How to Read into Robinhood's Stock Volatility

Written by AQUMON Team on 2021-08-10

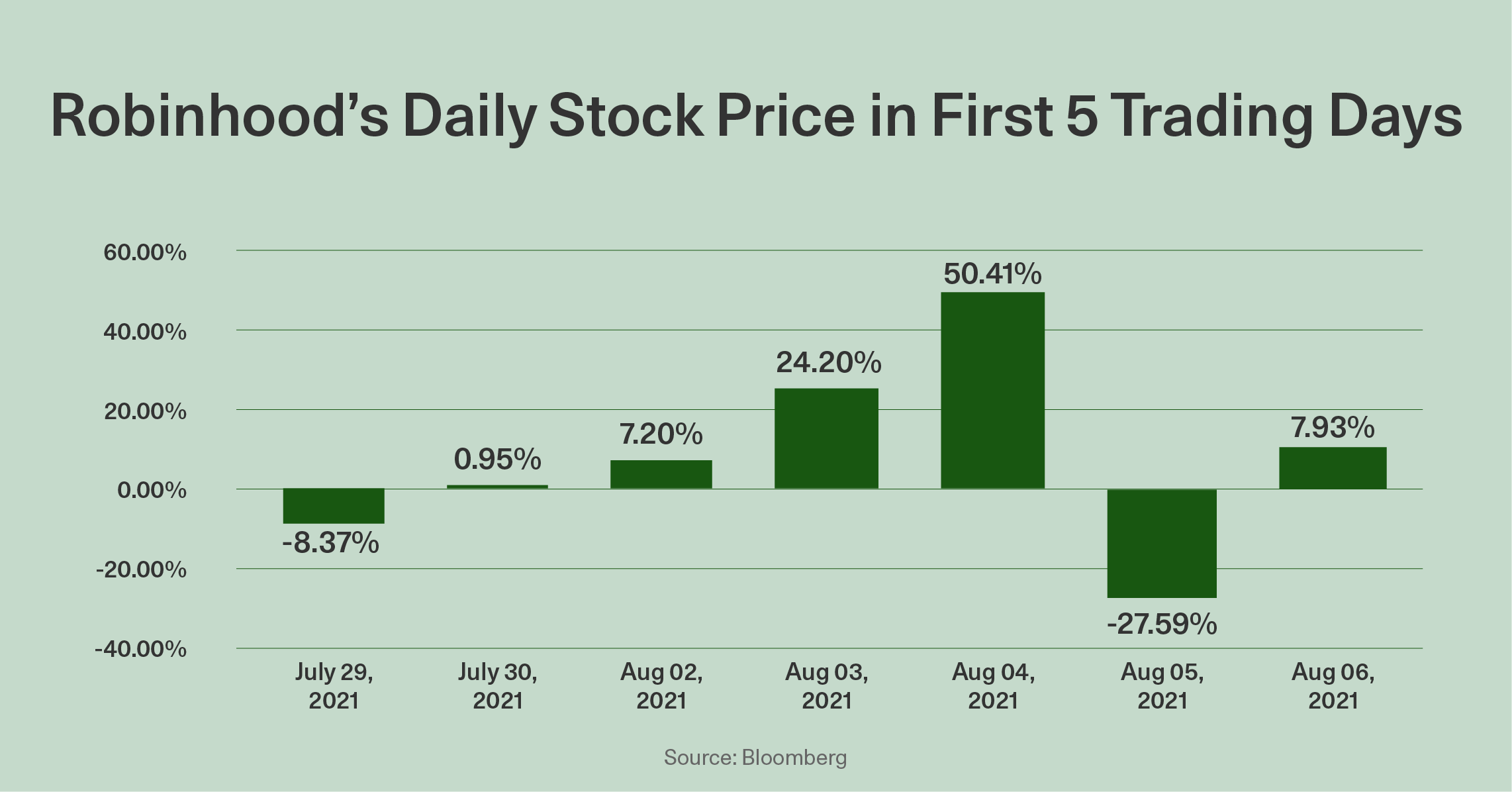

After stumbling out the gates down -8.36% of the first day of its initial public offering (IPO), Robinhood’s stock (HOOD.US) has rebounded like a vehicle on rocket fuel up +102.15% since its stock closed on July 29th before tumbling -19.66%:

Extended Reading: Robinhood, To Invest or Not to Invest?

So what were the drivers behind the recent rise and subsequent volatility?

1) Retail investors piled in by the boatload

Robinhood reached “meme stock” status jumping 10x in retail investor trading volume from last Monday to Tuesday. A further boost also came in the form of Cathie Wood’s Ark Investment Management announcing last week that their Ark Fintech Innovation ETF (ARKF) bought 89,622 Robinhood shares in the previous session.

Bloomberg reports that retail traders bought about US$19.4 million worth of Robinhood’s shares last Tuesday, making it the 6th most purchased stock on retail investment platforms. It’s important to note that the stock traded US$4.2 billion that day so there were plenty of sellers as well.

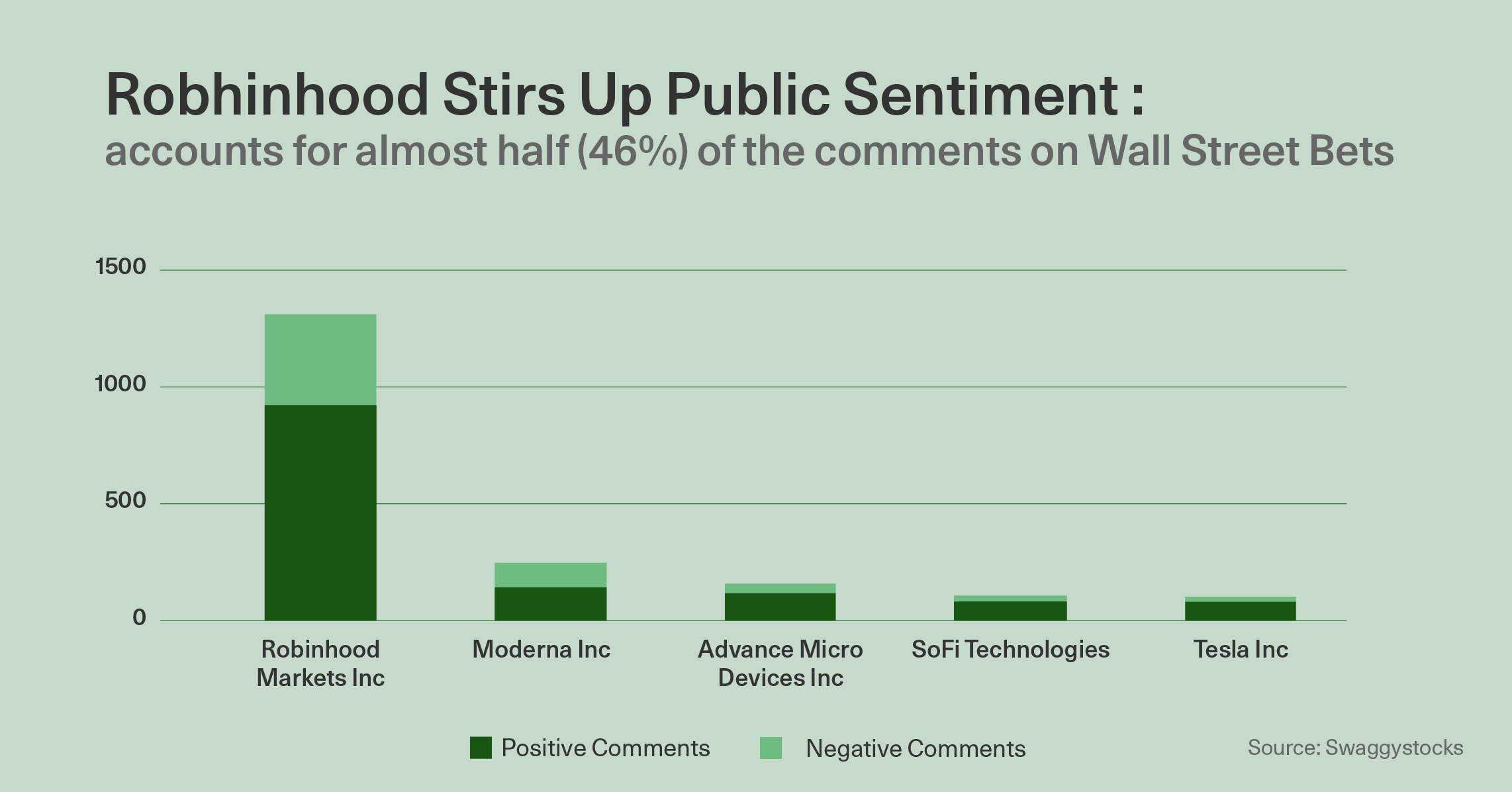

But it’s clear interest in Robinhood is reaching a frenzy when you look at the sentiment meters of the US retail trading army on WallStreetBets (WSB) with 46% of all comments (majority is positive) revolving around Robinhood making it the #1 most commented stock name amongst US retail investors last week:

This has calmed down quite a bit late last week but Robinhood still remains the top commented stock.

2) The stock’s surge coincided with options trading

It’s no surprise as we experienced with Gamestop (GME.US) or AMC Entertainment Holdings (AMC.US) that it is options trading and not just outright stock buying that is amplifying the volatility and surge in the stock price.

An option is a contract that gives the owner the right to buy (called “call option”) or sell (called a “put option”) of the said stock at a certain price until a specified expiration date. For example you could buy a US$80 August call option of Robinhood’s with the anticipation that the stock price will exceed US$80 by expiration date (August 20th). If it does exceed you get to buy the stock at a lower price (US$80) than market price. If it ends up lower than US$80 you are obligated to buy it at a price higher than market price (so you will sustain a loss).

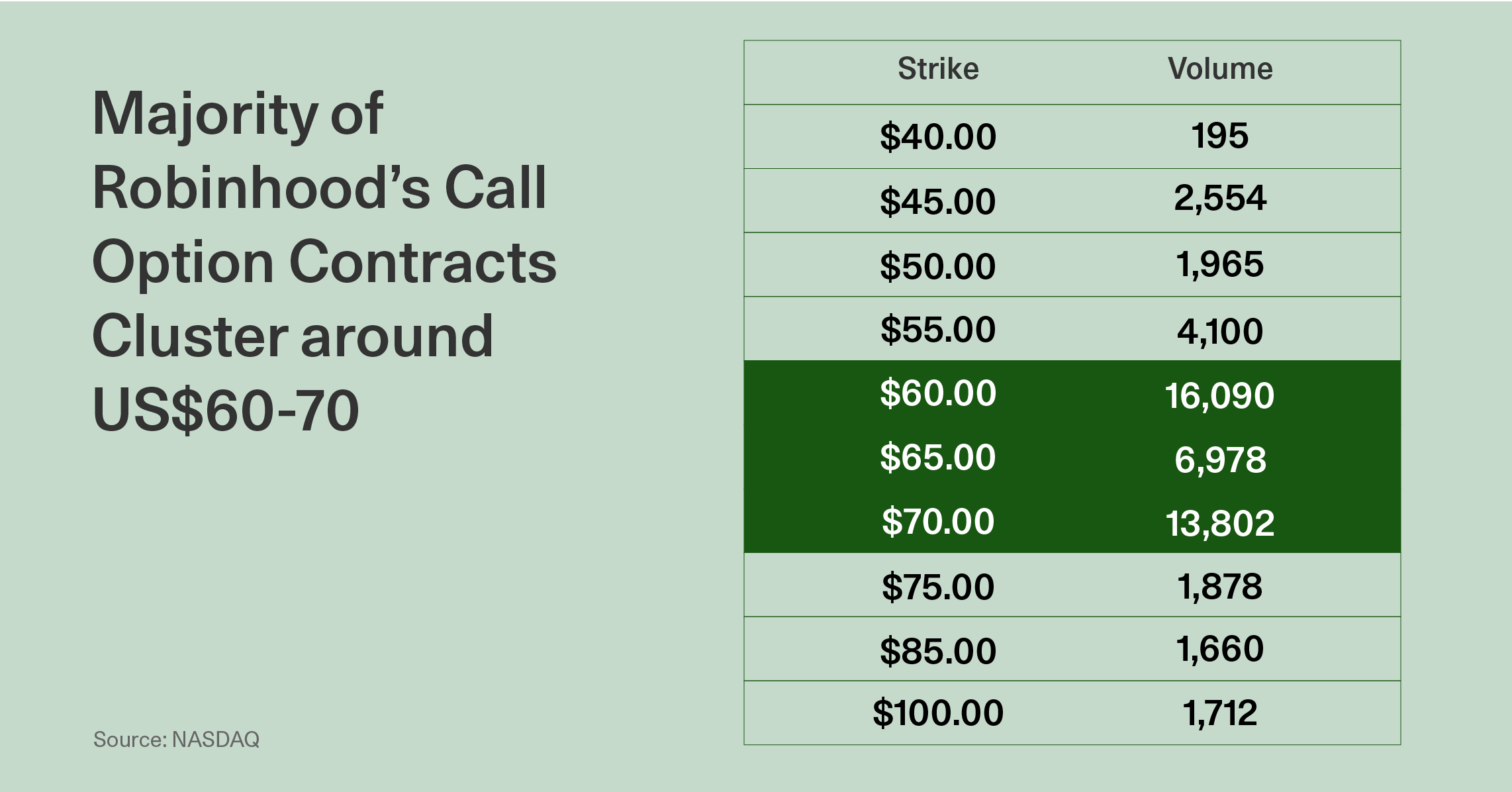

If we look at the August call option chain of Robinhood (showing what options investors are buying) you can clearly see that the vast majority of the activity is hovering around US$60-70 which is quite clear why we see the price of Robinhood jump from US$46.80 to US$70.39 (+50.40%) last Tuesday and may continue to push these levels:

It is important to note we are starting to see call option buying at the US$85-100 level as well late last week.

3) Artificial “diamond hands”

A big part of a meme stock is the need to have investors willing to hold onto the stock even if it has high volatility or drops significantly in pricing because they see the long term value.

Robinhood app’s own IPO Access Platform has an artificial diamond hands mechanism built in discouraging their users from selling. How? If users of the IPO Access Platform sell the stock within 30 days, they will be banned from future IPOs in the next 60 days. So considering 25% of all the IPO shares went towards Robinhood’s existing users this as result will recreate an artificial lockup and put a bit more pressure to drive the stock price up (or at least hold the stock price more constant).

4) Stockholder sale drove stock price down

What drove last week’s late week selloff was the announcement that existing shareholders will sell up to 97.9 million shares. Many of these existing shareholders were ones that came to Robinhood’s rescue due to the Gamestop saga. For those that remember, Robinhood was forced in February to suddenly meet new capital requirements to match customer trade demands which they luckily met by raising US$3 billion from investors. These same investors recently sold a portion of their shares.

For those who've been reading our blogs knows that Robinhood’s IPO came with a unique feature which allowed employees and existing shareholders to sell up to 15% of shares held without a lockup period.

Extended Reading: GameStop's Wild Rise - Explaining the Squeeze

Interest from institutional investors seems lukewarm at this point. If the Gamestock experience was any indication, if institutional investors also pile it, the stock price would see another sizable boost. For the time being, investors need to understand, if the investors in the stock remain retail-driven, then volatility (both upside and downside) in the stock will remain elevated.

Aug Special: Register and Get FREE Stocks

But for those looking to take no risk yet enjoy the benefits of owning Robinhood’s stock then investors should open an account at AQUMON. Currently AQUMON is running a special account opening promotion offering new clients free fractional stocks as a promotion.

One of the combinations is free fractional shares of both Robinhood (HOOD) and Xiaomi (1810.HK)! So if you have yet to become an AQUMON client, claim your free stock today!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.