2021 Year in Review: Portfolio returns as high as +23.08%

Written by AQUMON Team on 2022-01-13

Key highlights:

1. Overview of Portfolio performance

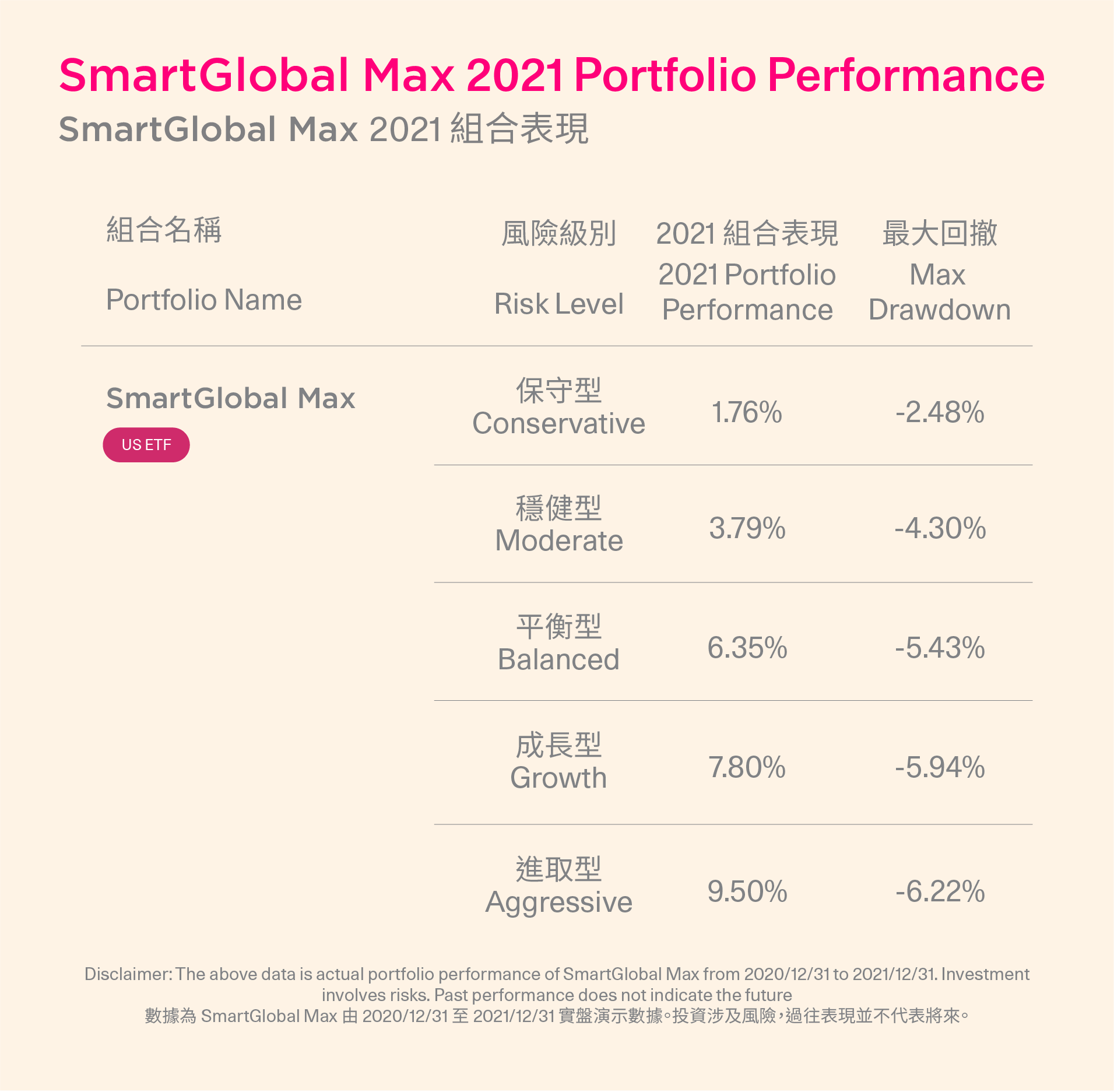

- AQUMON's renowned Flagship SmartGlobal Series has performed exceptionally well in achieving long-term wealth growth for investors this year. Among all, SmartGlobal Max has always been the top pick for investors since its launch, boasting an outstanding annualized return between +1.76% to +9.50% (from conservative to aggressive respectively).

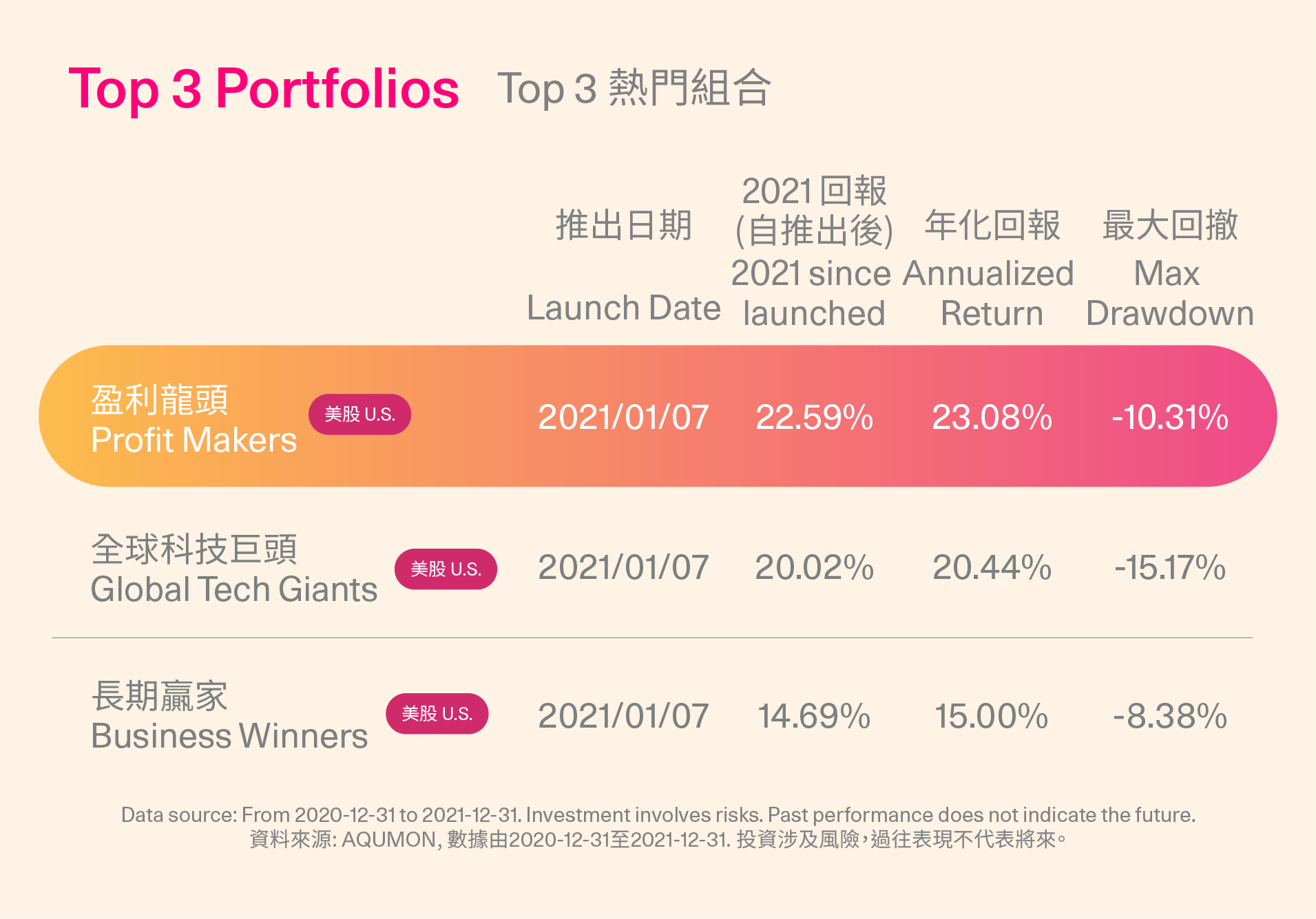

- Among our SmartStock thematic portfolios, which utilize big data analysis and SmartFactor® technology to filter and select valuable stocks, Profit Makers (U.S. stock portfolio) achieved +23.08% year-to-date returns since its launch in January 2021;

2. In 2021, AQUMON has upgraded both our products and services to continue providing an enhanced investment experience for you:

- More product offerings: In May, we launched SmartGlobalC, Asia's first cryptocurrency (ETF) portfolio targeting overseas investors. In Q3, we launched SmartGlobal UltiMax, a portfolio that combines passive investing and tactical strategy to achieve outperforming alpha returns. AQUMON also managed to bring to market13 new thematic SmartStock portfolios, allowing investors greater choice in selecting their own investment themes.

- Other than portfolio, AQUMON announced its live stock trading function in July 2021, covering major trading markets such as A-shares, Hong Kong and the U.S. stock market, ultimately evolving into an all-in-one investment app.

- Lowering investment thresholds to provide greater accessibility: With the help of fractional share technology, investors can use the AQUMON platform with as little as HK$10,000 (or US$1,000), a dramatic decrease from the previous $100,000 minimum investment amount.

3. Finally in Q4, AQUMON Bespoke was unveiled as we expanded our service offerings to mass-affluent consumers, family offices, professional investors and wealth management institutions by providing hyper-personalized and quantitative investment solutions.

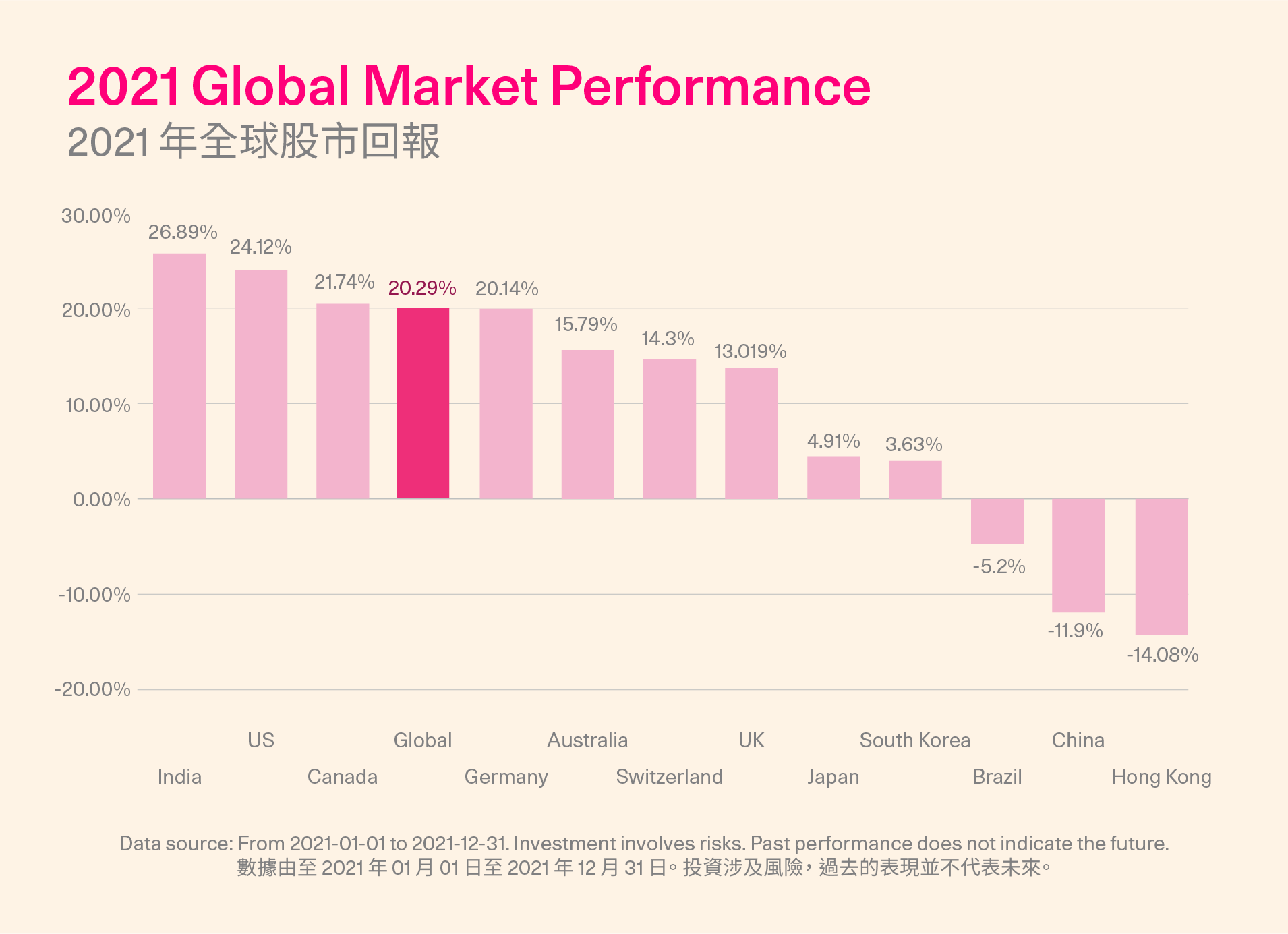

Market Review:

Looking at the performance of various stock markets, China and Hong Kong’s performance did not live up to expectations, despite the fact that they were the strongest markets in 2019. On the other hand, emerging markets (India), the U.S. and Canada were ranked as the top 3 markets of 2021. In the meantime, the S&P 500 index ends 2021 on a high note with an increase of +24%.

If your focus was predominantly on the Greater China stock markets, 2019 was a rewarding year as the stocks outperformed the global index. Unfortunately, with the turn of 2021’s market situation with major defaults of property moguls, regulatory crackdown on giant tech companies, it is likely that you found your investments underperforming.

This leads us back to AQUMON’s core investment logic: always diversify your investments in different best-in-class assets to achieve relatively stable returns and minimize the risk of a single market downturn.

With our award-winning SmartGlobal Max portfolio, our investment assets include the best-performing U.S. stocks, as well as those in emerging markets, European markets, Hong Kong and China markets, bonds, alternative investments and more. Investors may not get the highest annual return, yet from the long-term perspective, the annualized return is much more balanced with risk being properly factored in.

AQUMON’s Portfolio Performance:

Flagship Asset Allocation Strategy - SmartGlobal Series:

AQUMON’s flagship SmartGlobal portfolios were launched in 2018, built upon the Nobel Prize-Winning Economic Theories (i.e. Markowitz Efficient Frontier, Black-Litterman model), that helps construct a risk-optimized portfolio.

In 2021, we extended our offerings in flagship series:

- SmartGlobal Max (invest into US ETFs)

- SmartGlobal (invest into HK ETFs)

- SmartGlobal UltiMax

- SmartGlobalC (Asia’s first bitcoin ETF, for overseas clients only)

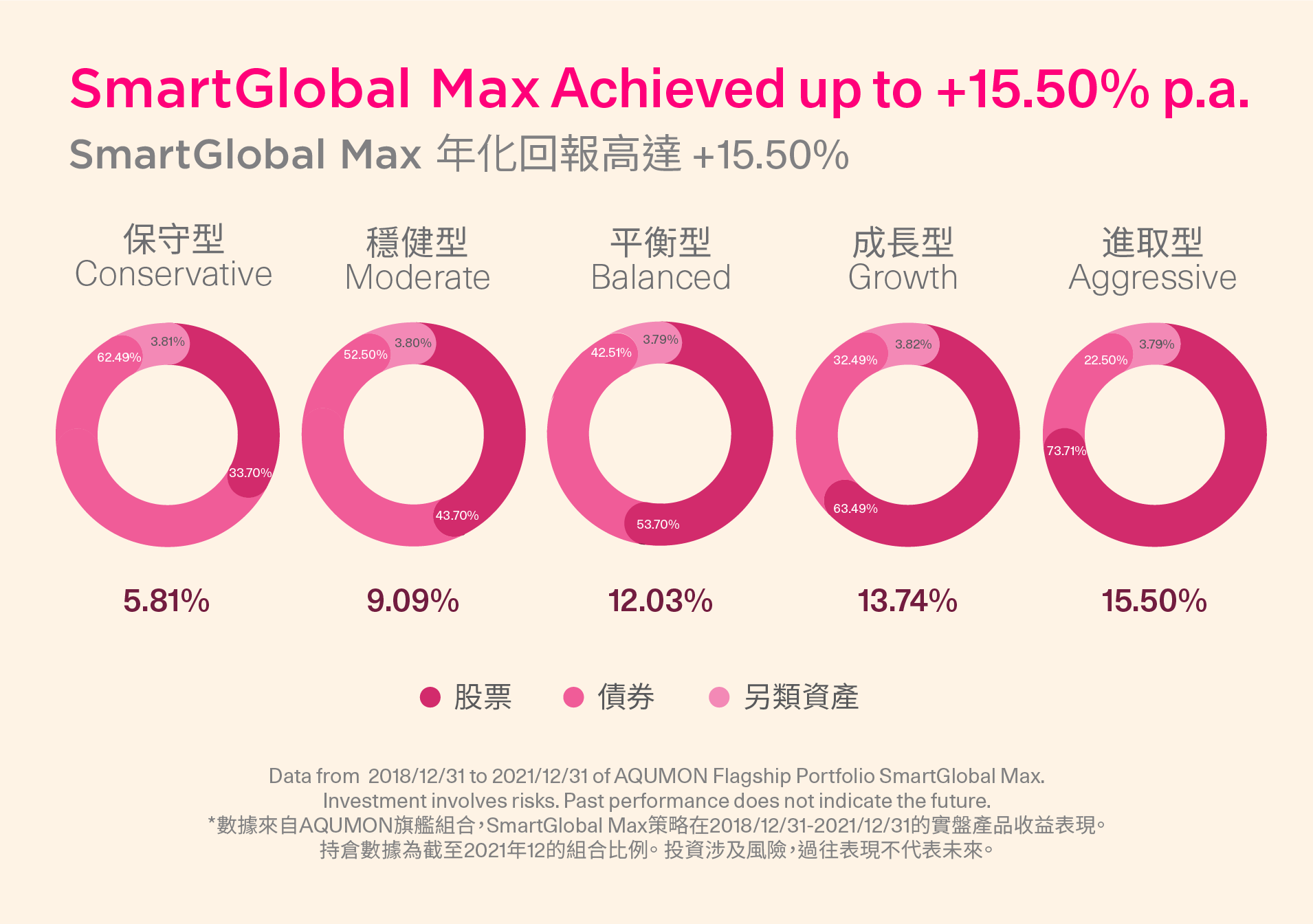

The objective of our flagship portfolio is to deliver sustainable and steady returns for investors in the long-term. Clients can invest in a globally diversified portfolio based on their investment preference and risk appetite. For investors with higher risk-tolerance levels, the weighting of the equity is higher; for those with lower levels, the proportion of bonds acquired is higher.

From the long-term investing perspective, the globally-diversified strategy employed in our flagship portfolio has successfully yielded an annualized return of up to +15.50% in the past 3 years, making it popular choice for clients who prefer passive returns or are new to investment.

To navigate the market volatility of 2021, our QuantiMacro technology was deployed to analyze the macroeconomic data, and our algorithms anticipated that the U.S. economy is at risk of stagflation (i.e. slow economic growth accompanied by rising prices, inflation combined with a decline in the gross domestic product). With the anticipated risk, we made a mid-year adjustment of our investment strategy of our flagship portfolios.

Take SmartGlobal Max as an example, adjustments include:

- Reduced the proportion of high risk assets in the portfolio, such as equity investment, by 2.5%.

- Adjusted the equity’s region weighting: increased the proportion of U.S. stocks and reduced Chinese stocks to align with the MSCI indexes; further increased the weighting of the value and finance sectors in the U.S. region.

- Reselected shorter bond maturity instruments: as we anticipated interest rate increases in the U.S. and other developed markets

- Adjusted underlying investments include: increased the weighting of the VTIP index and added the BSV index (Vanguard Short Term ETF), CBON (Chinese Bonds) and XLF (S&P 500 Financial ETF).

Thematic SmartStock Portfolio:

AQUMON launched 13 Thematic SmartStock Portfolio in January and April 2021 respectively, which include different popular investment themes such as technology, healthcare and ESG.

Based on our self developed PowerFactors® investment strategy, we were able to quickly select valuable equity holdings (covering Hong Kong, U.S. and A-shares stock markets) through big data and algorithms to construct robust stock portfolios. Among our stock portfolios in 2021, U.S. portfolios became the top-performers thanks to the upward U.S-led market trend.

SmartStock Portfolios are auto-adjusted in accordance with the market changes and investment strategies (as long as you turn the auto-rebalancing function on, we will monitor your portfolios and make necessary adjustments for you). Clients could check the stock holdings in the app.

Extended readings:

US Stock Portfolios Rebalancing Notes

HK Stock Portfolios Rebalancing Notes

【A-Shares Portfolios】Reasons for Rebalancing

AQUMON Bespoke: Hyper-personalized Comprehensive Wealth Management Service

Tailored investment solutions for the discerning investor. This year, we further expanded our service offerings by launching AQUMON Bespoke, a hyper-personalized and comprehensive wealth management service, exclusively tailored for investors who seek out the exceptional in investments.

If you have invested, or are planning to invest, over HK$500,000 with AQUMON, you are eligible to join the Bespoke service. With Bespoke, we combine the best scientific solutions and personalized services. Clients can enjoy a custom-tailored investment plan that will be driven by our quantitative SmartAdvice engine, in addition, you can consult and adjust your investments quarterly with a dedicated investment manager.

All personalized investment advice and diagnosis will be provided with no additional charge.

Read more about the Bespoke service:

Bespoke: Exceptional Investments for the Discerning Investor

【Bespoke】Introducing SmartAdvice: Personalized Investment Advice

As we move into 2022, seize the opportunity to plan ahead your wealth goals and investment plan. We’re revolutionizing the financial industry through technology, the new shift will no longer rely on “house view” but rather scientifically-driven data and insights to run investment strategies. With this investment philosophy in mind, AQUMON’s investments do not sway in the face of uncertainty - led by a pandemic, meme-crazes, SPACS, and other trending topics - we hold true to our mission in providing long-term, sustainable returns with the help of smart technology so you can reach your life goals. We’re here to empower every investor to build wealth that is tangible. So start now and welcome 2022 with the best gift you can give your future self - invest with AQUMON today!

About us

AQUMON is a Hong Kong based award-winning financial technology company. Our mission is to leverage smart technology to make next-generation investment services affordable, transparent and accessible to both institutional clients and the general public. Through its proprietary algorithms and scalable, technical infrastructure, AQUMON’s automated platform empowers anyone to invest and maximise their returns. AQUMON has partnered with more than 100 financial institutions in Hong Kong and beyond, including AIA, CMB Wing Lung Bank, ChinaAMC, and Guangzhou Rural Commercial Bank. Hong Kong University of Science and Technology, the Alibaba Entrepreneurs Fund, affiliate of BOC International Holdings Limited, Zheng He Capital Management and Cyberport are among AQUMON's investors.

The brand is held under Magnum Research Limited and is licensed with Type 1, 4 and 9 under the Securities and Futures Commission (SFC) of Hong Kong. AQUMON is also licensed by the U.S. Securities and Exchange Commission (SEC) and the Asset Management Association of China (AMAC).

Disclaimer

Viewers should note that the views and opinions expressed in this material do not necessarily represent those of Magnum Research Group and its founders and employees. Magnum Research Group does not provide any representation or warranty, whether express or implied in the material, in relation to the accuracy, completeness or reliability of the information contained herein nor is it intended to be a complete statement or summary of the financial markets or developments referred to in this material. This material is presented solely for informational and educational purposes and has not been prepared with regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Viewers should not construe the contents of this material as legal, tax, accounting, regulatory or other specialist of technical advice or services or investment advice or a personal recommendation. It should not be regarded by viewers as a substitute for the exercise of their own judgement. Viewers should always seek expert advice to aid decision on whether or not to use the product presented in the marketing material. This material does not constitute a solicitation, offer, or invitation to any person to invest in the intellectual property products of Magnum Research Group, nor does it constitute a solicitation, offer, or invitation to any person who resides in the jurisdiction where the local securities law prohibits such offer. Investment involves risk. The value of investments and its returns may go up and down and cannot be guaranteed. Investors may not be able to recover the original investment amount. Changes in exchange rates may also result in an increase or decrease in the value of investments. Any investment performance information presented is for demonstration purposes only and is no indication of future returns. Any opinions expressed in this material may differ or be contrary to opinions expressed by other business areas or groups of Magnum Research Limited and has not been updated. Neither Magnum Research Limited nor any of its founders, directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this material or reliance upon any information contained herein.