening everywhere – even hotpot restaurants have to launch new dishes to attract new customers. Seeing our hot pot restaurant consistently and systematically experiment and improve with new menu items and service approaches is a good sign this restaurant will have legs to continue delivering value to both its investors and customers in the long run.

If our hotpot restaurants pass these 6 baseline tests then chances it’s a pretty decent quality company.

This is just a start in what you should look at before investing into a company but there are clearly many other fundamental factors such as Return on Equity (ROE), Return on Total Assets (ROA), and Leverage that investors should look at before investing. It’s quite a handful but if you like doing things yourself we hope we helped you get started.

Coming back to AQUMON and how we can help.

All of these factors mentioned are assessed by our algorithm to select the best stocks for each thematic portfolio in our upcoming SmartStock Portfolios.

We here at AQUMON strongly believe, just like how analyzing DNA for a human can increase your understanding of an individual, analyzing factors for stocks can help investors better understand a company’s stock, where their stock return comes from and in turn build effective investment strategies.

Developed by AQUMON's Quantitative team, our PowerFactor algorithm identifies the underlying factors investors should target and uses them to systematically screen and rank stocks for investors efficiently – over 200+ underlying factors are analyzed to measure a stock’s performance. The key categories include company value, size, growth, cash flow, profitability, safety, and so on. No stone is left unturned.

AQUMON also goes the extra mile to ensure your portfolio has the best performance by doing the following.

1. Scientific model scoring – each factor is non-linearly processed to find the deeper correlation between returns and factors.

2. Balance risk and return – each portfolio is made up of 10 to 20 stocks across different industries to diversify investment risks and to maximize returns.

3. Continuous monitoring – your investment portfolio will be adjusted according to the market.

Our PowerFactor algorithm automatically unlocks the true return potentials in our 6 new thematic SmartStock Portfolios for our investors in three simple steps: screen, select, and confirm.

These portfolios are something we know you’ll love! Please keep an eye on our updates and follow AQUMON on social media now! Download our app to have a smooth and simple investing experience.

If you would like to read more we have introduced the concept of factors investing in our previous article here.

About us

As a leading startup in the FinTech space, AQUMON aims to make sophisticated investment advice cost-effective, transparent and accessible to both institutional and retail markets, via the adoptions of scalable technology platforms and automated investment algorithms.

AQUMON’s parent company Magnum Research Limited is licensed with Type 1, 4 and 9 under the Securities and Futures Commission of Hong Kong. In 2017, AQUMON became the first independent Robo Advisor to be accredited by the SFC.

AQUMON’s major investors include the HKUST, Cyberport, Alibaba Entrepreneurs Fund and the Bank of China International's affiliate.

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.